|

市場調查報告書

商品編碼

1630207

企業影片-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Enterprise Video - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

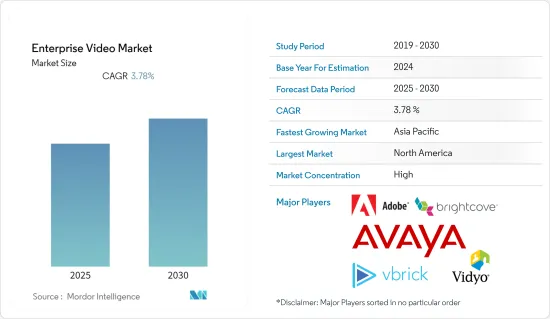

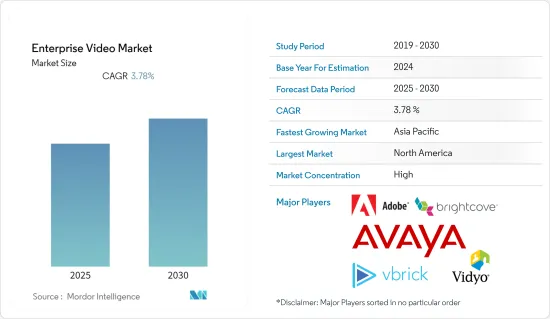

預測期內企業視訊市場複合年成長率預估為 3.78%

主要亮點

- 公司依靠影片解決方案來改善內部和外部相關人員之間的協作,最大限度地提高客戶參與並豐富職業發展。此外,企業影片正在成為公司內部和外部業務內容行銷策略的一個組成部分。

- 過去五年,串流媒體參與企業的內容量顯著增加,有效用戶快速成長。企業視訊會議仍然是該市場中最受歡迎和最具影響力的部分。這使得企業能夠一致、有效率、快速地進行廣播、啟用通訊、為員工和承包商提供培訓並促進協作。

- 視訊平台在企業應用中的使用增加導致了補充安全解決方案的進一步開發。組織無法保證敏感資料或對話不會在虛擬會議期間洩漏。在 COVID-19 大流行期間,企業被迫適應並採用更好的溝通方法。

- 2022 年 1 月,StrikeForce Technologies 宣布了一種為現代組織和政府機構構建的視訊會議安全替代方法。新提案的策略應用了一種新技術,根據專有資訊和所需的隱私等級進行四級機密性保護。該計劃根據每次會議的優先順序建議單獨的行動。

- 企業視訊服務的成長導致各種供應商創新並提供各種音訊、視訊、文件共用和協作解決方案。這項創新導致公司同時使用多個會議提供者。這種快速成長的趨勢導致了混亂和一些混亂,但卻讓產業內的中小企業得以參與競爭。

企業視訊市場趨勢

在預測期內,醫療保健將佔據主要市場佔有率

- 會議等視訊解決方案可以輕鬆提供醫療支援。這些解決方案可在本地或雲端基礎的環境中使用,對於醫療機構和患者來說具有成本效益且合理。推動市場成長的關鍵因素是向遠端醫療服務的轉變和醫療保健 IT 支出的增加。政府加大努力改善衛生基礎設施進一步支持了這一點。然而,緩慢的網路連線和金融挑戰正在限制市場成長。此外,操作這些視訊會議設備的複雜性、技術意識和公眾接受度低也是市場挑戰。

- 由於 COVID-19 大流行,世界多個國家已採取預防措施。由於學校關閉和社區被要求留在家裡,多個組織不得不想辦法讓員工在家工作。 COVID-19 大流行改變了組織對視訊會議在實現遠距工作、學習和遠端協作方面所發揮的關鍵作用的觀點。

- 儘管 COVID-19 大流行繼續擾亂全球經濟活動,但隨著所研究的市場與關鍵業務平台直接連接,並且在此期間團隊可以進行遠端通訊,整個全部區域的投資仍在成長。

- 2020 年,包括 Zoom 在內的這些視訊通訊平台的新網域註冊量迅速增加。據查核點 Security 稱,自 2020 年 1 月以來已註冊了 1,700 多個新域名,其中 25% 是在 2020 年 3 月第一周註冊的。根據 Buffer 2021 年遠距工作狀況報告的最新調查結果,在疫情期間開始遠距工作的受訪者中,近 94% 表示他們將選擇在餘下的職業生涯中遠距工作。

- 在管理方式改變的同時,疫情也促使軟體使用方式改變。採用Zoom等視訊會議軟體不僅僅是視訊通訊工具。管理人員已開始進一步數位化,以適應透過企業管理和計劃生產力軟體進行處理業務的轉變。對於跨產業的企業來說,協作、業務溝通、追蹤進展和分配行動項目的能力變得越來越重要。

- 各機構之間的合作促進了卓有成效的夥伴關係。 2022 年 1 月,收購 Webex 的 Yuja 宣布與查普曼大學簽訂了為期三年的協議,並與派克峰社區學院簽訂了企業視訊平台和 Zoom Connector 的無條件授權合約。 Zoom Connector 是現有影片平台的附加模組,可自動上傳使用 Zoom 錄製的影片。該協議允許錄製的影片在任何裝置上安全地傳播和觀看,並且還提供字幕和影片索引以改善影片內搜尋功能。

北美是領先的企業視訊市場

- 由於基礎設施完善、行動裝置在各行業的普及以及 IBM 和思科等大型跨國公司的集中,北美佔據了很大的市場佔有率。美國是企業視訊市場最大的國家。該市場的推動因素是越來越多的中小企業尋求更好的協作,以及大型企業向視訊會議和內容管理室的增強模式的轉變。 ActiveCampaign 進行的一項研究顯示,超過 41% 的小型企業正在使用視訊會議軟體改進進行行銷。

- 中型和大型公司專注於核心競爭力,並更有可能外包 IT 解決方案。此外,與IT基礎設施和行動設定相關的成本急劇增加導致行動化營運服務的使用增加,從而推動預測期內的市場成長。

- 近年來,企業影片已成為美國多家公司內容行銷策略的關鍵要素。內容傳遞網路(CDN) 的發展透過加速多媒體網路內容的交付並為企業提供高品質的視訊串流來推動市場成長。

- 全國各地的各種教育機構一直在使用影像來加強學習,例如課程影片和網路研討會。一些學校、學院和大學創建多媒體內容並透過視訊演示進行分發。如前所述,作為客戶獲取流程的一部分,Yuja 於 2021 年 8 月與德克薩斯州休士頓州休斯頓的聖托馬斯大學合作。該大學實施了 YuJa 的企業視訊平台,該平台提供學習管理系統 (LMS)、直播功能以及全面的錄影和管理工具。

- 遠距遠端醫療服務的擴展和進步以及醫療保健 IT 支出的增加是推動市場成長的關鍵因素。例如,2021 年 2 月,直接面向患者的平台 Sesame 宣布將把視訊預約擴展到大休士頓地區,以滿足 COVID-19 大流行期間所有專業領域的患者和獨立從業者的遠端醫療需求。

企業影片產業概況

儘管企業視訊市場競爭激烈,目前由少數公司主導,但全球市場預計將進行整合。擁有重要市場佔有率的領先公司正致力於透過利用策略聯合舉措來擴大其海外基本客群,以提高市場佔有率和盈利。 Adobe Inc.、Brightcove, Inc.、Avaya, Inc.、Vidyo, Inc.、Vbrick Systems, Inc.、Mediaplatform, Inc.、Polycom, Inc.、Cisco Systems, Inc.、IBM Corporation、Microsoft Corporation、Kaltura Inc. 、Ooyala, Inc. 是當前市場上的一些主要參與企業。

- 2021 年11 月- Flipkart 子公司Myntra 將在Myntra 應用程式上舉辦影響者和專家的現場視訊會議,展示自行策劃的產品和造型概念,讓觀眾可以立即購物我們推出了M-Live,一種即時影片串流和即時商務促進消費者和品牌之間即時互動的平台。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 擴大組織規模

- 對即時通訊的需求不斷成長

- 市場限制因素

- 實施成本高

- 價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按類型

- 視訊會議

- 影片內容管理

- 網路直播

- 其他

- 按成分

- 硬體

- 軟體

- 按最終用戶產業

- 醫療保健

- BFSI

- 資訊科技/通訊

- 零售

- 其他

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 澳洲

- 其他亞太地區

- 拉丁美洲

- 墨西哥

- 巴西

- 其他拉丁美洲

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 其他中東/非洲

- 北美洲

第6章 競爭狀況

- 公司簡介

- Adobe Inc.

- Brightcove, Inc.

- Avaya, Inc.

- Vidyo, Inc.

- Vbrick Systems, Inc

- Mediaplatform, Inc.

- Polycom, Inc.

- Cisco Systems, Inc.

- IBM Corporation

- Microsoft Corporation

- Kaltura Inc.

- Ooyala, Inc.

第7章 投資分析

第8章 市場機會及未來趨勢

The Enterprise Video Market is expected to register a CAGR of 3.78% during the forecast period.

Key Highlights

- Organizations are using video solutions to improve collaboration between internal and external stakeholders, maximize customer engagement, and enrich career development. Enterprise video has also emerged as a critical element of a company's content marketing strategy for internal and external operations.

- Streaming media players have reported whopping growth in content volumes and a steep increase in active users over the last five years. Enterprise video conferencing remains the most popular and impactful segment in this market. It allows enterprises to consistently, efficiently, and quickly broadcast, enable messaging, provide training to employees and contractors, and facilitate collaboration.

- The increased utilization of video platforms for enterprise applications furthered the development of complementary security solutions. Organizations lack the assurance that sensitive data and conversations won't be exposed during virtual meetings. This fear grew during the COVID-19 pandemic as companies were forced to adapt and employ better means of communication.

- In January 2022, StrikeForce Technologies announced an alternative approach to video conferencing security built for modern organizations and government agencies, and the COVID-19 pandemic influenced sensitive collaboration needs. The newly proposed strategy applies a novel methodology for protection based on four levels of sensitivity based on tiers of proprietary information or levels of necessary privacy. The plan recommends individual actions for the respective conference priority level.

- The growth of enterprise video services led to the innovation of various audio, video, file sharing, and collaborative solutions, which different providers majorly offer. This innovation led to firms using multiple conferencing providers at a time. This burgeoning trend has led to confusion and some disorder but has allowed the smaller players in the industry to compete.

Enterprise Video Market Trends

Healthcare to Hold a Significant Market Share during the Forecast Period

- Video solutions like conferencing have enabled easy medical support. These solutions are available on-premise and cloud-based and hence are cost-effective, making them reasonable for healthcare organizations and patients. The primary factor fueling the market's growth is the rising shift and increasing healthcare IT spending toward telemedicine services. This is further supported by increased efforts by national governments to improve their healthcare infrastructures. However, slow internet connections and financial challenges restrain the market's growth. Furthermore, complexities involved in the operation of these video conferencing equipment, low technology awareness, and acceptance among the people are other factors contributing to the challenges of the market.

- Due to the COVID-19 pandemic, several countries worldwide implemented preventive measures. With schools being closed and communities being asked to stay at home, multiple organizations were forced to find a way to enable employees to work from home. The COVID-19 pandemic changed the organizational perspective about remote work and learning and the critical role video conferencing plays in allowing remote collaboration.

- Though the COVID-19 pandemic continues to hamper economic activities worldwide, the overall regional investments have grown since the market studied has been directly aligned with critical operations platforms, allowing teams to communicate remotely throughout the period.

- In 2020, the new domain registration on these video communication platforms, including Zoom, rapidly increased. According to Checkpoint Security, since January 2020, more than 1700 new domains have been registered, and 25% were recorded in the first week of March 2020. As per updated findings from the 2021 State of Remote Work Report by Buffer, nearly 94% of surveyed individuals who started working remotely due to the pandemic opted to work remotely for the rest of their career, compared to 99% of individuals opting for it if they used to work remotely even before the pandemic.

- Alongside the changes in managerial style, the pandemic also stimulated changes in the use of the software. The embracing of Zoom and other videos conferencing software goes beyond video communication tools. Managers began to digitize further to accommodate the shift to handle affairs through corporate management and project productivity software. The ability to collaborate and communicate on work, track progress, and assign action items became increasingly crucial for businesses across industries.

- Collaborations between institutions encouraged the fostering of very fruitful partnerships. In January 2022, Yuja, which acquired Webex, announced the signing of a three-year contract with Chapman University and a non-conditional agreement with Pikes Peak Community College to license their Enterprise Video Platform and Zoom Connector. The Zoom Connector is an additional module to the existing video platform that enables the automated upload of videos recorded through Zoom. The contract premises the recordings to be spread securely and viewed on any device, along with featuring captioning and indexing videos for improved search-inside-video capabilities.

North America is the Major Market for Enterprise Video Market

- North America holds a significant market share owing to the presence of established infrastructure, the proliferation of mobile devices across various verticals, and the high concentration of large multinational companies like IBM, Cisco, and others. The US is the single largest country in the enterprise video market. The market is driven by the increasing number of SMEs looking for better collaborations and the shift of large enterprises towards enhanced modes of video conferencing and content management rooms. A survey conducted by ActiveCampaign revealed that more than 41% of SMEs use improved methods of video conferencing software for marketing.

- The medium and large-sized corporations are highly focused on their core competencies, where they are most likely to outsource the IT solutions, which are expected to boost the market in the region over the forecast period. Besides, the surge in cost associated with the setup of IT infrastructure and mobility has led to the increased utilization of managed mobility services, thereby propelling market growth over the forecast period.

- In recent years, enterprise video emerged as a critical component of the content marketing strategy of several companies in the United States. The development of content delivery networks (CDNs) accelerated the delivery of multimedia internet content and provided organizations with higher-quality video streams, fueling the market's growth.

- In various educational institutes in the country, videos have been used to improve learning, like visual recordings of courses and webinars. Several schools, colleges, and universities created multimedia content and delivered it via video presentations. As stated earlier, as part of its customer acquisition process, Yuja, in August 2021, collaborated with the University of St. Thomas, Houston, Texas. The University implemented YuJa's Enterprise Video Platform, which offers a learning management system (LMS), live streaming capabilities, and comprehensive video recording and management tools.

- The overall shift and increasing healthcare IT spending toward expanding and advancing telemedicine services is a primary factor fueling the market's growth. For instance, in February 2021, Sesame, a direct-to-patient platform, announced its video appointment expansion to Greater Houston to address the telemedicine requirements of patients and independent practices across all specialties during the COVID-19 pandemic.

Enterprise Video Industry Overview

The Enterprise Video Market is highly competitive and currently dominated by a few players, and the global market is expected to be consolidated. Major players with a prominent share in the market are focusing on expanding their customer base across foreign countries by leveraging strategic collaborative initiatives to increase their market share and profitability. Adobe Inc., Brightcove, Inc., Avaya, Inc., Vidyo, Inc., Vbrick Systems, Inc., Mediaplatform, Inc., Polycom, Inc., Cisco Systems, Inc., IBM Corporation, Microsoft Corporation, Kaltura Inc., and Ooyala, Inc. are some of the major players present in the current market.

- November 2021 - Flipkart's subsidiary Myntra launched their live video streaming and lived commerce platform M-Live to facilitate a real-time engagement between consumers and brands that allows influencers and experts to host live video sessions of product and styling concepts curated by themselves on the Myntra app, allowing viewers to shop instantly.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Size of Organizations

- 4.2.2 Increasing Need for Real Time Communication

- 4.3 Market Restraints

- 4.3.1 High Cost of Deployment

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Video Conferencing

- 5.1.2 Video Content Management

- 5.1.3 Webcasting

- 5.1.4 Other Types

- 5.2 By Components

- 5.2.1 Hardware

- 5.2.2 Software

- 5.3 By End-user Industry

- 5.3.1 Healthcare

- 5.3.2 BFSI

- 5.3.3 IT & Telecommunications

- 5.3.4 Retail

- 5.3.5 Other End-User Industries

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 Australia

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.4.1 Mexico

- 5.4.4.2 Brazil

- 5.4.4.3 Rest of Latin America

- 5.4.5 Middle East & Africa

- 5.4.5.1 United Arab Emirates

- 5.4.5.2 Saudi Arabia

- 5.4.5.3 Rest of Middle-East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Adobe Inc.

- 6.1.2 Brightcove, Inc.

- 6.1.3 Avaya, Inc.

- 6.1.4 Vidyo, Inc.

- 6.1.5 Vbrick Systems, Inc

- 6.1.6 Mediaplatform, Inc.

- 6.1.7 Polycom, Inc.

- 6.1.8 Cisco Systems, Inc.

- 6.1.9 IBM Corporation

- 6.1.10 Microsoft Corporation

- 6.1.11 Kaltura Inc.

- 6.1.12 Ooyala, Inc.