|

市場調查報告書

商品編碼

1630216

電纜標籤:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Cable Tags - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

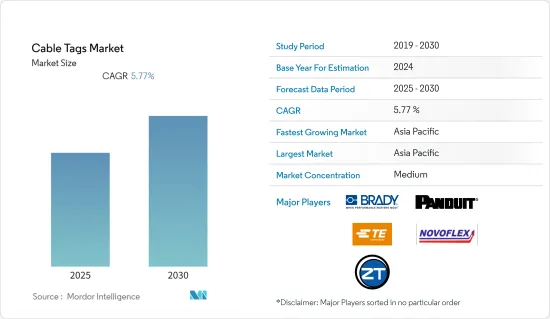

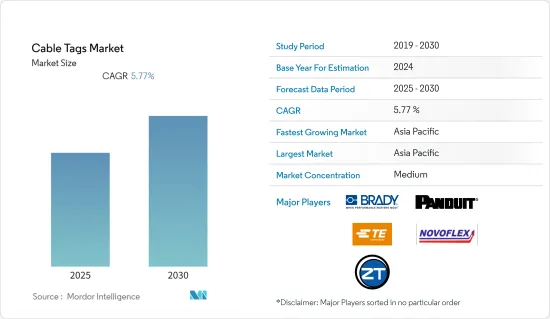

預計電纜標籤市場在預測期內的複合年成長率為 5.77%。

主要亮點

- 由於工業和城市的採用,自動化市場正在以顯著的速度成長。自動化涉及許多組件,如配電盤、繼電器、HVAC 系統、人機介面 (HMI) 和 IT 系統,這些組件透過電線和電纜連接。

- 這些電纜的尺寸可小至 0.5 平方毫米至 35 平方毫米。對於經驗豐富的專業人士來說,追蹤自動化系統內的精確電線連接是一項艱鉅的挑戰。因此,電纜標籤的使用已成為電纜管理過程中的重要組成部分。

- 此外,資料中心最近發展迅速。隨著雲端處理、社群媒體、巨量資料、線上遊戲和其他線上應用程式的興起,不斷需要增強的IT基礎設施來處理不斷成長的資源需求,這就是超大規模資料的進一步補充應中心要求。

電纜標籤市場趨勢

製造業佔據電纜標籤最終用戶產業的主要佔有率

- 各行業的製造商需要識別零件、紙箱、托盤和貨物。這需要在不犧牲生產線速度的情況下對各種產品和包裝系統進行貼標、編碼和標記。

- 電纜標籤可以承受高溫和惡劣的天氣條件,確保標籤的印刷永不褪色,這對製造業來說是必要的。電纜標籤公司現在正在尋找創新方法來解決這個問題。

- 此外,連續自黏標籤材料非常適合標記倉庫和管道。自黏標籤用於資產標籤、可移動資產追蹤、臨時追蹤標籤、倉庫標籤、管道標記、電線和電纜識別以及組件和電路基板的安全識別。

亞太地區預計將呈現最高成長率

- 中國是全球電纜標籤市場的主要企業之一,這主要是由於其在工業自動化方面的高投資率以及本土製造業產量的不斷成長。自動化系統中追蹤準確電線連接的需求正在推動對電纜標籤的需求。

- 根據國家統計局數據,2018年中國工業增加價值成長6.1%。由於工業零售額成長約10.4%,預計將持續成長。這些因素也是該國自動化的重要驅動力。

- 印度製造業是成長最快的產業之一,與前一年同期比較成長7.9%。印度製造舉措旨在使印度對國內和國際參與者俱有同等的吸引力,並讓印度經濟得到全球認可。到2020年終,印度製造業規模預計將達到1兆美元。

- 日本正走向自動化工業經濟,工業4.0版的進展正在迅速推進。日本已成為工廠自動化產品的製造地,供應亞太地區的不同市場。

- 由於 2020 年日本將舉辦奧運會,公共和私人對建設計劃的投資正在加速。政府透過重點發展基礎設施來提振經濟的努力預計也將推動建設產業的成長。由於電纜標籤的採用對於基礎設施發展至關重要,因此預計也會對電纜標籤市場產生影響。

電纜標籤行業概覽

該市場具有市場細分高、市場滲透率高、退出障礙低的特性。該市場是一個競爭日益激烈的市場空間,多個區域和全球參與者都在爭奪注意力。在這個市場上營運的公司正在收購致力於電纜標記技術的公司,以增強其產品能力。

- 2017 年 8 月 - TE Connectivity 收購了 Hirschman Car Communications,這是一家為汽車和商用車提供天線、天線系統和廣播調諧器的供應商。此次收購擴大了 TE Connectivity 的產品系列,並擴展了其為全球聯網汽車和自動駕駛汽車提供的整合且高度工程化的解決方案。赫斯曼汽車通訊在電子和軟體開發方面擁有強大的研發和工程能力,使我們能夠進一步鞏固我們作為汽車感測和連接領域全球領導者的地位。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 調查範圍

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 市場促進與市場約束因素介紹

- 市場促進因素

- 建設產業的使用增加

- 自動化採用率的提高

- 市場限制因素

- 難以生產耐用的印刷標籤

第5章市場區隔

- 按類型

- 金屬

- 非金屬

- 按最終用戶

- 資訊科技和電訊

- 建造

- 電力/公共產業

- 製造業

- 其他最終用戶

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭狀況

- 公司簡介

- TE Connectivity Ltd

- Brady Corporation

- ZipTape Label ID Systems

- Novoflex Marketing Ltd

- Panduit Corporation

- 3M Company

- Vizinex RFID Inc.

- HellermannTyton Group PLC(AptivPLC)

- Industrial Labelling Solution

- Marking Services Inc.

- Nelco

第7章 投資狀況

第8章 市場機會及未來趨勢

簡介目錄

Product Code: 63594

The Cable Tags Market is expected to register a CAGR of 5.77% during the forecast period.

Key Highlights

- The market for automation is increasing at a significant rate, owing to its adoption in industrial and urban use. Automation uses a large number of components, such as switchgear, relays, HVAC systems, human-machine interface (HMI,) and IT systems, which are connected through wires or cables.

- These cables may be small in size, ranging from 0.5 sq. mm to 35 sq. mm. Tracking the exact wire connection in an automation system is a challenging task for any skilled professional. Thus, the use of a cable tag has become an important component in the cable management process.

- Moreover, recently, data centers are growing drastically. With the rise in cloud computing, social media, big data, online gaming, and other online applications, there is a constant need for enhanced IT infrastructure that caters to the ever-increasing demand for resources; a factor that further supplements the demand for hyperscale data centers.

Cable Tags Market Trends

Manufacturing Occupies Major Share in the Cable Tag End-user Industry

- Manufacturers across various industries must identify parts, cartons, pallets, and shipments. This requires labeling, coding, and marking on a wide range of products and packaging systems, without sacrificing line speed.

- Cable tags are able to withstand high temperature and harsh weather condition so that the printing on the tag does not fade away, which is necessary for the manufacturing sector. Cable tag companies are now finding innovative ways to resolve this problem.

- Furthermore, continuous self-adhesive label stocks are ideal for warehouse and pipe marking. Self-adhesive labels are being used for asset labeling, removable asset tracking, temporary tracking labels, warehouse labeling, pipe marking, wire and cable identification, and secure identification of component parts and circuit boards.

Asia-Pacific is Expected to Witness Highest Growth Rate

- China is one of the major players in the global cable tags market, mainly due to a high rate of investment in industrial automation and also due to growing local manufacturing production. The need to track the exact wire connection in an automation system is boosting the demand for cable tags.

- According to the National Bureau of statistics, China's industrial output grew by 6.1% in 2018. The growth is expected to sustain as a result of the increase in retail sales of industrial products by about 10.4%. These factors are also acting as a significant driver for automation in the country.

- The Indian manufacturing sector is one of the highest growth sectors, registering a 7.9% year-on-year growth. The Make in India initiative plans to make India equally attractive for domestic and foreign players, and give global recognition to the Indian economy. By the end of 2020, the Indian manufacturing sector is expected to touch USD 1 trillion.

- Japan is becoming an automated industrial economy, and the advancement in Industrial version 4.0 is taking up at a faster pace in the country. The country has emerged as the manufacturing hub for the factory automation products, supplying them to another regional market in the Asia-Pacific region.

- The Olympic games that are to be held in Japan in 2020 has accelerated the pace of public and private sector investment in construction projects. Even the government efforts to revitalize the economy by focusing on infrastructure development are expected to provide momentum to the construction industry's growth. As the adoption of cable tags are vital in infrastructure, this is expected to impact the market for cable tags.

Cable Tags Industry Overview

The market can be characterized by high levels of market fragmentation, rising levels of market penetration, and low exit barriers. The market comprises several regional and global players vying for attention in an increasingly contested market space.The companies operating in the market are also acquiring companies working on cable tag technologies to strengthen their product capabilities.

- August 2017 - TE Connectivity acquired Hirschmann Car Communication, a company that provides antennas, antenna systems, and broadcast tuners for automotive and commercial vehicle applications. The acquisition expands TE Connectivity's product portfolio as well as the integrated and highly engineered solutions provided for connected and autonomous vehicles, worldwide. Hirschmann Car Communication's strong R&D and engineering capabilities in electronics and software development allow the company to further strengthen its global leadership position in automotive sensing and connectivity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Scope of the Study

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Introduction to Market Drivers and Restraints

- 4.4 Market Drivers

- 4.4.1 Increased Usage in Construction Industry

- 4.4.2 Increasing Adoption of Automation

- 4.5 Market Restraints

- 4.5.1 Difficulty in Manufacturing Durable Printed Tags

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Metallic

- 5.1.2 Non-metallic

- 5.2 By End User

- 5.2.1 IT and Telecom

- 5.2.2 Construction

- 5.2.3 Power and Utilities

- 5.2.4 Manufacturing

- 5.2.5 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 TE Connectivity Ltd

- 6.1.2 Brady Corporation

- 6.1.3 ZipTape Label ID Systems

- 6.1.4 Novoflex Marketing Ltd

- 6.1.5 Panduit Corporation

- 6.1.6 3M Company

- 6.1.7 Vizinex RFID Inc.

- 6.1.8 HellermannTyton Group PLC (AptivPLC)

- 6.1.9 Industrial Labelling Solution

- 6.1.10 Marking Services Inc.

- 6.1.11 Nelco

7 INVESTMENT LANDSCAPE

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219