|

市場調查報告書

商品編碼

1630198

阻燃塗料:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Fire Retardant Coatings - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

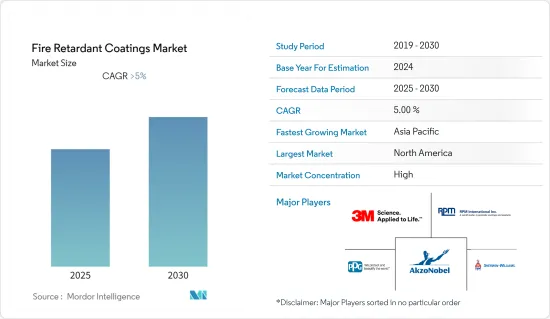

阻燃塗料市場預計在預測期內將維持5%以上的複合年成長率

由於封鎖、社交距離和貿易制裁對全球供應鏈網路造成了嚴重破壞,COVID-19 大流行阻礙了市場。由於活動停止,建築業出現下滑。然而,這種情況預計將在 2021 年恢復,並在預測期內使市場受益。

主要亮點

- 市場研究的關鍵促進因素是全球建設活動的增加以及石油和天然氣探勘活動的成長。

- 然而,某些應用的低成本替代品的可用性阻礙了市場的成長。

- 頁岩氣產量的大幅增加可能會為全球市場帶來機遇,其中大部分消費來自中國和印度等國家。

阻燃塗料市場趨勢

建築和施工行業的需求不斷成長

- 由於亞太和北美地區基礎設施計劃快速增加,建築業佔據壓倒性佔有率。

- 阻燃塗料用於建築業,以減少火災造成的損害並防止火災的發生。防火措施包括安裝和使用結構和操作系統,以盡量減少火災對人員和財產的影響。

- 根據土木工程師協會預測,到2025年,中國、印度和美國預計將佔全球建築業成長的近60%,推動阻燃塗料的市場成長率。

- 美國是世界上最大的建築市場之一。根據美國人口普查局的數據,2021年美國建築業價值為1.58兆美元,約佔全國GDP總量的4.3%。

- 根據美國人口普查局的數據,2021 年 12 月獲得建築許可的私人住宅總數為 1,873,000 套,比 11 月修正後的數字 1,717,000 套成長 9.1%。 2021年建築許可證數量預計為1,724,700套,比上年的1,471,100套增加17.2%。

- 富馬醇塗料主要用於被動防火。加熱時,該塗層會膨脹至其原始厚度的許多倍,形成絕緣碳化物,保護底層結構,例如暴露的結構鋼或石膏板。

- 溶劑型或水性薄膜塗層系統用於需要30、60或90分鐘耐火性的建築物的防火。阻燃塗料的需求高度依賴建築支出。

- 美國目前正在進行的最昂貴的建設計劃包括底特律的哈德遜河開發項目(10 億美元)、紐約的范德比爾特一號(31.4 億美元)和國土安全部的邊境牆長期戰略(150 億美元)。其中包括第二大道地鐵三期計劃(MTA-紐約市交通局)(142億美元)、Gateway Hudson隧道計劃(127億美元)以及甘迺迪國際機場擴建和維修(130億美元)。

- 因此,預計上述因素將對未來幾年阻燃劑市場產生重大影響。

亞太地區成長最快

- 亞太地區是阻燃塗料成長最快的市場。阻燃塗料在建築工地消耗,正在推動市場成長。

- 通常需要阻燃塗料來保護各種產品免受火災,包括可燃和不可燃的火災。阻燃塗料是最古老、最有效、最簡單的方法,可以在不改變材料基本性能的情況下應用於任何表面。

- 中國、印度和越南等亞太國家的建設活動成長強勁,預計將在預測期內推動該地區的碳酸鋇消費。

- 根據美國國際貿易管理局的數據,中國是世界上最大的建築市場,預計到 2030 年將以 8.6% 的速度成長。據國家發展和改革委員會(NDRC)稱,未來五年(2025年)中國將投資1.43兆美元用於重大建設計劃。上海計畫未來三年投資387億美元,廣州已簽署16個新基礎建設計劃,投資80.9億美元。

- 在印度,2021 年 3 月,建築和開發產業創造了 260.8 億美元的收入,活動額為 247.2 億美元。 2022年,印度透過政府在基礎建設發展和經濟適用住宅(包括全民住宅和智慧城市計畫)的舉措,為建築業貢獻了約6,400億美元。在預測期內,該國建設活動的擴張正在推動阻燃塗料市場。

- 在印度尼西亞,根據國家中期發展計劃(RPJMN 2020-2024),政府計劃投資4,120億美元發展該國交通、工業、能源和住宅基礎設施計劃,這將推動阻燃塗料的發展市場是有可能的。

- 根據印尼統計局(BPS)統計,2021年該國建築業GDP為1,770億美元。此外,根據世界水泥資料,2022年印尼建築市場成長7.2%。

- 日本財務省的數據顯示,2021會計年度日本建築業銷售額約1.22兆美元,較去年同期成長2.1%。

- 因此,預計上述因素將在未來幾年推動亞太地區阻燃塗料的需求。

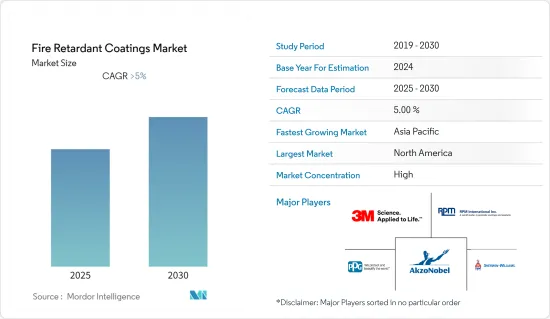

阻燃塗料產業概況

阻燃塗料市場正在整合。主要參與企業包括(排名不分先後)3M、Akzo Nobel NV、RPM International Inc、PPG Industries, Inc 和 The Sherwin-Williams Company。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 促進因素

- 全球建設活動增加

- 石油和天然氣探勘活動的成長

- 抑制因素

- 低成本替代品的可用性

- 其他限制因素

- 產業價值鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭程度

第5章市場區隔(以金額為準的市場規模)

- 樹脂型

- 矽膠

- 環氧樹脂

- 丙烯酸纖維

- 乙烯基塑膠

- 其他

- 科技

- 水性的

- 溶劑型

- 粉末塗料

- 其他

- 塗層類型

- 滲透塗層

- 水泥基塗料

- 最終用戶產業

- 建築/施工

- 電力

- 運輸

- 石油和天然氣

- 其他

- 地區

- 亞太地區

- 中國

- 印度

- 日本

- 韓國

- 其他亞太地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 歐洲

- 德國

- 英國

- 義大利

- 法國

- 歐洲其他地區

- 南美洲

- 巴西

- 阿根廷

- 南美洲其他地區

- 中東/非洲

- 沙烏地阿拉伯

- 南非

- 其他中東/非洲

- 亞太地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 市場佔有率分析

- 主要企業策略

- 公司簡介

- 3M

- Akzo Nobel NV

- Albi Protective Coatings

- Benjamin Moore & Co

- Carboline

- Contego International Inc.

- Hempel AS

- Isolatek International

- Jotun

- No-Burn, Inc.

- PPG Industries, Inc.

- RPM International Inc

- The Sherwin-Williams Company

- TREMCO ILLBRUCK

第7章 市場機會及未來趨勢

- 頁岩氣產量大幅增加

- 其他機會

The Fire Retardant Coatings Market is expected to register a CAGR of greater than 5% during the forecast period.

The COVID-19 pandemic hampered the market, as lockdowns, social distances, and trade sanctions triggered massive disruptions to global supply chain networks. The construction industry witnessed a decline due to the halt in activities. However, the condition recovered in 2021 and was expected to benefit the market during the forecast period.

Key Highlights

- Major factors driving the market studied are increasing construction activities globally and growth in oil & gas exploration activities.

- However, the availability of low-cost alternatives for some applications hinders the market's growth.

- The strong rise in shale gas production will likely act as an opportunity for the markeglobal marketed the market across the globe with the largest consumption in a country such as China, India, etc.

Fire Retardant Coatings Market Trends

Growing Demand from Building & Construction Industry

- The building and construction industry is the dominating segment, owing to the escalation in infrastructure projects in Asia-Pacific and North American regions.

- Fire retardant coatings are used in the construction industry to reduce the extent of damage that a fire can cause and help to avert one from breaking out in the first place. Fire protection involves installing and using structural and operational systems to minimize the impact of fire on people and property.

- According to the Institution of Civil Engineers, China, India, and the United States are expected to account for almost 60% of all global growth in the construction sector by 2025, thus increasing the market growth of fire retardant coatings.

- The United States was among the top construction markets globally. Per the United States Census Bureau, in 2021, construction in the United States was valued at USD 1.58 trillion, accounting for around 4.3% of the country's total GDP.

- According to the US Census Bureau, the total privately owned housing units authorized by building permits in December 2021 were 1,873,000, 9.1% more than the revised rate of 1,717,000 in November. In 2021, an estimated 1,724,700 housing units were authorized by building permits, 17.2% more than 1,471,100 in the previous year.

- Intumescent coatings are mostly used in passive fire protection. Intumescent coatings are typically water-based, solvent-based, or epoxy-based paint-like materials, which expand by many times their original thickness when heated to form an insulating char to protect the substrate, such as exposed structural steel or sheetrock, in the event of fire accidents.

- Solvent-based or water-based thin film coating systems are used for fire protection in buildings with a resistance requirement of 30, 60, and 90 minutes. The demand for intumescent coatings is majorly dependent on construction spending.

- Some of the most expensive construction projects in the United States, which are currently underway, are Hudson's Development, Detroit (USD 1 billion), One Vanderbilt, New York (USD 3.14 billion), DHS border wall long-term strategy (USD 15 billion), phase 3 of the second avenue subway project - MTA - New York city transit (USD 14.2 billion), gateway Hudson tunnel project (USD 12.7 billion), and JFK international airport expansion and renovations (USD 13 billion).

- Therefore, the factors above are expected to impact the fire retardant market in the coming years significantly.

Asia-Pacific Region to Exhibit the Fastest Growth

- The Asia-Pacific region stands to be the fastest-growing market for fire retardant coatings. Consumption of these coatings in construction activities drives the market's growth.

- Fire retardant coatings are often required to protect a wide range of products bo,th flammable and nonflammable, against fire. It is the oldest, most efficient, and easiest method to apply any surface without modifying the intrinsic properties of materials.

- Asia-Pacific countries, such as China, India, and Vietnam, have been registering strong growth in construction activities, which is expected to drive the consumption of barium carbonate in the region over the forecast period.

- As per U.S. International Trade Administration, China is the world's largest construction market and is forecasted to grow at an annual average rate of 8.6% till 2030. According to National Development and Reform Commission (NDRC), China is investing USD 1.43 trillion in major construction projects in the next five years, 2025. The Shanghai plan includes an investment of USD 38.7 billion in the next three years, whereas Guangzhou signed 16 new infrastructure projects with an investment of USD 8.09 billion.

- In India, the construction development sector and activities stood at USD 26.08 billion and USD 24.72 billion, respectively, in March 2021. In 2022, India contributed about USD 640 billion to the construction industry due to government initiatives in infrastructure development and affordable housing, such as housing to all, smart city plans, etc. The growing construction activities in the country are driving the fire retardant coatings market over the forecast period.

- In Indonesia, under the National Medium-term Development Plan (RPJMN 2020-2024), the government plans to invest USD 412 billion in the development of transport, industrial, energy, and housing infrastructure projects in the country, which may help boost the fire retardant coatings market.

- As per Statistics Indonesia (BPS), in the year 2021, the GDP of the construction sector in the country was USD 0.177 trillion. Furthermore, as per the data by World Cement, the Indonesian construction market recorded a growth of 7.2% in 2022.

- According to the Ministry of Finance of Japan, the construction industry in Japan generated sales of approximately USD 1.22 trillion in the fiscal year 2021, registering an increase of 2.1% compared to the same period last year.

- Therefore, the factors above are expected to boost the demand for fire retardant coatings in the Asia-Pacific region in the coming years.

Fire Retardant Coatings Industry Overview

The Fire Retardant Coatings Market is consolidated. Some major players include (not in a particular order) 3M, Akzo Nobel N.V., RPM International Inc, PPG Industries, Inc., and The Sherwin-Williams Company, amongst others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Drivers

- 4.1.1 Increasing Construction Activities Across the Globe

- 4.1.2 Growth in Oil & Gas Exploration Activities

- 4.2 Restraints

- 4.2.1 Availability of Low-Cost Alternatives

- 4.2.2 Other Restraints

- 4.3 Industry Value-Chain Analysis

- 4.4 Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Consumers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products and Services

- 4.4.5 Degree of Competition

5 MARKET SEGMENTATION (Market Size in Value)

- 5.1 Resin Type

- 5.1.1 Silicone

- 5.1.2 Epoxy

- 5.1.3 Acrylic

- 5.1.4 Vinyl

- 5.1.5 Other Resin Types

- 5.2 Technology

- 5.2.1 Water-borne

- 5.2.2 Solvent-borne

- 5.2.3 Powder Coatings

- 5.2.4 Others

- 5.3 Coating Type

- 5.3.1 Intumescent Coating

- 5.3.2 Cementitious Coating

- 5.4 End-user Industry

- 5.4.1 Building & Construction

- 5.4.2 Power

- 5.4.3 Transportation

- 5.4.4 Oil & Gas

- 5.4.5 Others

- 5.5 Geography

- 5.5.1 Asia-Pacific

- 5.5.1.1 China

- 5.5.1.2 India

- 5.5.1.3 Japan

- 5.5.1.4 South Korea

- 5.5.1.5 Rest of Asia-Pacific

- 5.5.2 North America

- 5.5.2.1 United States

- 5.5.2.2 Canada

- 5.5.2.3 Mexico

- 5.5.3 Europe

- 5.5.3.1 Germany

- 5.5.3.2 United Kingdom

- 5.5.3.3 Italy

- 5.5.3.4 France

- 5.5.3.5 Rest of Europe

- 5.5.4 South America

- 5.5.4.1 Brazil

- 5.5.4.2 Argentina

- 5.5.4.3 Rest of South America

- 5.5.5 Middle East & Africa

- 5.5.5.1 Saudi Arabia

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East & Africa

- 5.5.1 Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Market Share Analysis

- 6.3 Strategies Adopted by Leading Players

- 6.4 Company Profiles

- 6.4.1 3M

- 6.4.2 Akzo Nobel N.V.

- 6.4.3 Albi Protective Coatings

- 6.4.4 Benjamin Moore & Co

- 6.4.5 Carboline

- 6.4.6 Contego International Inc.

- 6.4.7 Hempel AS

- 6.4.8 Isolatek International

- 6.4.9 Jotun

- 6.4.10 No-Burn, Inc.

- 6.4.11 PPG Industries, Inc.,

- 6.4.12 RPM International Inc

- 6.4.13 The Sherwin-Williams Company

- 6.4.14 TREMCO ILLBRUCK

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Strong Rise in Shale Gas Production

- 7.2 Other Opportunities