|

市場調查報告書

商品編碼

1630201

行動裝置管理:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Mobile Device Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

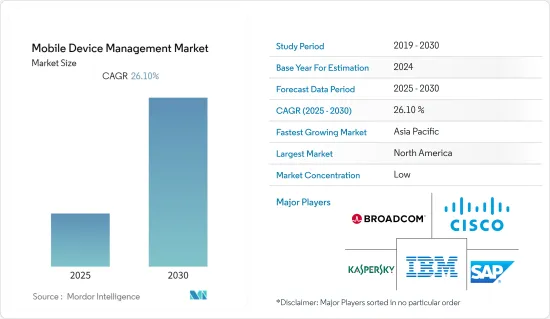

預計行動裝置管理市場在預測期內的複合年成長率將達到 26.1%。

有幾個因素正在推動所研究的市場的成長,包括日益成長的安全問題、管理和保護數量不斷增加的行動裝置的需求、雲端基礎的行動裝置管理解決方案的日益採用以及對遠端管理功能的需求不斷成長。

主要亮點

- 行動裝置使員工可以輕鬆地在家中、辦公室或在旅途中工作。雖然這提供了靈活性和便利性,但也可能使您的組織面臨潛在威脅。管理行動裝置安全和設備運作狀況對於最大限度地降低組織的風險狀況至關重要。

- BYOD(自帶設備)的日益普及以及保護大量企業資料的安全問題日益突出,是影響 MDM 市場成長的關鍵因素。 BYOD 的興起是整個商業領域的一股明顯力量。快速成長的行動裝置群已成為每個組織的重要考量。因此,需要一個提供高監控能力和強大資料保護的平台。

- 沒有 MDM 保護的裝置遭受惡意軟體和其他病毒攻擊的風險會增加,這可能會使它們儲存的敏感資料面臨風險。個人資料外洩可能會對組織在消費者和其他業務合作夥伴中的聲譽產生永久性影響,使其成為推動市場的最重要因素之一。

- 使用劣質行動電話會增加爆炸的風險。這是因為這些行動電話可能使用廉價的電子元件和未經徹底測試的鋰離子電池,導致過熱並可能爆炸。 MDMS系統將協助進口符合品質和標準的正品行動裝置。

- 2023年5月,尼泊爾通訊管理局推出了行動裝置管理系統。此安全軟體使監管機構可以輕鬆實施保護、監控和管理最終用戶行動裝置的策略。據當局稱,已有 27,000 人在 MDMS 上註冊了行動電話,包括註冊了 IMEI 號碼。這個獨特的 15 位數代碼可精確識別您輸入 SIM 卡的裝置。

- 行動裝置製造商正在努力將 5G 組件整合到其設備中,以充分利用 5G 網路的潛力。這些努力被認為是設備低延遲和高速管理的關鍵。 5G業務支援多場景的多種業務及相關業務需求。

- 隨著 5G 預計很快就會進入企業領域,企業可能需要重新設計其企業行動策略。由於 5G 將推動智慧型裝置、穿戴式裝置、人工智慧、物聯網、AR 和 VR 跨產業的採用,因此您將需要正確的管理解決方案來簡化裝置管理。

- 然而,缺乏對技術進步的認知、實施和管理的複雜性、與不同設備操作系統的兼容性問題、對資料隱私和安全的擔憂、對大量IT 專業知識的需求以及實施和維護MDM 解決方案的成本這些因素正在限制MDM 的成長。

行動裝置管理 (MDM) 市場趨勢

雲端基礎的部署預計將主導市場

- 雲端基礎的行動裝置管理解決方案因其靈活性、流暢性、擴充性和經濟性而迅速被企業採用。

- AT&T 最近的一項研究表明,混合工作模式預計將從 2021 年的 42% 成長到 2024 年的 81%。 2022 年 7 月 13 日至 7 月 31 日期間,FlexJobs 對 2,000 多名受雇者進行了調查,以了解他們對當前工作環境重要主題的見解。根據 FlexJobs 的員工敬業度報告,48% 的雇主為員工實施了遠距工作。當被問及疫情後的工作場所計畫時,26% 的受訪者表示他們將採用混合模式,22% 的受訪者表示他們將允許遠距工作。遠端工作的採用預計將推動雲端基礎的行動裝置管理解決方案的採用。

- 2023 年 4 月,Google Cloud 將宣布一系列新的安全合作夥伴關係,以便為企業和公共部門 IT 團隊在大規模管理混合工作時提供更多選擇、強大功能和簡單性。 Google Cloud 透過與 Okta 和 VMware 建立新的合作夥伴關係,擴展了 Google Workspace 的身份、裝置和存取管理功能,使大型企業和公共機構能夠向員工提供經 FedRAMP 批准的協作和通訊工具。

- 儘管 MDM 的主要目的是安全性,但它還有許多其他核心功能。行動裝置管理解決方案的主要元件是存取管理、裝置和應用程式安全、資料安全、裝置追蹤、端點監控和管理、任務自動化、技術支援和內容管理。雲端基礎的解決方案為 IT 團隊提供了遠端註冊、鎖定、管理和保護設備等功能。現代行動裝置使用各種作業系統,需要定期更新平台韌體以保持裝置平穩運作。與本地解決方案相比,雲端基礎的MDM 解決方案可以更快地回應這些更新要求。

- 製造業、通訊、運輸、公共產業、物流和零售等多個行業由於其各種優勢而更喜歡雲端基礎的MDM 解決方案。由於預算限制和易於存取雲端基礎的MDM 解決方案,中小型企業也正在迅速轉向基於雲端的部署解決方案。

預計北美將佔據最大的市場佔有率

- 北美是突出的市場之一,主要是由於許多地區的最終用戶行業對先進技術的需求不斷增加。此外,設備管理技術的進步正在推動該地區的市場成長。

- 根據消費者科技美國(CTA)和美國人口普查局的數據,美國智慧型手機銷量從 2021 年的 730 億美元增加到 2022 年的 747 億美元。根據 GSMA 的數據,到 2025 年,北美智慧型手機用戶數量預計將達到 3.28 億。此外,到 2025 年,該地區的行動用戶(86%) 和網路普及率 (80%) 可能會快速成長。對行動電話日益成長的需求可能為開發研究市場提供有利可圖的機會。

- 隨著 5G 服務在該地區許多地區的推出,行動裝置管理的角色預計將變得更加重要。據GSMA預計,2022年北美5G連線數將突破10億。在通訊業者持續的網路投資以及各價格分佈5G智慧型手機擴張的推動下,預計到2025年將超過20億。到2025年,北美將成為第一個5G連線數佔總連線數超過50%的地區。

- 許多區域企業正在轉向企業行動解決方案,以幫助管理日益動態的行動員工隊伍,並保護內容免受資料外洩、網路攻擊、網路和網路威脅安全以及嚴重資料遺失的影響。這推動了整個全部區域對行動裝置管理解決方案的需求。

- 這就是為什麼蘋果在 2022 年 3 月宣布將為美國所有中小企業推出 Apple Business Essentials。這項新服務將裝置管理、24/7 Apple 支援和 iCloud 儲存體結合到靈活的訂閱方案中。 Apple 也宣布了新的 AppleCare+ for Business Essentials 選項,可以添加到任何計劃中。所有客戶均可享有兩個月的免費試用,包括使用 Apple Business Essentials 測試版的客戶。

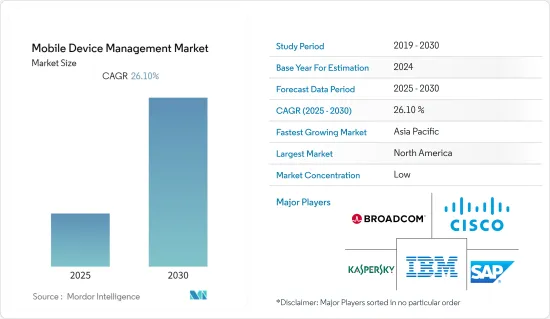

行動裝置管理 (MDM) 產業概述

行動裝置管理市場競爭非常激烈,因為有許多大大小小的參與者在國際市場上運作和提供國內和國內解決方案。主要企業正在採取產品創新等策略,大多數領先的供應商都提供行動裝置管理作為其企業行動管理 (EMM) 產品的一部分。

- 2022 年 6 月 - 企業軟體領域的知名創新者 VMware Inc. 推出了 VMware Workspace ONE,這是其隨時隨地的工作空間平台,可讓 IT 團隊更輕鬆地管理所有員工設備並提高安全性。新功能包括用於進階行動裝置安全性的工作區 ONE Mobile Threat Defense 以及針對 Windows 作業系統裝置的增強更新和修補程式管理功能。

- 2022 年 5 月 - Ivanti Software 宣布推出 Ivanti Neurons for MDM,為企業擁有的一次性 (COSU) 設備管理和向雲端基礎的設備管理的過渡提供支援。輕鬆進行 5G 切片、交付和更新更高的應用程式優先順序、添加 USB 安全性等等。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- COVID-19 對 MDM 及相關市場的影響(由於全球封鎖措施,對有效 MDM 政策的需求激增 | 從工作站穩步轉向可攜式BYOD 設備 | 本研究中對短期和短期的全面分析) 對需求預測的影響)

第5章市場動態

- 市場促進因素

- BYOD 採用率增加

- 保護大量企業資料的安全問題日益嚴重

- 市場限制因素

- 引進基礎建設時初始投資較高

- 企業MDM解決方案主要選擇標準分析

第6章 市場細分

- 依部署類型

- 本地

- 雲

- 按最終用戶產業

- 通訊/資訊技術

- 銀行/金融服務

- 衛生保健

- 零售

- 政府機構

- 製造業

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Vmware Inc.

- Citrix Systems, Inc.

- MobileIron Inc.

- IBM Corporation

- Broadcom Inc.(Symantec Corporation)

- Sophos Group PLC

- Centrify Corporation

- Kaspersky Lab Inc.

- SAP SE

- Ivanti Software Inc.

- Cisco Systems Inc.

- BlackBerry Limited

- SOTI Inc

- Miradore Ltd

- JAMF

第 8 章. 比較供應商分析(包括對供應商選擇標準的分析,例如部署難易度、整合、解決方案彈性和成本)

第 9 章供應商市場佔有率分析 - MDM 市場

第10章投資分析

第11章市場展望

The Mobile Device Management Market is expected to register a CAGR of 26.1% during the forecast period.

Several factors, like the increasing security concerns, the need to manage and secure a growing number of mobile devices, the rising adoption of cloud-based mobile device management solutions, and the growing demand for remote management capabilities, are anticipated to drive the growth of the studied market.

Key Highlights

- Mobile devices facilitate employees to conveniently do their work from home, at the office, or on the go. While this offers flexibility and convenience, it could expose an organization to potential threats. Managing mobile devices' security and device health is vital to minimizing an organization's risk posture.

- The rising adoption of Bring Your Device (BYOD) and the growing security concerns to protect an enormous amount of corporate data are significant factors influencing the growth of the MDM market. The proliferation of BYOD has become an apparent force across the business landscape. The rapidly expanding fleet of mobile devices has become an essential consideration for every organization. It drives them to deploy a platform that offers high oversight and robust data protection.

- Devices without the protection of an MDM are at an increased risk of malware and other virus attacks that could compromise the confidential data stored. Any compromise in personal data can permanently affect an organization's reputation with its consumers and other business partners, which is one of the most critical factors driving the market.

- Using low-quality mobile phones can increase the risk of explosions. This is because these phones may use cheap electronic components and lithium-ion batteries that are not adequately tested, leading to overheating and potential explosions. An MDMS system would help in importing genuine mobile devices that meet quality and standards.

- In May 2023, the Nepal Telecommunications Authority introduced the Mobile Device Management System. This security software facilitates the regulator to implement policies that secure, monitor, and manage end-user mobile devices. According to the authority, 27,000 individuals have registered their phones with the MDMS, including registration of the International Mobile Equipment Identity (IMEI) number. This unique 15-digit code precisely identifies the device with the SIM card input.

- Mobile device manufacturers are working toward equipping the devices with built-in 5G components to exploit the full potential of 5G networks. Such efforts are considered to be the key to low latency and high-speed management of the devices. 5G services support various services and associated service requirements across multiple scenarios.

- With 5G expected to reach the enterprise space soon, businesses would need to redesign their enterprise mobility strategies. This is because 5G will increase the adoption of smart devices, wearables, AI, IoT, AR, and VR across industries, therefore, requiring proper management solutions to simplify device management.

- However, the lack of awareness about technological advancements, complexity in implementation and management, compatibility issues with different device operating systems, concerns over data privacy and security, the need for significant IT expertise, and the cost of implementing and maintaining MDM solutions restrain the growth of the studied market.

Mobile Device Management (MDM) Market Trends

Cloud-based Deployment is Expected to Dominate the Market

- Various organizations are rapidly adopting the cloud-based deployment of mobile device management solutions in the corporate landscape owing to their flexible, smooth, scalable, and affordable characteristics.

- A recent AT&T study found the hybrid work model is anticipated to grow from 42% in 2021 to 81% in 2024. Between July 13 and July 31, 2022, FlexJobs surveyed over 2,000 employed professionals for their insight on important topics surrounding the current work landscape. According to FlexJobs' Employee Engagement Report, 48% of employers are harboring some remote work for their workforce. When asked what their company's post-pandemic workplace plans would be, 26% of respondents said their employer would follow a hybrid model, and 22% said they would be allowed to work remotely. The adoption of remote work is anticipated to boost the adoption of cloud-based mobile device management solutions.

- In April 2023, Google Cloud announced a series of new security alliances to bring more choice, capability, and simplicity to enterprise and public sector IT teams tasked with managing hybrid work at scale. Google Cloud extended its identity, device, and access management capabilities of Google Workspace through new alliances with Okta and VMware, enabling large-scale businesses and public sector organizations to provide their workforces with FedRAMP-authorized collaboration and communication tools.

- Although MDM's primary purpose is security, it also has many other core functions. The main components of a mobile device management solution are access management, device and application security, data security, device tracking, endpoint monitoring and management, task automation, tech support, and content management. Cloud-based solutions empower IT teams, with functionality, such as enrolling, locking, managing, and protecting devices from a remote location. Modern mobile devices use different operating systems that demand regular firmware updates of their platforms for the device's smooth functioning. A cloud-based MDM solution enables a faster response to such update requirements than an on-premises solution.

- Several industry verticals, such as manufacturing, telecom, transportation, utilities, logistics, and retail, prefer cloud-based MDM solutions due to their various advantages. Small and medium-sized enterprises (SMEs) are also rapidly moving toward cloud deployment solutions due to budget constraints and the ease of accessibility of cloud-based MDM solutions.

North America is Expected to Hold the Largest Market Share

- North America is one of the prominent markets, mainly attributed to the increasing demand for advanced technology across numerous regional end-user industries. Additionally, the evolution of device management technologies is aiding the market's growth in the region.

- According to the Consumer Technology Association (CTA) and the US Census Bureau, the sales value of smartphones sold in the United States increased from USD 73 billion in 2021 to USD 74.7 billion in 2022. According to GSMA, the number of smartphone subscribers in North America is anticipated to reach 328 million by 2025. Moreover, by 2025, the region might witness an upsurge in the penetration rates of mobile subscribers (86%) and the Internet (80%). The increasing demand for mobile phones is likely to offer lucrative opportunities for the development of the studied market.

- With 5G services being deployed in many parts of the region, the role of mobile device management is expected to gain even more importance. According to GSMA estimates, North America surpassed 1 billion 5G connections in 2022. It would surpass 2 billion by 2025, driven by continuous network investments from operators and the expanding range of 5G smartphones at numerous price points. By 2025, North America would become the first region where 5G accounts for over 50% of total connections.

- Many regional organizations are increasingly deploying enterprise mobility solutions that help manage the increasingly dynamic mobile workforce and protect their content from data breaches, cyber-attacks, web and network threat security, and severe data losses. This is fueling the demand for mobile device management solutions across the region.

- To that extent, in March 2022, Apple announced the launch of its Apple Business Essentials for all small businesses in the United States. The new service combines device management, 24/7 Apple support, and iCloud storage into flexible subscription plans. Apple also unveiled its new AppleCare+ for Business Essentials options that could be added to any plan. A two-month free trial would be available to all customers, including those who have been employing Apple Business Essentials in beta.

Mobile Device Management (MDM) Industry Overview

The mobile device management market is highly competitive, owing to the presence of many small and large players operating and providing domestic and domestic solutions in the international market. The significant players are adopting strategies like product innovation, and most large vendors offer mobile device management as a part of their enterprise mobility management (EMM) offerings. Some of the recent developments in the market are:

- June 2022 - VMware Inc., a prominent innovator in enterprise software, unveiled innovations to its anywhere workspace platform, VMware Workspace ONE, which would make it easier for IT teams to manage and better secure all employee devices. The new capabilities comprise workspace ONE Mobile Threat Defense for advanced mobile device security and enhanced update/patch management features for Windows OS devices.

- May 2022 - Ivanti Software announced the launch of its Ivanti Neurons for MDM, including enhancements for managing Corporate-owned single-use (COSU) devices and transitioning to cloud-based device management. It facilitates 5G slicing, configuring higher app priority distribution and updates, additional USB security, etc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Impact of COVID-19 on MDM and Allied Markets (Steep Increase in Demand for Effective MDM Policies due to Lockdown Measures Imposed Globally | Steady Shift from Workstations to Portable BYOD Devices| Impact on Near & Short-term Demand Forecasts to be Comprehensively Analyzed in the Study)

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of BYOD

- 5.1.2 Growing Security Concerns to Protect Enormous Amount of Corporate Data

- 5.2 Market Restraints

- 5.2.1 High Initial Investment During the Deployment in the Infrastructure

- 5.3 Analysis of Key Criteria for the Selection of MDM Solutions in Enterprises

6 MARKET SEGMENTATION

- 6.1 By Deployment Type

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By End-user Vertical

- 6.2.1 Telecom and Information Technology

- 6.2.2 Banking and Financial Service

- 6.2.3 Healthcare

- 6.2.4 Retail

- 6.2.5 Government

- 6.2.6 Manufacturing

- 6.2.7 Other End-user Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Vmware Inc.

- 7.1.2 Citrix Systems, Inc.

- 7.1.3 MobileIron Inc.

- 7.1.4 IBM Corporation

- 7.1.5 Broadcom Inc. (Symantec Corporation)

- 7.1.6 Sophos Group PLC

- 7.1.7 Centrify Corporation

- 7.1.8 Kaspersky Lab Inc.

- 7.1.9 SAP SE

- 7.1.10 Ivanti Software Inc.

- 7.1.11 Cisco Systems Inc.

- 7.1.12 BlackBerry Limited

- 7.1.13 SOTI Inc

- 7.1.14 Miradore Ltd

- 7.1.15 JAMF