|

市場調查報告書

商品編碼

1630206

車輛分析:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Vehicle Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

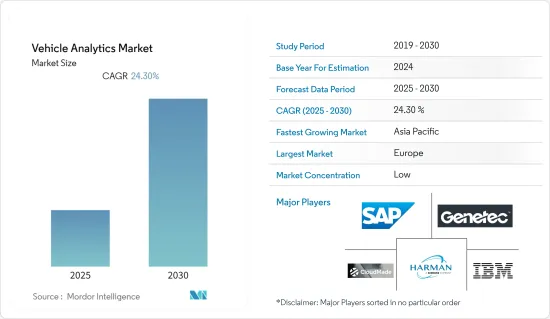

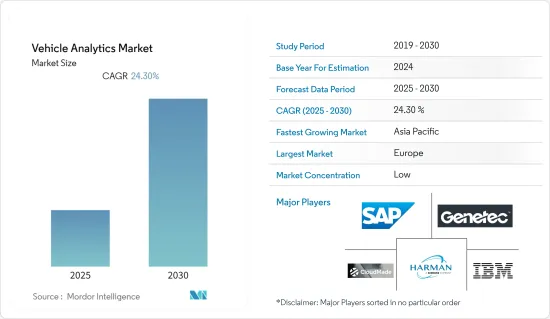

預計車輛分析市場在預測期內的複合年成長率為 24.3%。

隨著巨量資料的興起以及在壓縮時限內做出關鍵業務決策的需求不斷成長,商業智慧和分析工具在過去幾年中獲得了巨大的市場佔有率。預計該行業在預測期內將出現積極成長。

主要亮點

- 數位化已成為汽車產業技術創新的重要驅動力。汽車配備了至少 50 個感測器,旨在收集更詳細的資訊,如速度、排放氣體、距離、資源使用、駕駛行為和燃油消費量。產生的資料將為汽車行業相關人員提供必要的技術進步,用於進一步分析、創建相關分析並更好地利用指標。

- 預測分析應用程式允許最終用戶評估過去的模式和駕駛行為,以確定未來的可能性。除此之外,聯網汽車產業的成長預計將為汽車產業(包括分析)帶來重大挑戰和機會。它已成為創新的巨大驅動力。

- 透過將車輛遠端資訊處理資料和分析見解與客戶和業務資料相結合,資料創新的經營模式。隨著 Li-Fi 和 5G 等新的、更快的無線網路連接技術的發展,先進的資料驅動服務也面臨越來越有吸引力的機會。認知到永續交通和運輸管理的智慧解決方案,各國政府正在為新技術的推動者提供經濟利益,以加速實施並加速實現戰略目標。

- 向雲端的遷移預計也將推動產業成長並提供新的創新機會。然而,對線上覆蓋和互通性的擔憂預計將阻礙行業擴張。此外,該技術的高初始成本和解決方案的高價格預計將限制其在高階車輛中的採用並限制市場。

車輛分析市場趨勢

預測性維護可望佔據主要市場佔有率

- 汽車製造商不斷透過感測器即時評估車輛部件的性能,為預測性維護方法提供了機會。您可以從給定年份和型號的大多數車輛中提取資料,並使用預測維護將這些資訊與保固維修趨勢進行比較。如果密切監測和解決這些趨勢,就可以減少重大召回的影響,最大限度地減少不必要的扳手時間,並有可能挽救生命。

- 此外,車輛故障也是造成交通事故的主要原因之一。此類故障的發生往往是由於人為疏忽對車輛的及時維修和保養所造成的。預測分析解決方案在研究進行之前提醒業主潛在的維護需求。從車輛中安裝的各種感測器收集的資料有助於執行預測性維護任務。

- 認知預測維護可實現全面、即時和深入的洞察。此外,製造商流程的各個方面都將透過物聯網連接起來,從而實現更智慧、更有效率的決策。據 Appinventiv 稱,全球 5G 物聯網 (IoT) 端點市場預計在聯網汽車領域將大幅成長,從 2020 年的 40 萬台增至今年的 1,910 萬台。今年5G物聯網的裝置量預計將成長至約4,900萬台。

- 該市場仍然是先進預測解決方案的前沿。監控離合器和煞車皮磨損和使用情況的簡化預測維護解決方案已成為主流。監測類似的磨損設備並做出未來預測。

- 此外,車隊經理擴大採用這些解決方案來保持最佳維護狀態並主動減少設備故障。具有 GPS 追蹤等功能的通訊技術的進步已成為一種經濟高效的解決方案,並且易於實施。

- 隨著電動車需求的增加,這個市場有潛力成長。在電動車中,充電期間的電壓波動可能會損壞電池。與人工智慧 (AI) 整合的預測分析有助於電池回饋和監控系統,以避免不必要的損壞,從而有助於延長電池壽命。

預計歐洲將佔較大市場佔有率

- 歐洲國家正在利用先進技術來增強道路安全。據國際電信聯盟稱,歐洲 38% 的致命道路事故發生在都市區,凸顯了歐洲採取嚴格道路安全措施的必要性。自動駕駛汽車和新技術在道路上的日益普及凸顯了車輛分析實施範圍的不斷擴大。去年7月,一位參與歐洲全自動駕駛汽車立法制定的歐盟官員表示,歐盟行政部門計劃在9月底前提案全球首個技術立法,並要求成員國開發先進的自動駕駛汽車技術。核准配備 .

- 巨量資料概念的發展使得汽車製造商能夠在車輛中儲存結構化和半結構化資料,使他們能夠自行收集、儲存、分析和比較資料。這使他們能夠產生有用的結果並做出決策,從而推動該地區對車輛分析的需求。

- 車輛分析的雲端部署是市場的關鍵驅動力之一。在歐洲,透過利用先進的線上運算能力和遠端存取雲端軟體解決方案,車輛分析變得更加高效。汽車製造商現在可以利用這些遠端存取系統來分析車輛指標、確定車輛健康狀況,並為道路安全和智慧交通技術開發做出貢獻。

- 兩家公司將共同努力,透過雲端技術提供改進的系統,使汽車相關企業能夠在歐洲利用雲端。這對於嘗試車輛分析等解決方案的新業務至關重要。去年11月,汽車業著名軟體服務供應商四維圖新歐洲與騰訊雲宣佈建立聯合合作夥伴關係,以滿足包括GDPR在內的所有歐洲監管要求和標準。

- 此外,去年 2 月,OCTO Telematics 宣布與福特馬達公司達成一項新協議,將其資料流合作擴展到歐洲。這是建立在去年7月在北美市場簽署的第一份協議的基礎上的。透過利用福特的連網車輛資料,OCTO 將改善其在英國、德國、義大利、法國和西班牙的保險和分析服務市場中經過驗證的遠端資訊處理服務。

車輛分析產業概述

車輛分析市場高度分散,主要參與者包括 SAP SE、CloudMade、Genetec Inc.、HARMAN International Industries Inc. 和 IBM Corporation。市場參與者正在採取夥伴關係、創新、投資和收購等策略來加強其產品供應並獲得永續的競爭優勢。我們透過在研發方面的大量投資不斷創新產品的能力使我們比競爭對手更具競爭優勢,並獲得了巨大的市場佔有率。

- 2022 年 10 月,IBM 發布了其軟體的新版本 4.0。 IoT Connected Vehicle Insight Private 是一款連網汽車軟體,旨在透過將認知運算功能擴展到連網汽車來改善車內體驗。現代汽車是移動資料中心,配有車載感測器和電腦,可以近乎即時地收集和檢索車輛資料。 IoT Connected Vehicle Insights Private 可讓您存取、管理和分析來自連網車輛的大量資料。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 車輛遠端資訊處理的擴展

- 人工智慧和預測分析等技術的進步推動了車隊管理的應用

- 市場限制因素

- 解決方案的高成本限制了豪華車的實施

第6章 市場細分

- 按發展

- 本地

- 雲

- 按用途

- 預測性維護

- 安全保衛管理

- 駕駛員性能分析

- 其他應用

- 按最終用戶產業

- 車隊車主

- 保險公司

- OEM和服務供應商

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- SAP SE

- CloudMade

- Genetec Inc.

- HARMAN International Industries Inc.(Samsung Electronics Co. Ltd)

- IBM Corporation

- Inquiron Ltd

- Intelligent Mechatronic Systems Inc.

- Microsoft Corporation

- Teletrac Navman US Ltd

第8章投資分析

第9章市場的未來

The Vehicle Analytics Market is expected to register a CAGR of 24.3% during the forecast period.

With the rise of Big Data and the increasing need to make critical business decisions within a compressed timeframe, business intelligence, and analytics tools have gained a substantial market share in the past years. The growth in this industry is anticipated to be positive during the forecast period.

Key Highlights

- Digitalization has become an essential driver of innovation in the vehicle industry. Cars account for at least 50 sensors designed to collect more detailed information, such as speed, emissions, distance, resource usage, driving behavior, and fuel consumption. The generated data gives the automotive industry stakeholders the required technological advancement to use for further analysis, create relation analysis, and enable better utilization of the metrics.

- The predictive analytics applications enable the end users to evaluate prior patterns and driving behavior, deciding the likelihood of future possibilities. Apart from this, growth in the connected car industry is expected to provide significant challenges and opportunities to the automotive sector, including analytics. It has been a massive impetus for innovations.

- Innovative business models can be generated by combining vehicle telematics data and analytic insights into customer and business data. As new and faster wireless network connectivity technology is evolving, such as Li-Fi and 5G, a rising opportunity lies in the advanced data-driven services, which is also appealing. The awareness of an intelligent solution for sustainable traffic and transport management has prompted the governments to provide the new technology enablers the financial benefits to fast pace the adoption and meet their strategic targets sooner.

- Migration to the cloud is also expected to increase industry growth and provide new opportunities for innovation. However, concerns about online coverage and interoperability are expected to hamper industry expansion. Furthermore, the market is expected to be constrained due to the high initial cost of the technology and the high price of solutions limiting adoption in high-end cars.

Vehicle Analytics Market Trends

Predictive Maintenence is Expected to Hold Significant Market Share

- As automakers are constantly assessing the performance of the vehicle part in real-time through sensors, it unlocks the opportunity for a predictive maintenance approach. Data can be pulled out from most vehicles of a given year and model, and that information can be compared with warranty repair trends using predictive maintenance. These trending issues are carefully observed and addressed, limiting the fallout from large-scale recalls, minimizing unnecessary wrench time, and potentially saving lives.

- Moreover, vehicle breakdowns are one of the significant causes of road accidents. These breakdowns often occur due to human negligence in the timely service and maintenance of vehicles. Predictive analytics solutions inform the owner about the potential maintenance requirement before a study can occur. Data collected from the various sensors fitted in a car assists in carrying out predictive maintenance tasks.

- Cognitive predictive maintenance makes holistic, real-time, and deep insights possible. Also, every aspect of a manufacturer's processes can be connected through IoT, leading to smart and efficient decision-making. According to Appinventiv, the global 5G Internet of Things (IoT) endpoint market is forecast to grow significantly in the connected car segment, from 0.4 million in 2020 to 19.1 million units in the current year. The 5G IoT installed base is forecast to grow to around 49 million this year.

- The market is still an open place for any advanced predictive solutions. It is dominated by simplistic predictive maintenance solutions, which monitor the wear and usage of clutches and brake pads. A similar wear-out apparatus is monitored, and projections are made about the future.

- Also, fleet managers are increasingly incorporating these solutions to stay on top of maintenance and mitigate equipment failure in advance. The adoption has been easier with the technological advancement in communications with capabilities, such as GPS tracking, emerging as a cost-efficient solution.

- The market has growth potential as the demand for electric vehicles increases. In EV(s), voltage variations during charging can damage the battery. Predictive analytics integrated with artificial intelligence (AI) facilitates the feedback and monitoring system for batteries to avoid unnecessary damage that assists in extending the lifespan of batteries.

Europe is Expected Holds Significant Market Share

- European countries leverage advanced technology to enhance road safety. According to ITU, 38% of traffic fatalities in Europe occur inside urban areas, emphasizing the need for stringent road safety implementations in Europe. The increasing adoption of self-driving cars and newer technologies on the road highlight the growing scope of vehicle analytics implementations. In July last year, according to an EU official involved in making the laws for fully self-driving cars in Europe, the EU's executive planned to propose the world's first technical legislation by the end of September, allowing member countries to approve the sales and registration of around 1,500 vehicles for every carmaker model for every year installed, with advanced self-driving technology.

- The development of big data concepts has made it possible for automakers to store structured and semi-structured data in vehicles that can gather, store, analyze and compare the data on their own. This, thereby, helps to produce useful results and make decisions that drive the demand for vehicle analytics in this region.

- Cloud deployment of vehicle analytics has been one of the key drivers of the market. Vehicle analytics has become immensely efficient in Europe, leveraging advanced computing features online and remotely accessing cloud software solutions. Automakers can now leverage these remotely accessible systems to analyze vehicle metrics, determine the vehicle's health, and contribute to road safety and advanced transportation technology development.

- The companies collaborate to provide improved systems through cloud technologies, allowing automotive businesses to leverage the cloud in Europe, which is crucial for new businesses to try solutions like vehicle analytics. In November last year, NavInfo Europe, a prominent software service provider for the automotive industry, and Tencent Cloud jointly announced their partnership, meeting all the European regulatory requirements and standards, including GDPR.

- Furthermore, in February last year, OCTO Telematics announced signing a new agreement with Ford Motor Company to extend its data streaming collaboration into Europe. This would build on the initial agreement signed in the North American market in July of the previous year. By leveraging Ford's connected vehicle data, OCTO would improve its market-proven telematics services in insurance and analytical services in the United Kingdom, Germany, Italy, France, and Spain.

Vehicle Analytics Industry Overview

The Vehicle Analytics market is highly fragmented, with major players like SAP SE, CloudMade, Genetec Inc., HARMAN International Industries Inc. (Samsung Electronics Co. Ltd), and IBM Corporation. Players in the market are adopting strategies such as partnerships, innovations, investments, and acquisitions to enhance their product offerings and gain sustainable competitive advantage. Their ability to continually innovate the products by investing heavily in R&D has allowed them to gain a competitive advantage over their competitors, enabling them to gain significant market share over others.

- In October 2022, IBM announced the software's new version, 4.0. IoT connected vehicle insights private is connected vehicle software that aims to improve the in-car experience by extending cognitive computing capabilities to connected automobiles. Modern vehicles are mobile data centers equipped with onboard sensors and computers that can collect and retrieve vehicle data in near-real time. IoT-connected vehicle insights private allow the company to access, manage, and analyze large amounts of data from connected vehicles.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption Of Vehicle Telematics

- 5.1.2 Advancements in Technology, Such as Artificial Intelligence and Predictive Analytics Leading to Applications in Vehicle Management

- 5.2 Market Restraints

- 5.2.1 High Cost of Solutions Limiting Adoption in High End Cars

6 MARKET SEGMENTATION

- 6.1 By Deployment

- 6.1.1 On-premise

- 6.1.2 Cloud

- 6.2 By Application

- 6.2.1 Predictive Maintenence

- 6.2.2 Safety and Security Management

- 6.2.3 Driver Performance Analysis

- 6.2.4 Other Applications

- 6.3 By End-user Industry

- 6.3.1 Fleet Owners

- 6.3.2 Insurers

- 6.3.3 OEMs and Service Providers

- 6.3.4 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SAP SE

- 7.1.2 CloudMade

- 7.1.3 Genetec Inc.

- 7.1.4 HARMAN International Industries Inc. (Samsung Electronics Co. Ltd)

- 7.1.5 IBM Corporation

- 7.1.6 Inquiron Ltd

- 7.1.7 Intelligent Mechatronic Systems Inc.

- 7.1.8 Microsoft Corporation

- 7.1.9 Teletrac Navman US Ltd