|

市場調查報告書

商品編碼

1630228

企業人工智慧 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Enterprise AI - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

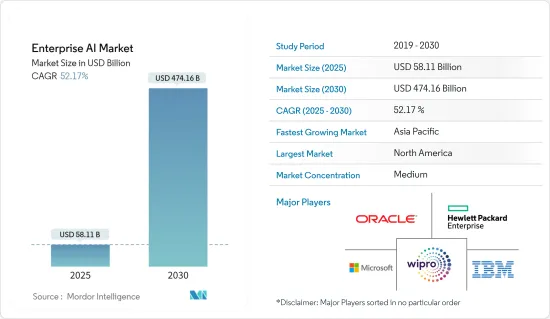

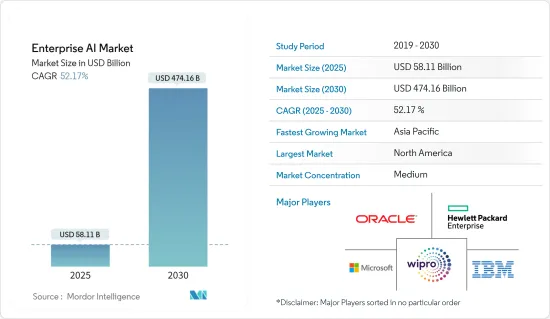

企業人工智慧市場規模預計到2025年為581.1億美元,預計2030年將達到4,741.6億美元,預測期內(2025-2030年)複合年成長率為52.17%。

公司正在認知到將人工智慧融入其業務流程、透過流程自動化提高效率並降低成本的價值。最重要的是,它可以幫助公司預測業務成果並提高盈利。

主要亮點

- 企業數位化是市場最主要的趨勢。第四次工業革命(工業4.0)以實體和先進數位技術為特徵,如物聯網、人工智慧、智慧機器人、無所不在的行動超級運算、資訊管理和分析,並對各行業產生重大影響。影響。

- 與工業 4.0 的傳播相關的工業自動化熱潮正在推動機器人和自動化技術的引入,以提高製造流程的效率。例如,根據美國銀行的數據,到 2025 年,機器人和人工智慧工業機器人領域的價值預計將達到約 240 億美元。這一趨勢正在加強企業中人工智慧的一個重要方面,即機器人流程自動化(RPA)。

- 此外,2022 年 6 月,該公司宣布選擇專注於工業 4.0 的製造執行系統 (MES) 供應商凱睿德 (Critical Manufacturing) 來最佳化 SwissSEM 的生產流程。做出這項決定是為了最大限度地降低營運成本並提高公司高度複雜的生產線的營運效率,邁向更高的數位自動化。凱睿德製造的全新製造執行系統 (MES) 可提供有關生產流程的準確、即時資訊,為持續流程改進、品質改進和降低成本奠定基礎。

- 邊緣運算、擴增實境、虛擬實境、工業機器人、自動駕駛汽車、數位製造、工業物聯網、數位製造等新技術正在推動各製造業取得顯著進步。這些解決方案有潛力提高生產流程的個人化、適應性和敏捷性,進一步推動市場成長。

- 2022 年 2 月,美國鋼鐵公司與機器人和人工智慧工作室 Carnegie Foundry 宣佈建立戰略投資和合作關係。這兩家總部位於匹茲堡的新興企業將共同努力,利用尖端的機器人技術和人工智慧來加速和擴大工業自動化。透過這筆資金籌措,Carnegie Foundry 將在先進製造、工業機器人、整合系統、自主移動和語音分析等領域行銷和擴展其機器人和人工智慧技術的工業自動化產品組合。

- 據美國鋼鐵公司稱,此次合作將使該公司處於工業機器人和獨立解決方案創新的前沿。鋼鐵製造商表示,需要先進的技術來滿足客戶對強大且有彈性的供應鏈的期望。

- 此外,企業人工智慧是數位轉型的關鍵推動者。未來幾年內,幾乎所有企業軟體應用程式都將支援人工智慧。因此,開發大規模建置、部署和營運企業人工智慧應用程式的能力對於企業生存至關重要。

- 根據O'Reilly 的2022 年企業人工智慧採用報告(基於時事通訊收件人對企業人工智慧採用調查的回應),31% 的公司表示他們沒有使用人工智慧(高於最近的13%),43%目前正在評估實施情況, 26%的人已經實施了人工智慧應用。在大洋洲,採用人工智慧的製造業受訪者數量從 18% 躍升至 31%。大量組織缺乏人工智慧管治。在生產人工智慧產品的 26% 受訪者中,只有 49% 制定了監督計劃創建、衡量和觀察方式的管治計畫(51% 的受訪者表示沒有)。

- 近年來,專注於工業4.0相關解決方案的各種夥伴關係關係進一步加速了研究市場的成長。例如,2022年1月,西班牙電信旗下數位服務部門Telefonica Tech與西班牙工程服務公司Grupo Alava簽署協議,為西班牙通訊業者提供私有5G、巨量資料「AI」分析和雲端服務。預測分析解決方案,該解決方案也利用了邊緣運算。

企業人工智慧軟體市場趨勢

雲端的引入預計將顯著成長市場

- 人工智慧雲端以前只是一個概念,現在開始被企業採用,將人工智慧與雲端運算結合。為雲端運算帶來新價值的人工智慧工具和軟體是一個主要促進因素。雲端是一種經濟的資料儲存和運算選項,有助於人工智慧的採用。

- Flexera Software 表示,75% 的企業受訪者表示,他們將在 2023 年採用 Microsoft Azure 進行公共雲端使用。 AWS、Microsoft Azure、Google Cloud 或 Hyperscalar 是世界上最高的雲端運算平台供應商之一。

- 人工智慧雲端主要由人工智慧使用案例的共用基礎設施組成,在任何給定時間在雲端基礎設施上同時支援多個計劃和人工智慧工作負載。 AI Cloud 為組織提供了存取 AI 的機會,並透過結合 AI 硬體和軟體並在混合雲端基礎設施上提供 AI 軟體即服務,使他們能夠更好地利用其 AI 功能。

- 雲端中人工智慧最吸引人的好處之一是它能夠解決的挑戰。它將極大地使人工智慧民主化並使其更容易使用。人工智慧驅動的企業轉型是透過降低實施成本和促進共同創造和創新來驅動的。

- 世界各地的組織擴大採用雲端解決方案。例如,2022 年 7 月,B2B虛擬網路營運商 (VNO) Cloud Connect Communications 獲得了電訊部 (DoT) 頒發的在孟買和艾哈默德巴德營運的許可證。 Cloud Connect 描述了一種雲端基礎的統一通訊解決方案,這是一種透過可程式 API 與 CRM(客戶關係管理)和語音通訊整合的企業呼叫管理系統,可對國內和國際市場的論壇進行呼叫和管理訪問。

- 此外,2022 年 1 月,Oracle 宣布推出適用於電信公司的 Oracle Cloud。 Oracle Cloud for Telcos 是基於 Oracle 雲端基礎架構建構的一整套雲端解決方案。 OCI是一個採用分散式雲端架構的雲端平台,在全球擁有36個公有雲區域。此外,OCI 平台擁有超過 60 個工業應用程式套件,支援第三方、自訂和 Oracle Fusion Cloud 應用程式套件工作負載。

歐洲正在經歷顯著的市場成長

- 在歐洲,由於工業革命和自動化等主流趨勢,需求不斷增加。該地區的公司正在投資各種自動化技術,包括機器人和人工智慧以及機器學習的發展。

- 大量政府資金也支持該地區製造業採用最新技術。例如,2022 年 10 月,英國研究與發展局 (UKRI) 向 12 個智慧工廠計劃提供了 1,370 萬英鎊的資金,以開發提高能源效率、生產力和製造業成長的技術。資助公司包括使用人工智慧來發現鋼鐵生產效率低下的公司以及在 3D 列印中使用回收材料的公司。這是政府更廣泛的 1.47 億英鎊「變得更聰明的創新挑戰」的一部分,該挑戰旨在增加英國製造業的技術使用。

- 此外,該地區的主要企業正在投資企業人工智慧市場並擴大其能力。例如,2022年9月,Oracle宣布創建西班牙首個Oracle雲端基礎設施(OCI)區域,以滿足西班牙快速成長的企業雲端服務需求。隨著馬德里新區域的開放, Oracle在西班牙的公共和私營部門客戶及合作夥伴現在可以更新應用程式、試驗資料和分析,並將關鍵任務工作負載從其資料中心遷移到 OCI。服務。

- 例如,惠普企業於 2022 年 5 月宣布將在捷克共和國開設新地點,以加強其歐洲超級電腦供應鏈。新工廠將生產公司自訂設計的解決方案,以推進科學研究、成熟 AL/ML 計劃並加速創新。

- 此外,2022年5月,歐洲三大壁爐供應商之一的Jotul與商業雲端供應商Infor建立了合作關係。 Jotul 透過業內最大的銷售組織之一和全球經銷商網路行銷其產品。 Jotul 將從目前的 ERP 解決方案升級到 Infor M3 CloudSuite 和標準化工業製造解決方案 Infor Consulting Services。

- 認知運算的興起預計將使在區域企業中複製人類的感官知覺、推理、思考、學習和決策能力成為可能。憑藉著利用巨大運算能力的能力,這種範式在速度和識別模式的能力上都超越了人類複製,並提供了個人可能無法感知的解決方案,有望擴大其對人工智慧解決方案的使用。

- 此外,自動化在製造業中的日益普及、降低製造成本的需求不斷成長以及機器對機器(M2M)技術的滲透正在推動該地區自動化的採用,從而導致工業控制的採用增加預計將推動需求。此外,德國是世界第五大數位經濟體,已廣泛實施工業4.0以實現工業生產數位化(根據GTAI)。此外,根據 Bitkom 數位協會的一項研究,62% 的德國公司正在使用工業 4.0 相關技術和解決方案(軟體、IT 服務、硬體)。

企業人工智慧軟體產業概況

由於有許多重要的參與企業,企業人工智慧市場上競爭公司之間的競爭非常激烈。 IBM、SAP SE、惠普企業、谷歌公司、微軟公司、甲骨文公司等許多公司都試圖透過為其用戶設計新的創新產品來佔領最大的市場佔有率。我們透過在研發、併購、策略擴張、資金籌措和策略夥伴關係方面的大量投資獲得了競爭優勢。

2024 年 8 月 去年剛成立的班加羅爾新興企業Sarvam AI 推出了一系列由生成式 AI 車型驅動的 B2B 產品。 Sarvam 週二宣布了多元化的產品陣容,瞄準金融服務、法律服務、消費品、科技、媒體和通訊等領域。該系列包括 Sarvam Agents、Sarvam 2B、Shuka 1.0、A1 以及針對各種語言量身定做的多個 Sarvam 模型。

2024年7月,富士通與專門從事安全和資料隱私的企業人工智慧公司Cohere Inc.建立了戰略夥伴關係關係。此次夥伴關係旨在透過開發和提供大規模語言模型 (LLM) 來為企業提供先進的日語能力,從而改善客戶和員工的體驗。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 利用市場促進和市場約束因素

- 市場促進因素

- 對自動化和基於人工智慧的解決方案的需求不斷成長

- 分析指數成長的資料的需求日益增加

- 市場限制因素

- 招聘率低

- 產業吸引力-波特五力分析

- 買方議價能力

- 供應商的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- 主要成分分析

- 人工智慧對半導體的影響

- COVID-19 市場影響評估

第5章市場區隔

- 按類型

- 解決方案

- 按服務

- 按發展

- 本地

- 雲

- 按最終用戶產業

- 製造業

- 車

- BFSI

- 資訊科技/通訊

- 媒體/廣告

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第6章 競爭狀況

- 公司簡介

- IBM Corporation

- Oracle Corporation

- Wipro Limited

- Hewlett Packard Enterprise

- Microsoft Corporation

- Amazon Web Services

- Google Inc.

- Intel Corporation

- SAP SE

- Sentient Technologies

- AiCure LLC

- NEC Corporation

- NVIDIA Corporation

第7章 投資分析

第8章市場的未來

The Enterprise AI Market size is estimated at USD 58.11 billion in 2025, and is expected to reach USD 474.16 billion by 2030, at a CAGR of 52.17% during the forecast period (2025-2030).

Enterprises recognize the value of incorporating artificial intelligence into their business processes, improving efficiency and reducing costs by automating process flows. Most importantly, it has helped enterprises predict business outcomes, driving profitability.

Key Highlights

- The digitalization of enterprises is the most dominant trend in the market. The fourth industrial revolution (Industry 4.0) is characterized by physical and advanced digital technologies, such as the Internet of Things, artificial intelligence, intelligent robots, ubiquitous mobile supercomputing, information management, and analytics, which significantly impact various industries.

- The boom of industrial automation, with the widespread adoption of Industry 4.0, is driving the adoption of robots and automated technologies to enhance the efficiency of manufacturing processes. For instance, according to Bank of America, the industrial robot segment of robotics and AI is expected to be valued at about USD 24 billion by 2025. This trend has augmented robotic process automation (RPA) among enterprises, a significant aspect of AI.

- Additionally, in June 2022, Critical Manufacturing, a provider of an Industry 4.0-focused Manufacturing Execution System (MES), announced that it was selected by SwissSEM to optimize its production processes. This decision is made to move towards greater digital automation based on minimizing operating costs and enhancing operating efficiency for its highly complex production line. The new Manufacturing Execution System (MES) from Critical Manufacturing will facilitate accurate, real-time information about production processes, establishing a basis for continuous process improvement, enhanced quality, and reduced costs.

- Various manufacturing industries have experienced tremendous development due to new technologies, including edge computing, augmented and virtual reality, industrial robots, self-driving cars, digital manufacturing, IIOT, and digital manufacturing. These solutions enhance production processes' personalization, adaptability, and agility, which may further drive market growth.

- In February 2022, United States Steel and Carnegie Foundry, a robotics and AI studio, announced a strategic investment and relationship. The two Pittsburgh-based startups will work together to accelerate and expand industrial automation using cutting-edge robotics and artificial intelligence. Carnegie Foundry will use this funding to market and scale its industrial automation portfolio of robotics and AI technologies in advanced manufacturing, industrial robots, integrated systems, autonomous mobility, speech analytics, and other areas.

- According to US Steel, the collaboration keeps the company at the forefront of growing innovation in robotics and independent solutions for the industry. According to the steelmaker, highly advanced technology will be required to meet its client's expectations for a robust and resilient supply chain.

- Furthermore, Enterprise AI is a significant enabler of digital transformation. Nearly every enterprise software application will be AI-enabled in the years to come. Developing competencies in the capability to build, deploy, and operate enterprise AI applications at scale, therefore, is becoming imperative for business survival.

- According to O'Reilly's 2022 report on enterprise AI adoption (based on the answers given by recipients of its newsletters to a questionnaire on enterprise AI adoption), 31% of companies report not using AI (up from 13% recently), 43% are evaluating adoption, and 26% have implemented AI applications. The immediate increase, from 18% to 31%, in manufacturing respondents with AI was in Oceania. A considerable number of organizations lack AI governance. Of the 26% of respondents with AI products in production, only 49% have a governance plan to oversee how projects are created, measured, and observed (versus 51% for those without).

- In recent years, various partnerships focused on solutions related to Industry 4.0 have further accelerated the studied market's growth. For instance, in January 2022, Telefonica Tech, the digital services arm of Telefonica, signed a deal with Spanish engineering services company Grupo Alava to introduce a predictive analytics solution for the Industry 4.0 market that also leverages private 5G, big-data 'AI' analytics, and cloud and edge computing from the Spanish operator.

Enterprise AI Software Market Trends

Cloud Deployment is Expected to Experience a Significant Market Growth

- The AI cloud, which was previously a concept, has now started to be implemented by enterprises, combining AI with cloud computing. Some significant factors driving it include AI tools and software that deliver new, increased value to cloud computing. It is an economical data storage and computation option and plays a role in AI adoption.

- According to Flexera Software, 75% of enterprise respondents indicated adopting Microsoft Azure for public cloud usage in 2023. AWS, Microsoft Azure, and Google Cloud, or hyper scalers, are among the highest cloud computing platform providers worldwide.

- An AI cloud primarily consists of a shared infrastructure for AI use cases, supporting multiple projects and AI workloads simultaneously on cloud infrastructure at any given time. The AI cloud combines AI hardware and software to deliver AI software-as-a-service on hybrid cloud infrastructure, providing organizations with access to AI and enabling them to harness AI capabilities more.

- One of the most compelling advantages of AI in the cloud is the challenges it addresses. It significantly democratizes AI, making it more accessible. Lowering the adoption costs and facilitating co-creation and innovation drive AI-powered transformation for enterprises.

- Organizations across the world are increasingly adopting cloud solutions. For instance, in July 2022, Cloud Connect Communications, a B2B virtual network operator (VNO), was licensed by the Department of Telecommunications (DoT) to operate in Mumbai and Ahmedabad. CloudConnect would deliver corporate call management systems with Integrated Cloud-based Communication Solutions, CRM (customer relationship management) Integration with telephony through programmable APIs, and calls and administrative access to the forum in local and foreign markets.

- Further, in January 2022, Oracle introduced Oracle Cloud for Telcos. Oracle Cloud for Telcos is a complete suite of cloud solutions built on Oracle Cloud Infrastructure. OCI is a cloud platform that can be utilized in dispersed cloud architecture and has 36 public cloud regions globally. Moreover, with over 60 industry application suites, the OCI platform enables third-party, custom, and Oracle Fusion Cloud Applications Suite workloads.

Europe to Experience Significant Market Growth

- The European region is witnessing increased demand due to mainstream trends, such as the industrial revolution and automation. The regional firms have been identified to invest in various automation technologies, such as robotics, artificial intelligence, etc., with developments in machine learning.

- Many government fundings also aid the adoption of the latest technologies in the manufacturing industry in the region. For Instance, in October 2022, UK Research and Innovation (UKRI) awarded 12 smart factory projects a share of GBP 13.7 million in funding to develop technologies that improve energy efficiency, productivity, and growth in manufacturing. The budget recipients include companies using AI to spot inefficiencies in steel production and using recycled materials in 3D printing. It is a part of the government's broader GBP 147 million Made Smarter Innovation Challenge that seeks to increase the use of technology within UK manufacturing.

- Moreover, major regional players are investing and expanding their capabilities in the Enterprise AI market. For Instance, in September 2022, to address the country's quickly growing demand for enterprise cloud services, Oracle announced the creation of the first Oracle Cloud Infrastructure (OCI) region in Spain. With the opening of the new territory in Madrid, Oracle's public and private sector clients and partners in Spain will have access to various cloud services that will help them update their applications, experiment with data and analytics, and move mission-critical workloads from their data centers to OCI.

- For Instance, in May 2022, Hewlett Packard Enterprise announced the launch of its new site in the Czech Republic to strengthen Europe's Supercomputer Supply Chain. The new factory will likely manufacture the company's custom-designed solutions to advance scientific research, mature AL/ML initiatives, and accelerate innovation.

- Moreover, in May 2022, one of the top three suppliers of fireplaces in Europe, Jotul, and Infor, the business cloud provider, established a partnership. Jotul supplies the markets through one of the largest industry-wide global networks of its sales organizations and distributors. Jotul will upgrade to Infor M3 CloudSuite, a standardized industrial manufacturing solution, and Infor Consulting Services from its present ERP solution.

- This rise in cognitive computing is expected to enable the replication of human sensory perception, deduction, thinking, learning, and decision-making capabilities across regional enterprises. The ability to harness considerable amounts of computing power is poised to take this paradigm beyond human replication, both in terms of speed and capacity, to distinguish patterns and provide potential solutions that individuals may not be equipped to perceive, thus augmenting the use of AI solutions.

- Furthermore, a rise in the penetration of automation in the manufacturing sector, the rising need to mitigate manufacturing costs, and the penetration of machine-to-machine (M2M) technologies are encouraging the adoption of automation in the region, which is anticipated to propel the demand for industrial control systems. In addition, Germany is the fifth largest digital economy in the world, and Industry 4.0 for the digitalization of industrial production is being widely implemented in the country (as per GTAI). Also, 62% of companies utilize Industrie 4.0-related technologies and solutions (software, IT services, and hardware) in Germany, according to a Bitkom digital association study.

Enterprise AI Software Industry Overview

The competitive rivalry in the Enterprise AI Market is high due to many significant players. Players like IBM, SAP SE, Hewlett Packard Enterprise, Google Inc., Microsoft Corporation, Oracle Corporation, and many more are trying to achieve maximum market share by designing new and innovative products for users. Their significant investments in research and Development, mergers & acquisitions, strategic expansion, funding, strategic partnership, etc., have allowed them to gain a competitive advantage.

August 2024: Sarvam AI, a startup based in Bengaluru and established just last year, unveiled a range of B2B products powered by its generative AI models. Targeting sectors such as financial services, legal services, consumer goods, technology, media, and telecom, Sarvam introduced a diverse product lineup on Tuesday. This lineup features Sarvam Agents, Sarvam 2B, Shuka 1.0, A1, and multiple Sarvam models tailored for various Indic languages.

In July 2024, Fujitsu entered into a strategic partnership with Cohere Inc., an enterprise AI company specializing in security and data privacy, with offices in Toronto and San Francisco. This partnership aims to develop and provide a large language model (LLM) that equips enterprises with advanced Japanese language capabilities, thereby enhancing customer and employee experiences.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Introduction to Market Drivers and Restraints

- 4.3 Market Drivers

- 4.3.1 Increasing Demand for Automation and AI-based Solutions

- 4.3.2 Increasing Need to Analyze Exponentially Growing Data Sets

- 4.4 Market Restraints

- 4.4.1 Sluggish Adoption Rates

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technology Snapshot

- 4.6.1 Major Component Analysis

- 4.6.2 Impact of AI on the Semicondu

- 4.7 Assessment of the impact of COVID-19 on the market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Solution

- 5.1.2 Service

- 5.2 By Deployment

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.3 By End-user Industry

- 5.3.1 Manufacturing

- 5.3.2 Automotive

- 5.3.3 BFSI

- 5.3.4 IT and Telecommunication

- 5.3.5 Media and Advertising

- 5.3.6 Other End-user Industries

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia

- 5.4.4 Australia and New Zealand

- 5.4.5 Latin America

- 5.4.6 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 IBM Corporation

- 6.1.2 Oracle Corporation

- 6.1.3 Wipro Limited

- 6.1.4 Hewlett Packard Enterprise

- 6.1.5 Microsoft Corporation

- 6.1.6 Amazon Web Services

- 6.1.7 Google Inc.

- 6.1.8 Intel Corporation

- 6.1.9 SAP SE

- 6.1.10 Sentient Technologies

- 6.1.11 AiCure LLC

- 6.1.12 NEC Corporation

- 6.1.13 NVIDIA Corporation

![企業人工智慧市場:趨勢、機會與競爭分析 [2023-2028]](/sample/img/cover/42/1341997.png)