|

市場調查報告書

商品編碼

1630194

聚氨酯泡沫塗料:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Spray Polyurethane Foam - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

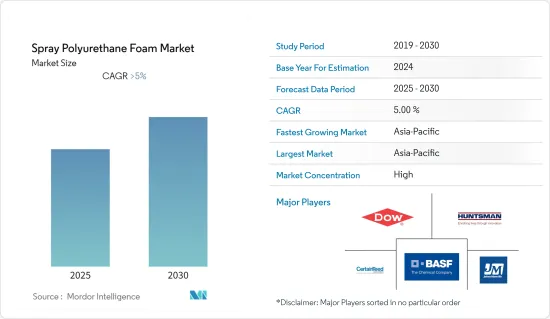

預計聚氨酯泡沫塗料市場在預測期內的複合年成長率將超過5%。

主要亮點

- COVID-19造成供應鏈和原料中斷,導致汽車和建築等行業放緩,導致聚氨酯泡沫塗料產量下降。預計到預測期結束時(2021年),噴塗聚氨酯市場將達到疫情前的水準。這是因為經濟開始好轉,供給狀況有改善。

- 對溫室氣體排放的日益關注以及市場作為建築耐久性管理策略關鍵部分的巨大潛力是短期內推動市場成長的主要因素。

- 另一方面,玻璃纖維和纖維素隔熱產品越來越受歡迎,這可能會減緩市場成長。

- 未來幾年,隨著模板提昇在混凝土抬升業務中變得越來越流行,市場將有更多賺錢的機會。

- 亞太地區在聚氨酯泡沫塗料(SPF)材料的消費中佔據主要佔有率。由於節能建築和石棉遏制應用的增加,預計該地區在預測期內也將出現最快的成長。

聚氨酯泡沫塗料市場趨勢

增加在絕緣應用中的使用

- 聚氨酯泡沫塗料用於隔熱材料應用,其消費量隨著時間的推移而穩定增加。然而,聚氨酯泡沫塗料隔熱材料在過去十年中經歷了快速成長。

- 節能信託基金的計算顯示,住宅的熱量損失有 25% 通過屋頂,35% 通過牆壁,25% 通過窗戶和通風口,15% 通過地板。因此,空心牆和閣樓或屋頂隔熱是任何人都可以安裝的兩種最有效的能源效率措施。

- 聚氨酯泡沫塗料在建築物外牆上的廣泛使用,如牆壁、天花板、地板、閣樓、拱腹、閣樓和屋頂,與提高能源效率,特別是減少建築物漏風的立法有直接關係。

- 在亞太地區,由於主要經濟體的人口成長和快速都市化,住宅建設需求不斷增加。根據 Global Construction Perspectives 和 Oxford Economics 的一項研究,印度未來 14 年每天需要建造 31,000 套住宅,才能滿足不斷成長的住宅需求。 2030年終,將建成住宅。

- 越來越嚴格的建築規範,例如加州的 Title 24 和國際規範委員會的國際節能規範,正在迫使建築商使用較少石化燃料並節省能源的材料。

- 此外,根據哈佛大學住宅研究聯合中心的數據,光是美國人每年就花費超過 4,000 億美元用於住宅重建和維修,其中可能包括隔熱材料的使用,因此需求不斷增加。

- 根據歐盟統計局公佈的資料,2021年建築收入大幅增加。

- 由於這些原因,未來幾年在隔熱材料中使用 SPF 可能會擴大聚氨酯泡沫塗料的市場。

亞太地區主導市場

- 由於各國政府在該地區建築和塗料行業的支出增加,預計亞太地區將成為預測期內最大的市場。

- 中國是亞太地區GDP最大的經濟體。儘管國家成長率依然較高,但正逐步放緩,經濟正從投資轉向消費、從製造業轉向服務業、從外需轉向內需再平衡。

- 根據中國「十四五」規劃,預計到2025年都市區常住人口將增加65%。預計這將增加未來幾年對所研究市場的需求。

- 隨著中國從疫情中恢復過來,許多住宅建設計劃已經開始。香港住宅委員會的目標是在截至 2030 年的 10 年內提供 301,000 個公共住宅。

- 「Atma Nirbhar Bharat」和「印度製造」等舉措預計將促進汽車工業的發展,因此可能對未來幾年聚氨酯泡沫塗料的需求產生積極影響。

- 根據NAP 2021,馬來西亞汽車製造業預計到2030年每年生產147萬輛汽車。從現在到2030年,該國用於汽車製造的聚氨酯泡沫塗料的需求預計將增加。

- 由於上述因素,預計亞太地區將在預測期內主導聚氨酯泡沫塗料市場。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 人們對溫室氣體排放的擔憂日益加劇

- 作為建築耐久性管理策略關鍵組成部分的巨大潛力

- 在冷藏空間、步入式冰箱、管道、儲罐等工業隔熱材料的重要性日益增加。

- 抑制因素

- 玻璃纖維和纖維素絕緣解決方案的競爭加劇

- 嚴格的環境保護局 (EPA) 和職業安全與健康管理局 (OSHA) 法規

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 依產品類型

- 雙組份高壓噴塗泡沫

- 雙組份低壓噴塗泡沫

- 單組分泡棉 (OCF)

- 其他產品類型

- 按用途

- 絕緣

- 防水的

- 石棉封裝

- 密封劑

- 其他用途

- 按地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 其他歐洲國家

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率(%)**/排名分析

- 主要企業策略

- 公司簡介

- ACCELLA CORPORATION

- BASF SE

- CERTAINTEED

- Dow

- Huntsman International LLC

- Icynene-Lapolla

- INVISTA

- ISOTHANE LTD.

- Johns Manville

- NCFI Polyurethanes

- SOPREMA

- Specialty Products Inc.

第7章 市場機會及未來趨勢

- 應用程式成為管道工程的新行業標準

- 散裝混凝土產業中模板吊掛的成長趨勢

簡介目錄

Product Code: 61474

The Spray Polyurethane Foam Market is expected to register a CAGR of greater than 5% during the forecast period.

Key Highlights

- COVID-19 caused disruption in the supply chain and raw materials, leading to a slowdown in industries like automotive and construction, owing to which the production of spray polyurethane foams decreased. The spray polyurethane market is expected to reach its pre-pandemic level by the end of the forecast period, which is 2021. This is because the economy started to get better and the supply situation got better.

- Growing concerns about greenhouse gas emissions and the market's strong potential as a key part of a building's durability management strategy are the main things that will drive the market's growth in the short term.

- On the other hand, fiberglass and cellulose insulation products are becoming more popular, which will likely slow the growth of the market.

- In the next few years, the market is likely to have more chances to make money because foam lifting is becoming more popular in the concrete raising business.

- Asia-Pacific holds a significant share in the consumption of spray polyurethane foam (SPF) materials. The region is also expected to witness the fastest growth during the forecast period, powered by the increase in energy-efficient construction and asbestos encapsulation applications.

Spray Polyurethane Foam Market Trends

Increasing Usage in the Insulation Applications

- Spray polyurethane foam has been used in insulation applications, and its consumption has steadily grown over time. However, spray polyurethane foam insulation has experienced exponential growth during the past decade.

- The Energy Saving Trust calculates that 25% of heat loss in homes is through the roof, 35% is through the walls, 25% is through windows or draughts, and 15% is through the floor. Hence, cavity walls and loft or roof insulation are two of the most effective energy efficiency measures anyone may install.

- The widespread use of spray polyurethane foam in building envelope assemblies, including walls, ceilings, floors, attics, crawl spaces, and roofing, is linked directly to code-mandated improvements in energy efficiency and, specifically, requirements for reducing building air leakage.

- Across the Asia-Pacific region, demand for residential construction has been rising owing to the growing population and rapid urbanization across major economies. According to a study done by Global Construction Perspectives and Oxford Economics, India will need to build 31,000 homes every day for the next 14 years to keep up with the growing demand for housing in the country. By the end of 2030, this will add up to 170 million homes.

- More and more strict building codes, like Title 24 in California and the International Energy Conservation Code from the International Code Council, force builders to use materials that use less fossil fuel and save energy.

- Furthermore, according to the Harvard Joint Center for Housing Studies, Americans alone spend more than USD 400 billion per year on residential renovations and repairs, which may include the use of insulation, which in turn increases their demand.

- The demand for building insulation is expected to rise in Germany as residential construction expands.As per data published by Eurostat, building construction revenue increased significantly in 2021.

- Because of all of these things, the use of SPF for insulation is likely to grow the market for spray polyurethane foam over the next few years.

Asia-Pacific Region to Dominate the Market

- Asia-Pacific is expected to be the largest market during the forecast period because the government is spending more on the construction and coating industries there.

- China is the largest economy in the Asia-Pacific region in terms of GDP. The growth rate in the country remains high but is gradually diminishing, and the economy is rebalancing from investment to consumption, manufacturing to services, and external to internal demand.

- According to China's 14th five-year plan, the number of permanent urban residents is supposed to rise to 65% by 2025. This is expected to increase demand for the market studied in the years to come.

- As China recovered from the pandemic, many residential construction projects kicked off in the country. Hong Kong's housing authorities launched a number of initiatives to jumpstart the construction of low-cost housing.The officials aim to provide 301,000 public housing units in 10 years, until 2030.

- Government reforms aided significant growth in industrial production as well as end-user demand for automobiles in India.Initiatives, such as "Atma Nirbhar Bharat" and "Make in India," are expected to boost the automotive industry, thereby positively impacting the demand for spray polyurethane foams in the coming years.

- Under the NAP 2021, the automotive manufacturing industry in Malaysia is expected to produce 1.47 million vehicles annually by 2030. From now until 2030, this is expected to increase the demand for spray polyurethane foam used to make cars in the country.

- Owing to all the aforementioned factors, the Asia-Pacific region is expected to dominate the spray polyurethane foam market during the forecast period.

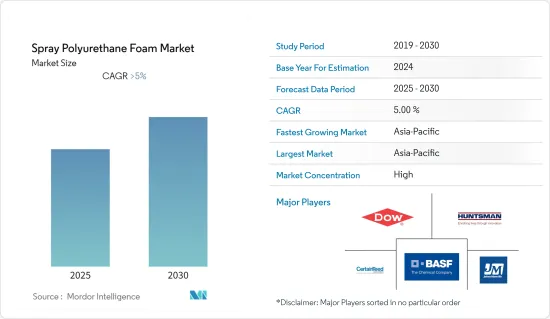

Spray Polyurethane Foam Industry Overview

The spray polyurethane foam market is consolidated by nature. Some of the major players in the market include (in no particular order) BASF SE, Huntsman International LLC, Johns Manville, Dow, and CERTAINTED, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Growing Concerns Related to Greenhouse Gas Emissions

- 4.1.2 Strong Potential as a Key Component of the Durability Management Strategy for a Building

- 4.1.3 Growing Significance in Industrial Insulation for Cold Storage Spaces, Walk-in Refrigerators, Pipes, Tanks, and Others

- 4.2 Restraints

- 4.2.1 Growing Competition from Fiberglass and Cellulose Insulation Solutions

- 4.2.2 Stringent Environmental Protection Agency (EPA) and Occupational Safety and Health Administration (OSHA) Regulations

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Product Type

- 5.1.1 Two-component High-Pressure Spray Foam

- 5.1.2 Two-component Low-Pressure Spray Foam

- 5.1.3 One Component Foam (OCF)

- 5.1.4 Other Product Types

- 5.2 Application

- 5.2.1 Insulation

- 5.2.2 Waterproofing

- 5.2.3 Asbestos Encapsulation

- 5.2.4 Sealant

- 5.2.5 Other Applications

- 5.3 Geography

- 5.3.1 Asia-Pacific

- 5.3.1.1 China

- 5.3.1.2 India

- 5.3.1.3 Japan

- 5.3.1.4 South Korea

- 5.3.1.5 Rest of Asia-Pacific

- 5.3.2 North America

- 5.3.2.1 United States

- 5.3.2.2 Canada

- 5.3.2.3 Mexico

- 5.3.3 Europe

- 5.3.3.1 Germany

- 5.3.3.2 United Kingdom

- 5.3.3.3 Italy

- 5.3.3.4 France

- 5.3.3.5 Rest of Europe

- 5.3.4 South America

- 5.3.4.1 Brazil

- 5.3.4.2 Argentina

- 5.3.4.3 Rest of South America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 South Africa

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share (%)**/ Ranking Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 ACCELLA CORPORATION

- 6.4.2 BASF SE

- 6.4.3 CERTAINTEED

- 6.4.4 Dow

- 6.4.5 Huntsman International LLC

- 6.4.6 Icynene-Lapolla

- 6.4.7 INVISTA

- 6.4.8 ISOTHANE LTD.

- 6.4.9 Johns Manville

- 6.4.10 NCFI Polyurethanes

- 6.4.11 SOPREMA

- 6.4.12 Specialty Products Inc.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Emerging Applications as the New Industry Standard for Pipeline Engineering

- 7.2 Growing Trend of Foam Lifting in the Concrete Raising Industry

02-2729-4219

+886-2-2729-4219