|

市場調查報告書

商品編碼

1630279

MEMS聯合感應器-市場佔有率分析、產業趨勢/統計、成長預測 (2025-2030)MEMS Combo Sensors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

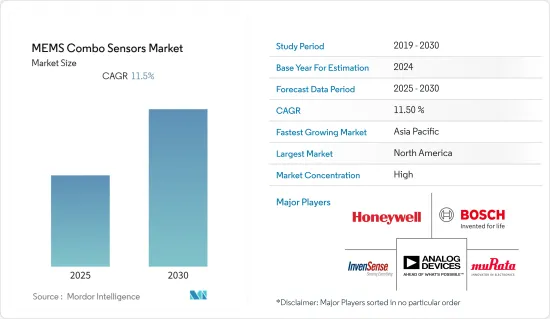

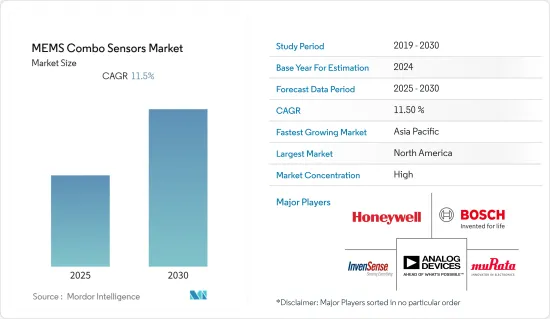

MEMS聯合感應器市場預計在預測期內複合年成長率為 11.5%

主要亮點

- 由於連網型設備的日益普及,全球對連網型穿戴式裝置裝置的需求正在顯著增加。根據思科系統公司統計,2018年全球連網穿戴裝置數量為5.93億台,預計2022年將達到11.05億台。因此,穿戴式裝置的日益普及預計將有助於研究期間的市場成長。

- 汽車產業正在經歷一場技術變革,自動駕駛汽車的採用即將到來。 ADAS(高級駕駛員輔助系統)變得越來越直覺。根據高盛預測,到 2025 年,ADAS/AV 市場預計價值 960 億美元。因此,對 MEMS 組合感測器的需求預計將會增加。

- 全球家用電子電器市場和物聯網設備的成長預計將對 MEMS聯合感應器市場需求產生正面影響。根據GFU的數據,2021年全球家用電子電器產品支出為312億歐元,較2020年成長2.5%。

- 隨著科技公司在全球加速創新以對抗 COVID-19 大流行,晶片產業的 MEMS聯合感應器正在經歷巨大的成長。電子領域進步的背後是對超小型設備的需求。除了推出新產品外,供應商還想方設法取得更多技術進步,以滿足不斷變化的需求。然而,由於COVID-19大流行影響了多個全球市場,汽車、旅遊和民航業都受到了不同程度的沉重打擊。

- 此外,疫情改變了人們對製造業全球供應鏈的看法,出現了更多在地化價值鏈和區域化。這樣做主要是為了最大限度地減少未來疫情造成的類似風險。

MEMS聯合感應器市場趨勢

對互聯手持設備和穿戴式裝置不斷成長的需求推動了市場

- 近年來,微電子機械系統聯合感應器因其能夠使電子設備小型化和執行複雜測量以及其準確性和可靠性而受到廣泛歡迎。推動 MEMS聯合感應器市場的關鍵因素包括對工業自動化和小型消費性設備(例如穿戴式裝置和物聯網連接設備)的需求。

- 全球智慧型手機用戶數量顯著增加,穿戴式裝置的需求也在增加。愛立信預計,全球智慧型手機用戶數量預計將從2021年的62.59億增加到2027年的76.9億。智慧型手機的不斷普及預計將在研究期間推動市場需求。

- 隨著行動遊戲的普及顯著增加,用於遊戲目的的手持設備的日益普及預計也將推動 MEMS聯合感應器市場。根據DeviceAtlas的數據,2021年全球行動遊戲支出為980億美元,較2020年成長13%。

- 此外,由於全球健康意識趨勢和健康資料追蹤應用的採用,人們對穿戴式裝置的興趣日益增加,預計將推動 MEMS聯合感應器市場的發展。據思科系統公司稱,到 2022 年,全球將有 11 億台連網穿戴裝置。

北美佔有很大的市場佔有率

- 由於對緊湊型系統和設備的需求不斷成長,北美預計將成為 MEMS聯合感應器市場的重要股東。該地區在研發領域投入巨資,並積極採用新技術進步。智慧型手機等家用電子電器的日益小型化以及將先進功能整合到創新的穿戴式技術中,正在為該地區創造可觀的收益鋪平道路。

- 此外,鑑於智慧電子、物聯網和汽車產業在全球市場佔有率,該地區預計將成為採用 ADAS 車輛和自動駕駛交通解決方案的先驅之一。根據Car of the Future預測,2021年美國ADAS產量將達1,845萬輛。

- 根據國際能源總署 (IEA) 的數據,美國插電式電動車銷量將從 2020 年的 34 萬輛增至 2021 年的 607,600 輛,成長近一倍。總體而言,該國的汽車產業也在持續成長,促進了該地區MEMS市場的成長,特別是汽車產業。此外,政府推動電動車發展的措施預計也將促進該地區的成長。例如,2021年11月,美國政府制定了一個雄心勃勃的目標,即到2030年讓50%的新車實現電動化,並承諾部署50萬個充電站以增強客戶信心。

- 此外,有關乘客安全的嚴格政府法規以及不斷發展的汽車和航太工業正在推動北美 MEMS聯合感應器市場的發展。資訊科技 (IT) 的進步以及物聯網在製造業、工業和汽車等廣泛應用中的日益普及,為該地區的業務營運帶來了新的維度。

MEMS聯合感應器產業概覽

隨著市場領導透過多樣化的產品系列和產品開發佔上風,MEMS聯合感應器市場正在走向整合。任何製造商的創新能力都取決於其在研發方面的投入。該行業是資本密集型行業,為新進入者設置了進入障礙。主要參與企業包括 Honeywell International, Inc.、Bosch Sensortec GmbH、Analog Devices, Inc.、Murata Manufacturing 和 InvenSense, Inc.。

- 2022 年 1 月 - TDK 推出 InvenSense ICM-45xxx SmartMotion 超高性能 (UHP) 6 軸 MEMS動作感測器系列。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 對手持和穿戴式裝置的需求增加

- ADAS 和自動駕駛解決方案在汽車產業的採用

- 互動遊戲的成長

- 市場限制因素

- MEMS 總體成本增加

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

第5章市場區隔

- 按類型

- 移動聯合感應器

- 環境聯合感應器

- 光學聯合感應器

- 其他感測器類型

- 按最終用戶

- 航太/國防

- 車

- 家用電子電器

- 用水和污水管理

- 石油和天然氣

- 飲食

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第6章 競爭狀況

- 公司簡介

- Honeywell International, Inc.

- Bosch Sensortec GmbH

- Analog Devices, Inc.

- Murata Manufacturing Co., Ltd.

- InvenSense, Inc.

- Panasonic Corporation

- KIONIX, Inc.

- MEMSIC, Inc.

- Microchip Technology, Inc.

- NXP Semiconductors

- Safran Colibrys SA

- STMicroelectronics NV

第7章 投資分析

第8章 市場機會及未來趨勢

The MEMS Combo Sensors Market is expected to register a CAGR of 11.5% during the forecast period.

Key Highlights

- The global demand for connected wearable devices is significantly increased owing to the rising popularity of connected devices. According to CISCO Systems, the global number of connected wearable devices stood at 593 million during fiscal 2018 and is expected to reach 1105 million by 2022. Thus, increasing the adoption of wearable devices is expected to contribute to market growth throughout the study period.

- The automotive industry is moving towards a technological shift and is on the verge of adopting autonomous vehicles. Advanced Driver Assistance Systems are increasingly becoming intuitive. According to Goldman Sachs, the ADAS/AV market is expected to be USD 96 billion by 2025. This, in turn, is anticipated to bolster the demand for the MEMS combo sensors.

- The growing global consumer electronics market and IoT devices are expected to positively influence the demand for the MEMS combo sensors market. According to GFU, the expenditure on consumer electronics products worldwide stood at 31.2 billion euros in 2021, an increase of 2.5% compared to 2020.

- The MEMS combo sensors in the chip industry have witnessed immense growth as technology companies globally accelerated innovation in the fight against the COVID-19 pandemic. The need for tiny devices is behind advances in the areas of electronics. Alongside introducing new products, vendors are navigating more ways of technological advancement to address the evolving demand. However, since the COVID-19 pandemic impacted multiple global markets, the automotive, mobility, and civil aviation industries have suffered drastically yet differently.

- Moreover, the pandemic has changed the perception of the global supply chain in manufacturing, where more localized value chains and regionalization have come into the picture. These are primarily done to minimize similar future risks posed by the pandemic.

MEMS Combo Sensors Market Trends

Growing Demand for Connected Handheld and Wearable Devices to Drive the Market

- Microelectromechanical system combo sensors have gained significant traction over recent years due to advantages, such as accuracy and reliability, in addition to the scope for making smaller electronic devices and the ability to provide a combination of measurements. Among the significant factors driving the MEMS combo sensors market are industrial automation and the demand for miniaturized consumer devices, such as wearables, IoT-connected devices, and others.

- The number of smartphone users is increasing significantly across the globe, and the demand for wearable devices is also growing. According to Ericsson, worldwide smartphone subscriptions are expected to increase from 6,259 million in 2021 to 7,690 million in 2027. This increasing adoption of smartphones is expected to propel market demand over the study period.

- The increasing popularity of handheld devices for gaming purposes is also projected to drive the market for MEMS combo sensors, and the popularity of mobile gaming is increasing significantly. According to DeviceAtlas, worldwide spending on mobile gaming stood at USD 98 billion in 2021, a 13% increase from 2020.

- Additionally, the growing inclination towards wearable devices owing to the global trend of health-conscious lifestyles and the adoption of health data tracking applications is expected to drive the MEMS combo sensors market. According to CISCO Systems, 1.1 billion connected wearable devices will be globally by 2022.

North America to Hold Significant Share of the Market

- North America is expected to be a significant shareholder in the MEMS combo sensors market, owing to the increasing demand for compact systems and devices. The region is an active adopter of new technological advancements with significant investments in the R&D sector. The growing drive to reduce the size of consumer electronics, like smartphones, and integrate advanced features in innovative wearable technology has paved the path for generating significant revenue in the region.

- Furthermore, owing to its significant global market share of smart electronic devices, IoT, and the Automotive industry, the region is expected to be one of the pioneers in adopting ADAS-enabled vehicles and self-driven transportation solutions. According to Car of the Future, the US ADAS unit production volume stood at 18.45 million in 2021.

- According to the International Energy Agency (IEA), the sales of plug-in electric light vehicles in the United States nearly doubled from 340,000 units in 2020 to 607,600 units in 2021. At an overall level, the automotive sector in the country has also been growing, contributing to the growth of the MEMS market, especially in the automotive industry, in the region. Further, government initiatives to boost electric vehicles are expected to contribute to the region's growth. For instance, In November 2021, the US government set an ambitious 50% electrified target for new automobiles by 2030, backed up by the declaration of the implementation of 500 000 charge sites to boost customer trust.

- In addition, stringent governmental regulations regarding passenger safety and the growing automotive and aerospace industries drive the market for MEMS combo sensors in North America. The advancements in information technology (IT) and the increased adoption of IoT across a wide range of manufacturing, industrial, and automotive applications have added a new dimension to conducting business operations in the region.

MEMS Combo Sensors Industry Overview

The MEMS combo sensors market is moving towards consolidation as market leaders are banking on diverse product portfolios and product development to gain an edge. Any player's innovation capabilities are dependent on investment in research and development. The industry is capital intensive and poses an entry barrier to new entrants. Key players are Honeywell International, Inc., Bosch Sensortec GmbH, Analog Devices, Inc., Murata Manufacturing Co., Ltd., and InvenSense, Inc., among others.

- January 2022 - TDK launched the InvenSense ICM-45xxx SmartMotion ultra-high-performance (UHP) family of 6-axis MEMS motion sensors which finds applications in equipment that require negligible gyro drift.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Demand for Handheld & Wearable Devices

- 4.2.2 Adoption of ADAS and Self Driving Solutions in Automotive Industry

- 4.2.3 Growth in Interactive Gaming

- 4.3 Market Restraints

- 4.3.1 Increase in Overall Cost of MEMS

- 4.4 Industry Attractiveness - Porter's Five Forces Analysis

- 4.4.1 Bargaining Power of Suppliers

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Threat of New Entrants

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Technology Snapshot

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Movement Combo Sensor

- 5.1.2 Environment Combo Sensor

- 5.1.3 Optical Combo Sensor

- 5.1.4 Other Sensor Type

- 5.2 By End User

- 5.2.1 Aerospace & Defense

- 5.2.2 Automotive

- 5.2.3 Consumer Electronics

- 5.2.4 Water and Wastewater Management

- 5.2.5 Oil and Gas

- 5.2.6 Food and Beverage

- 5.2.7 Other End Users

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Honeywell International, Inc.

- 6.1.2 Bosch Sensortec GmbH

- 6.1.3 Analog Devices, Inc.

- 6.1.4 Murata Manufacturing Co., Ltd.

- 6.1.5 InvenSense, Inc.

- 6.1.6 Panasonic Corporation

- 6.1.7 KIONIX, Inc.

- 6.1.8 MEMSIC, Inc.

- 6.1.9 Microchip Technology, Inc.

- 6.1.10 NXP Semiconductors

- 6.1.11 Safran Colibrys SA

- 6.1.12 STMicroelectronics NV