|

市場調查報告書

商品編碼

1630268

中國計劃物流:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)China Project Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

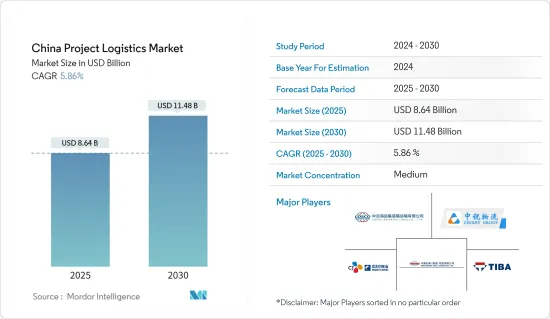

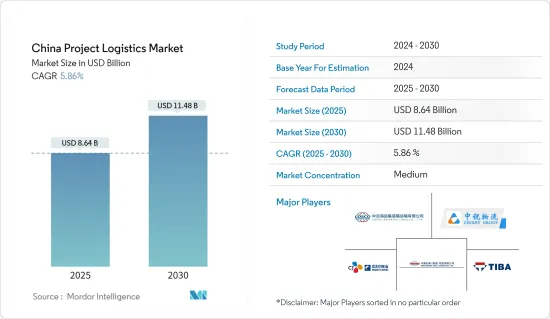

預計2025年中國計劃物流市場規模為86.4億美元,2030年將達114.8億美元,預測期間(2025-2030年)複合年成長率為5.86%。

主要亮點

- 中國的「一帶一路」計劃不僅加強了國內基礎設施投資,也向周邊地區延伸,從而擴大了計劃物流機會。由中國主導的「一帶一路」計劃是一項龐大的基礎設施投資計劃,主要旨在加強歐亞大陸、拉丁美洲和非洲的互聯互通、貿易和通訊。 「一帶一路」框架下的著名計劃包括中巴經濟走廊(CPEC)、中蒙俄經濟走廊、大英百科全書報道的新亞歐大陸橋。

- 隨著建築和基礎設施計劃的持續成長,對運輸鋼材及相關材料的高效物流服務的需求不斷增加。中國每年的鋼鐵產量相當於其他國家的總產量。 2024年8月,中國工業資訊化部(工信部)發布通知,叫停新建鋼鐵生產計劃。此舉訂定之際,工信部正在審查旨在遏制鋼鐵業產能過剩的措施。鑑於生產水準波動和國內需求下降,物流提供者被迫調整策略。必須有效管理庫存,以確保及時交貨,同時應對潛在的中斷。

- 此外,石化產業的擴張將對我國的計劃物流,特別是原料和成品的運輸產生重大影響。根據iCIS 2024年7月發布的報告,預計從2027年起,中國煉油產能將穩定在每年10億噸左右,並至少維持到2040年。考慮到 2000 年至 2026 年產能預計將激增 250% 以上,這是一個重大轉變。

- 隨著計劃貨物運輸的限制越來越嚴格,相關風險也不斷升級。除了貨運量限制之外,財務影響也變得更加明顯,特別是在 DSU(啟動延遲)價值方面。考慮到返工、運費、收入損失和其他營運費用等因素,很明顯,貨物損壞或延誤會導致重大的財務損失,DSU 損失達到數百萬美元的也不在少數。

中國計劃物流市場趨勢

中國基礎建設投資強化重點領域

- 由於中國政府優先發展基礎設施,這些投資在推動建築、能源和製造業等領域的大型計劃方面發揮著至關重要的作用。例如,2024 年 3 月,The Loadstar 報道稱,中國計劃在明年為交通計劃撥款 1,730 億美元,比 2023 年增加約 35 億美元。這項巨額支出凸顯了中國加強物流基礎設施的承諾。

- 值得注意的地區發展是,2024 年 7 月,國家統計局 (NBS) 報告稱,今年上半年固定資產投資資料增 3.9%,達到 24.53 兆元人民幣(3.38 兆美元)。我們已經實現了這個目標。此外,國家統計局報告稱,基礎設施投資增加5.4%。根據《世界時報》報道,根據國家統計局的評估,基礎設施投資的主要領域——水務管理、航空和鐵路——均錄得兩位數成長,支持了經濟擴張。

- 鐵路網的發展進一步說明了基礎設施投資的市場吸引力。 2024 年 3 月的新聞報導強調了一項正在進行的區域鐵路計劃,旨在加強與浦東國際機場等主要交通樞紐的連結性。

- 總之,中國大量的基礎設施投資正顯著推動計劃物流市場。預計這些發展將在可預見的未來繼續塑造市場格局。

中國原油產量提振市場

- 中國作為世界石油消費量和生產大國,其石油生產趨勢正在影響其物流策略。例如,根據PRS Newswire報道,中國海洋石油總公司(中海油)將在2024年1月將其油氣產量增加5%,即日產量195萬桶油當量(b/d)。預計今年開始的13個新計畫將在2024年實現增產,其中綏中36-1和渤中19-2油田計劃等國內企業最為突出。因此,重點關注高效的計劃物流,以確保資源的及時供應和生產目標的實現。

- 此外,2024年1月,Offshore Energy報告稱,中國原油產量較2023年增加2%。這一成長證實了中國是精煉石油產品的主要出口國。中遠海運物流等公司已經制定了客製化的物流解決方案,以應對石油業專案貨物運輸的計劃挑戰。

- 總而言之,中國不斷增加的原油產量正在推動計劃物流市場的成長。專注於高效的物流解決方案對於實現生產目標和保持中國在全球石油行業的主要企業至關重要。

中國計劃物流行業概況

由於中小企業數量眾多,中國計劃物流市場的主要特徵是細分。國內企業佔市場主導地位,知名企業包括奇瑞集團、中國外運、中遠海運物流等。公司需要擴大網路,以滿足國內重型貨物和出口不斷成長的需求。

計劃關鍵設備有著極為嚴格的標準,包括貨物運輸策略的製定、運輸卡車的調配、卡車、船舶、浮動的協調、時間管理等。此類設備必須在更短的時間內安全交付。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

- 分析方法

- 調查階段

第3章執行摘要

第4章市場動態與洞察

- 目前的市場狀況

- 市場動態

- 促進因素

- 由於可再生能源的使用增加,計劃物流公司的商機不斷擴大

- 電子商務成長

- 抑制因素

- 高成本

- 缺乏技術純熟勞工

- 機會

- 「一帶一路」計劃將為企業創造更多機會。

- 可再生能源計劃的成長

- 促進因素

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 政府法規和舉措

- 競爭公司之間的敵對關係

- 科技趨勢

- 關注 - 一帶一路計劃與投資

- 計劃貨物運輸相關風險詳情

- 價值鏈/供應鏈分析

- 地緣政治與疫情如何影響市場

第5章市場區隔

- 按服務

- 運輸

- 轉發

- 倉儲業

- 其他附加價值服務

- 按最終用戶

- 石油和天然氣、石化產品

- 採礦和採石

- 能源/電力

- 建造

- 製造業

- 其他最終用戶(航太/國防、汽車等)

第6章 競爭狀況

- 市場集中度概覽

- 公司簡介

- COSCO Shipping Logistics Co., Ltd.

- Chirey Group

- Translink International Logistics Group

- Kerry Logistics Network Limited

- Trans Global Projects Group(TGP)

- Sinotrans(HK)Logistics Ltd.

- CJ Smart Cargo

- Tiba Group

- Mitsubishi Logistics Corporation

- InterMax Logistics Solution Limited

- Wangfoong Transportation Ltd.

- Global Star Logistics (China) Co., Ltd.

- Sunshine Int'l Logistics Co.,ltd.

- Kuehne+Nagel

- Agility Logistics Pvt. Ltd.*

- 其他公司

第7章 市場機會及未來趨勢

第8章附錄

- 宏觀經濟指標(GDP 分佈,依活動分類)

- 經濟統計-交通運輸和倉儲業對經濟的貢獻

- 對外貿易統計-按產品、目的地和供應來源分類的進出口金額

The China Project Logistics Market size is estimated at USD 8.64 billion in 2025, and is expected to reach USD 11.48 billion by 2030, at a CAGR of 5.86% during the forecast period (2025-2030).

Key Highlights

- The Belt and Road Initiative (BRI) in China is not only bolstering domestic infrastructure investments but also extending its reach to neighboring regions, thereby amplifying opportunities in project logistics. Spearheaded by China, the BRI is a monumental infrastructure investment endeavor, with the primary goal of enhancing connectivity, trade, and communication spanning across Eurasia, Latin America, and Africa. Noteworthy projects birthed from the BRI umbrella encompass the China-Pakistan Economic Corridor (CPEC), the China-Mongolia-Russia Economic Corridor, and the New Eurasia Land Bridge, as highlighted by Britannica.

- As construction and infrastructure projects continue to grow, the demand for efficient logistics services to transport steel and related materials intensifies. Each year, China produces as much steel as the rest of the world combined. On August 2024, China's Ministry of Industry and Information Technology (MIIT) issued a notice suspending new steelmaking production projects. This move comes as MIIT reviews a policy aimed at controlling overcapacity in the steel sector. Given the fluctuating production levels and a decline in domestic demand, logistics providers are compelled to adapt their strategies. They must manage inventory effectively and ensure timely deliveries, all while navigating potential disruptions.

- Furthermore, the petrochemical industry's expansion significantly impacts project logistics in China, particularly in transporting raw materials and finished products. According to a report by I.C.I.S. in July 2024, China's refinery capacity is set to stabilize at approximately 1 billion tonnes annually from 2027 and is projected to maintain this level until at least 2040. This marks a substantial shift, considering the forecasted capacity surge of over 250% from 2000 to 2026.

- As the limits on project cargo movement tighten, the associated risks are escalating. Beyond just the constraints on cargo volume, the financial repercussions, especially in terms of Delay in Start-up (DSU) values, are becoming more pronounced. When considering factors such as re-fabrication, shipping charges, lost revenues, and other operational expenses, it's evident that a shipment arriving damaged or late can lead to substantial financial setbacks, often reaching multi-million dollar DSU losses.

China Project Logistics Market Trends

China's Infrastructure Investments Bolster Key Sectors

- As the Chinese government prioritizes infrastructure development, these investments play a pivotal role in bolstering large-scale projects across sectors like construction, energy, and manufacturing. For example, in March 2024, Loadster reported that China is set to allocate USD 173 billion for transport projects over the coming 12 months, marking an increase of roughly USD 3.5 billion from 2023. This significant outlay underscores China's commitment to enhancing its logistics infrastructure.

- In a notable regional move, in July 2024, the National Bureau of Statistics (NBS) released data indicating that fixed-asset investment in the first half of the year increased by 3.9 percent year-on-year, reaching CNY 24.53 trillion (USD 3.38 trillion). Additionally, NBS reported a 5.4 percent rise in infrastructure investment. Key areas of infrastructure investment, namely water conservancy management, aviation, and railways, all experienced double-digit growth, bolstering economic expansion, as per NBS's assessment, reported Global Times.

- Rail network developments further exemplify the market-driving power of infrastructure investments. In March 2024, reports highlighted ongoing regional rail projects aimed at enhancing connectivity with major transport hubs, including Pudong International Airport.

- In conclusion, China's substantial investments in infrastructure are significantly driving the project logistics market. These developments are expected to continue shaping the market landscape in the foreseeable future.

China's Crude Oil Production Boosts Market

- China, a global heavyweight in both crude oil consumption and production, sees its oil production trends shaping its logistics strategies. For example, in January 2024, China National Offshore Oil Corporation (CNOOC) set a goal to boost its oil and gas output by 5%, targeting a production rate of 1.95 million barrels per day (b/d) of oil equivalent, as reported by PRS Newswire. This uptick is anticipated from 13 new projects kicking off this year 2024, prominently featuring domestic ventures like the Suizhong 36-1 and Bozhong 19-2 oilfield projects. Consequently, there's a heightened emphasis on efficient project logistics to ensure timely resource delivery and meet production goals.

- Additionally, in January 2024, Offshore Energy reported a 2% rise in China's crude oil production compared to 2023. This uptick underscores China's stature as a prominent exporter of refined petroleum products. Companies such as COSCO Shipping Logistics are honing in on bespoke logistics solutions, tackling the distinct challenges of transporting project cargo within the oil sector.

- In conclusion, China's increasing crude oil production is driving the growth of its project logistics market. The focus on efficient logistics solutions is crucial for meeting production targets and maintaining China's position as a key player in the global oil industry.

China Project Logistics Industry Overview

China's project logistics market is characterized by fragmentation, largely due to the presence of numerous small and medium-sized enterprises. Some of the well-known businesses include Chirey Group, Sinotrans, and COSCO Shipping Logistics Co., Ltd. Domestic businesses dominate the market. To meet the rising demand and exports of heavy cargo from the nation, businesses must broaden their networks.

Project-critical equipment has highly strict criteria for the creation of a cargo transport strategy, the deployment of transport trucks, the coordination of trucks, ships, and floating cranes, as well as time management. This equipment must be delivered securely within shorter periods.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Market Dynamics

- 4.2.1 Drivers

- 4.2.1.1 Increasing Usage of Renewable Energies Boosts Opportunities for Project Logistics Companies

- 4.2.1.2 Growth of E-commerce

- 4.2.2 Restraints

- 4.2.2.1 Cost - Intensive

- 4.2.2.2 Lack of Skilled Labor

- 4.2.3 Opportunities

- 4.2.3.1 Belt and Road Initiative will creates more opportunities for the companies

- 4.2.3.2 Growth in Renewable Energy Projects

- 4.2.1 Drivers

- 4.3 Industry Attractiveness- Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers/Consumers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Government Regulations and Initiatives

- 4.4.1 Intensity of Competitive Rivalry

- 4.5 Technological Trends

- 4.6 Spotlight - Belt and Road Initiative (BRI) and Investments

- 4.7 Elaboration on risks involved in project cargo movement

- 4.8 Value Chain / Supply Chain Analysis

- 4.9 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Transportation

- 5.1.2 Forwarding

- 5.1.3 Warehousing

- 5.1.4 Other Value-added Services

- 5.2 By End-user

- 5.2.1 Oil and Gas, Petrochemical

- 5.2.2 Mining and Quarrying

- 5.2.3 Energy and Power

- 5.2.4 Construction

- 5.2.5 Manufacturing

- 5.2.6 Other End-Users (Aerospace & Defense, Automotive, etc.)

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 COSCO Shipping Logistics Co., Ltd.

- 6.2.2 Chirey Group

- 6.2.3 Translink International Logistics Group

- 6.2.4 Kerry Logistics Network Limited

- 6.2.5 Trans Global Projects Group (TGP)

- 6.2.6 Sinotrans (HK) Logistics Ltd.

- 6.2.7 CJ Smart Cargo

- 6.2.8 Tiba Group

- 6.2.9 Mitsubishi Logistics Corporation

- 6.2.10 InterMax Logistics Solution Limited

- 6.2.11 Wangfoong Transportation Ltd.

- 6.2.12 Global Star Logistics (China) Co., Ltd.

- 6.2.13 Sunshine Int'l Logistics Co.,ltd.

- 6.2.14 Kuehne + Nagel

- 6.2.15 Agility Logistics Pvt. Ltd.*

- 6.3 Other companies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity)

- 8.2 Economic Statistics - Transport and Storage Sector Contribution to Economy

- 8.3 External Trade Statistics - Exports and Imports by Product and by Country of Destination/Origin