|

市場調查報告書

商品編碼

1630219

自助倉儲軟體:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Self-storage Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

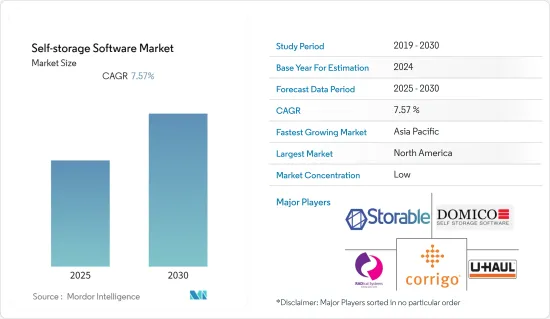

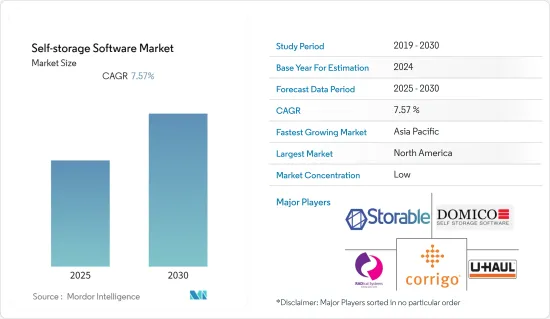

預計自助倉儲軟體市場在預測期間內複合年成長率為 7.57%

主要亮點

- 使用自助倉儲軟體的基本好處是它提供的驚人便利。這主要是雲端基礎的自助倉儲系統允許您從任何地方存取資料,只要您可以存取網際網路。一些軟體系統透過自訂儲存設施圖來視覺化可用和佔用的儲存單元。

- 全球都市化不斷上升,經濟前景改善,尤其是新興經濟體,為市場提供了積極的前景。由於都市區頻繁流動的案例增加,居住空間變得越來越昂貴,流動區域減少,都市區廣泛採用自助倉儲空間。同時,世界人口的快速成長導致家庭擁有更多的實體資產,推動了對額外儲存的需求並促進了市場成長。

- 雲端運算在企業中的採用越來越廣泛,包括自助倉儲。如今,筆記型電腦、平板電腦和辦公室桌上型電腦等個人技術正在逐步採用,原因有很多,其中包括巨大的成本節省。幾乎每家公司都意識到,線上儲存電腦程式比離線儲存、內部儲存或桌面儲存更具商業意義。因此,雲端基礎的自助倉儲和行動應用程式的出現正在推動市場。

- 自助倉儲競爭的加劇將推動市場需求。競爭越激烈,您的業務就會擴大得越大。隨著企業數量逐年增加,保持領先地位可能是一項挑戰。然而,增加競爭對業主和租戶來說都有很多好處。憑藉新的設施從人群中脫穎而出,改善您的行銷工作,並讓您自己有機會透過提供更多選擇來更好地服務您的客戶。此外,由於企業必須提供有競爭力的價格才能生存,這也有助於壓低價格。

- 對軟體應用程式付款流程的網路安全擔憂可能會限制市場。網路安全涵蓋各種情況和威脅。有些是技術性的,有些是與技術相關的。其他涉及人類,例如心懷不滿的員工或能夠實際存取系統的第三方。線上交易比店內交易更容易發生金融詐騙。然而,透過正確的流程和工具,可以降低攻擊風險、確保客戶資料安全並保護您的業務。

- 此外,新型冠狀病毒肺炎 (COVID-19) 大流行使世界陷入停滯,影響了主要業務並導致工業災難。然而,社交距離規則預計將增加協作軟體應用程式、安全解決方案、巨量資料和人工智慧的採用。各種最終用戶正在採用自助倉儲軟體解決方案來克服 COVID-19 造成的供應鏈風險。自助倉儲軟體供應商正在推出具有先進功能的新產品,以應對 COVID-19 爆發期間的社交距離規定。預計這將增加對自助倉儲軟體的需求,並對未來幾年的全球自助倉儲軟體市場產生積極影響。

自助倉儲軟體市場趨勢

雲端基礎的自助倉儲有望顯著成長

- 自助倉儲軟體最重要的優點是其驚人的便利性。如果您使用雲端基礎的自助倉儲系統,這也適用。這使您可以從任何有網路連線的地方存取資料。一些軟體系統還透過自訂儲存設施圖來視覺化可用和已佔用的儲存單元。

- 大多數現代軟體供應商現在都提供一些雲端軟體,因為它為最終用戶帶來最大的潛在好處。例如,大多數信譽良好的供應商選擇將資料託管在經過驗證且可靠的資料網路上。這使客戶資料與您的客戶保持密切聯繫,並允許您提供快速、安全的軟體連線。您還可以在大量伺服器上複製資料,因此即使發生損壞或自然災害,資料也是安全的,因為軟體是託管的。

- 根據 Unitrends 2021 年進行的一項研究,考慮到客戶需求,數位付款、視訊串流服務、連網型設備和智慧家庭設備的激增可能會推動雲端基礎的自助倉儲市場的成長。雲端基礎的自助倉儲來備份資料。

- 雲端基礎的自助倉儲軟體和傳統自助倉儲軟體的成本差異很大,但它們的價格通常比傳統軟體更低。因為整個過程比較簡單,所以初始成本更低。雲端基礎的自助倉儲軟體不需要將磁碟郵寄到您的機構並安裝在您的電腦上。許多程式可以使用網頁瀏覽器進行操作。由於客戶和提供者更容易訪問,營運成本通常較低。維護和支援大大簡化,因此對於最終用戶來說通常更便宜。

- 去年九月,SmartStop Self storage 開始推出新的雲端版本的 Self Storage Manager。同樣,去年 7 月,自助倉儲業者的領先科技公司 Storable 和經營 StorQuest Self Storage 系列品牌的私人創業房地產公司 William Warren Group (WWG) 宣布,為了實現雙方業務的共同利益和持續成長,我們簽訂了設施管理軟體開發協議,共同支援基於雲端的客製化設施管理軟體和相關管理平台解決方案的開發。這些新興市場的發展增強了對雲端基礎的平台和這個市場的需求。

預計北美將佔據主要佔有率

- 在自助倉儲軟體市場中,北美地區預計將佔據最大佔有率,其中美國佔據大部分市場。該地區的優勢在於擴大採用先進技術。此外,該地區擁有強大的自助倉儲軟體供應商骨幹力量,預計將推動該地區的市場發展。

- 該領域的市場參與企業包括 U-Haul International Inc.、The Storage Group 和 Domico Software。此外,隨著網路購物的發展趨勢和電子商務行業的發展,供應商現在可以在許多地方租用儲存空間。該地區的創新參與企業數量激增。

- 自助倉儲概念於2000年首次引進北美地區。僅在美國就有 54,000 個倉儲設施,預計可提供超過 26.3 億平方英尺的租賃空間。此外,過去幾十年來,自助倉儲市場一直是美國成長最快的細分市場之一。此外,預計多種因素將促進該市場的成長,包括儲存設施的增加以及功能有限且價格較低的輕量級自助倉儲軟體的採用。

- 在美國,未使用的儲存空間正在增加,而利用率正在下降。這徵兆,如果這種情況持續到夏季,人們會搬家,從而進行更多的存儲,自助倉儲業將更難承受經濟低迷的影響。在自助倉儲歷史上很受歡迎的地區,例如德克薩斯州休士頓,價格預計將平均下降 45%。在明尼蘇達州,2021 年 4 月一些儲存空間的價格下降了 50% 以上。根據Yardi Matrix最新的全國自助倉儲月度報告,自助倉儲物業的街價正在下降,專家樂觀地認為該行業將延續去年的強勁表現。

自助倉儲軟體產業概況

自助倉儲軟體產業高度分散且競爭激烈,許多公司提供軟體解決方案。公司正在迅速擴張。因此,全球整體市場成長也十分猛烈。技術的進步也為公司提供了永續的競爭優勢,市場上已經確認了一些聯盟和合併。

- 2022 年 8 月,在 10 個州經營超過 25 個設施的 SecureSpace Self Storage 從 Pegasus Group 收購了位於 3 個州的 11 個設施的 Central Self Storage 產品組合。這些設施位於舊金山灣區、奧勒岡州和德克薩斯州。總共將有 6,550 個單位,面積超過 650,000 平方英尺。

- 2022 年 7 月,戴爾科技集團宣布將在其業界領先的儲存產品組合中推出最新的軟體主導儲存解決方案,包括 PowerStore、PowerMax 和 Dell PowerFlex,以提高智慧性、自動化、網路彈性和多重雲端靈活性。這些進步為企業提供了安全、靈活的環境以及在數位時代蓬勃發展所需的洞察力。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 雲端基礎的自助倉儲軟體和行動應用程式的出現

- 自助倉儲市場競爭加劇

- 市場限制因素

- 未使用儲存價格上漲和季節依賴性

- 透過軟體應用程式進行付款流程的網路安全問題

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場區隔

- 公司規模

- 小型企業

- 大規模

- 類型

- 基於PC

- 雲

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭狀況

- 公司簡介

- Corrigo Incorporated(Jones Lang LaSalle Incorporated)

- U-Haul International Inc.

- Self-Storage Pro Inc.

- DOMICO Software

- Storable Group(SiteLink, storEDGE, and SpareFoot)

- RADical Systems (UK) Ltd

- Syrasoft LLC

- QuikStor Security & Software

- E-SoftSys LLC

- 6Storage

第7章 投資分析

第8章 市場機會及未來趨勢

簡介目錄

Product Code: 63645

The Self-storage Software Market is expected to register a CAGR of 7.57% during the forecast period.

Key Highlights

- The essential benefit of using self-storage software is the incredible convenience it provides. This is true mainly if using a cloud-based self-storage system allows the business to access the data from anywhere with Internet capability. Some software systems visualize available and occupied storage units through the custom storage facility map.

- The increasing rate of urbanization across the globe and improved economic outlook, specifically in emerging economies, are creating a positive outlook for the market. Urban populations widely adopt self-storage spaces due to the rising instances of them moving around more frequently and the increasingly expensive living spaces in cities with reduced wandering areas. In line with this, the rapidly increasing global population facilitates the demand for additional storage as families expand with more material possessions, thus favoring the market growth.

- The implementation of cloud computing has become prevalent for businesses, including self-storage. Today, personalized technology such as laptops, tablets, and company desktops have been phased in for plenty of reasons, starting with a vast cost reduction. Almost every company has found that it makes better business sense to store computer programs online instead of accumulating programs offline, in-house, or on a desktop. So, the emergence of cloud-based self-storage and mobile applications has driven the market.

- Increased Competition in Self storage drives the demand for the market. When the competition is high, there is a high scope of business. With the number of operators rising yearly, it can be tough to stay on top. But the benefits of increased competition are plentiful for both owners and renters. It gives a chance to stand out from the crowd with new amenities, improve marketing efforts, and better serve customers by providing them with more options. It also helps keep rates down as operators have to offer competitive pricing to bring in business.

- Cyber Security concerns about the payment process through software applications could restrain the market. Cybersecurity covers a wide variety of situations and threats. Some are technical and related to technology. Others involve humans, such as a disgruntled employee or a third party with physical access to the system. The potential for financial fraud is higher for online transactions than for in-store dealings. However, with proper processes and tools, it is possible to mitigate the risk of an attack and keep customer data safe to protect the business.

- Further, the novel COVID-19 pandemic has put the world at a standstill, affecting primary operations and leading to an industrial catastrophe. However, the adoption of collaborative software applications, security solutions, Big Data, and AI is expected to increase due to social distancing rules. Different end-users are adopting self-storage software solutions to overcome supply chain risks caused due to COVID-19. Self-storage software providers are launching new products with advanced functions to cope with social distancing regulations during the COVID-19 pandemic. This increases the demand for self-storage software and is projected to positively impact the global self-storage software market in the next few years.

Self Storage Software Market Trends

Cloud-based Self-storage is Expected to Witness Significant Growth

- The most crucial benefit of self-storage software is its incredible convenience. This holds if one is using a cloud-based self-storage system. This allows the business to access the data from anywhere with Internet capability. Some software systems also visualize available and occupied storage units through the custom storage facility map.

- Nowadays, most modern software providers provide some cloud software at this point, as it has the most significant potential benefits for the end-user. For instance, most reputable providers choose to host their data on proven and reliable data networks. This allows customer data to be stored near the customer, providing a fast and secure software connection. This also allows the data to be duplicated on numerous servers, so data is safe in the event of corruption or natural disasters since the software is hosted.

- According to the survey conducted by Unitrends in 2021, 85 percent of the organizations have started using cloud-based Self- storage for backup of the data considering the demands of the customers, owing to the rising adoption of digital payments, video streaming services, connected devices, and smart home devices which may propel cloud-based Self-storage market progress.

- While the cost of cloud-based and conventional self-storage software can vary widely, it's often easy to find it for a cheaper rate than traditional software. The upfront costs are lower because the entire process is more straightforward. Cloud-based self-storage software doesn't need to be mailed to the facility on a disk and installed on the computer. Many programs can be operated right in the Web browser. Operational costs are often lower due to the ease of access from the customer and provider. The maintenance and support are significantly simplified, which usually translates to lower prices for the end-user.

- In September last year, SmartStop Self storage commences the rollout of Self Storage Manager's new cloud version. Similarly, In July last year, Storable, the leading technology company for self-storage operators, and The William Warren Group (WWG), a privately held entrepreneurial real estate company that operates the StorQuest Self Storage family of brands, entered into a Facility Management Software Development Agreement to co-develop and support customized facility management software and related operating platform solutions based on Cloud for the benefit and continued growth of both businesses. Such developments enhance the cloud-based platform and demand for this market.

North America is Expected to Hold the Major Share

- The North American region was expected to have the most significant market share of the self-storage software market, with the United States occupying most of the market. The dominance in the region is due to the increasing adoption of advanced technologies. Moreover, the area has a robust foothold of self-storage software providers, which is anticipated to drive the market in the region.

- Some of the players in the market of the segment are U-Haul International Inc., The Storage Group, and Domico Software, among others. In addition, the developing trend of online shopping and the development of the e-commerce industry has permitted vendors to rent their storage space in numerous locations. There has been an upsurge in this region's number of innovative players.

- The self-storage concept was first introduced in the North American region in 2000. It is anticipated that more than 2.63 billion square feet of rental space are available across 54,000 storage facilities in the United States alone. Moreover, the self-storage market has been one of the fastest-growing sectors in the United States over the past few decades. Furthermore, various factors, such as the increasing number of storage facilities and the adoption of lighter versions of self-storage software, with limited features and lower prices, are anticipated to contribute to this market's growth.

- The unused storage space is growing, and rates are declining in the United States. This is a sign that the self-storage industry will face a tough time withstanding an economic downfall if it continues through the summer season when people do a lot of moving and, as a result, storing. In areas like Houston, Texas, where self-storage is a historically thriving business, prices are expected to go down an average of 45%. In Minnesota, prices dropped by more than 50% for some storage spaces in April 2021. According to the latest National Self Storage Monthly Report from Yardi Matrix, the street rates for self-storage properties are coming off, and experts are optimistic that the sector will continue to perform well in the last year.

Self Storage Software Industry Overview

The self-storage software industry is quite fragmented, and the competition is fierce, with many companies providing software solutions in the market. The companies are expanding rapidly. As a result, the overall market growth is also rampant globally. Technological advancements are also bringing sustainable competitive advantage to companies, and the market is witnessing multiple partnerships and mergers.

- In August 2022, SecureSpace Self Storage, which operates over 25 facilities in 10 states, acquired an 11-property Central Self Storage portfolio in three states from Pegasus Group. The facilities are in the San Francisco Bay Area, Portland, Oregon, and Austin, Texas. Together, they comprise more than 650,000 square feet in 6,550 units.

- In July 2022, Dell Technologies launched software-driven modern storage solutions such as PowerStore, PowerMax, and Dell PowerFlex across its industry-leading storage portfolio to drive increased intelligence, automation, cyber resiliency, and multi-cloud flexibility. These advancements give businesses a secure and flexible environment to derive critical insights to grow in the digital era.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Emergence of cloud-based self-storage software and mobile applications

- 4.2.2 Increasing Competition in Self-storage Market

- 4.3 Market Restraints

- 4.3.1 The growth in the unused storage prices and dependency on the season

- 4.3.2 Cyber Security Concerns about Payment Process through Software Apps

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of COVID-19 Impact on the Market

5 MARKET SEGMENTATION

- 5.1 Size of Enterprise

- 5.1.1 Small and Medium

- 5.1.2 Large

- 5.2 Type

- 5.2.1 PC-based

- 5.2.2 Cloud

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia Pacific

- 5.3.4 Latin America

- 5.3.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Corrigo Incorporated (Jones Lang LaSalle Incorporated)

- 6.1.2 U-Haul International Inc.

- 6.1.3 Self-Storage Pro Inc.

- 6.1.4 DOMICO Software

- 6.1.5 Storable Group (SiteLink, storEDGE, and SpareFoot)

- 6.1.6 RADical Systems (UK) Ltd

- 6.1.7 Syrasoft LLC

- 6.1.8 QuikStor Security & Software

- 6.1.9 E-SoftSys LLC

- 6.1.10 6Storage

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219