|

市場調查報告書

商品編碼

1630264

手掌靜脈生物辨識:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Palm Vein Biometrics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

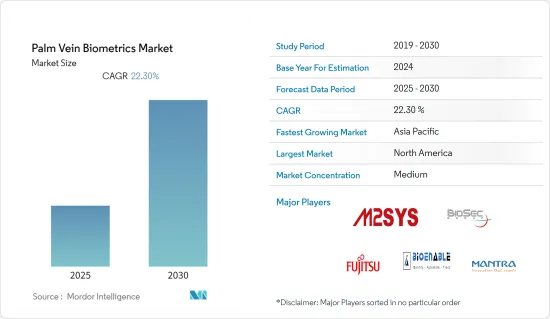

預計手掌靜脈生物辨識市場在預測期內的複合年成長率為 22.3%。

主要亮點

- 多年來,控制對設施和系統的存取的需求不斷增加。如今,許多組織依靠密碼或卡片來驗證其身分。然而,這種傳統方法面臨嚴峻的挑戰。例如,卡片遺失或被盜會帶來安全風險。任何擁有正確的密碼和卡片組合的人都可以被授予存取受限區域和資料的權限。因此,出於安全目的的生物識別技術的應用正在增加,預計將對市場成長產生積極影響。

- 例如,印度巴拉特石油公司有限公司使用手掌靜脈識別技術來追蹤員工並提供授權存取。富士通等公司於 2018 年宣布,將向日本員工推出手掌靜脈身份驗證技術。手掌靜脈身份驗證取代了基於密碼的措施,允許員工僅用手即可進入建築物並登入桌面。

- 由於生物識別有多種選擇,公司還可以採用多因素認證來進一步減少詐欺的可能性。預計此類趨勢也會影響市場成長。例如,富士通正在規劃一種新的房間存取控制身份驗證概念,結合手掌靜脈掃描技術和臉部認證。

手掌靜脈生物辨識市場趨勢

BFSI 預計將佔據最大市場佔有率

- 隨著安全漏洞的增加,BFSI 領域對高度安全的身份驗證和識別系統的需求不斷增加。各種銀行和金融機構正在將生物識別技術(例如手掌,以為其客戶提供安全存取。例如,日本商業銀行東京三菱銀行實施了手掌靜脈生物辨識系統,為其客戶提供安全且經濟高效的解決方案。

- 除了實體存取控制之外,手掌靜脈生物辨識技術也有望在非接觸式付款認證中變得流行。例如,2018年,日本永旺信用服務公司和富士通將在一些便利商店開始試用採用手掌靜脈認證技術的無卡零售付款系統。

- 許多 BFSI 組織已採用手掌靜脈生物辨識技術,這正在推動市場成長。例如,金融服務機構 Gesa Credit Union 與金融科技公司 Fiserv 合作,利用手掌辨識技術。 Fiserv 是一家金融服務技術解決方案提供商,提供綜合服務,包括 DNA 帳戶處理平台和用於生物識別的 Verifast:Palm 認證。

- 許多新興企業也在產品創新方面進行投資。例如,2019 年 6 月,用於認證和身份驗證的基於手掌生物識別技術的供應商 Redrock Biometrics 宣佈在僅限受邀參加的 2019 年 Finovate Spring 展會上推出其身份驗證解決方案 PalmID-X。

預計北美將佔據較大市場佔有率

- 據美國聯邦貿易委員會 (FTC) 稱,北美地區與付款和銀行業務相關的身份竊盜呈上升趨勢,生物識別等高級身份驗證服務的採用預計將會增加。根據聯邦貿易委員會的數據,加州 2018 年身份竊盜申訴數量最多。據報告,大約有 73,668 起身分盜竊案件。

- 該地區的組織也越來越有興趣採用利用生物識別特徵來識別個人的系統。例如,總部位於新澤西州的醫療保健公司 Atlantic Health System 使用 Patient Secure 的手掌手掌靜脈掃描解決方案來加快患者入院速度並提高記錄準確性。這項技術有助於防止個人使用他人的醫療資料來獲得治療。

- 許多 BFSI 組織已採用手掌靜脈生物辨識技術,這推動了該地區的市場成長。例如,美國金融服務機構 Gesa Credit Union 與金融科技公司 Fiserv 合作,利用手掌辨識技術。 Fiserv 是一家金融服務技術解決方案提供商,提供整合服務,包括其 DNA 帳戶處理平台和用於生物識別的Verifast:Palm 認證。

- 許多新興企業也在該地區投資產品創新。例如,2019 年 6 月,用於身份驗證和身份驗證的基於手掌生物識別技術的供應商Redrock Biometrics(舊金山)宣佈在僅限受邀參加的Finovate Spring 2019 展會上宣布推出其身份驗證解決方案PalmID- X。該解決方案將生物識別的應用擴展到大量人群,並為無需物理代幣的無縫服務和交易奠定了基礎。 PalmID-X 使用標準 RGB 和紅外線相機,捕獲手掌的指紋或皮下靜脈,創建高度獨特的手掌簽名。

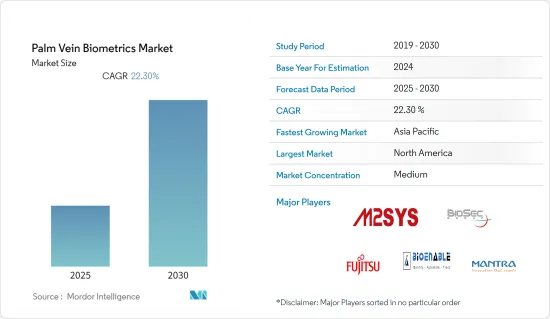

手掌靜脈生物辨識行業概況

手掌靜脈生物辨識市場競爭激烈,由多家大公司組成。許多公司正在透過新產品發布、業務擴張和策略併購來擴大市場佔有率。

- 2019 年 11 月 - 富士通開始銷售 FUJITSU 安全解決方案 AuthConductor V2,該解決方案使用包括手掌靜脈身份驗證在內的各種身份驗證方法為客戶提供全面的生物識別支援。除了使用手掌靜脈認證提供統一的辦公環境外,該產品還配備了使用臉部認證、指紋認證和IC卡認證的PC登錄,並且可擴充性。透過此版本更新,富士通將透過支援各種用例和身份驗證場景的安全且靈活的解決方案來提高客戶的便利性。

- 2019 年 6 月 - Redrock Biometrics 推出身分驗證解決方案 PalmID-X。將生物識別的範圍擴大到大量人員,並為無需使用實體令牌的無縫服務和交易奠定基礎。捕捉掌紋和/或皮下靜脈以創建獨特的手掌簽名。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 人們對資料隱私保護的興趣日益濃厚

- 金融交易安全的需求日益增加

- 市場限制因素

- 手掌靜脈生物辨識技術的技術局限性

- 產業價值鏈分析

- 工業吸引力 - 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- COVID-19 對市場的影響

第5章市場區隔

- 按類型

- 硬體

- 軟體和解決方案

- 按申請

- 衛生保健

- BFSI

- 其他應用

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第6章 競爭狀況

- 公司簡介

- M2SYS Technology-KernellO Inc.

- BioSec Group Ltd

- BioEnable Technologies Pvt. Ltd

- Fujitsu Limited

- Mantra Softech(India)Private Limited

- IdentyTech Solutions America Inc.

- Matrix Comsec Pvt. Ltd

- Imprivata Inc.

- Hitachi Ltd

第7章 投資分析

第8章 市場機會及未來趨勢

簡介目錄

Product Code: 66615

The Palm Vein Biometrics Market is expected to register a CAGR of 22.3% during the forecast period.

Key Highlights

- Over the years, the requirement to control access to premises, and systems has grown. Currently, many organizations rely on passwords, or cards to confirm people's identity for access. However, this traditional approach poses severe challenges. For instance, loss, or theft of cards causes security risks. With the correct combination of PIN and card, anyone could be granted access to restricted areas or data. Thus, increasing application of biometrics for security purpose is expected to positively impact the market growth.

- For instance, Bharat Petroleum Corporation Limited in India is using palm vein recognition technology to keep track of employees and provide authorized access to them. Companies such as Fujitsu, in 2018, announced that it will deploy its palm vein authentication technology to its employees in Japan. The palm vein authentication will replace password-based measures, and allow the employees to gain access to buildings and log in to their desktops with only their hand.

- With multiple options available for biometric identification, companies could choose to adopt multifactor authentication to reduce the probability of fraud even further. Such trends are also expected to influence market growth. For instance, Fujitsu has plans to combine its palm vein scanning technology with facial recognition in a new authentication concept for access control.

Palm Vein Biometrics Market Trends

BFSI Expected to Hold the Largest Market Share

- With the increasing level of security breaches, need for highly secure verification and identification systems have increased in the BFSI sector. Various banks and financial institutions integrated biometrics technologies such as palm vein recognition technology with access control systems to provide customers with secure access. For instance, Bank of Tokyo-Mitsubishi, a commercial bank in Japan, implemented a palm vein biometric system to provide a secure and cost-effective solution to its customers.

- Apart from physical access control, palm vein biometrics is expected to gain traction for contactless payment authentication. For instance, in 2018, Japan's AEON Credit Service and Fujitsu will begin a trial of a cardless retail payment system using biometric palm vein authentication technology at some convenience stores.

- Many BFSI organizations are adopting palm vein biometrics, which is fueling the market's growth. For instance, Gesa Credit Union, a financial services institution is leveraging palm recognition technology in association with financial technology company Fiserv. Fiserv is a financial services technology solutions provider, that offers a DNA account processing platform and integrated services, including Verifast: Palm Authentication for biometric authentication.

- Many startups are also investing in product innovations. For instance, in June 2019, Redrock Biometrics, a vendor of palm-based biometrics for authentication and identification, announced the launch of its identification solution, PalmID-X at the exclusive invitation-only Finovate Spring 2019.

North America Expected to Hold Significant Market Share

- According to the Federal Trade Commission, identity thefts related to payment and banking sector are prominent in North America, which in turn, is set to boost the adoption of advanced authentication services such as biometrics. According to the Federal Trade Commission, in 2018, California experienced the maximum number of identity theft complaints. Around 73,668 cases of identity thefts were reported.

- The region is also witnessing a growing interest among organizations in adopting systems that use biometric characteristics to identify people. For instance, a New Jersey-based healthcare company, Atlantic Health System uses Patient Secure's biometric palm vein scanning solution to speed up the patient intake and improve record accuracy. This technology helps in preventing individuals from using someone else's medical data to receive treatment.

- Many BFSI organizations are adopting palm vein biometrics, which is fueling the market's growth in the region. For instance, Gesa Credit Union, a financial services institution, headquartered in the United States, is leveraging palm recognition technology in association with financial technology company Fiserv. Fiserv is a financial services technology solutions provider, that offers a DNA account processing platform and integrated services, including Verifast: Palm Authentication for biometric authentication.

- Many startups are also investing in product innovations in the region. For instance, in June 2019, Redrock Biometrics (San Francisco), a vendor of palm-based biometrics for authentication and identification, announced the launch of their identification solution, PalmID-X at the exclusive invitation-only Finovate Spring 2019. The solution expands the application of biometric identification to a large group of people, creating a basis for seamless services and transactions without the physical tokens. Using a standard RGB camera and infrared camera, PalmID-X captures palm prints or subdermal veins to produce a highly unique palm signature.

Palm Vein Biometrics Industry Overview

The palm vein biometrics market is competitive and consists of several major players. Many companies are increasing their market presence by introducing new products, by expanding their operations or by entering into strategic mergers and acquisitions.

- November 2019 - Fujitsu launched sales of the FUJITSU Security Solution AuthConductor V2 which uses various authentication methods, including palm vein authentication, to deliver comprehensive biometric authentication support for customers. In addition to providing a unified palm vein authentication office environment, this product features facial authentication, fingerprint authentication and IC card authentication for PC logons, and is fully scalable to support use by anywhere from several people to organizations with tens of thousands of users. With the launch of this upgraded solution, Fujitsu enables customers to enjoy convenience with secure and flexible solutions for a diverse range of use cases and authentication scenarios.

- June 2019 - Redrock Biometrics launched its identification solution, PalmID-X. It expands the applicability of biometric identification to multiple people, creating a basis for seamless services and transactions without physical tokens. It captures palm prints and/or subdermal veins to create a unique palm signatures.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Data Privacy Protection Concerns

- 4.2.2 Increasing Need to Secure Financial Transactions

- 4.3 Market Restraints

- 4.3.1 Technical Limitations of Palm Vein Biometrics

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porters Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technology Snapshot

- 4.7 Impact of Covid-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Hardware

- 5.1.2 Software and Solution

- 5.2 Application

- 5.2.1 Healthcare

- 5.2.2 BFSI

- 5.2.3 Other Applications

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 M2SYS Technology - KernellO Inc.

- 6.1.2 BioSec Group Ltd

- 6.1.3 BioEnable Technologies Pvt. Ltd

- 6.1.4 Fujitsu Limited

- 6.1.5 Mantra Softech (India) Private Limited

- 6.1.6 IdentyTech Solutions America Inc.

- 6.1.7 Matrix Comsec Pvt. Ltd

- 6.1.8 Imprivata Inc.

- 6.1.9 Hitachi Ltd

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219