|

市場調查報告書

商品編碼

1630287

閥門和致動器:市場佔有率分析、行業趨勢和統計、成長預測(2025-2030)Valves And Actuators - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

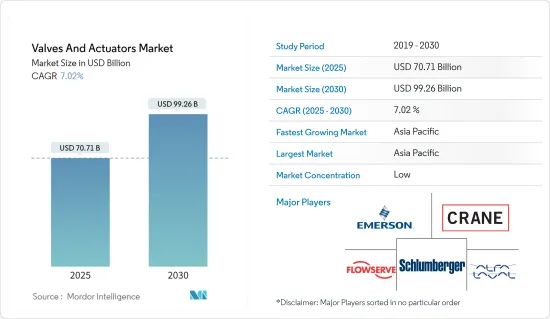

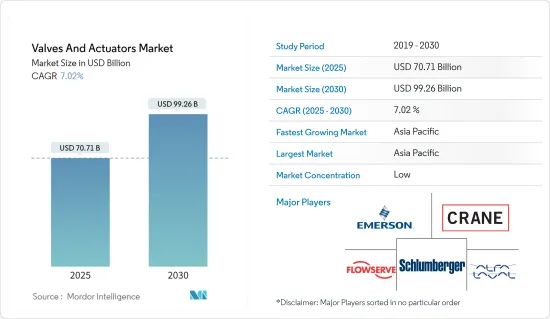

閥門和致動器市場規模預計到 2025 年為 707.1 億美元,預計到 2030 年將達到 992.6 億美元,預測期內(2025-2030 年)複合年成長率為 7.02%。

閥門和致動器市場包括供應商為石油、天然氣和發電行業提供的各種閥門和致動器。市場規模由每個行業供應商產生的收益決定。

石油和天然氣探勘計劃、運輸管道計劃和持續維護活動對控制閥的需求量很大。在先進技術進步的推動下,該市場正在快速成長,為智慧致動器的發展鋪平了道路。這些智慧致動器無縫整合感測器、馬達、通訊模組和控制器。它的適應性使其易於調整、安裝和拆卸,使其成為各種工業領域機器人的主要產品。

隨著閥門和致動器技術的進步,工程師正在優先考慮能夠提供準確性能、減少功耗並最大限度減少環境碳排放的解決方案。解決傳統閥門技術的這些挑戰正在推動市場成長。

海水淡化可以去除海水中的鹽和礦物質,對於多種產業至關重要。製造業、食品加工和農業等行業越來越依賴清潔水,推動了對海水淡化的需求,將其作為解決日益嚴重的水資源短缺的關鍵解決方案。

閥門和致動器在水處理廠、發電、煉油廠、採礦和食品生產中至關重要。然而,由於工業成長疲軟,特別是在已開發國家,對這些零件的需求停滯不前。

總體而言,由於電力和化學行業需求的增加、海水淡化活動的需求以及先進技術的採用,對許多行業至關重要的閥門和致動器市場正在成長。

閥門和致動器市場趨勢

石油和天然氣領域佔主要市場佔有率

- 石油和天然氣領域是致動器市場的重要組成部分,因為致動器對於調節管道中的石油和天然氣流量、維護安全系統以及自動化上游和下游的許多任務至關重要。由於需要可靠、持久且準確的控制系統,致動器已在工業中廣泛應用。在日益複雜的採礦和精製過程中尤其如此。為了確保石油和天然氣設施的安全有效運行,此類致動器用於控制閥門自動化和防噴器以及其他關鍵設備等應用。

- 在石油和天然氣領域,深海探勘和生產活動的增加大大增加了對海底致動器的需求。惡劣的水下環境需要海底致動器來操作設備。最近的進展旨在使這些致動器更加可靠和耐用,使其能夠承受腐蝕環境、高壓和低溫。例如,致動器製造商Rotork開發了一種先進的海底電動致動器,其性能和壽命已提高,以滿足深海計劃的要求。

- 石油和天然氣產業正在加速採用數位和致動器致動器,以提高營運效率和安全性。這些智慧致動器的感測器和通訊功能可實現即時監控、診斷和控制。 Bettis RTS 智慧電動致動器由業界領導者艾默生電氣製造,具有先進的診斷和遠端控制功能。這使您能夠更有效地管理石油和天然氣營運。

- 工業閥門有多種形狀和尺寸,每種都有不同的功能,包括閘閥、截止閥、球閥、蝶閥、止回閥、壓力閥和隔膜閥。隨著商業建築和自動化計劃越來越依賴閥門,預計未來幾年對工業燃氣閥門的需求將會增加。這一激增將受到技術進步、工業化和都市化程度的提高以及現有設施的擴建的推動。

- 2024 年 2 月,塞勒姆市有 3,000 個家庭在城市燃氣發行(CGD) 網路下註冊使用家用管道天然氣 (D-PNG)。印度石油公司 (IOCL) 已為 1,550 個家庭安裝了電錶。

- 據貝克休斯稱,北美是世界上最大的石油和天然氣鑽機所在地。截至2024年5月,該地區有700個陸上鑽機和22個海上鑽機。到2023年,全球石油鑽機平均數量將超過1,800個。

- 探勘和生產作業中對可靠控制系統的需求、不斷成長的液化天然氣基礎設施以及全球能源需求都促使石油和天然氣行業成為致動器。海底致動器和智慧致動器的最新技術趨勢,以及對環境合規性和安全性的重視,使該行業在充滿挑戰的市場中更具彈性。

亞太地區成長強勁

- 中國正在大力投資工業自動化,以提高製造效率並降低人事費用。隨著工廠轉向高度自動化流程,對作為這些系統重要組成部分的致動器的需求不斷增加。

- 《中國製造2025》等中國政府舉措強調對自動化、技術研發和投資的關注。鑑於該國依賴從德國和日本進口的自動化設備,「中國製造」計畫旨在加強國內生產並促進市場成長。

- 印度製定了一項國家製造業政策,旨在2025年將製造業佔GDP的比重提高到25%,並透過印度政府等舉措,於2022年推出發展核心製造業以達到全球製造業標準的製造業政策。印度製造業正在逐步轉向更自動化和流程主導的製造,這有望提高製造效率並增加產量,從而推動市場成長。

- 此外,國際貿易和工業部和能源部正在加強支持中小企業引進和推廣智慧工廠技術。透過韓國技術資訊振興院成立了智慧製造創新辦公室。它還計劃到2025年在10個重點產業擁有4500個智慧工廠。政府的此類積極措施有望刺激市場成長。

- 為了滿足不斷成長的需求,東南亞的天然氣探勘活動不斷增加,預計該地區石油和天然氣公司對各種類型閥門的需求將會增加。馬來西亞和印尼報告了上游的成功發現,其中包括穆巴達拉能源公司在南安達曼區塊的重大發現。

閥門和致動器行業概述

閥門和致動器市場適度分散,國內外供應商都擁有數十年的經驗。供應商採取了強力的市場競爭策略,並大力投資廣告以維持其在市場上的地位。

各大廠商都在積極引進創新技術。市場上的其他領導者正在專注於整合解決方案以吸引消費者。相較之下,小型和新興供應商則優先考慮成本效益,從而擴大競爭格局。現在公共部門已接近成熟,重點正在轉向私營部門。

品質認證、多樣化的產品供應、有競爭力的價格和技術專長等關鍵因素對於贏得新契約至關重要。競爭公司之間的敵意仍然很高,並且預計在預測期內將持續下去。

市場主要參與者包括艾默生電氣公司、斯倫貝謝有限公司、阿法拉伐公司、福斯公司、克瑞公司等。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

第5章市場動態

- 市場促進因素

- 技術進步促進智慧閥門和致動器的應用

- 海水淡化需求增加

- 市場限制因素

- 已開發國家工業成長停滯

第6章市場細分:致動器

- 按類型

- 油壓

- 氣動

- 電動式

- 機械的

- 其他類型

- 按行業分類

- 石油和天然氣

- 發電

- 化學

- 用水和污水

- 礦業

- 其他最終用戶產業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 義大利

- 亞洲

- 中國

- 日本

- 印度

- 韓國

- 澳洲/紐西蘭

- 拉丁美洲

- 中東 非洲

- 北美洲

第7章市場細分:閥門

- 按類型

- 球

- 蝴蝶

- 門/手套/檢查

- 插頭

- 控制

- 其他類型

- 按行業分類

- 石油和天然氣

- 發電

- 化學

- 用水和污水

- 礦業

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第8章 競爭格局

- 公司簡介

- Emerson Electric Co.

- Schlumberger Limited

- Alfa Laval Corporate AB

- Flowserve Corporation

- Crane Co.

- Rotork PLC

- Metso Oyj

- KITZ Corporation

- IMI Critical Engineering

- Samson Controls Inc.

第9章投資分析

第10章市場機會與未來趨勢

The Valves And Actuators Market size is estimated at USD 70.71 billion in 2025, and is expected to reach USD 99.26 billion by 2030, at a CAGR of 7.02% during the forecast period (2025-2030).

The valves and actuators market encompasses various valves and actuators supplied by vendors catering to oil and gas and power generation industries. Market size is determined by the revenue generated by these vendors across industries.

Control valves see heightened demand from oil and gas exploration projects, transportation pipeline initiatives, and ongoing maintenance activities. The market is witnessing a surge, fueled by the push for advanced technologies, paving the way for the development of smart actuators. These smart actuators integrate sensors, motors, communication modules, and controllers seamlessly. Their adaptability allows for easy adjustments, setups, or dismantling, making them a staple in robots across various industries.

As valve and actuator technology advances, engineers prioritize solutions that deliver precise performance, consume less power, and minimize the environmental carbon footprint. This commitment to address the challenges of traditional valve technologies is fueling market growth.

Desalination, which is the process of removing salts and minerals from salty water, is essential for various industries. Industries such as manufacturing, food processing, and agriculture rely more on clean water, leading to a growing demand for desalination as a key solution to increasing water scarcity.

Valves and actuators are pivotal in water treatment plants, power generation, refineries, mining, and food production. Yet, demand for these components has stagnated, particularly in developed nations, due to sluggish industrial growth.

Overall, the valve and actuators market, integral to many industries, is growing, owing to rising demand from the power and chemical industries, the need for desalination activities, and the adoption of advanced technologies.

Valves And Actuators Market Trends

The Oil and Gas Segment Holds Major Market Share

- The oil and gas segment is an important contributor to the actuators market because actuators are essential for regulating the flow of gas and oil through pipelines, maintaining safety systems, and automating a number of tasks in both upstream and downstream operations. Actuators have become widely used in the industry due to the necessity for dependable, long-lasting, and accurate control systems. This is especially true in the increasingly complicated extraction and refining processes. To ensure the safe and effective functioning of oil and gas facilities, actuators in this category are utilized in applications such as valve automation blowout preventers and control of other essential equipment.

- The oil and gas segment increased exploration and production activities in deeper oceans, which has resulted in a major increase in demand for subsea actuators. Extreme underwater environments require subsea actuators to operate equipment. Recent advancements aim to make these actuators more dependable and durable, allowing them to resist corrosive environments, high pressures, and low temperatures. For example, in order to meet the requirements of deep-water projects, Rotork, an actuator manufacturer, has developed advanced subsea electric actuators that offer improved performance and longevity.

- To improve operational efficiency and safety, the oil and gas segment is embracing digital and smart actuation systems at an increasing rate. These smart actuators' sensors and communication capabilities enable real-time monitoring, diagnostics, and control. The Bettis RTS intelligent electric actuators, manufactured by the major industry player Emerson Electric, offer advanced diagnostic features and remote-control capabilities. This allows for more effective administration of oil and gas operations.

- Industrial valves are available in numerous shapes and sizes, including gate, globe, ball, butterfly, check, pressure, and diaphragm valves, each serving distinct functions. As commercial construction and automation projects increasingly rely on them, the demand for industrial gas valves is projected to rise in the coming years. This surge is fueled by technological advancements, heightened industrialization and urbanization, and the expansion of existing facilities.

- In February 2024, 3,000 households in Salem City were registered for domestic piped natural gas (D-PNG) under the city gas distribution (CGD) network. Indian Oil Corporation Limited (IOCL) has installed meters at 1,550 households.

- According to Baker Hughes, North America hosts oil and gas rigs globally. As of May 2024, the region boasted 700 land and 22 offshore rigs. In 2023, the global count of oil rigs surpassed 1,800 units on average.

- The necessity for dependable control systems in exploration and production activities, the growing LNG infrastructure, and the world's need for energy all contribute to the oil and gas segment's continued growth as a key growth area for actuators. Recent subsea and smart actuator technology developments and a strong emphasis on environmental compliance and safety have strengthened the segment's resilience in a challenging market.

Asia-Pacific to Register Major Growth

- China is investing significantly in industrial automation to enhance manufacturing efficiency and reduce labor costs. As factories transition to advanced automated processes, there is an increasing need for actuators, which are essential components in these systems.

- China's government initiatives, like the "Made in China 2025" plan, underscore its focus on automation, technology R&D, and investment. Given the reliance on imports from Germany and Japan for automation equipment, the "Made in China" initiative aims to strengthen domestic production and boost the market's growth.

- India is gradually progressing on the road to Industry 4.0 through the Government of India's initiatives like the National Manufacturing Policy, which aims to increase the share of manufacturing in GDP to 25% by 2025, and the PLI scheme for manufacturing, which was launched in 2022 to develop the core manufacturing industry at par with global manufacturing standards. The manufacturing industry in India is gradually shifting to more automated and process-driven manufacturing, which is expected to increase efficiency and boost production in the manufacturing industry, thereby driving market growth.

- Moreover, the Ministry of Trade, Industry, and Energy is strengthening its efforts by supporting SMEs in adopting and expanding smart factory technologies. They have established the Smart Manufacturing Innovation Office through the Korea Technology and Information Promotion Agency. Also, 10 significant industries are targeted to boast 4,500 smart factories by 2025. Such proactive government measures are poised to stimulate the market's growth.

- The increase in gas exploration activities in Southeast Asia to meet rising demand is expected to drive the need for various types of valves among oil and gas companies in the region. Malaysia and Indonesia have reported successful upstream discoveries, including a significant find by Mubadala Energy in the South Andaman Block.

Valves And Actuators Industry Overview

The valves and actuators market is moderately fragmented, featuring local and international vendors with decades of experience. Vendors are adopting robust competitive strategies, heavily investing in advertising to maintain their market presence.

Leading vendors are actively introducing innovative technologies. Other prominent players in the market are emphasizing integrated solutions to captivate consumers. In contrast, smaller and emerging vendors prioritize cost-benefit advantages, heightening the competitive landscape. With the public sector nearing maturity, a substantial focus is shifting toward the private sector.

Key factors like quality certification, diverse product offerings, competitive pricing, and technical expertise are pivotal in securing new contracts. The competitive rivalry remains high and is projected to persist during the forecast period.

Some of the major players in the market are Emerson Electric Co., Schlumberger Limited, Alfa Laval Corporate AB, Flowserve Corporation, and Crane Co.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technological Advancements Propelling Application of Smart Valves and Actuators

- 5.1.2 Increase in Demand for Desalination Activities

- 5.2 Market Restraints

- 5.2.1 Stagnant Industrial Growth in Developed Countries

6 MARKET SEGMENTATION - ACTUATORS

- 6.1 By Type

- 6.1.1 Hydraulic

- 6.1.2 Pneumatic

- 6.1.3 Electric

- 6.1.4 Mechanical

- 6.1.5 Other Types

- 6.2 By End-user Vertical

- 6.2.1 Oil and Gas

- 6.2.2 Power Generation

- 6.2.3 Chemical

- 6.2.4 Water and Wastewater

- 6.2.5 Mining

- 6.2.6 Other End User Verticals

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Italy

- 6.3.3 Asia

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 India

- 6.3.3.4 South Korea

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East Africa

- 6.3.1 North America

7 MARKET SEGMENTATION - VALVES

- 7.1 By Type

- 7.1.1 Ball

- 7.1.2 Butterfly

- 7.1.3 Gate/Globe/Check

- 7.1.4 Plug

- 7.1.5 Control

- 7.1.6 Other Types

- 7.2 By End-user Vertical

- 7.2.1 Oil and Gas

- 7.2.2 Power Generation

- 7.2.3 Chemical

- 7.2.4 Water and Wastewater

- 7.2.5 Mining

- 7.2.6 Other End User Verticals

- 7.3 By Geography

- 7.3.1 North America

- 7.3.2 Europe

- 7.3.3 Asia

- 7.3.4 Australia and New Zealand

- 7.3.5 Latin America

- 7.3.6 Middle East and Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Emerson Electric Co.

- 8.1.2 Schlumberger Limited

- 8.1.3 Alfa Laval Corporate AB

- 8.1.4 Flowserve Corporation

- 8.1.5 Crane Co.

- 8.1.6 Rotork PLC

- 8.1.7 Metso Oyj

- 8.1.8 KITZ Corporation

- 8.1.9 IMI Critical Engineering

- 8.1.10 Samson Controls Inc.