|

市場調查報告書

商品編碼

1630242

以風險為基礎的認證:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Risk-based Authentication - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

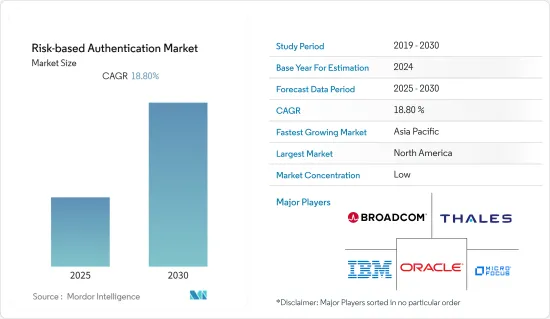

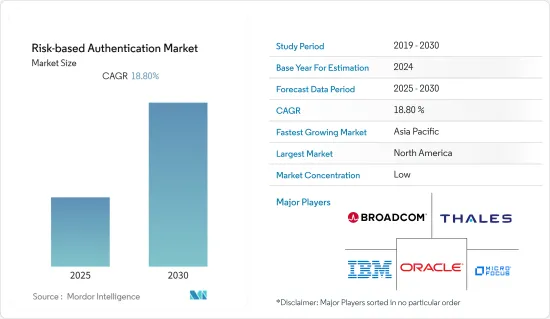

基於風險的身份驗證市場預計在預測期內將以 18.8% 的複合年成長率成長。

主要亮點

- COVID-19 大流行導致世界各地的詐騙行為大幅增加。據美國聯邦貿易委員會稱,自 2020 年 1 月以來,2021 年 3 月已有超過 217,000 名美國提交了與新冠病毒相關的詐騙報告,因新冠病毒相關詐騙造成的損失總計達 3.82 億美元。同樣,消費金融局2020年收到54.23萬起詐騙申訴,較2019年大幅增加54%。

- 此外,根據認證詐欺審查員協會(ACFE)的數據,受疫情影響,網路詐騙風險從2020年5月的45%大幅上升至2020年8月的47%。此外,未來 12 個月網路詐騙風險預計將增加 60%。

- 數位管道已成為消費者與企業和彼此互動的關鍵。在數位世界中,企業越來越依賴網路內部和外部的系統網路來服務客戶並更好地管理組織。此類系統有助於管理、儲存和傳輸各種訊息,包括財務帳戶、智慧財產權、個人識別資訊和交易記錄。

- 為了幫助實現這一目標,組織擴大採用自動化解決方案來實現更快的工作流程、分析工作流程並改善對公司進步構成挑戰的領域。因此,從傳統的儲存和分析到雲端基礎的基礎設施和儲存技術發生了重大轉變。 Flexera 2021 年雲端狀況報告顯示,基於對 750 名 IT 專業人員的調查,92% 的受訪者制定了多重雲端策略,82% 的受訪者制定了混合雲端策略。大約 36% 的公司表示他們每年在雲端使用上的支出超過 1,200 萬美元,83% 的公司表示他們每年在雲端使用上的支出超過 120 萬美元。

基於風險的身份驗證市場趨勢

銀行和金融服務業佔很大佔有率

- 傳統銀行正在轉型為新型態、敏捷、策略性集中的機構。不斷變化和複雜的法規、激烈的競爭和苛刻的客戶帶來的挑戰導致了數位轉型的調整。

- 消費者越來越傾向於提供數位化服務的銀行。根據 Lightico 的研究,2020 年 3 月,約 82% 的客戶擔心親自前往分店,63% 的客戶表示願意嘗試數位應用程式。因此,這些轉變預計將是長期的。

- 隨著數位銀行和透過客服中心的遠距銀行變得越來越普遍,需要新的、便捷的方法來驗證客戶身分。行動銀行和電子銀行管道每天擴大用於轉帳和交易,這為網路犯罪分子入侵用戶帳戶和提取資金打開了大門。由於客戶忘記密碼或受到網路釣魚和其他網路犯罪分子的攻擊,傳統密碼的安全性較低,因此該行業正在轉向更複雜的身份驗證系統,例如正在出現的基於風險的身份驗證系統。

- 多個組織和管理機構,包括聯邦金融機構檢查委員會 (FFIEC)、紐約州金融服務部 (NYDFS)、網路安全監理局和全國保險專員協會 (NAIC),負責監管金融機構、保險公司、銀行和許多其他組織強制要求使用多重身份驗證(MFA) 來保護敏感資料的存取。

- 資料外洩會導致成本飆升和有價值的客戶資訊遺失。根據身分盜竊資源中心的數據,美國的資料外洩事件將從 2015 年的 784 起增加到 2020 年的 1,001 起。

- 此外,BFSI 領域的雲端工作負載正在增加,大量資料轉移到雲端。此外,與行動錢包等第三方的整合增加,加上生態系統中許多供應商的複雜安全基礎設施,為該領域帶來了重大的安全挑戰。

北美預計將佔據很大佔有率

- 北美地區引領市場,以美國為首。該地區的企業越來越依賴電腦網路和電子資料來進行正常業務。個人和財務資訊的線上傳輸和儲存也在不斷增加。

- 這是因為與其他區域相比,該區域擁有更多的組織資料。此外,美國目前在雲端技術和分析的採用方面佔據最大佔有率,預計 2020 年將呈現類似趨勢。

- 各行業資料外洩數量的顯著增加正在推動企業採用強大的身份驗證方法。例如,根據白宮經濟顧問委員會的統計,美國經濟每年因網路攻擊而面臨約570億美元至1,090億美元的損失。

- 根據 Experian PLC 發布的統計數據,31% 的資料外洩受害者聲稱他們的電子郵件 ID、密碼和信用卡/簽帳金融卡等身分資訊被盜。此外,美國公司 Risk-based Security 報告稱,2020 年發生了超過 3,932 起資料外洩事件。與 2019 年相比,公開報告的資料外洩數量減少了 48%,但超過 370 億筆記錄遭到洩露。這些事實表明,該國越來越需要採用基於風險的身份驗證解決方案。

- 該地區各國政府也鼓勵使用各種身分驗證技術。例如,2020 年 4 月,美國政府賦予聯邦機構使用替代形式的身份驗證的靈活性,以彌補服務差距並實現其目標。機構可以做出風險確定並向合格PIV 資格的人員發放替代憑證或身分驗證設備。預計這將增加所研究市場的招聘需求。

基於風險的身份驗證產業概述

競爭企業之間競爭激烈,企業紛紛進行技術創新、併購、業務擴張等策略性投資。此類投資將幫助企業進一步滲透市場並佔領更好的市場佔有率。市場上存在具有強大品牌形象的大公司,它們之間競爭以獲取更高的市場佔有率。然而,該行業正以 18.8% 的複合年成長率快速成長,為市場企業發展提供了進一步的成長空間。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 技術簡介

- COVID-19 市場影響評估

- 市場促進因素

- 主要最終用戶行業的資料外洩和網路攻擊增加

- 企業採用BYOD趨勢

- 市場限制因素

- 更新風險評分以應對不斷變化的網路安全威脅的壓力越來越大

第5章市場區隔

- 透過提供

- 解決方案

- 按服務

- 按發展

- 本地

- 雲

- 按最終用戶產業

- 銀行與金融服務 (BFSI)

- 零售

- 資訊科技/通訊

- 政府機構

- 衛生保健

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭狀況

- 公司簡介

- RSA Security LLC

- IBM Corporation

- Broadcom Inc.(CA Technologies Inc.)

- Micro Focus International plc(NetIQ)

- Okta Inc.

- SecureAuth Corporation

- Thales Group(Gemalto NV)

- Equifax Inc.

- Oracle Corporation

- HID Global Corporation(Assa Abloy AB)

- Financial Software Systems Inc.

第7章 投資分析

第8章市場的未來

The Risk-based Authentication Market is expected to register a CAGR of 18.8% during the forecast period.

Key Highlights

- The COVID-19 pandemic has led to significant growth in fraudulent activities across the globe. According to the Federal Trade Commission, in March 2021, more than 217,000 Americans had filed a coronavirus-related fraud report since January 2020, with losses to Covid-linked fraud totaling USD 382 million. Similarly, the Consumer Financial Bureau fielded 542,300 fraud complaints in 2020, a significant 54% increase compared to 2019.

- Furthermore, according to the Association of Certified Fraud Examiners or ACFE, due to the pandemic, the cyber fraud risk significantly increased from 45% in May 2020 to 47% in August 2020. In addition, it is expected that an increase in cyber fraud risk is expected to reach 60% over the next 12 months.

- Digital channels are becoming imperative as consumers interact with businesses and each other. In the digital world, to accommodate their customers and better manage their organizations, companies are becoming increasingly dependent on a web of systems, both on and off their networks. Such systems assist in managing, storing, and transmitting various information, such as financial accounts, intellectual property, personally identifiable information, transaction records, and others.

- In support of this, various organizations are increasingly adopting automation solutions to enable fast workflow and analyze the work processes to improvise the areas that challenge the company's progress. This has resulted in a massive shift from traditional storage and analytics to cloud-based infrastructure and storage technologies. According to a Flexera 2021 State of the Cloud Report, based on a survey of 750 IT professionals, 92% of the respondents have a multi-cloud strategy, while 82% have a hybrid cloud strategy. About 36% of enterprises reported that their annual spend exceeded USD 12 million, and 83% said that cloud spend exceeds USD 1.2 million per year.

Risk-Based Authentication Market Trends

Banking and Financial Services Hold the Major Share

- Traditional banks have been turning to new and strategically focused agile institutions. The diverse challenges related to the ever-changing complex regulations, intense competition, and demanding customers have resulted in an alignment toward digital transformation.

- Consumer propensity toward banks that offer services with digitalization is increasing. According to a study by Lightico, in March 2020, around 82% of customers were concerned about visiting their branch in person, and 63% mentioned that they are willing to try the digital application. Thus, these shifts are expected to be long-lasting.

- With the growing popularity of digital banking and remote banking via call centers, the requirement for new and convenient ways to authenticate customer identity has been generated. Mobile and e-banking channels are increasingly used every day to transfer and perform transactions, which opens doors to cybercriminals trying to compromise a user's account to extract money. The low-security level of traditional PINs due to customers forgetting their passcodes or being hacked due to phishing and other cybercrimes has led to the rise of more sophisticated authentication mechanisms, like risk-based authentication systems, in the industry.

- Several organizations and governing bodies, such as the Federal Financial Institutions Examination Council (FFIEC), New York State Department of Financial Services (NYDFS), and the Cybersecurity Regulation and National Association of Insurance Commissioners (NAIC), mandated the use of multi-factor authentication (MFA) to protect access to sensitive data for financial institutions, insurers, banks, and many other organizations.

- Data breaches lead to an exponential rise in costs and loss of valuable customer information. According to Identity Theft Resource Center, the number of data breaches in the United States increased from 784 in 2015 to 1,001 in 2020.

- Moreover, the BFSI sector is experiencing an increase in cloud workloads, where a significant amount of data is moved to the cloud. Furthermore, the rising integration of the third party, such as mobile wallets, coupled with complex security infrastructure where many vendors are deployed around the ecosystem, is creating a significant security challenge in the sector.

North American Expected to Hold Major Share

- The North American region led the market with the United States as the most prominent contributor to the region's market. The businesses in the region are increasingly dependent on computer networks and electronic data to conduct their regular operations. An increasing pool of personal and financial information is also transferred and stored online.

- This is because of the populous nature of the region in terms of organizational data, compared to other regions. Moreover, the United States currently accounts for the largest share in the adoption of cloud technologies and analytics and is expected to show the same trend in 2020.

- The substantial increase in the number of data breaches across various industries boosts companies to adopt robust authentication methods. For instance, according to the White House Council of Economic Advisers, the US economy faces losses of approximately USD 57 billion to USD 109 billion per annum, due to cyber-attacks.

- According to a statistic presented by Experian PLC, 31% of the data breach victims claimed the theft of their identity, like e-mail ids, passwords, credit/debit card numbers, etc. Also, Risk-based Security, an American firm, reported that 2020 has seen over 3,932 data breaches. When compared to 2019, the number of publicly reported breach events decreased by 48%, however, several records exposed exceeded 37 billion. These facts indicate the growing need for the adoption of a risk-based authentication solution in the country.

- Also, the governments in the region have been encouraging the usage of various authentication techniques. For instance, in April 2020, the US government gave federal agencies the flexibility to use alternative authentication forms to fulfill service gaps and achieve their goals. Agencies can make a risk determination and issue an alternate credential or authenticator for PIV eligible personnel. This is anticipated to augment the demand for the adoption of the market studied.

Risk-Based Authentication Industry Overview

The intensity of competitive rivalry is high as players engage in strategic investments in the form of innovation, mergers and acquisitions, and expansions. Such investments help the companies in further penetrating the market and gain a better market share. There is a presence of major companies in the market which have strong brand identity creating rivalry for gaining higher share. However, the industry is growing rapidly at a CAGR of 18.8%, which provides further room for the growth of players operating in the market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3 Technology Snapshot

- 4.4 Assessment of Impact of COVID-19 on the market

- 4.5 Market Drivers

- 4.5.1 Growing Data Breaches and Cyber Attacks across Key End-user Verticals

- 4.5.2 Adoption of BYOD Trends in Enterprises

- 4.6 Market Restraints

- 4.6.1 Growing Pressure to Update Risk Scores in line With Evolving Cyber-security Threats

5 Market SEGMENTATION

- 5.1 By Offering

- 5.1.1 Solution

- 5.1.2 Service

- 5.2 By Deployment

- 5.2.1 On-premise

- 5.2.2 Cloud

- 5.3 By End-user Vertical

- 5.3.1 Banking and Financial Services (BFSI)

- 5.3.2 Retail

- 5.3.3 IT and Telecommunication

- 5.3.4 Government

- 5.3.5 Healthcare

- 5.3.6 Other End-user Verticals

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 RSA Security LLC

- 6.1.2 IBM Corporation

- 6.1.3 Broadcom Inc. (CA Technologies Inc.)

- 6.1.4 Micro Focus International plc (NetIQ)

- 6.1.5 Okta Inc.

- 6.1.6 SecureAuth Corporation

- 6.1.7 Thales Group (Gemalto N.V.)

- 6.1.8 Equifax Inc.

- 6.1.9 Oracle Corporation

- 6.1.10 HID Global Corporation (Assa Abloy AB)

- 6.1.11 Financial Software Systems Inc.