|

市場調查報告書

商品編碼

1630229

Wi-Fi 分析 -市場佔有率分析、產業趨勢/統計、成長預測 (2025-2030)Wi-Fi Analytics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

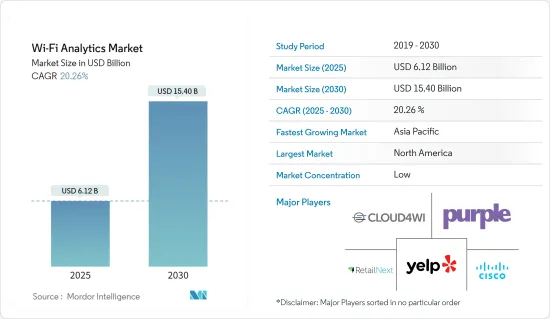

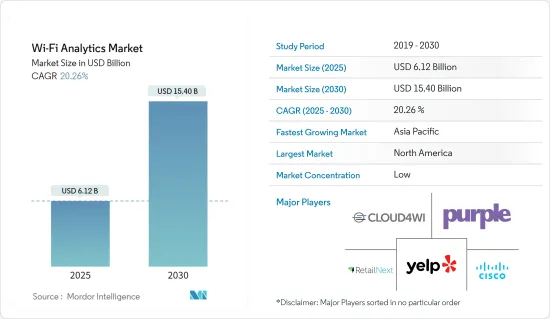

Wi-Fi 分析市場規模預計到 2025 年為 61.2 億美元,預計到 2030 年將達到 154 億美元,預測期內(2025-2030 年)複合年成長率為 20.26%。

Wifi 的優越性最重要的因素是它不需要在客戶的智慧型手機上安裝應用程式、收集行為資料、收集客戶檔案,並且基於客戶的店內行銷訊息進行鄰近性分析。支援 Wifi 的頻寬的增加進一步推動了該技術的採用。

主要亮點

- Wifi 分析可讓您利用無線網路提供的資訊,對實體空間做出更好的決策。 Wifi 已發展成為最廣泛、最通用和現代的店內零售分析技術之一。電子商務企業使用線上行銷分析工具來監控客戶透過公司網站的導航資料。收集的資料提供見解並推動決策以增加業務收益。

- 公共無線區域網路部署的增加、行動電話的普及、無線區域網路分析投資的增加以及巨量資料分析的使用的增加預計將影響無線區域網路分析市場的成長。

- 如今,購物中心、公共場所、交通樞紐、甚至汽車和火車都配備了車載 Wi-Fi,預計將在市場上變得司空見慣。增強的服務選項可確保客戶滿意度並推動市場成長。

- 然而,資料安全問題、嚴格的政府法規和措施以及缺乏標準化的監管合規性預計將阻礙市場擴張。物聯網 (IoT) 和行動連接智慧產品的使用不斷增加,預計將為市場滲透提供利潤豐厚的機會。

- COVID-19 正在促使公司開發創新的解決方案,讓員工在工作時無需擔心感染病毒。因此,許多公司採用了在家工作的概念,讓個人避免不必要的旅行。全球大流行已導致數千家企業暫時破產或關閉。由於各種最終用戶部門的重新開放以及智慧型手機的普及導致網際網路可用性的增加,市場在大流行後的情況下正在快速成長。

Wi-Fi市場趨勢分析

分析市場分析領域將顯著成長

- 市場分析部分的分析顯示未來幾年將顯著成長。隨著越來越多的公司專注於了解受眾並將資料轉化為可行的見解,Wi-Fi 分析在市場分析中的應用正在顯著成長。透過 Wi-Fi 分析,您可以確定哪些裝置和應用程式消耗的頻寬最多,並決定如何為學生和專案分配頻寬,同時確保其他地方的適當服務等級。

- 此外,智慧型手機和智慧型裝置的日益普及以及網路普及率的不斷提高也支持無線區域網路分析在市場分析中的應用。行動裝置使用的增加也導致 Wi-Fi 使用者數量的增加。

- 例如,根據Cisco的數據,全球行動用戶總數預計每年成長 2%,從 2018 年的 51 億增加到 2023 年的 57 億。從人口來看,2018年佔全球人口的66%,今年佔全球人口滲透率的71%。

- 到 2023 年,行動 Wi-Fi 速度也將增加兩倍。在全球範圍內,平均 Wi-Fi 速度預計將從 2018 年的 30.3 Mbps 增加到 2023 年的 92 Mbps。過去三年中,Wi-Fi 熱點數量增加了一倍以上。到 2023 年,全球整體將有約 6.28 億個公共 Wi-Fi 熱點,高於 2018 年的 1.69 億個。 Wi-Fi6 熱點在過去三年中增加了兩倍多,到今年年底將佔所有公共 Wi-Fi 熱點的 11%。

北美有望成為最大市場

- 該地區強大的財務狀況使企業能夠投資物聯網和巨量資料分析等先進解決方案和技術。由於思科系統公司(美國)、Zebra Technologies(美國)、Fortinet(美國)和 Ruckus Wireless(美國)等幾家主要 Wi-Fi 分析供應商的存在,該地區獲得了巨大的市場佔有率。

- 許多零售商、餐廳和飯店利用這項功能,提供公共熱點來吸引顧客。 Wi-Fi 熱點可以收集有關使用者行為、花費的時間等可用於支援您的業務的資訊。

- 隨著越來越多的智慧型手機連接,零售商可以根據客戶興趣提供更多產品和服務。因此,智慧型手機用戶的普及對零售市場產生正面影響,進而促進市場成長。

- 過去幾年,各地區消費者支出的增加推動了智慧型手機的需求。然而,鑑於滲透率較高,市場成長正趨於穩定。據思科系統公司稱,今年北美地區雙模行動裝置的 Wi-Fi 連線速度增加了一倍。 2018年平均Wi-Fi網路連線速度為46.9 Mbps,超過109.5 Mbps,其中北美地區的Wi-Fi速度最高,2018年至2023年的複合年成長率為18%。

- 根據 GSMA 的數據,到 2025 年,北美智慧型手機用戶數量預計將達到 3.28 億。此外,到 2025 年,該地區的行動用戶(86%) 和網路普及率 (80%) 可能會增加。由於網路使用量的增加,公共 Wi-Fi 安裝量也不斷增加。大多數用戶喜歡 Wi-Fi 熱點,因為 Wi-Fi 的網路速度比行動資料更快。

Wi-Fi 分析產業概述

Wi-Fi 分析市場高度分散。整體而言,現有競爭對手之間的競爭非常激烈。此外,我們預計大公司和新興企業之間將出現專注於創新的收購和合作。市場主要企業包括 Cisco Systems, Inc.、Cloud4Wi, Inc.、Purple Wi-Fi Ltd.、RetailNext, Inc.、Yelp Wi-Fi Inc. 等。市場參與企業正在採取聯盟、創新和收購等策略來增強其產品供應並獲得永續的競爭優勢。

2023 年 1 月,Purple 宣布與彈翻床設施 Altitude Trampoline Park 建立策略合作夥伴關係,以加強 CRM 記錄收集、獲取場館級回饋並增加特許支出。 Altitude 選擇在其位於美國的公司站點中整合 Purple 的訪客 WiFi 解決方案。自開業以來,陸續增加了專利權,每個園區的室內空間超過30,000平方英尺。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 產業價值鏈分析

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- 智慧型手機和智慧型裝置的使用增加

- 物理場館更採用公共 Wi-Fi

- 市場問題

- 資料安全問題和嚴格的政府法規和措施

第6章 市場細分

- 按成分

- 解決方案

- 按服務

- 按發展

- 本地

- 雲

- 按用途

- 存在分析(例如客流量分析)

- 行銷分析(客戶參與、顧客體驗管理、顧客行為分析等)

- 按行業分類

- 零售

- 款待

- 運動/休閒

- 運輸

- 醫療保健

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 供應商市場佔有率

第8章 競爭格局

- 公司簡介

- Cisco Systems, Inc.

- Cloud4Wi, Inc.

- Purple Wi-Fi Ltd

- RetailNext, Inc.

- Yelp Wi-Fi Inc.

- Ruckus Wireless Inc.(Arris International Limited)

- Fortinet Inc.

- Blix

- Skyfii Limited

- Singtel

- MetTel, Inc.

第9章投資分析

第10章投資分析市場的未來

The Wi-Fi Analytics Market size is estimated at USD 6.12 billion in 2025, and is expected to reach USD 15.40 billion by 2030, at a CAGR of 20.26% during the forecast period (2025-2030).

The most important factor contributing to wifi's superiority is that it doesn't require an application installed on customers' smartphones to gather behavioral data or collect customer profiles and trigger proximity-based marketing messages based on customers' in-store location. An increase in wifi supporting bandwidth further supports the adoption of the technology.

Key Highlights

- Wifi analytics enables the organization to use the information available through the wireless network to make better decisions about physical space. Wifi has evolved as one of the most widespread and versatile modern in-store retail analytics technologies. E-commerce businesses use online marketing analytics tools to monitor customer navigation data through company websites. The collected data yields insights and makes decisions to increase business revenue.

- Increased public wifi deployment, mobile phone proliferation, increased investment in wifi analytics, and increased usage of big data analytics are projected to influence the growth of the wifi analytics market.

- Shopping complexes, public places, transport hubs, and nowadays, even cars and trains boast of having onboard wifi, which is expected to become regular in the market. It is an enhanced service option to ensure customer satisfaction and propel market growth.

- However, data security issues, stringent government regulations and policies, and the lack of standardized regulatory compliance are expected to hinder market expansion. An increase in the usage of the Internet of Things (IoT) and mobile-connected smart items are predicted to provide profitable opportunities for market advancement.

- COVID-19 has prompted businesses to develop innovative solutions allowing workers to work without worrying about getting the virus. As a result, many firms have embraced the work-from-home concept, allowing individuals to avoid unnecessary travel. Temporary collapse and closure of thousands of businesses globally hamper the market during the pandemic. With the reopening of various end-user sectors and increased internet availability with smartphone penetration, the market is growing rapidly in the post-pandemic scenario.

Wi-Fi Analytics Market Trends

Market Analytics Segment is Analyzed to Witness Significant Growth

- The market analytics segment is analyzed to witness significant growth in the coming years. The application of Wi-Fi analytics in market analytics is growing largely due to growing emphasis of businesses to understand their audience, and turn data into actionable insights. With wifi analytics, a user can identify which devices or applications are consuming the most bandwidth and make decisions on how to allocate bandwidth to students and programs, and at the same time, ensure appropriate service levels elsewhere.

- Moreover, the increasing use of smartphones and smart devices, coupled with the growing internet penetration, is driving the application of wifi analytics in the market analytic. This increase in the use of mobile devices is also increasing the number of Wi-Fi users.

- For instance, according to Cisco Systems, Globally, the total number of mobile subscribers is expected to increase by 2% every year, from 5.1 billion in 2018 to 5.7 billion in 2023. In terms of population, it accounted for 66% of the global population in 2018 and 71% of the global population penetration in the current year.

- And also, In 2023, mobile Wi-Fi speeds tripled. Globally, average Wi-Fi speeds are expected to increase from 30.3 Mbps in 2018 to 92 Mbps in 2023. Wi-Fi hotspots are more than doubled in the past three years. By 2023, there are approximately 628 million public Wi-Fi hotspots globally, up from 169 million in 2018. Wi-Fi6 hotspots will increase more than triple from the past three years, accounting for 11% of all public Wi-Fi hotspots by the end of the current year.

North America is Expected to Register the Largest Market

- The strong financial position of the region enabled organizations to invest in advanced solutions and technologies, such as IoT and big data analytics. The presence of multiple major Wi-Fi analytics vendors, such as Cisco Systems (US), Zebra Technologies (US), Fortinet (US), and Ruckus Wireless (US), have enabled the region to draw a significant share.

- Using this feature to their advantage, many retailers, restaurants, and hotels offer public hotspot point to attract customers, through which the Wi-Fi hotspot gather information about the user behavior, time spent, etc., and can use for supporting the business.

- As more smartphones connect, retailers can provide more products and services based on customers' interests. Henceforth, the increasing penetration of smartphone users is positively impacting the retail market, which is, in turn, increasing the market's growth.

- Over the past few years, increased consumer spending across regions has driven the demand for smartphones. However, the market's growth is plateauing, considering the intense penetration levels. According to Cisco Systems, the North American Wi-Fi connection speeds originating from dual-mode mobile devices is doubled in the current year. The average Wi-Fi network connection speed was 46.9 Mbps in 2018 and exceeded 109.5 Mbps and North America is experiencing the largest Wi-Fi speeds with 18% of CAGR from 2018 to 2023.

- According to GSMA, the number of smartphone subscribers in North America is expected to reach 328 million by 2025. Moreover, by 2025, the region may witness an increase in the penetration rates of mobile subscribers (86%) and the Internet (80%). The increasing usage of the Internet has enabled the growth of public Wi-Fi installments. As the Internet speed through Wi-Fi is faster than that of mobile data, most users prefer Wi-Fi hotspots.

Wi-Fi Analytics Industry Overview

The Wi-Fi analytics market is highly fragmented. Overall, the competitive rivalry among existing competitors is high. Moreover, acquisitions and collaboration of large companies with startups are expected, which are focused on innovation. The major players in the market are Cisco Systems, Inc., Cloud4Wi, Inc., Purple Wi-Fi Ltd, RetailNext, Inc., and Yelp Wi-Fi Inc. among others. Players in the market are adopting strategies such as partnerships, innovations, and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In January 2023, Purple announced a strategic partnership with Altitude Trampoline Park, a trampoline facility, to enhance CRM record collecting, obtain venue-level feedback, and increase expenditure at concessions. Altitude has opted to integrate Purple's Guest WiFi solution throughout its corporate sites in the United States. Additional franchise locations have followed after the launch, with each park having more than 30,000 square feet of indoor area.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Use of Smartphones and Smart Devices

- 5.1.2 Increasing Deployment of Public Wi-Fi across Physical Venues

- 5.2 Market Challenges

- 5.2.1 Data Security Issues and Stringent Government Regulations and Policies

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solution

- 6.1.2 Services

- 6.2 By Deployment

- 6.2.1 On-premise

- 6.2.2 Cloud

- 6.3 By Application

- 6.3.1 Presence Analytics (Footfall Analytics, etc.)

- 6.3.2 Marketing Analytics (Customer Engagement, Customer Experience Management, Customer Behavior Analytics, etc.)

- 6.4 By End-user Vertical

- 6.4.1 Retail

- 6.4.2 Hospitality

- 6.4.3 Sports and Leisure

- 6.4.4 Transportation

- 6.4.5 Healthcare

- 6.4.6 Other End-user Verticals

- 6.5 By Geography

- 6.5.1 North America

- 6.5.2 Europe

- 6.5.3 Asia Pacific

- 6.5.4 Latin America

- 6.5.5 Middle East and Africa

7 VENDOR MARKET SHARE

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Cisco Systems, Inc.

- 8.1.2 Cloud4Wi, Inc.

- 8.1.3 Purple Wi-Fi Ltd

- 8.1.4 RetailNext, Inc.

- 8.1.5 Yelp Wi-Fi Inc.

- 8.1.6 Ruckus Wireless Inc. (Arris International Limited)

- 8.1.7 Fortinet Inc.

- 8.1.8 Blix

- 8.1.9 Skyfii Limited

- 8.1.10 Singtel

- 8.1.11 MetTel, Inc.