|

市場調查報告書

商品編碼

1630300

轉速表 -市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Tachometer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

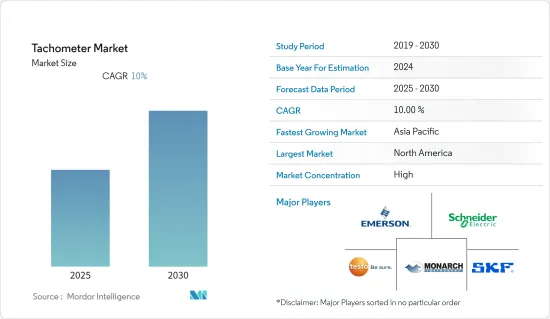

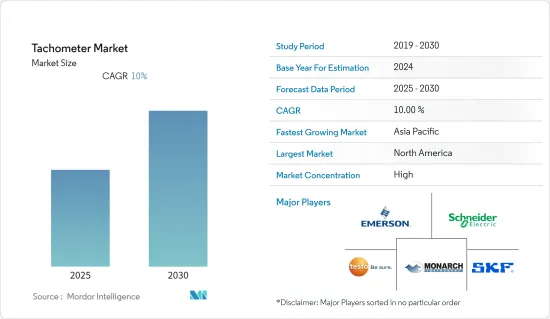

轉速表市場預計在預測期內複合年成長率為 10%

主要亮點

- 由於強勁成長,自動駕駛汽車正在推動對雷達感測器的需求。 OEM之間的新車輛評估計劃正在推動轉速計技術的發展,以整合這些系統以補充 ADAS 應用的攝影機設備。雷達與其他感測器和轉速計相結合,可提供有關安全和防撞的增強資訊。

- 此外,轉速表是用於在校準的類比錶盤或數位顯示器上顯示每分鐘轉數 (RPM) 的關鍵組件,因此交通風力發電機的部署不斷增加,預計將刺激轉速表的採用。例如,TAK Studio 設計的高速公路頂燈由風力發電機動力來源,風力渦輪機透過高速駛過的汽車和卡車產生的空氣湍流而旋轉。

- 此外,政府增加投資以推廣風力渦輪機等清潔和綠色能源技術也有望在預測期內推動市場成長。

- 轉速表在不同終端使用者中的使用是由中小型供應商的產品開發所推動的,反映了其廣泛的應用。 2021 年 12 月,GPMS International Inc. 宣布已獲得 ODA 批准,為 Mi 系列直升機配備 Foresight MX。此認證包裝已獲得 ODA核准,符合 FAA 補充型式認證要求,並且可以獲得當地民航當局的批准。售後市場 Foresight MX套件由 16 個 CPU 供電的智慧感測器、3 個轉速計和一個板載控制單元組成。配備 Foresight MX 的飛機將於 2022 年在非洲執行聯合國世界糧食計劃署的人道任務。

- 然而,存在技術限制,例如維護成本高、磁鐵隨著時間的推移而減弱、過熱時容易出錯以及市場上容易出現低成本假冒產品等,是阻礙研究市場成長的主要因素。

- COVID-19 大流行迫使世界各地的企業調整策略,以在「新常態」中生存。 COVID-19 疫情影響了各個製造業,導致工業活動暫時停止。除了媒體和工業應用之外,汽車生產是轉速表的主要採用者,也受到了供應鏈中斷的影響。

- 此外,對先進卡車運輸設備的迫切需求席捲了世界各地的商業經濟體,第一波疫情後,企業的運輸能力大幅下降,產生了直接影響。國際邊界的完全關閉限制了將貨物運送至目的地的方式。這迫使卡車供應商、鐵路和飛機製造商認知到需要改善其基礎設施並更好地監控其營運。

轉速表市場趨勢

汽車產業預計將錄得強勁成長

- 轉速表指示引擎曲軸轉數,並允許駕駛員根據駕駛情況選擇適當的油門和檔位,以實現平穩高效的駕駛。預計汽車銷量的成長將推動汽車製造商在預測期內採用轉速計。例如,根據OICA的數據,2021年全球汽車銷量達到8,268萬輛。

- 各國政府擴大推廣電動車的使用。例如,歐盟(EU)在2022年初宣布了7500億歐元的獎勵策略,其中包括200億歐元用於促進清潔汽車的銷售,以及到2025年為電動和氫動力汽車提供200億歐元。萬歐元安裝充電站。這表明電動車的數量預計將增加,從而刺激預測期內轉速表的採用。

- 中國已超過歐洲國家,成為電動車的主要採用者之一。人們對環境問題的認知不斷提高以及對政府法規的支持是推動中國電動車產業成長的關鍵因素。例如,中國政府公佈了2021年電動車產業藍圖,其中指出,到2030年,中國銷售的汽車有40%將是電動車。

- 近幾十年來,由於開發中國家,特別是亞太、中東和拉丁美洲地區的經濟成長,乘用車銷量大幅成長。 OICA資料顯示,2021年全球乘用車銷售量將達5,640萬輛,高於2020年的5,392萬輛。預計此類趨勢將對所研究市場的成長產生正面影響。

亞太地區佔主要市場佔有率

- 推動亞太地區轉速表市場的關鍵因素是工業部門的成長和大量人口推動汽車需求。艾默生電氣公司和霍尼韋爾國際公司等重要參與企業的出現以及研發活動的顯著成長預計將推動轉速表在該地區的廣泛採用。

- 該地區車輛銷售和運作的成長預計將推動用戶和製造商採用轉速表。例如,根據中國工業協會(CAAM)的數據,2021年僅中國就銷售了約479萬輛商用車和2,148萬輛乘用車。

- 支持性的政府法規對亞太地區電動汽車產業的發展發揮重要作用。例如,2021年,印度聯合內閣核准了價值1810億印度盧比的國家先進化學電池生產相關獎勵計劃,用於印度的電池製造和儲存。印度政府也實施了多項促銷措施,包括對電動車車主的稅收優惠和發展公共電動車充電基礎設施,預計這些措施將在未來幾年推動電動車產業的發展。

- 此外,政府和私人公司增加對風力發電的投資預計將在預測期內推動市場成長。例如,國際可再生能源機構預測,到2050年,亞洲將成為風力發電的主要市場,佔陸上風力發電量的50%以上,離岸風力發電的60%以上。

轉速表產業概況

轉速表市場上的競爭公司之間的競爭非常激烈,主要企業包括艾默生電氣、施耐德電氣和霍尼韋爾國際公司。然而,市場仍處於整合狀態。透過研究和開發,市場上的每家公司都比其他參與企業獲得了競爭優勢。策略夥伴關係和併購使這些公司在市場上佔據了更大的佔有率。

- 2022 年 7 月 - 為研討會提供高品質專業設備的 Jaltest Tools 推出了一款新型數位轉速計 (5,000 2008),用於測量汽車冷卻系統風扇等零件的轉速 (rpm),現已上市。新產品包括計算一定時間內的旋轉次數並顯示測量過程中的最大值和最小值的功能。

- 2021 年 9 月 - Nippon Seiki 計畫停產 ADVANCE RS 80 轉速表,並重新推出稍作改動的 ES 80 轉速表。該公司還表示,零件的變化將導致新產品的價格上漲。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 中國產業價值分析

- COVID-19對轉速表市場的影響分析

第5章市場動態

- 市場促進因素

- 汽車需求增加

- 對轉速監控的需求不斷增加

- 市場限制因素

- 維護成本高

第6章 市場細分

- 按資料擷取方式

- 接觸式

- 非接觸式

- 按最終用戶產業

- 車

- 航太

- 工業的

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Testo SE & Co. KGaA

- Emerson Electric Co.

- Schneider Electric corporation

- PCE Deutschland GmbH

- PROMAX ELECTRONICA SL

- Monarch Instrument

- Ono Sokki India Private Limited.

- SKF AB

- Precision Scientific Instruments Corporation

- Dantec Dynamics A/S.(Nova Instruments Company)

- SRI Electronics

- Shanghai Automation Instrumentation Co., Ltd

- Lutron Electronic Enterprise Co., Ltd.

- LOR Manufacturing Company, Inc.

第8章投資分析

第9章 市場機會及未來趨勢

簡介目錄

Product Code: 67179

The Tachometer Market is expected to register a CAGR of 10% during the forecast period.

Key Highlights

- Due to the robust growth, the autonomous car is instrumental in driving the radar sensor demand. Tachometer technology is driven by the new car assessment program among the OEMs, as they integrate these systems to complement camera devices for ADAS applications. Radars, combined with other sensors and tachometers, provide enhanced information on safety and collision avoidance.

- Furthermore, the increasing deployment of traffic wind turbines is expected to fuel the adoption of tachometers as it is an essential component that is used to display the revolutions per minute (RPM) on calibrated analog dials or digital displays. For instance, TAK Studio designed overhead highway lights powered by wind turbines that are spun by the air turbulence generated as cars and trucks travel past at high speed.

- Additionally, the increasing investments by the governments to promote cleaner-greener-energy technologies such as windmills are also expected to fuel the market growth over the forecast period.

- The application of tachometers in diverse end users is encouraged by product developments by smaller vendors, reflecting its wide appropriation. In December 2021, GPMS International Inc. announced that it received ODA Approval to install Foresight MX on the Mi- family of helicopters. The certification package was ODA approved, comprising compliance with FAA Supplemental Type Certificate requirements, and is open to local civil aviation authority authorization. Aftermarket Foresight MX kits consist of 16 CPU-equipped smart sensors, three tachometers, and an Onboard Control Unit. The Foresight MX-equipped aircraft is expected to be scheduled for servicing the United Nations World Food Program's humanitarian mission in Africa in 2022.

- However, technical limitations such as higher maintenance cost, its susceptibility to errors as these devices have magnets, which can weaken over time, and if overheated along with the easy availability of low-cost counterfeit products in the market are some of the major factors challenging the growth of the studied market.

- The COVID-19 outbreak forced companies worldwide to adjust their strategies to survive in the 'new normal.' The COVID-19 outbreak affected various manufacturing industries, resulting in a temporary shutdown of industrial operations. The production of automobiles across mediums and industrial applications, which are prominent adopters of tachometers, was affected by the disruption in the supply chains.

- Furthermore, the need for immediately advanced trucking units swept commercial economies worldwide, with an immediate impact post the first wave of the pandemic, when there was a significant reduction in the transportation capabilities of companies. A complete shutdown of international borders limited the mediums for the shipping of goods to their destinations. This forced truck vendors and railway and airplane manufacturers to recognize the need for better oversight over operations through improved infrastructure.

Tachometer Market Trends

Automotive Sector is Expected to Register a Significant Growth

- The tachometer shows the rotation rate of the engine's crankshaft to enable the driver to choose the right throttle and gear for driving conditions that allow them a smooth and efficient drive. The increasing number of vehicles sold is expected to boost the adoption of tachometers by vehicle manufacturers over the forecast period. For instance, according to OICA, the global sales of automobiles reached 82.68 million in 2021.

- Governments are increasingly promoting the usage of electric vehicles. For instance, in early 2022, the European Union announced a EUR 750 billion stimulus package that includes EUR 20 billion to boost the sales of clean vehicles and a provision of EUR 1 million to install electric and hydrogen vehicle charging stations by 2025. This indicates that the number of electric cars is expected to grow, fueling the adoption of the tachometers over the forecast period.

- China has emerged among the leading adopters of electric vehicles and has even outpaced European countries. The growing environmental concerns and supportive government regulation are among the primary factors driving the growth of the EV industry in China. For instance, in 2021, the Chinese government unveiled its roadmap for the EV industry, according to which 40 percent of the vehicles sold in the country will be electric by 2030.

- Passenger car sales have increased significantly in the last few decades, owing to the economic growth of developing countries, especially in the Asia Pacific, Middle East, and Latin American region. According to the data provided by OICA, the global sales of passenger cars reached 56.4 million units in 2021, from 53.92 million units in 2020. Such trends are expected to have a positive impact on the growth of the studied market.

Asia Pacific to Hold Significant Market Share

- The growth of the industrial sector, and the large population driving the demand for automobiles, are some of the major factors driving the market for tachometers in the Asia Pacific region. The presence of some significant players in the area, such as Emerson Electric Co., and Honeywell International Inc., amongst others, coupled with the remarkable growth in research and development activities, are expected to promote wide-scale adoption of tachometers in the region.

- The increasing sales and number of vehicles in operation in the region are expected to boost the adoption of the tachometers by the user and manufacturers. For instance, according to the China Association of Automobile Manufacturers (CAAM), in 2021, about 4.79 million commercial vehicles and 21.48 million passenger cars were sold in China alone.

- Supportive government regulations play a crucial role in developing the electric vehicle industry in the Asia Pacific region. For instance, in 2021, India's Union Cabinet approved INR 18,100 crore worth National Program on Advance Chemistry Cells Production Linked Incentive Scheme for battery manufacturing and storage in India. The Indian government is also running several promotional measures, including tax incentives for electric vehicle owners, public EV charging infrastructure development, etc., which are expected to drive the EV industry forward in the coming years.

- Furthermore, the increasing investments by the government and private players in wind power are expected to boost market growth over the forecast period. For instance, according to the forecasts by International Renewable Energy Agency, Asia is poised to become the leading market for wind energy, accounting for more than 50% of onshore and 60% of offshore wind installations by 2050.

Tachometer Industry Overview

The competitive rivalry in the tachometer market is high owing to some key players such as Emerson Electric, Schneider Electric, and Honeywell International Inc., among others. However, the market remains consolidated. Through research and development, the companies in the market have gained a competitive advantage over other players. Strategic partnerships and, mergers & acquisitions have allowed these companies to achieve a more significant footprint in the market.

- July 2022 - Jaltest Tools, a provider of workshops with high-quality professional equipment, launched the new digital tachometer (50002008) to measure the speed (rpm) of components such as the cooling system fan of vehicles. Some features of the new product include counting the number of turns for a certain period and displaying maximum and minimum values during measurement.

- September 2021 - Nippon Seiki Co., Ltd. discontinued the ADVANCE RS 80 tachometer with the plans to relaunch the ES 80 tachometer by adding minor changes. The company also hinted that the price of new products would be higher due to changes in parts.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value China Analysis

- 4.4 Analysis on the impact of COVID-19 on the Tachometer Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Automobiles

- 5.1.2 Increasing Need for Rotation Speed Monitoring

- 5.2 Market Restraints

- 5.2.1 High Maintenance Cost

6 MARKET SEGMENTATION

- 6.1 By Data Acquisition Method

- 6.1.1 Contact Type

- 6.1.2 Non-Contact Type

- 6.2 By End-user Industry

- 6.2.1 Automotive

- 6.2.2 Aerospace

- 6.2.3 Industrial

- 6.2.4 Other End-user Industries

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Testo SE & Co. KGaA

- 7.1.2 Emerson Electric Co.

- 7.1.3 Schneider Electric corporation

- 7.1.4 PCE Deutschland GmbH

- 7.1.5 PROMAX ELECTRONICA S.L

- 7.1.6 Monarch Instrument

- 7.1.7 Ono Sokki India Private Limited.

- 7.1.8 SKF AB

- 7.1.9 Precision Scientific Instruments Corporation.

- 7.1.10 Dantec Dynamics A/S. (Nova Instruments Company)

- 7.1.11 SRI Electronics

- 7.1.12 Shanghai Automation Instrumentation Co., Ltd

- 7.1.13 Lutron Electronic Enterprise Co., Ltd.

- 7.1.14 LOR Manufacturing Company, Inc.

8 INVESTMENT ANALYSIS

9 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219