|

市場調查報告書

商品編碼

1851086

基板式PCB:市場佔有率分析、產業趨勢、統計數據和成長預測(2025-2030)Substrate-Like-PCB - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

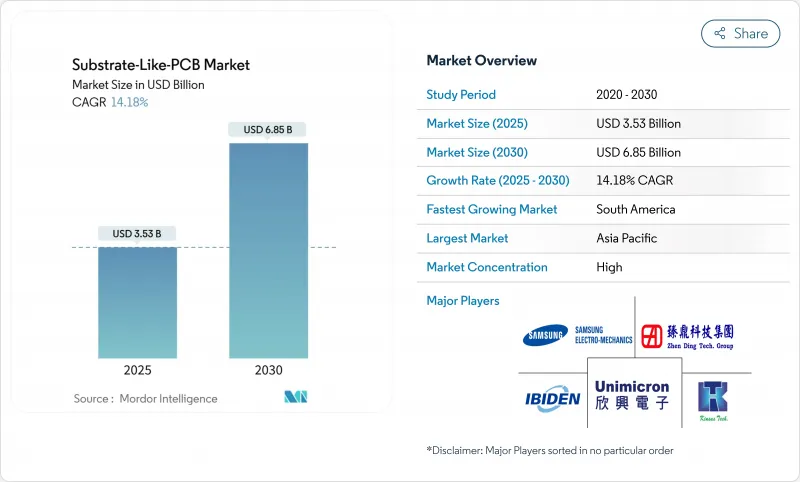

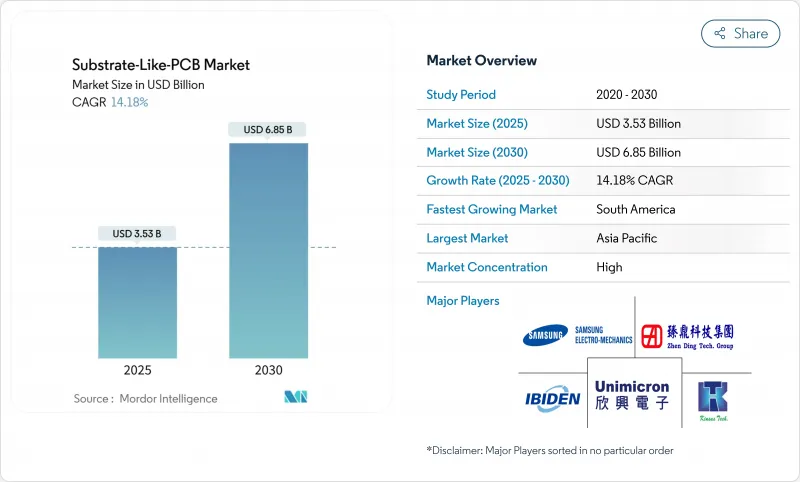

預計到 2025 年,類 PCB基板市場規模將達到 35.3 億美元,到 2030 年將擴大到 68.5 億美元,複合年成長率為 14.18%。

隨著原始設備製造商 (OEM) 從傳統的高密度互連基板過渡到無需完全採用半導體封裝即可實現積體電路基板級佈線密度的解決方案,市場需求正在加速成長。銷售成長主要集中在 5G 無線通訊、人工智慧處理器和汽車高級駕駛輔助系統 (ADAS) 控制器領域,這些領域對訊號完整性要求線寬/間距小於等於 25µm。亞太地區預計將佔據 2024 年 69% 的收入,這主要得益於半導體代工廠和 PCB 製造商之間的緊密合作以及對改進型半積層製造生產線的持續投資。由於其低損耗介電特性,ABF 增材膜在材料選擇上佔據主導地位,但集中化的供應基礎正在推動一級製造商之間的垂直整合。 25µm 以下的產量比率最佳化越來越依賴人工智慧驅動的檢測,這為製程控制領域的領導者帶來了結構性的成本優勢。地緣政治激勵獎勵,例如美國國防部提供的 3000 萬美元津貼,正在提高新參與企業的資格要求,同時也鼓勵區域多元化發展。

全球基板PCB市場趨勢與洞察

智慧型手機OEM廠商採用高密度互連技術的趨勢激增

供應商利用類基板PCB市場技術,將電路密度提高了約30%,從而為5G數據機、AI協處理器和多鏡頭相機控制等組件騰出更多空間,同時保持設備厚度平坦。旗艦機型的規模經濟效益將惠及中階行動電話,維持高產量生產,從而在更廣泛的產品組合中攤提資本成本。

對5G通訊模組的需求不斷成長

毫米波基地台板和消費級 5G 無線網卡需要 ≤25µm 的走線寬度,以限制插入損耗和串擾。網路設備製造商 (OEM) 為大規模 MIMO 陣列和波束成形前端指定類基板 PCB 設計,並將基板密度與頻譜效率目標掛鉤。隨著預期數據速率的提高,同樣的設計規則也將應用於智慧型手機和平板電腦。

SLP生產線資本支出高

這款待開發區的基板PCB市場產品線需要精密雷射鑽孔、直接影像微影術以及1000級無塵室。 1億美元的支出將迫使規模較小的製造商組成合資企業或退出市場,從而將產能整合到那些擁有雄厚財力的老牌企業手中。

細分市場分析

智慧型手機將在2024年佔據類基板PCB市場47%的收入佔有率,並將在2025年繼續保持市場主導地位。此細分市場將充分利用全球行動電話出貨量帶來的類基板PCB市場規模優勢,以實現產能的快速擴張。搭載人工智慧引擎和五天線5G模組的高階設備需要≤25µm的佈線,這將進一步推高尖端市場的需求。隨後成本曲線的級聯變化將擴大旗艦級產品以外的市場規模,並推動中端市場對此技術的普及。

穿戴式裝置是成長最快的細分市場,年複合成長率高達 15.4%,這主要得益於健康監測要求和擴增實境頭戴裝置的普及。供應商透過將高效電源管理 IC 直接整合到基板中來最佳化能量密度,從而證明了 SLP 小於 0.5 毫米通孔間距的價值。隨著 OEM 廠商指定使用冗餘感測器融合板,汽車電子產業的收入來源也更加多元化。網路基礎設施和邊緣運算閘道正在採用 SLP 來滿足散熱和延遲目標,而工業和醫療系統則因其嚴格的可靠性要求而獲得更高的平均售價。

到2024年,10-12層PCB將佔總產量的37%,在確保佈線餘量的同時,也兼顧了可控的產量比率風險。這一層數是智慧型手機基板PCB市場規模的支柱。受晶片級AI加速器和汽車域控制器的推動,12層以上的PCB設計正以13%的複合年成長率成長。在此,「基板類PCB市場佔有率」將屬於那些能夠掌握連續層壓循環中累積翹曲控制的製造商。 8-10層PCB則主要針對對成本敏感的消費物聯網產品,並為正在提升SLP(基板類PCB)技術水準的HDI(高密度互連)供應商提供了一條入門途徑。

基板型PCB市場依應用領域(智慧型手機、平板電腦、穿戴式裝置、汽車電子產品及其他)、堆疊層數(8-10層、10-12層及其他)、基板類型(ABF、改質環氧樹脂/FR-4及其他)、線/間距解析度(30/30mm、25/25mm、≤20/20mm)和地區進行細分。市場預測以美元計價。

區域分析

以台灣、韓國和日本為首的亞太地區將在2024年維持69%的營收佔有率。晶圓代工產業鏈的生態系統使PCB供應商能夠匯集半導體客戶的研發成果,進而加速製造設計週期。中國製造商正在積極擴大產能。振鼎科技2024年的營收成長了23%,並有望在2027年之前實現IC基板營收50%的複合年成長率。日本材料巨頭正在向該地區供應ABF薄膜,從而增強了區域供應鏈的密度。

北美地區2024年的貢獻將達到18%,這得益於3,000萬美元的國防資金和《晶片製造和整合產品法案》(CHIPS Act)的激勵措施,用於支付先進工具的成本。 TTM Technologies位於錫拉丘茲的工廠投資1.3億美元,是北美最大的超高密度整合產品(ultraHDI)投資項目,旨在保障國防供應鏈的安全。車輛電氣化和專用5G網路的部署將對該地區的需求構成結構性抑制。

AT&S在歐洲主導規模雖小但策略性佈局,該公司已擴大在馬來西亞的生產規模,以滿足德國OEM廠商對ADAS電路板的需求。歐盟旨在維護技術主權的津貼將支持SLP生產線的擴張,尤其是在汽車和醫療領域。

南美洲雖然起步較低,但隨著近岸外包將輕型組裝轉移到多明尼加共和國和墨西哥,其複合年成長率達到了12.2%。各國政府正在推動電子產業叢集發展,以創造就業機會並吸引符合自由貿易協定的試點南美洲輕型組裝業務投資。

儘管中東和非洲仍在發展中,但主權多元化基金將向半導體後端生態系統注入資金,以保持成長潛力,並隨著區域設計工作室的成熟,促進未來基板類PCB市場的滲透。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 智慧型手機OEM廠商採用高密度互連浪湧

- 對5G通訊模組的需求不斷成長

- 穿戴式裝置和物聯網裝置小型化趨勢

- 用於車載ADAS和電動車電子設備的印刷電路基板日益複雜

- SLP上的覆晶實現異質整合

- 政府對境內先進PCB製造廠的補貼

- 市場限制

- SLP生產線的資本支出較高

- 製程良率在<25mL/S時面臨挑戰

- 有關特殊積垢化學品的環境法規

- 由於供應商有限,ABF樹脂供應有風險。

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特的五力模型

- 供應商的議價能力

- 買方的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭的激烈程度

- 產業價值鏈分析

第5章 市場規模與成長預測

- 透過使用

- 智慧型手機

- 藥片

- 穿戴式裝置

- 汽車電子產品

- 網路和通訊基礎設施

- 物聯網/邊緣設備

- 工業和醫療用電子設備

- 以堆積層數計算

- 8-10層

- 10-12層

- >12層

- 按基礎材料

- ABF(味之素增效膜)

- 改質環氧樹脂/FR-4

- 其他(聚四氟乙烯、BT樹脂)

- 按線/空解析度

- 30/30µm

- 25/25µm

- 20/20µm

- 按地區

- 北美洲

- 美國

- 加拿大

- 墨西哥

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 西班牙

- 俄羅斯

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 韓國

- 印度

- 澳洲

- 亞太其他地區

- 中東和非洲

- GCC

- 南非

- 其他中東和非洲地區

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Kinsus Interconnect Technology Corp.

- Ibiden Co., Ltd.

- Compeq Manufacturing Co., Ltd.

- Daeduck Electronics Co., Ltd.

- Unimicron Technology Corp.

- Zhen Ding Technology Holding

- TTM Technologies

- Meiko Electronics Co., Ltd.

- ATandS AG

- Korea Circuit Co., Ltd.

- LG Innotek Co., Ltd.

- Samsung Electro-Mechanics

- Shennan Circuits Co., Ltd.

- Tripod Technology

- Fujitsu Interconnect

- Wus Printed Circuit

- HannStar Board Corp.

- Nippon Mektron Ltd.

- NCAB Group AB

- Multek Ltd.

第7章 市場機會與未來展望

The Substrate-Like PCB market size reached USD 3.53 billion in 2025 and is forecast to advance to USD 6.85 billion by 2030, reflecting a 14.18% CAGR.

Demand accelerates as OEMs migrate from conventional high-density interconnect boards to solutions that deliver IC-substrate-level wiring density without fully moving into semiconductor packaging. Volume growth is anchored in 5G radio, artificial-intelligence processors, and automotive ADAS controllers that require <=25 µm line/space geometries for signal integrity. Asia-Pacific captured 69% of revenue in 2024, benefiting from tight linkages between semiconductor foundries and PCB fabricators plus sustained investment in modified semi-additive processing lines . ABF build-up films dominate material selection on the strength of low-loss dielectric properties, though their concentrated supply base prompts vertical-integration moves by tier-one fabricators. Yield optimization below 25 µm increasingly hinges on AI-enabled inspection, giving process-control leaders a structural cost advantage. Geopolitical reshoring incentives-such as the USD 30 million U.S. Department of Defense grant-add regional diversification while tightening qualification hurdles for new entrants.

Global Substrate-Like-PCB Market Trends and Insights

Surging smartphone OEM adoption for high-density interconnects

Premium handset vendors used Substrate-Like PCB market technology to raise circuit density by roughly 30%, unlocking more space for 5G modems, AI coprocessors, and multi-lens camera control while holding device thickness flat. Scale benefits from flagship models flow into mid-tier phones, sustaining high production runs that amortize capital costs across broader portfolios.

Rising demand for 5G communication modules

Millimeter-wave base-station boards and consumer 5G radio cards require <=25 µm routing to curb insertion loss and crosstalk. Network OEMs specify Substrate-Like PCB market designs for massive-MIMO arrays and beam-forming front ends, linking board density with spectral-efficiency targets. The same design rules migrate into smartphones and tablets as data-rate expectations climb.

High CAPEX for SLP production lines

A greenfield Substrate-Like PCB market line requires precision laser drills, direct-imaging photolithography, and Class 1000 cleanroom space. The USD 100 million outlay pressures smaller fabricators to form joint ventures or exit, consolidating capacity with incumbents that boast balance-sheet depth.

Other drivers and restraints analyzed in the detailed report include:

- Miniaturization trends in wearables & IoT devices

- Automotive ADAS & EV electronics escalating PCB complexity

- Process-yield challenges at <25 µm L/S

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

Smartphones accounted for 47% of Substrate-Like PCB market revenue in 2024 and remain the anchor customer set entering 2025. The segment leverages the Substrate-Like PCB market size advantage inherent in global handset shipments to underwrite rapid capacity ramps. Premium devices that pair AI engines with 5-antenna 5G radios require <=25 µm wiring, reinforcing demand at the leading edge. A cascading cost curve then enables mid-tier adoption, extending volume visibility beyond flagship refreshes.

Wearables are the fastest-growing niche at a 15.4% CAGR, catalyzed by health monitoring mandates and augmented-reality headsets. Suppliers optimize energy density by embedding high-efficiency power-management ICs directly onto the board, proving the value of SLP's sub-0.5 mm via pitch. Automotive electronics add diversified revenue streams as OEMs specify redundant sensor-fusion boards. Networking infrastructure and edge-computing gateways adopt SLP to meet thermal and latency targets, while industrial and medical systems command premium ASPs due to stringent reliability.

The 10-12-layer cohort controlled 37% of 2024 output, balancing routing headroom with manageable yield risk. This stratum remains the workhorse for the Substrate-Like PCB market size tied to smartphone boards. Designs exceeding 12 layers are scaling at 13% CAGR on the back of chiplet-based AI accelerators and automotive domain controllers. Here, "Substrate-Like PCB market share" accrues to fabricators that master cumulative-warp control across sequential lamination cycles. Layer counts of 8-10 serve cost-sensitive consumer IoT products, offering an entry path for HDI vendors up-skilling toward SLP.

Substrate-Like-PCB Market is Segmented by Application (Smartphones, Tablets, Wearables, Automotive Electronics, and More), by Build-Up Layer Count (8 - 10 Layers, 10 - 12 Layers, and More), by Base Material (ABF, Modified Epoxy / FR-4, and More), by Line/Space Resolution (30/30 Mm, 25/25 Mm, and <= 20/20 Mm) and by Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Asia-Pacific retained a 69% revenue share in 2024, anchored by Taiwan, South Korea, and Japan. Foundry-adjacent ecosystems accelerate design-for-manufacture cycles, letting PCB vendors co-opt R&D from semiconductor customers. Chinese fabricators expand capacity aggressively; Zhen Ding booked 23% top-line growth in 2024 and is steering toward 50% CAGR in IC-substrate revenue through 2027. Material majors in Japan supply ABF films to the region, reinforcing local supply-chain density.

North America contributed 18% in 2024 but benefits from USD 30 million defense funding plus CHIPS Act incentives that defray advanced tooling. TTM Technologies' USD 130 million Syracuse facility constitutes the largest ultra-HDI investment on the continent, targeting secure-supply defense workloads. Automotive electrification and private-network 5G rollouts give regional demand a structural leg.

Europe's smaller yet strategic footprint is led by AT&S, which extended Malaysian production to serve German OEMs needing ADAS boards. EU grants targeting technology sovereignty support incremental SLP lines, especially for automotive and medical verticals.

South America, though starting from a low base, records a 12.2% CAGR as near-shoring shifts light assembly to the Dominican Republic and Mexico. Governments promote electronics clusters for job creation, drawing pilot SLP investment to align with free-trade agreements.

The Middle East and Africa remain nascent but preserve upside through sovereign diversification funds channeling capital into semiconductor back-end ecosystems, enabling future Substrate-Like PCB market penetration once regional design houses mature.

- Kinsus Interconnect Technology Corp.

- Ibiden Co., Ltd.

- Compeq Manufacturing Co., Ltd.

- Daeduck Electronics Co., Ltd.

- Unimicron Technology Corp.

- Zhen Ding Technology Holding

- TTM Technologies

- Meiko Electronics Co., Ltd.

- ATandS AG

- Korea Circuit Co., Ltd.

- LG Innotek Co., Ltd.

- Samsung Electro-Mechanics

- Shennan Circuits Co., Ltd.

- Tripod Technology

- Fujitsu Interconnect

- Wus Printed Circuit

- HannStar Board Corp.

- Nippon Mektron Ltd.

- NCAB Group AB

- Multek Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Surging smartphone OEM adoption for high-density interconnects

- 4.2.2 Rising demand for 5G communication modules

- 4.2.3 Miniaturization trends in wearables and IoT devices

- 4.2.4 Automotive ADAS and EV electronics escalating PCB complexity

- 4.2.5 Flip-chip on SLP enabling heterogeneous integration

- 4.2.6 Government subsidies for on-shore advanced PCB fabs

- 4.3 Market Restraints

- 4.3.1 High CAPEX for SLP production lines

- 4.3.2 Process-yield challenges at <25 m L/S

- 4.3.3 Environmental rules on specialty build-up chemistries

- 4.3.4 Supply risk of ABF resin due to limited vendors

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porters Five Forces

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes

- 4.7.5 Intensity of Rivalry

- 4.8 Industry Value Chain Analysis

5 MARKET SIZE and GROWTH FORECASTS (VALUE)

- 5.1 By Application

- 5.1.1 Smartphones

- 5.1.2 Tablets

- 5.1.3 Wearables

- 5.1.4 Automotive Electronics

- 5.1.5 Networking and Communication Infrastructure

- 5.1.6 IoT / Edge Devices

- 5.1.7 Industrial and Medical Electronics

- 5.2 By Build-Up Layer Count

- 5.2.1 8 - 10 Layers

- 5.2.2 10 - 12 Layers

- 5.2.3 > 12 Layers

- 5.3 By Base Material

- 5.3.1 ABF (Ajinomoto Build-up Film)

- 5.3.2 Modified Epoxy / FR-4

- 5.3.3 Others (PTFE, BT Resin)

- 5.4 By Line/Space Resolution

- 5.4.1 30 / 30 µm

- 5.4.2 25 / 25 µm

- 5.4.3 20 / 20 µm

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Mexico

- 5.5.2 South America

- 5.5.2.1 Brazil

- 5.5.2.2 Argentina

- 5.5.2.3 Rest of South America

- 5.5.3 Europe

- 5.5.3.1 United Kingdom

- 5.5.3.2 Germany

- 5.5.3.3 France

- 5.5.3.4 Italy

- 5.5.3.5 Spain

- 5.5.3.6 Russia

- 5.5.3.7 Rest of Europe

- 5.5.4 APAC

- 5.5.4.1 China

- 5.5.4.2 Japan

- 5.5.4.3 South Korea

- 5.5.4.4 India

- 5.5.4.5 Australia

- 5.5.4.6 Rest of APAC

- 5.5.5 Middle East and Africa

- 5.5.5.1 GCC

- 5.5.5.2 South Africa

- 5.5.5.3 Rest of Middle East and Africa

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share for key companies, Products and Services, and Recent Developments)

- 6.4.1 Kinsus Interconnect Technology Corp.

- 6.4.2 Ibiden Co., Ltd.

- 6.4.3 Compeq Manufacturing Co., Ltd.

- 6.4.4 Daeduck Electronics Co., Ltd.

- 6.4.5 Unimicron Technology Corp.

- 6.4.6 Zhen Ding Technology Holding

- 6.4.7 TTM Technologies

- 6.4.8 Meiko Electronics Co., Ltd.

- 6.4.9 ATandS AG

- 6.4.10 Korea Circuit Co., Ltd.

- 6.4.11 LG Innotek Co., Ltd.

- 6.4.12 Samsung Electro-Mechanics

- 6.4.13 Shennan Circuits Co., Ltd.

- 6.4.14 Tripod Technology

- 6.4.15 Fujitsu Interconnect

- 6.4.16 Wus Printed Circuit

- 6.4.17 HannStar Board Corp.

- 6.4.18 Nippon Mektron Ltd.

- 6.4.19 NCAB Group AB

- 6.4.20 Multek Ltd.

7 MARKET OPPORTUNITIES and FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment