|

市場調查報告書

商品編碼

1630196

中國AMH(自動物料輸送):市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)China AMH - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

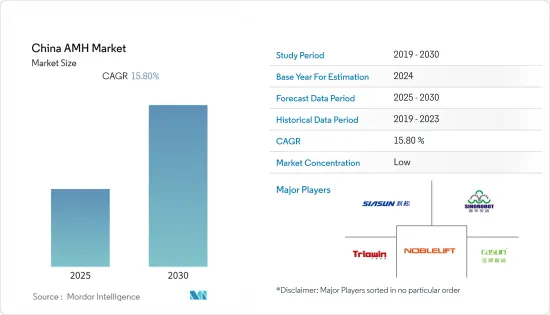

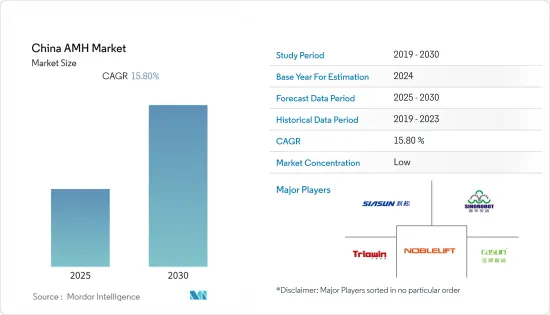

中國AMH(自動物料輸送)市場預計在預測期間內複合年成長率為15.8%

主要亮點

- 自2012年以來,中國一直是機器人產業最大的市場,並且沒有任何放緩的跡象。按照「中國製造2025」政策的目標,中國正走在2020年成為技術和自動化領導者的正確道路上。

- 透過在製造業中引入自動化,中國預計到2025年將製造成本降低30%。根據中國國家統計局預測,2020年,60歲以上老年人口將超過2,985萬人。此外,到2050年,預計將有3.3億中國人年齡在65歲或以上。這將導致技術純熟勞工短缺,並需要減少工作活動以維持職場生產力。

- 未來四年,目前對外國科技公司的投資預計將轉向國內研發活動。中國政府已採取必要措施嚴格控制境外資本流動,並核准了建立國家機器人創新中心的計畫。這證明了投資的挪用。

- 國際機器人聯合會預測,到2020年,日本將有950,300台工業機器人投入運作。因此,該國的AMH(自動物料輸送)市場預計在預測期內將出現良好成長。

中國AMH(自動化物料輸送)市場趨勢

AGV 複合年成長率最高

- AGV在中國應用於汽車、食品飲料、製藥、零售、電子和製造業。由於物聯網帶動的工業發展,中國的汽車和通用製造業預計未來將獲得牽引力。

- 多項政府措施正在支持這項變革。例如,「中國製造2025」(中國)的推出是為了培育製造業生產力和成長的未來。透過這些策略,中國中央政府預計2020年中國汽車產量將達到3,000萬輛,到2025年將達到3,500萬輛。

- 此外,物聯網正快速加速中國的物流,促進各零售和電子商務公司的銷售。數十億個連結對像有潛力支援直接客戶互動並自動化銷售和訂購流程。

- 因此,幾家領先公司正在為市場提供先進的 AGV。例如,2020 年 12 月,豐田堆高機推出了兩款與豐田先進物流公司巴斯蒂安解決方案合作開發的新型自動倉庫車輛。

一般製造業可望維持最高增速

- 製造業是中國經濟的支柱之一,正經歷快速轉型。據稱,低階製造公司正在遷往東南亞以降低成本,其中包括汽車和電子製造公司。預計未來五年汽車產業每年將以6%至7%的速度成長。

- 中國是全球最大的製造業經濟體,被認為是全球最具競爭力的國家之一。在不影響建立複雜能力的情況下維持核心低成本生產基地和成本優勢的努力有助於經濟成功。製造業是中國經濟的標誌之一,正經歷快速轉型。這一巨大轉變正在幫助中國成為世界製造業市場的領先國家之一。

- 根據國家發改委統計,2020會計年度中國高技術製造業投資與前一年同期比較成長12%。

- 此外,據工業和資訊化部稱,到2020年,中國將新增100多個智慧製造先導計畫。根據《智慧製造「十三五」規劃》,中國的目標是在2025年建立智慧製造體系並實現重點產業轉型。

中國AMH(自動物料輸送)產業概況

中國的AMH(自動物料輸送)市場分散且競爭激烈。產品推出、高額研發投入、夥伴關係與收購是國內企業維持激烈競爭所採取的主要成長策略。

- 2021 年 9 月 - 一家位於天津的製造商獲得稅收優惠和政府擔保貸款,以實現中國龐大工廠的現代化,並生產可提高其技術專業知識的產品。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- COVID-19 對市場的影響

- 市場促進因素

- 技術進步不斷推動市場成長

- 工業 4.0 投資推動自動化和物料輸送的需求

- 智慧製造快速發展

- 市場限制因素

- 缺乏技術純熟勞工

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 依產品類型

- 硬體

- 軟體

- 服務

- 依設備類型

- 移動機器人

- 自動導引運輸車(AGV)

- 自動堆高機

- 自動拖車/曳引機/標籤

- 單元貨載

- 組裝

- 特殊用途

- 自主移動機器人(AMR)

- 雷射導引車

- 自動化倉庫(ASRS)

- 固定通道(堆垛機高機+穿梭系統)

- 輪播(水平輪播+垂直輪播)

- 垂直升降模組

- 自動輸送機

- 腰帶

- 滾筒

- 調色盤

- 開賣

- 堆垛機

- 常規型(高電位+低電位)

- 機器人

- 分類系統

- 移動機器人

- 按最終用戶產業

- 飛機場

- 車

- 飲食

- 零售/倉庫/配送中心/物流中心

- 一般製造業

- 藥品

- 小包裹

- 其他最終用戶

第6章 競爭狀況

- 公司簡介

- Guangzhou Sinorobot Technology Co. Ltd

- Siasun Robot & Automation Co. Ltd

- Machinery Technology Development Co. Ltd

- Noblelift Intelligent Equipment Co. Ltd

- Shanghai Triowin Automation Machinery Co. Ltd

- Shenzhen Casun Intelligent Robot Co. Ltd

- Shenzhen Okavg Co. Ltd

- Zhejiang Guozi Robot Technology Co. Ltd

第7章 投資分析

第8章市場的未來

簡介目錄

Product Code: 61998

The China AMH Market is expected to register a CAGR of 15.8% during the forecast period.

Key Highlights

- China has been the largest market for the robotics industry since 2012, and the country shows no signs of a slowdown. The country is on the exact path of becoming a leader in technology and automation by 2020, as targeted by the country's 'Made in China 2025' policies.

- By adopting automation in manufacturing, China is expected to cut manufacturing costs by 30% by 2025. According to the National Bureau of Statistics China, the country has more than 29.85 million of the population aged above 60 years in 2020. It is further anticipated that by 2050, 330 million Chinese will be over age 65. This would result in a dearth of skilled labor, which would require job activities to be eased to maintain productivity at work, which will boost the growth of the market studied.

- In the next four years, the current investments being made in foreign technology companies are expected to be diverted toward R&D activities in the country itself. The Chinese government is taking the necessary steps to strictly control the flow of capital abroad and approve plans to establish a National Robotics Innovation Center. This proves the diversion of investments.

- The forecast from the International Federation of Robotics indicates that 950,300 industrial robots will be operational in the country in 2020. Thus, the automated material handling market in the country is expected to experience favorable growth over the forecast period.

China Automated Material Handling Market Trends

AGV to Register Highest CAGR

- AGVs in China are being used across automotive, food and beverage, pharmaceutical, retail, electronics, and manufacturing industries. The automotive and general manufacturing industry in China is expected to gain traction in the future, owing to industrial developments with IoT as a mediator.

- Several government initiatives support the change; for example, Made in China 2025 (China) was introduced to promote the future of productivity and growth in manufacturing industries. Due to these strategies, the Chinese Central Government expects China's automobile output to reach 30 million units by 2020 and 35 million by 2025.

- In addition, the IoT has ramped up logistics into high gear in China, which has encouraged sales of various retail and e-commerce companies. Billions of connected objects have the potential to support direct customer interaction and automate sales and ordering processes.

- Hence, several leading players are offerings advanced AGVs for the market. For instance, in December 2020, Toyota Forklift has unveiled two new autonomous warehouse vehicles, developed in partnership with Bastian Solutions, a Toyota Advanced Logistics company.

General Manufacturing is expected to hold the highest growth rate

- Manufacturing is one of the pillars of the Chinese economy and is undergoing a rapid transformation. It is reported that low-end manufacturing firms are moving to Southeast Asia to cut costs, which include automotive and electronics manufacturing companies. It is estimated that the automotive industry will expand by 6-7% annually in the next five years.

- China is the world's largest manufacturing economy and is also considered to be one of the most competitive nations globally. The effort to maintain its core low-cost production base and cost advantage without compromising on building complex capabilities is contributing to the success of the economy. Manufacturing is one of the prominent features of China's economy, and it is undergoing a rapid transformation. This large-scale transformation has aided the country in being a leading nation in the manufacturing market globally.

- According to the National Development and Reform Commission (NDRC), China's investment in the high-tech manufacturing industry expanded by 12% year-on-year in FY 2020.

- Moreover, According to the Ministry of Industry and Information Technology, China added more than 100 smart manufacturing pilot projects till 2020. As per the 13th Five-Year Plan of Smart Manufacturing, China aims to establish its intelligent manufacturing system and transform key industries by 2025.

China Automated Material Handling Industry Overview

The China automated material handling market is fragmented and highly competitive in nature. Product launches, high expense on research and development, partnerships and acquisitions, etc., are the prime growth strategies adopted by the companies in the country to sustain the intense competition.

- September 2021 - A Tianjin-based maker has received tax breaks and government-guaranteed loans to build products that modernize China's vast factory sector and advance its technological expertise.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Impact of Covid-19 on the Market

- 4.3 Market Drivers

- 4.3.1 Increasing technological advancements aiding market growth

- 4.3.2 Industry 4.0 investments driving the demand for automation and material handling

- 4.3.3 Rapid growth of Smart manufacturing

- 4.4 Market Restraints

- 4.4.1 Unavailability for skilled workforce

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Hardware

- 5.1.2 Software

- 5.1.3 Services

- 5.2 By Equipment Type

- 5.2.1 Mobile Robots

- 5.2.1.1 Automated Guided Vehicle (AGV)

- 5.2.1.1.1 Automated Forklift

- 5.2.1.1.2 Automated Tow/Tractor/Tug

- 5.2.1.1.3 Unit Load

- 5.2.1.1.4 Assembly Line

- 5.2.1.1.5 Special Purpose

- 5.2.1.2 Autonomous Mobile Robots (AMR)

- 5.2.1.3 Laser Guided Vehicle

- 5.2.2 Automated Storage and Retrieval System (ASRS)

- 5.2.2.1 Fixed Aisle (Stacker Crane + Shuttle System)

- 5.2.2.2 Carousel (Horizontal Carousel + Vertical Carousel)

- 5.2.2.3 Vertical Lift Module

- 5.2.3 Automated Conveyor

- 5.2.3.1 Belt

- 5.2.3.2 Roller

- 5.2.3.3 Pallet

- 5.2.3.4 Overhead

- 5.2.4 Palletizer

- 5.2.4.1 Conventional (High Level + Low Level)

- 5.2.4.2 Robotic

- 5.2.5 Sortation System

- 5.2.1 Mobile Robots

- 5.3 By End-user Vertical

- 5.3.1 Airport

- 5.3.2 Automotive

- 5.3.3 Food and Beverage

- 5.3.4 Retail/Warehousing/ Distribution Centers/Logistic Centers

- 5.3.5 General Manufacturing

- 5.3.6 Pharmaceuticals

- 5.3.7 Post and Parcel

- 5.3.8 Other End-Users

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Guangzhou Sinorobot Technology Co. Ltd

- 6.1.2 Siasun Robot & Automation Co. Ltd

- 6.1.3 Machinery Technology Development Co. Ltd

- 6.1.4 Noblelift Intelligent Equipment Co. Ltd

- 6.1.5 Shanghai Triowin Automation Machinery Co. Ltd

- 6.1.6 Shenzhen Casun Intelligent Robot Co. Ltd

- 6.1.7 Shenzhen Okavg Co. Ltd

- 6.1.8 Zhejiang Guozi Robot Technology Co. Ltd

7 INVESTMENT ANALYSIS

8 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219