|

市場調查報告書

商品編碼

1630291

抬頭顯示器:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Head-up Display - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

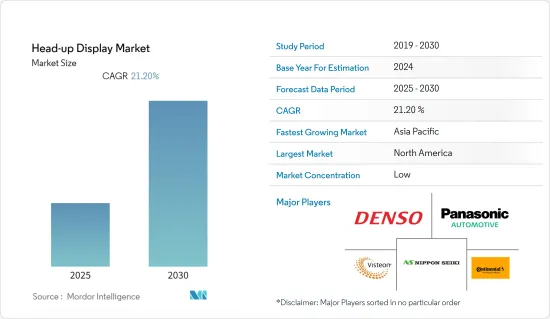

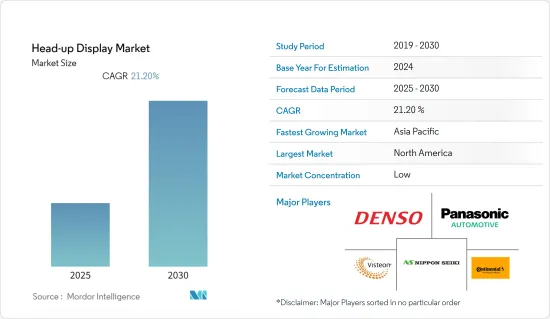

預測期內抬頭顯示器市場複合年成長率預估為 21.2%

主要亮點

- 抬頭顯示器,也稱為 HUD,是一種透明顯示器,使用者無需將目光從正常觀點移開即可顯示資料。抬頭顯示器自 20 世紀中葉以來就已為人所知,主要用於飛機上。然而,在 20 世紀 50 年代,有人嘗試在汽車上測試這項技術。目前,寶馬、奧迪、沃爾沃、賓士等大多數豪華汽車製造商都配備了HUD。

- 據世界衛生組織稱,每年約有 135 萬人死於道路交通事故。 HUD 是一種駕駛輔助系統,可為駕駛員和行人及時報告潛在的危險事件。

- 此外,貨運卡車可能是第一批實現廣泛自動化的車輛。根據《富比士》雜誌報道,美國貨運業務每年價值8,000億美元。然而,美國道路上每年約有 4,900 人死於卡車相關事故。卡車駕駛時,安全是重中之重,這可能是採用 HUD 的原因。

- 擋風玻璃抬頭顯示器直接在擋風玻璃螢幕上顯示相關資訊。駕駛員始終可以看到他們需要的資訊。此外,許多駕駛者也經常聽到來自「智慧」汽車的鈴聲、鈴聲、嘟嘟聲和其他不相關的警告,而他們並不總是聽從這些警告。我們需要建立一個讓人們不會關機的系統。

- 在新冠肺炎 (COVID-19) 疫情期間,封鎖導致經濟活動停止。汽車製造是HUD市場最重要的應用。全球製造業下降 20-50%,將直接影響 HUD 市場。

抬頭顯示器市場趨勢

HUD 在汽車行業的廣泛採用推動了市場成長

- 數位化是汽車產業的一大趨勢。在過去的幾十年裡,該行業見證了數位領域的許多技術進步。其中之一是 HUD 形式的技術增強。

- 車輛的 HUD 使駕駛員能夠專注於道路,將速度、警告訊號以及其他重要的車輛和導航資訊安全、直接地顯示在擋風玻璃上,就在駕駛員的視線範圍內。

- 對安全性和用戶舒適度日益成長的需求是推動汽車行業採用 HUD 的最重要因素之一。此外,交通事故的增加也加劇了對 HUD 的需求。例如,根據世界衛生組織 (WHO) 統計,全球每年有超過 135 萬人死於交通事故。交通事故傷害是 5 歲至 29 歲的第一大死因。此外,根據基礎設施、運輸和研究經濟局 (BITRE) 的數據,2021 年新南威爾斯州有 293 人死於道路交通事故。

- 奧迪、寶馬、雷克薩斯、路虎和梅賽德斯-奔馳等豪華品牌在其高階車輛中提供 HUD 系統作為標準或可選配件。

- 然而,OEM正在考慮這一點,現在甚至將其作為標準配置配備在經濟型汽車中。日產於 2022 年 5 月推出的 Ariya 是繼 Skyline、Rogue、Qashqai、Pathfinder 和 QX60 之後第六款使用PanasonicWS HUD 的車輛。 WS HUD是一種透過將車速、導航指令和ProPILOT 2.0駕駛支援資訊等各種資訊投影到擋風玻璃上來顯示駕駛視野內的系統。

- 此外,隨著AR的實施,HUD已成為ADAS(高級駕駛輔助系統)的重要組成部分。未來十年,OEM預計將在其車輛中安裝更多 ADAS 應用程式。

- BMW還在 HUD 中加入了娛樂功能。使用方向盤上的按鈕捲動廣播電台和歌曲清單。因此,配備HUD的新車的推出預計將推動市場成長。

北美預計將佔據很大佔有率

- 由於北美是各種汽車品牌的主要生產基地以及軍事和國防創新趨勢,預計北美將佔據較大的市場佔有率。

- 北美已開發地區的政府法規擴大支持支持車輛和交通安全的汽車創新和技術。 2018年10月,美國運輸部(USDOT)發布了最新的自動駕駛汽車聯邦指南「自動駕駛汽車3.0」(AV 3.0),標題為「為未來的交通運輸做好準備」。 AV 3.0 強化了美國交通部支持將自動化安全整合到各種運輸系統中的承諾。

- 此外,軍事預算是分配給國防部的美國聯邦預算的最大部分,更具體地說,是專門用於軍事相關支出的部分。根據第61屆NDAA兩院會議,美國2022會計年度國防預算將達7,777億美元。

- 美國是世界上最大的航太、國防和太空市場之一。柯林斯航空航太公司將為美國聯邦航空管理局提供虛擬實境系統,該系統將用於研究飛行員在使用抬頭顯示器飛行時的表現。此VR設備將使FAA研究人員能夠靈活、高效、有效地在HUD先進視覺系統領域進行研究。這些舉措是為了因應航空領域的市場成長。

- 此外,BAE Systems 於 2022 年 5 月推出了民用和軍用飛行員的 LiteWave抬頭顯示器,該顯示器體積縮小了 70%,安裝速度提高了 80%,而且重量更輕。此平視顯示器設計安裝在飛行員的頭頂上方,並直接在飛行員的視線中顯示方向、高度和速度等重要資訊。 LiteWave 採用 BAE 的取得專利的波導技術,可以調整到單獨的飛行位置,使飛行員能夠在惡劣的天氣條件和夜間保持最佳的情境察覺。

抬頭顯示器行業概況

抬頭顯示器市場競爭激烈且細分,全球和地區參與企業眾多。供應商越來越注重產品差異化和創新。

- 2021 年 12 月 - 沃爾沃汽車向 Spectralics 投資 200 萬美元,該公司致力於開發一種新型光學薄膜,可用於將汽車的整個擋風玻璃轉變為擴增實境(AR) 顯示器。該技術在擋風玻璃上創建了一個寬視場抬頭顯示器,可以將物體覆蓋在現實世界的背景上,以產生距離感。

- 2021 年 7 月 - 康寧公司宣布推出汽車玻璃解決方案的新產品類型。康寧的曲面鏡解決方案是現代摩比斯擴增實境抬頭顯示器系統的關鍵組件。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

第5章市場動態

- 市場促進因素

- HUD 技術進步

- 提高乘客和車輛安全意識

- 市場問題

- 先進抬頭顯示器系統的高成本

第6章 市場細分

- 按類型

- 擋風玻璃抬頭顯示器

- 組合器抬頭顯示器

- 基於 AR 的抬頭顯示器

- 按用途

- 車

- 軍用/民航業

- 其他

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 歐洲其他地區

- 亞太地區

- 中國

- 日本

- 韓國

- 澳洲

- 其他亞太地區

- 其他

- 北美洲

第7章 競爭格局

- 公司簡介

- Denso Corporation

- Nippon Seiki Co. Ltd.

- Panasonic Automotive Systems(Panasonic Corporation)

- Visteon Corporation

- Continental AG

- BAE Systems PLC

- Thales Group

- Garmin Ltd.

- Elbit Systems

- Pioneer Corporation

- Saab AB

- HUDWAY LLC

- Collins Aerospace(Rockwell Collins Inc.)

第8章投資分析

第9章 市場機會及未來趨勢

簡介目錄

Product Code: 66998

The Head-up Display Market is expected to register a CAGR of 21.2% during the forecast period.

Key Highlights

- The head-up display, also known as a HUD, is any transparent display that presents data without requiring users to look away from their usual viewpoints. Head-up displays have been known since the mid-20th century and were primarily used in aircraft. However, during the 1950s, attempts were made to test this technology for cars. Currently, most luxury car manufacturers, such as BMW, Audi, Volvo, Mercedes-Benz, etc., equip their vehicle model range with HUD.

- According to WHO, approximately 1.35 million people die every year due to road traffic crashes. The HUD is a driver assistance system that reports timely events that conceal a potential risk to drivers and pedestrians.

- Further, trucks carrying freight will likely be the first vehicles to see widespread autonomous use. According to Forbes, the freight business in America is USD 800 billion per year enterprise which explains why a truck driving is the number 1 job in 29 American states. But approximately 4,900 people die each year on US roadways in a truck-involved crash. Safety is a large priority when it comes to the operation of trucks, which might lead to adopting HUD.

- The windshield head-up display shows relevant information directly on the windshield screen. The driver always has all the information he needs in the line of sight. Further, many drivers are so inundated with all these non-contextual warnings from their 'smart' vehicles with bells, chimes, and beeps that they do not always hear them. It has been needed to make sure to build systems that people do not turn off.

- During COVID-19, the lockdown resulted in bringing economic activity to a standstill. The manufacturing of automotive is the most important application of the HUD market. Manufacturing has gone down by 20-50% globally, which would directly impact the HUD market.

Heads-Up Display Market Trends

Growing Adoption of HUD in Automotive Industry Driving the Market's Growth

- Digitalization is a major trend in the automotive industry. The industry has witnessed numerous technological advancements in the digital field over the last couple of decades. The technological enhancement in the form of HUD is one such example.

- A vehicle's HUD keeps drivers focused on the road, safely delivering speed, warning signals, and other vital vehicle and navigation information on the windshield directly in the driver's line of sight.

- The growing need for safety and user comfort is one of the most important factors driving the adoption of HUD in the automotive industry. Moreover, an increasing number of road accidents fuels the need for HUD. For instance, According to the World Health Organization, over 1.35 million people die each year as a result of road traffic crashes globally. Injuries from road traffic accidents are the leading cause of death among people aged between 5 and 29 years. Moreover, according to the Bureau of Infrastructure and Transport Research Economics (BITRE), there were 293 road deaths in New South Wales in 2021.

- Luxury brands such as Audi, BMW, Lexus, Land Rover, and Mercedes-Benz, among others, are offering a HUD system as a standard or optional add-on feature across their premium vehicles.

- However, OEMs have been thinking and making them standard even in economy cars. In May 2022, Ariya, launched by Nissan, is the sixth car model from Nissan to use the WS HUD of Panasonic, following the Skyline, Rogue, Qashqai, Pathfinder, and QX60. The WS HUD is a system that presents a variety of information such as vehicle speed, navigation instructions, and ProPILOT 2.0 driver assist information in the driver's line of sight by projecting it on the windshield.

- Additionally, the implementation of AR has made HUD an important part of Advanced Driver Assistance Systems (ADAS). The OEMs are expected to include more ADAS applications in their vehicles in the next decade.

- BMW also includes entertainment functions in the HUD. It displays radio stations or song lists as one scrolls through them using a button on the steering wheel. Hence the launch of new car models equipped with HUD is anticipated to boost the market's growth.

North America is Expected to Hold a Significant Share

- North America is expected to cater to a significant market share with its major production sites of various automotive brands and innovation trends in military and defense.

- The government regulations in the developed regions of North America are increasingly favoring automotive innovations and technologies that support vehicle and road safety. In October 2018, the US Department of Transportation (USDOT) announced their latest federal guidance for automated vehicles entitled, "Preparing for the future of transportation: Automated Vehicles 3.0." (AV 3.0). AV 3.0 reinforced the USDOT commitment to supporting the safe integration of automation into the broad transportation system.

- Further, the military budget is the largest portion of the United States federal budget allocated to the Department of Defense, or more specifically, the portion of the budget that goes to any military-related expenditures. According to the 61st NDAA bicameral agreement, the United States will spend 777.7 billion dollars on the national defense budget for the fiscal year 2022.

- The United States (US) is one of the world's biggest markets for aerospace, defense, and space. Collins Aerospace is providing the Federal Aviation Administration with a virtual reality system that will be used to investigate how pilots perform when flying with a head-up display. The VR device enables FAA researchers to conduct research in the domain of advanced vision systems on HUDs with flexibility, efficiency, and effectiveness. Such an initiative caters to the market growth adoption in the aviation sector.

- Moreover, in May 2022, BAE Systems unveiled a lightweight LiteWave head-up display for commercial and military pilots, which is 70% smaller and 80% faster to install. This HUD is designed to be mounted above a pilot's head to present critical information directly in their lines of sight, such as direction, altitude, and speed. Powered by BAE's patented waveguide technology, LiteWave can be adjusted to any individual flying position, allowing the pilot to maintain optimal situational awareness, even during poor weather or at night.

Heads-Up Display Industry Overview

The head-up display market is competitive and fragmented, with the presence of a large number of global and regional players. The vendors are increasingly focusing on product differentiation and innovation.

- December 2021 - Volvo Cars have invested USD 2 million in Spectralics, a company that is working to create a new kind of thin optics film that might be used to transform the entire windshield of a car into an augmented reality (AR) display screen. The technology has the potential to create a wide field of view heads-up display on the windshield, with objects superimposed on the real-world background to give a sense of distance.

- July 2021 - Corning Incorporated has announced a new product category for its Automotive Glass Solutions. Corning curved mirror solutions are key components in the Augmented Reality (AR) heads-up display system by Hyundai Mobis.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Force Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Covid-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Technological Advancements of HUD

- 5.1.2 Growing Awareness About Passenger and Vehicle Safety

- 5.2 Market Challenges

- 5.2.1 High Cost of Advanced Head-Up Display Systems

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Windshield-Based Head-Up Display

- 6.1.2 Combiner-Based Head-Up Display

- 6.1.3 AR-Based Head-Up Display

- 6.2 By Application

- 6.2.1 Automotive

- 6.2.2 Military and Civil Aviation Industry

- 6.2.3 Other Applications

- 6.3 Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 United Kingdom

- 6.3.2.2 Germany

- 6.3.2.3 France

- 6.3.2.4 Rest of Europe

- 6.3.3 Asia-Pacific

- 6.3.3.1 China

- 6.3.3.2 Japan

- 6.3.3.3 South Korea

- 6.3.3.4 Australia

- 6.3.3.5 Rest of Asia-Pacific

- 6.3.4 Rest of the World

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Denso Corporation

- 7.1.2 Nippon Seiki Co. Ltd.

- 7.1.3 Panasonic Automotive Systems (Panasonic Corporation)

- 7.1.4 Visteon Corporation

- 7.1.5 Continental AG

- 7.1.6 BAE Systems PLC

- 7.1.7 Thales Group

- 7.1.8 Garmin Ltd.

- 7.1.9 Elbit Systems

- 7.1.10 Pioneer Corporation

- 7.1.11 Saab AB

- 7.1.12 HUDWAY LLC

- 7.1.13 Collins Aerospace (Rockwell Collins Inc.)

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219