|

市場調查報告書

商品編碼

1630224

內容傳遞網路(CDN) 安全:市場佔有率分析、產業趨勢/統計、成長預測 (2025-2030)Content Delivery Network (CDN) Security - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

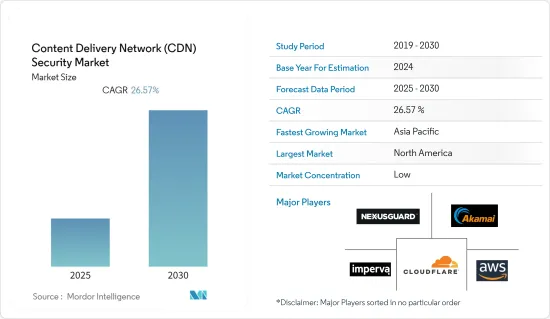

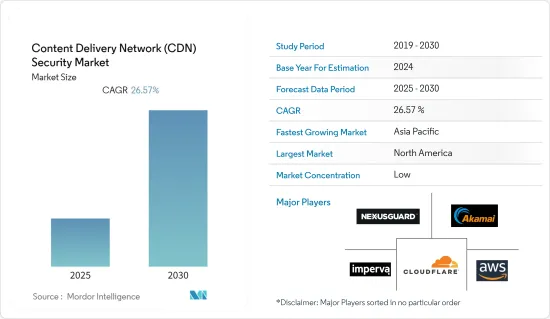

內容傳遞網路(CDN) 安全市場預計在預測期內複合年成長率為 26.57%。

主要亮點

- 電子商務網站和政府機構等行業對 DNS 保護的需求很高,以保護自己免受新出現的安全漏洞的影響。先進技術的早期採用、流行社交媒體和 OTT 平台的主導地位日益增強,正在推動 CDN 安全的需求在預測期內顯著成長。

- 5G預計將推動對CDN保全服務的需求。 5G基礎設施的引入將擴大頻寬並增加對高品質影片服務的需求。此外,根據Visual Networking Index的全球網路流量預測,智慧型手機用戶的比例已從去年初的23%上升到去年的50%,其中79%的行動流量是影片形式。

- 推動這一成長的另一個趨勢是從傳統 CDN 逐漸轉向基於雲端基礎的CDN。此類雲端基礎的服務的利用預計將推動 CDN 安全市場的發展。此外,互聯事物和企業移動性的激增,加上企業需要緩解 DDoS 等網路攻擊的增加,預計將有助於 CDN 安全市場的成長。

- 缺乏適當的標準和流程可能會阻礙影片材料的識別和管理。隨著電影和廣告影片串流服務的使用增加導致網路攻擊和病毒的增加,一些關鍵組織正在轉向自己的 CDN 來滿足他們的需求,我們被迫建立安全性。

- COVID-19 期間市場受到正面影響。世界各地的人們現在都在網路上工作、學習、購物和看電影。 DDoS 攻擊和應用程式層安全攻擊案例的增加正在推動疫情後的市場成長。

內容傳遞網路(CDN) 安全市場趨勢

Web應用防火牆(WAF)類型佔據主要市場佔有率

- 網路應用程式防火牆(WAF) 市場是由客戶保護公共和內部 Web 應用程式的需求所驅動的。 WAF 保護 Web 應用程式和 API 免受各種攻擊,包括自動攻擊(機器人)、注入攻擊和應用程式層拒絕服務 (DoS)。據SimilarWeb稱,上年度,Indeed.onelogin.com佔Indeed.com引薦流量的12.36%以上。 Jobs.take.indeedassessments.com 是 Indeed.com 的第二大引薦流量來源,佔專業網站所有引薦流量的 9.91% 以上。網路流量的增加正在推動市場成長。

- 保護面向公眾的 Web 應用程式免受自訂或第三方程式碼中的攻擊和漏洞是使用雲端 Web 應用程式防火牆 (WAF) 服務的關鍵原因。

- WAF 必須檢查流量並決定是否封鎖它。根據網路部署和 WAF 執行的分析處理的成本,這對於依賴低延遲響應來運行和吸引用戶的應用程式來說可能是一個挑戰。

- 雲端基礎的WAF 在組織中越來越受歡迎,用於保護面向公眾的 Web 應用程式。主要原因包括傳統企業網站、B2C 和 B2B Web 應用程式以及 API 驅動的應用程式的興起。

- 此外,大規模 B2C 應用程式遭受機器人自動攻擊的風險也在增加。有些公司使用 Drupal 和 WordPress 等第三方 CMS 託管網站,但這些 CMS 往往包含各種缺陷,導致資料因注入而外洩。此類應用程式的增加正在增加對WAF的需求。

北美可望創最大市場規模

- 由於其網際網路普及率較高以及線上遊戲和行動視訊串流觀看人數的增加,預計北美將在 CDN 安全市場中佔據重要的市場佔有率。此外,主要參與者的存在以及許多最終用戶領域技術的早期採用是該地區成為市場領跑者的關鍵因素。

- 北美佔據了大部分市場佔有率,主要是由於殭屍網路命令和控制 (C&C) 伺服器的存在。殭屍網路(也稱為 C2)被攻擊者用來維持與目標網路內受感染系統的通訊。這些系統包括電腦、智慧型手機、物聯網以及越來越多採用的比特緩解服務。

- 醫療保健企業的運作方式各不相同,但都有一個通用:最大限度地提高患者照護。數位醫療保健提供者擴大在線上託管健康記錄。臨床醫生捕獲的資料需要安全的內容傳送解決方案來確定業務的自由流程,尤其是在緊急情況下。

- 此外,位於華盛頓特區的微軟公司等知名公司可能會推動市場擴張。該地區 4K 解析度顯示器的使用正在增加。此外,高速資料網路的部署和雲端基礎的服務的快速可用性可能會增加 CDN 安全市場的規模。

- 相反,支援智慧城市計畫和未來 5G 網路部署的技術發展是 CDN 安全市場擴張的關鍵驅動力。同樣,由於北美地區網際網路普及率的提高,人們對線上遊戲和數位行銷的偏好不斷增加,這可能會為 CDN 安全市場的行業參與者創造新的可能性。

- 此外,去年 4 月,領先的端到端多重雲端技術解決方案供應商 Rackspace Technology 宣布,領先的端到端多雲端技術解決方案供應商 Akamai Technologies 與 Akamai Technologies 合作,提供可靠的解決方案。 secure digital experience 宣布與該公司加強策略夥伴關係,提供諮詢服務,幫助保護世界各地的公司的應用程式和 API。 Rackspace 和 Akamai 合作,透過 Akamai 的 Web 應用程式和 API Protector 協助企業客戶保護其雲端工作負載,該保護器為我所做的網站、應用程式和 API 提供一站式、不妥協的安全性。

內容傳遞網路(CDN) 安全產業概述

內容傳遞網路(CDN)永續市場由 Akamai Technologies, Inc. 主導。

2022 年 11 月,雲端原生日誌記錄和安全分析新興企業Devo Technology 宣布與 Amazon Web Services 建立多年策略夥伴關係。此次擴大的夥伴關係將使 Devo 能夠在應用 AI/ML 和安全日誌分析的新興領域快速發展,創建與 AWS保全服務相匹配的解決方案,並提供更好的客戶體驗。

2022 年 10 月,為我們的線上生活提供支援和保護的雲端公司 Akamai Technologies, Inc. 透過在全球推出全新的完全軟體定義的流量淨化中心,顯著改進了其DDoS 防護平台(Prolexic),並宣布擴大專用防禦能力。隨著全球各地不斷發生更複雜、破紀錄的 DDoS 攻擊,Akamai 的 Prolexic 可以保護客戶免受多太Terabit攻擊,並為全球各種規模的線上企業提供更高的效能和可靠性。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- DDoS 和應用層安全攻擊增加

- 媒體和娛樂領域越來越偏好雲端基礎的服務

- 市場挑戰

- 缺乏網路安全方面的技術專長

第6章 市場細分

- 按組織規模

- 中小企業

- 大型企業

- 按類型

- DDoS 對策

- 網路應用程式防火牆

- 反機器人和反抓取措施

- 資料安全

- DNS保護

- 按最終用戶產業

- 媒體與娛樂

- 零售

- BFSI

- 資訊科技和電信

- 衛生保健

- 其他最終用戶產業(政府、教育、旅遊/旅遊、製造業、公共產業)

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Akamai Technologies, Inc.

- Amazon Web Services, Inc.

- Cloudflare Inc.

- Imperva Inc.

- Nexusguard Limited

- Distil Networks Inc.

- Verizon Digital Media Services Inc.

- CDNetworks Inc.

- Net Scout Arbor Inc.

- Limelight Networks Inc.

第8章投資分析

第9章 市場機會及未來趨勢

The Content Delivery Network Security Market is expected to register a CAGR of 26.57% during the forecast period.

Key Highlights

- DNS protection is in high demand for e-commerce websites and government agencies, among other industries, to defend against emerging security vulnerabilities. Early adoption of advanced technologies, and the growing domination of popular social media and OTT platforms, have led to significant demand for CDN security growth throughout the forecast period.

- 5G is expected to fuel the demand for CDN security services. The deployment of 5G infrastructure will result in greater bandwidth, triggering a more significant demand for high-quality video services. Moreover, according to the Visual Networking Index's forecast of global Internet traffic, the proportion of smartphone users increased to 50% in the previous year from 23% early last year, with 79% of mobile traffic in video format.

- Another trend buoying this growth is the gradual shift from traditional CDNs to cloud-based CDNs. This use of cloud-based services is expected to drive the development of the CDN security market. Also, the growing penetration of connected things and enterprise mobility trends, coupled with the need to alleviate increasing cyber-attacks, such as DDoS, among enterprises, is anticipated to contribute to the growth of the CDN security market.

- A lack of adequate standards and processes may hamper the identification and control of video material. The increased use of video streaming services for movies and ads is to account for the rise in cyberattacks and viruses, forcing some significant organizations to establish their own CDN security to meet their needs.

- During COVID-19, the market was positively impacted. Several business operations shifted almost entirely to the web; people around the globe are now working, studying, shopping, and watching movies online. The increasing instances of DDoS and application layer security attacks drive the market growth after the pandemic.

Content Delivery Network Security Market Trends

Web Application Firewall (WAF) Type Segment Holds a Significant Market Share

- The web application firewall (WAF) market is driven by customers' needs to protect public and internal web applications. WAFs protect web applications and APIs against various attacks, including automated attacks (bots), injection attacks, and application-layer denial of service (DoS). According to SimilarWeb, Indeed.onelogin.com contributed more than 12.36 percent of Indeed.com's referral traffic in the earlier year. Jobs.take.indeedassessments.com was Indeed's second-largest referral traffic source, accounting for more than 9.91 percent of all referral traffic to the professional networking site. The increasing web traffic drives market growth.

- Protecting public-facing web applications against attacks and exploits of vulnerabilities in custom or third-party code is the primary cause for using cloud web application firewall (WAF) services.

- The WAF must inspect traffic and decide whether it should be blocked. Depending on the network placement and how costly the analysis operations they perform might be, this can become challenging to applications that depend on low latency responses to function or engage their users.

- Cloud-based WAF has been gaining popularity among organizations to protect their public-facing web applications. The main causes include - the traditional corporate website, B2C and B2B web applications, and a growing number of API-driven applications.

- Further, the market has witnessed large B2C applications facing a higher risk of automated attacks from bots. Some organizations opt to host websites powered by third-party CMS, such as Drupal or WordPress, which frequently include various flaws that expose them to data leakage through injection. The growth of such applications has augmented the demand for WAF.

North America is Expected to Register the Largest Market

- North America is anticipated to hold a significant market share in the CDN security market with a high internet penetration rate with a growing number of viewers for the online gaming and mobile video streaming segment. Additionally, the presence of the market giants and the early adoption of technologies across many end-user verticals are some of the prominent factors behind the region being the market front-runner.

- The majority of the share in the market is occupied by North America, mainly due to the presence of botnet command & control (C&C) servers. Also known as C2, attackers use them to maintain communications with compromised systems within a target network. These systems include computers, smartphones, and the IoT, which increase the adoption of bit mitigation services.

- Healthcare businesses operate in different ways but share a consistent focus on maximizing patient care. Increasingly, digital healthcare providers host health records online; clinicians capture data that demands secured content delivery solutions to determine the free flow of operations, especially during critical emergencies.

- Furthermore, prominent firms like Microsoft Corporation, located in Washington, DC, are more likely to fuel market expansion. This region has seen an increase in the use of 4K resolution monitors. Furthermore, the deployment of high-speed data networks and the fast use of cloud-based services are likely to increase the size of the CDN security market.

- Conversely, technical developments enabling smart city initiatives and the future deployments of 5G networks are critical drivers of the CDN security market expansion. Similarly, the rise in online gaming and digital marketing preferences due to increased internet penetration in the North American region is likely to open up new potential for industry players in the CDN security market.

- Furthermore, in April last year, Rackspace Technology, one of the leading end-to-end, multi-cloud technology solutions providers, announced enhancements to its strategic partnership with Akamai Technologies, trusted solutions for powering and protecting digital experiences, to provide consultative services to global businesses to help secure their applications and APIs. Rackspace and Akamai collaborated to assist business clients in protecting their cloud workloads by utilizing Akamai's Web Application and API Protector, which provides one-stop, zero-compromise security for websites, apps, and APIs.

Content Delivery Network Security Industry Overview

The content delivery network (CDN) security market is highly fragmented, with the presence of major players like Akamai Technologies, Inc., Amazon Web Services, Inc., Cloudflare Inc., Imperva Inc., and Nexusguard Limited, among others. Players in the market are adopting strategies such as partnerships, mergers, investments, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In November 2022, Devo Technology, cloud-native logging and security analytics startup, announced a multi-year strategic partnership with Amazon Web Services. This expanded partnership would enable Devo to swiftly develop in the emerging fields of applied AI/ML and security log analytics and create solutions matched with AWS security services, resulting in a better client experience.

In October 2022, Akamai Technologies, Inc., the cloud company that offers and protects life online, announced a significant evolution of its DDoS protection platform (Prolexic) with the global rollout of new, fully software-defined scrubbing centers, extending its dedicated defense capacity to 20 tbps and accelerating future product innovations. Following a wave of more sophisticated and record-breaking DDoS attacks throughout the globe, the change allows Akamai Prolexic to defend clients from multi-terabit attacks better and deliver greater performance and dependability for online companies of any size across the globe.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Instances of DDoS and Application Layer Security Attacks

- 5.1.2 Increasing Preference for Cloud-Based Services for Media and Entertainment

- 5.2 Market Challenges

- 5.2.1 Lack of Technical Cybersecurity Expertise

6 MARKET SEGMENTATION

- 6.1 By Organization Size

- 6.1.1 Small and Medium-scale Business

- 6.1.2 Large-scale Business

- 6.2 By Type

- 6.2.1 DDoS Protection

- 6.2.2 Web Application Firewall

- 6.2.3 Bot Mitigation & Screen Scraping Protection

- 6.2.4 Data Security

- 6.2.5 DNS Protection

- 6.3 By End-user Industry

- 6.3.1 Media & Entertainment

- 6.3.2 Retail

- 6.3.3 BFSI

- 6.3.4 IT and Telecom

- 6.3.5 Healthcare

- 6.3.6 Other End-user Industries (Government, Education, Travel and Tourism, Manufacturing, and Utilities)

- 6.4 Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Akamai Technologies, Inc.

- 7.1.2 Amazon Web Services, Inc.

- 7.1.3 Cloudflare Inc.

- 7.1.4 Imperva Inc.

- 7.1.5 Nexusguard Limited

- 7.1.6 Distil Networks Inc.

- 7.1.7 Verizon Digital Media Services Inc.

- 7.1.8 CDNetworks Inc.

- 7.1.9 Net Scout Arbor Inc.

- 7.1.10 Limelight Networks Inc.