|

市場調查報告書

商品編碼

1630213

塑膠成型機:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Plastic Compounding Machinery - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

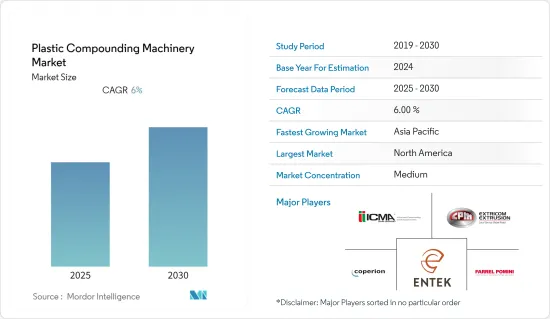

塑膠成型機市場預計在預測期內複合年成長率為 6%

主要亮點

- 塑膠配混是指用各種添加劑客製化基本塑膠原料,以達到不同性能、顏色和性能要求的過程。我們透過各種物理過程和實驗室配方將必要的添加劑和顏色融入塑膠樹脂中來實現這一目標。

- 各種類型的機器用於完成透過共混和混合聚合物和添加劑來製備複合塑膠的整個過程。各種最終用戶產業中塑膠零件的使用不斷增加,推動了對塑膠的需求。例如,根據喬治亞大學的數據,到 2050 年,塑膠累積產量預計將達到 340 億噸,而 20 世紀 50 年代僅為 20 億噸。

- 此外,汽車行業對高強度、低重量、低油耗和耐用性且能夠滿足環境和相關標準的零件的需求不斷增加,預計該行業將擴大採用塑膠成型機。同樣,食品和飲料行業預計將更多地採用塑膠成型機,因為擴大採用塑膠來生產更輕的最終產品,並專注於產品設計。

- 塑膠成型機也應用於生質塑膠產業。生質塑膠在各個最終用戶產業的採用正在增加。根據歐洲生物塑膠協會的數據,全球生質塑膠產量預計將從2021年的179.2萬噸增加到2027年的629.1萬噸。

- 然而,由於生質塑膠回收延遲而造成的製造業運轉率率低以及生質塑膠製造設備的高成本是阻礙該市場成長的主要挑戰。

- COVID-19 的影響是巨大的。由於幾家大公司的存在,亞太地區是塑膠成型機的主要用戶之一,但疫情影響較大,需求放緩。然而,由於主要終端用戶產業正在復甦,預計市場在預測期內將呈現上升趨勢。

塑膠成型機市場趨勢

包裝產業預計將出現最大的採用率

- 由於材料和格式之間的差異成長,預計包裝行業中塑膠成型機的採用將顯著成長,這將顯著推動包裝行業的根本性轉變。這些差異是由於市場內消費行為和產品創新的變化所造成的。

- 包裝也是塑膠產品最大的最終用戶領域,佔全球塑膠用量的 40% 以上。此外,消費者對塑膠包裝越來越感興趣,因為它重量輕且易於處理。

- 此外,最終用戶行業對包裝和包裝材料使用的日益關注預計將在預測期內推動這些行業中塑膠成型機的採用。例如,當談到食品包裝特性時,所有市場中消費者的主要關注點都與容器的衛生和防漏性有關,但包裝材料本身也被認為至關重要。

- 此外,近年來,日益成長的環境問題刺激了包裝行業對生質塑膠的需求,預計這將為所研究的市場提供成長機會。例如,根據歐洲生物塑膠公司的數據,2022年剛性和軟包裝產業生質塑膠的總產能分別約為37.61萬噸和69.56萬噸。

- 電商產業的成長也是支撐包裝塑膠需求的關鍵因素。據Oceana預計,到2025年,電商塑膠包裝的使用量預計將達到45.33億磅。這些趨勢為所研究市場的成長創造了良好的前景。

亞太地區預計將經歷最大的成長

- 預計亞太地區在預測期內將實現最高成長率。這是由於多種因素造成的,包括中國、日本和印度等國家人口和社會因素的變化,例如都市化進程的加速、人口老化以及中產階級的出現及其不斷成長的願望。

- 亞太地區對工程塑膠的強勁需求預計將支持塑膠化合物產業並推動該地區對成型機的需求。工程塑膠的關鍵驅動力之一是新興經濟體消費者購買力的不斷增強。

- 該地區持續的經濟成長改善了消費者的財務狀況並提高了他們的購買力。因此,汽車的需求和產量持續成長。此外,隨著消費者購買力的增強,對技術先進的消費品、家用電子電器產品和電氣電子產品的需求不斷增加,這推動了亞太地區工程塑膠的需求不斷推高。

- 該地區的一些國家正在採取重大措施實施解決方案並將永續流程納入其業務,以實現永續發展目標,預計這將對研究市場的成長產生重大影響。

- 此外,各個最終用戶產業對包裝塑膠和其他塑膠產品的需求不斷成長,鼓勵參與企業擴大在該地區的業務。例如,主要企業塞拉尼斯計劃擴建其位於中國南京的化合物和 LFT 工廠,到 2023 年底增加約 52KT 化合物和長纖維熱塑性塑膠 (LFT) 產能。

塑膠成型機產業概況

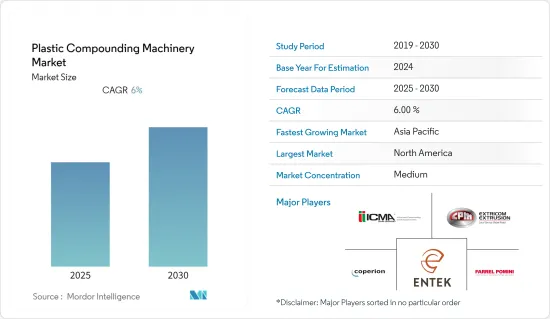

由於全球範圍內存在各種設備供應商,塑膠成型機市場適度細分。參與企業致力於產品開發和技術創新,目的是最大化市場佔有率。此外,每家公司都透過全球業務擴張來擴大其市場佔有率。主要市場參與企業包括 CPM Extrusion Group、Entek Extruders、Farrel Corporation 和 Coperion GmbH。

- 2022 年 11 月 - Brabender 推出新型電加熱雙螺桿擠出機 B-TSE-S 30/40 大型混煉機。據該公司稱,擠出機是作為中試工廠和實驗室之間的介面而開發的。具有整合驅動和加工部分的緊湊設計適用於由塑膠、食品/飼料、橡膠和許多其他可擠出材料製成的各種擠出產品的配方開發和小規模生產。

- 2022 年 7 月 - 義大利擠出機製造商 Bausano 在 K 2022 展會上展示了用於氣缸感應加熱的智慧型能源系統。該產品旨在與 Nextmover 系列雙螺桿擠出機和專為塑膠回收再生用設計的新型 E-GO R 單螺桿擠出機相容。據該公司稱,該產品採用具有特殊開口的強製冷卻感應線圈,可最大限度地減少熱量損失。此外,與電阻系統相比,冷卻氣流直接進入塑化缸,冷卻速度更快。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

- 技術簡介

第5章市場動態

- 市場促進因素

- 全球包裝產業穩定成長

- 擠出和複合機械在食品行業中越來越受歡迎

- 市場限制因素

- 由於承購延遲,製造業運轉率率低

第6章 市場細分

- 透過機器

- 單螺桿

- 雙螺桿

- 同向旋轉雙螺桿

- 其他

- 按用途

- 標準熱塑性塑膠

- 工程塑膠

- 母粒製造

- 特殊聚合物

- 地板材料複合物

- 其他(LFT、熱可塑性橡膠(TPE、-S、-V、-U)、HFFR、熱固性樹脂、生質塑膠等)

- 按最終用戶產業

- 包裝

- 建築學

- 醫療保健

- 塑膠

- 化學

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Coperion GmbH

- CPM EXTRUSION GROUP

- Farrel Corporation

- ICMA San Giorgio SpA

- Ikegai Corp.

- Kobe Steel, Ltd.

- KraussMaffei Group

- Nordson Corporation

- Randcastle Extrusion Systems, Inc.

- TECHNOVEL Corporation

- The Japan Steel Works, LTD.

- Theysohn Group

- Shibaura Machine CO., LTD(Toshiba Machine Co.,LTD)

- TPV Compound Srl

- USEON(Nanjing)Extrusion Machinery Co.,Ltd.

- Welset Plast Extrusions Pvt. Ltd.

第8章投資分析

第9章市場的未來

The Plastic Compounding Machinery Market is expected to register a CAGR of 6% during the forecast period.

Key Highlights

- Plastics compounding refers to the process of taking basic, raw plastic material and customizing it with various additives to achieve various properties, colors, and performance requirements. Various physical processes and lab formulations achieve this by combing the necessary additives and color into the plastic resin.

- Various types of machinery are used to achieve the entire process of preparing the formulation plastic by blending and mixing polymers and additives. The rising use of plastic components across various end-user industries drives the demand for plastics. For instance, according to the University of Georgia, the cumulative production of plastic is anticipated to reach 34 billion metric tons by 2050, from a mere 2 billion metric tons in the 1950s.

- Furthermore, the increasing demand for high-strength, low-weight, fuel-efficient, and durable components in the automotive sector, allowing them to comply with environmental and related norms, is expected to boost the adoption of plastic compounding machinery in the industry. Similarly, the food and beverage industry is expected to exhibit growth in the adoption of plastic compounding machinery, owing to the increasing adoption of plastic in the industry, to enable lightweight end-products with a focus on product design.

- Also, plastic compounding machinery is finding its applications in the bioplastics industry. The adoption of bioplastics in various end-user industries is increasing. According to European Bioplastics, the global production of bioplastics is expected to grow from 1,792 thousand metric tons in 2021 to 6,291 thousand metric tons by 2027.

- However, low capacity utilization in the manufacturing Industry owing to slow offtake and the high cost of this equipment are among the major factor challenging the studied market's growth.

- A notable impact of COVID-19 has been observed on the studied market. Asia Pacific region, which is among the major user of plastic compounding machinery owing to the presence of several major players, a higher impact of the pandemic resulted in a slowdown in demand. However, with major end-user industries on their way to recovery, the studied market is expected to witness an upward growth trend during the forecast period.

Plastic Compounding Machinery Market Trends

Packaging Industry Expected to Show Maximum Adoption

- The adoption of plastic compounding machinery is expected to grow significantly in the packaging industry owing to the differential growth across materials and formats, which is significantly driving the fundamental shifts in the packaging industry. These differentials are a by-product of changing consumer behaviors and product innovation within the market.

- Also, packaging is the largest end-user segment for plastic products accounting for more than 40% of the total plastic usage in the world. Also, consumers have exhibited an increasing inclination towards plastic packaging, as plastic packages are light in weight and more comfortable to handle.

- Also, the increasing focus on packaging and the use of packaging material across end-user industries is expected to boost the adoption of plastic compounding machinery in these industries during the forecast period. For instance, when it comes to the features of food packaging, the critical consumer priorities across all markets relate to the hygiene and leak-proof properties of the container, but the packaging material itself is also considered essential.

- Furthermore, in recent years, the growing environmental concern has been driving the demand for bioplastics in the packaging industry, which is expected to create growth opportunities for the studied market. For instance, according to European Bioplastics, in 2022, the total production capacities of bioplastics in the rigid and flexible packaging industry were about 376.1 thousand metric tons and 695.6 thousand metric tons, respectively.

- The growth of the e-commerce industry has also become a key instigator behind the demand for plastics for packaging. According to Oceana, the estimated use of e-commerce plastic packaging is expected to reach 4,533 million pounds by 2025. Such trends create a favorable outlook for the studied market's growth.

Asia-Pacific is Expected to Exhibit the Maximum Growth

- The Asia-Pacific region is expected to register the maximum growth rate during the forecast period, owing to several factors, such as the changing demographics and social factors, such as growing urbanization, aging population, and the rising middle class and their growing aspirations, in countries like China, Japan, and India.

- Strong demand for engineering plastics in Asia-Pacific is likely to boost the plastic compounding industry, which is expected to propel the compounding machinery demand in the region. One of the major drivers of engineering plastics is the growing purchasing power of consumers in developing countries/emerging economies.

- With consistent economic growth in the region, the financial status of consumers is increasing, which in turn is improving their purchasing power. As a result, their demand for and production of automobiles is growing consistently. In addition, with the improvement of their purchasing power, their demand for technologically advanced consumer goods and appliances and electrical and electronic goods is continually increasing, which in turn is boosting the demand for engineering plastics in Asia-Pacific.

- Several countries in the region are taking major steps to introduce solutions and incorporate sustainable processes in the businesses to achieve sustainable development goals, which is expected to have a notable impact on the studied market's growth.

- Furthermore, the growing demand for packaging plastics and other plastic products across various end-user industries is encouraging several players to expand their presence in the region. For instance, Celanese, a leading plastic compounding company, is planning to expand its Nanjing, China, Compounding, and LFT facilities to add approximately 52KT of compounding and long-fiber thermoplastics (LFT) capacity by the second half of 2023.

Plastic Compounding Machinery Industry Overview

The Plastic Compounding Machinery Market is moderately fragmented owing to the presence of various equipment providers globally. The market players are involved in product developments and innovations with a view to capturing maximum market share. Also, the companies are involved in expanding their market presence through the global expansion of their operations. Some key market players include CPM Extrusion Group, Entek Extruders, Farrel Corporation, and Coperion GmbH.

- November 2022 - Brabender launched the new electrically heated twin-screw extruder B-TSE-S 30/40 Big Compounder. According to the company, the extruder was developed as an interface between the pilot plant and the laboratory. Its compact design combines the drive and processing unit, making it suitable for developing formulations and small-scale production of various extrudates made of plastics, food and feed, rubber, and many other extrudable materials.

- July 2022 - Bausano, an Italy-based extrusion machinery manufacturer, introduced its Smart Energy System for cylinder induction heating at K 2022. The product has been designed for both a twin screw extruder Nextmover range and the new single screw extruder E-GO R, which is designed for recycling plastics. According to the company, the product features forced-cooled induction coils with special openings to minimize heat loss. Furthermore, for faster cooling compared to resistive systems, the cooling airflow is channeled directly onto the plasticizing cylinder.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitute Products & Services

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of COVID-19 on the Market

- 4.5 Technology Snapshot

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Stable growth in the Global Packaging Industry

- 5.1.2 Rising Popularity of Extruding and Compounding Machinery in Food Industry

- 5.2 Market Restraints

- 5.2.1 Low Capacity Utilization in the Manufacturing Industry owing to Slow Off take

6 MARKET SEGMENTATION

- 6.1 By Machinery

- 6.1.1 Single-Screw

- 6.1.2 Twin-Screw

- 6.1.3 Co-rotating Twin-Screw

- 6.1.4 Other Types

- 6.2 By Application Type

- 6.2.1 Standard Thermoplastics

- 6.2.2 Engineering Plastics

- 6.2.3 Masterbatch Production

- 6.2.4 Specialty Polymers

- 6.2.5 Flooring Compounds

- 6.2.6 Others (including LFT, Thermoplastic elastomers (TPE,- S, -V, -U) ,HFFR, thermosets, bio-plastics, etc.)

- 6.3 By End-user Industry

- 6.3.1 Packaging

- 6.3.2 Construction

- 6.3.3 Medical

- 6.3.4 Plastics

- 6.3.5 Chemicals

- 6.3.6 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle-East & Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Coperion GmbH

- 7.1.2 CPM EXTRUSION GROUP

- 7.1.3 Farrel Corporation

- 7.1.4 ICMA San Giorgio SpA

- 7.1.5 Ikegai Corp.

- 7.1.6 Kobe Steel, Ltd.

- 7.1.7 KraussMaffei Group

- 7.1.8 Nordson Corporation

- 7.1.9 Randcastle Extrusion Systems, Inc.

- 7.1.10 TECHNOVEL Corporation

- 7.1.11 The Japan Steel Works, LTD.

- 7.1.12 Theysohn Group

- 7.1.13 Shibaura Machine CO., LTD (Toshiba Machine Co.,LTD)

- 7.1.14 TPV Compound Srl

- 7.1.15 USEON (Nanjing) Extrusion Machinery Co.,Ltd.

- 7.1.16 Welset Plast Extrusions Pvt. Ltd.