|

市場調查報告書

商品編碼

1630301

收縮和彈力套筒標籤:市場佔有率分析、行業趨勢和成長預測(2025-2030)Shrink And Stretch Sleeve Labels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

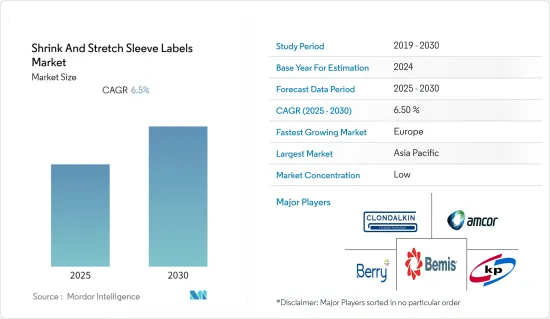

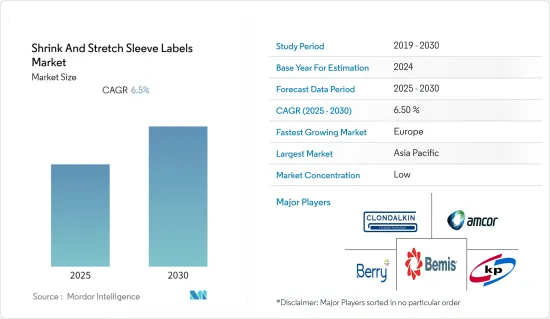

收縮和彈力套筒標籤市場預計在預測期內複合年成長率為 6.5%。

主要亮點

- 這些標籤是一種先進的標籤解決方案,與傳統的不乾膠標籤相比具有顯著的優勢。廣泛應用於食品飲料、家居用品、化工包裝等各行業。

- 由於對創新且具有視覺吸引力的包裝解決方案的需求不斷增加,收縮和彈力套筒標籤市場在過去十年中經歷了顯著成長。這種成長是由印刷技術的進步以及競爭市場中對產品差異化日益成長的需求所推動的。

- 這些標籤由 PVC、PETG 和 OPS 等聚合材料製成,可包裝您的產品並提供無縫的 360 度品牌宣傳機會。與傳統標籤相比,這種全身標籤具有顯著優勢,允許品牌利用整個表面區域進行行銷和資訊宣傳。在這些標籤上列印高解析度圖形和鮮豔色彩的能力提高了品牌知名度和消費者興趣。

- 這種趨勢在食品和飲料產業尤其明顯,視覺吸引力直接影響消費者的購買決策。此外,製藥和個人護理行業依賴這些標籤來符合複雜的幾何形狀、提供防篡改功能並增強整體產品吸引力。收縮和彈力套筒標籤用途廣泛,足以適應各種容器形狀和尺寸,使其成為希望提高貨架展示度和品牌認知度的製造商的首選。

- 全球收縮和彈力套筒標籤市場主要由亞太地區主導,地區差異較大。該地區的成長是由強大的製造業、不斷成長的中等收入人口以及對包裝商品不斷成長的需求所推動的。中國、印度、日本等重點市場以先進技術和大規模產能領先。

- 儘管收縮和彈力套筒標籤市場有著光明的成長軌跡,但它也面臨重大挑戰。其中最主要的是塑膠材料對環境的影響,監管機構和具有環保意識的消費者對塑膠材料的審查越來越嚴格。

收縮和彈力套筒標籤市場趨勢

增加各種產品貨架吸引力的需求預計將推動市場

- 收縮和彈力套筒標籤市場的主要成長要素是增強產品商店吸引力的需求不斷成長。消費品產業的競爭日益激烈,促使品牌採取創新策略來脫穎而出。收縮和彈力套筒標籤以其全身覆蓋和高品質印刷而聞名,是一種有吸引力的解決方案。

- 360度品牌可以比傳統標籤進行更精緻的設計,大大增加了貨架上產品的視覺衝擊力。這種知名度的提高吸引了消費者的注意力並導致銷量增加。此外,包裝飲料消費量的增加進一步加速了收縮和彈力套筒標籤市場的發展。

- 收縮和彈力套筒標籤越來越受歡迎,主要是因為它們的設計多功能性。它可以無縫地裝入容器中,無論是瓶子、罐子還是不規則形狀的容器,使其成為各種產品的完美選擇。這種適應性使品牌能夠創造出傳統標籤無法實現的創新設計。

- 該公司現在正在整合霧面飾面、金屬效果和觸覺元素,以增強消費者的視覺和觸覺體驗。這些先進的包裝能力對於希望在競爭激烈的市場中脫穎而出的品牌至關重要。

亞太地區在收縮和彈力套筒標籤市場中佔據主要佔有率

- 亞太地區的收縮和彈力套筒標籤市場主要由中國和印度推動,但其成長背後有多個因素。這些包括都市化進程的加速、包裝食品消費的增加、聚合物薄膜的可用性的提高以及更具成本效益的勞動力。都市化推動了消費品需求的增加,並增加了對高效包裝解決方案的需求。

- 同時,由於生活方式的不斷變化和可支配收入的增加,包裝食品的消費量增加,使簡便食品成為主流。製造此類套管所必需的聚合物薄膜的易得性確保了原料的穩定供應。此外,該地區具有競爭力的人事費用有助於降低生產成本,使這些標籤解決方案對製造商來說具有成本效益。

- 東南亞被稱為對價格敏感的市場,隨著收縮和拉伸套的推出,該市場有望顯著成長。這些套筒以具有複雜設計的經濟高效的裝飾容器而聞名,並且在該地區的市場上越來越受歡迎。聚合物薄膜的現成供應和可承受的人事費用進一步增強了市場動力。鑑於該地區的價格敏感性,收縮和拉伸套已成為尋求平衡成本效率與優質包裝的製造商的一個有吸引力的選擇。此外,這些套筒可實現複雜的設計,使品牌能夠在擁擠的貨架上脫穎而出,增加對消費者的吸引力。

- 儘管中國和印度引領亞太市場,但該地區每個國家對 COVID-19 疫情都有自己獨特的應對措施。值得注意的是,包裝和標籤產業的製造和生產在包裝對 GDP 貢獻顯著的國家中持續存在。這次疫情凸顯了包裝在保護產品安全和完整性、支持這些產業需求方面發揮的關鍵作用。包裝工業強大的國家不僅保持了經濟穩定,而且透過持續生產和創新標籤解決方案增強了國內生產總值。

- 每個地區的國家對加工食品的需求正在顯著增加。由於拉伸和收縮薄膜的多功能性、耐用性和成本效益,製造商對它們越來越感興趣。這種採用率的增加不僅幫助食品製造商提供更安全、更高品質的產品,而且還刺激了對拉伸套和收縮標籤的需求。

- 該薄膜的適應性使其能夠適應各種容器形狀和尺寸,滿足各種包裝需求。其耐用性使標籤在整個產品生命週期中保持完整和清晰,其成本效益吸引了尋求最佳化包裝預算的製造商。因此,對這些標籤解決方案的需求只會不斷增加,支持整個亞太市場的擴張。

收縮和彈力套筒標籤行業概述

收縮和彈力套筒標籤市場呈現出高度分散的競爭格局,以大量區域性中小企業為特徵。不斷成長的客製化需求正在推動這些中小企業的崛起,每家企業都針對客戶需求量身定做特定細分市場。

主要企業正在採取策略性收購和夥伴關係關係,為市場帶來創新解決方案。收縮和彈力套筒標籤市場的主要企業正在策略性地收購其他公司並與其他公司合作,以加強產品系列併推出創新解決方案。這些策略旨在加強我們的市場地位並滿足消費者不斷變化的需求。

- 2024 年 6 月,全球永續包裝解決方案領導者 Amcor 與知名零嘴零食製造商 Lorenz Snacks 合作,為其扁豆塗層花生產品推出可回收包裝。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 宏觀經濟因素對市場的影響

- 標籤產業整體主要趨勢分析(收縮標籤與套筒標籤佔有率比較)

第5章市場動態

- 市場概況

- 市場促進因素

- 能夠適合任何尺寸和形狀並提供您所需的保護

- 提高商店各種產品吸引力的需求

- 防篡改的需求推動了收縮套管市場

- 市場挑戰

- 飲料業對立式袋的需求不斷成長以及整個回收過程的複雜性

- 市場機會

第6章 市場細分

- 按類型

- 收縮套管

- 拉伸套

- 按材質

- PVC

- PET

- PE

- OPP &OPS

- 其他材料(PO、PLA等)

- 按最終用戶

- 食物

- 軟性飲料

- 酒精飲料

- 化妝品/家居用品

- 藥品

- 其他最終用戶

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 亞洲

- 中國

- 印度

- 日本

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Bemis Company

- Berry Plastic Group Inc.

- Klockner Pentaplast Group

- Amcor PLC

- Clondalkin Group Holdings BZ

- Huhtamaki Oyj

- Schur Flexibles

- Cenveo Group

- Taghleef Industries

第8章 收縮標籤和套筒標籤主要樹脂供應商

- Exxon Mobil Corporation

- Eastman Chemicals

- Lyondell Basell

- The Dow Chemical Company

- Celanese Corporation

- Indorama Group

- LG Chem Limited

- Carmel Olefins Limited

- Borealis Group

- Nova Chemicals

- SABIC Group

第9章投資分析

第10章市場展望

The Shrink And Stretch Sleeve Labels Market is expected to register a CAGR of 6.5% during the forecast period.

Key Highlights

- These labels represent advanced labeling solutions that offer significant advantages over traditional adhesive labels. They are extensively utilized across various industries, including food and beverage, household products, and chemical packaging.

- The shrink and stretch sleeve labels market has experienced significant growth over the past decade, driven by the increasing demand for innovative and visually appealing packaging solutions. This growth is attributed to advancements in printing technologies and the rising need for product differentiation in a competitive market.

- These labels, made from polymer materials such as PVC, PETG, and OPS, encase products, providing a seamless 360-degree branding opportunity. This full-body coverage offers substantial advantages over traditional labels, allowing brands to utilize the entire surface area for marketing and information purposes. The ability to print high-resolution graphics and vibrant colors on these labels enhances brand visibility and consumer engagement.

- This trend is particularly prevalent in the food and beverage industry, where visual appeal directly influences consumer purchasing decisions. Additionally, the pharmaceutical and personal care industries have adopted these labels for their ability to conform to complex shapes, provide tamper evidence, and enhance the product's overall appeal. The versatility of shrink and stretch sleeve labels in accommodating various container shapes and sizes makes them a preferred choice for manufacturers aiming to improve shelf presence and brand recognition.

- Asia-Pacific dominates the global shrink and stretch sleeve labels market, exhibiting significant regional disparities. The region's growth is driven by a robust manufacturing industry, a growing middle-income group, and increasing demand for packaged goods. Key markets such as China, India, and Japan lead the way, capitalizing on their advanced technology and large-scale production capabilities.

- Although the shrink and stretch sleeve labels market demonstrates a promising growth trajectory, it faces significant challenges. Chief among these is the environmental impact of plastic-based materials, which has attracted increased scrutiny from regulators and environmentally conscious consumers.

Shrink And Stretch Sleeve Labels Market Trends

Demand to Increase On-shelf Appeal of Various Products Expected to Drive the Market

- The rising demand for enhancing product shelf appeal is a primary growth driver for the shrink and stretch sleeve labels market. As competition intensifies in the consumer goods industry, brands are increasingly adopting innovative strategies for differentiation. Shrink and stretch sleeve labels, known for their full-body coverage and high-quality prints, present a compelling solution.

- Their 360-degree branding capability allows for more elaborate designs than conventional labels, significantly boosting a product's visual impact on the shelf. This increased visibility attracts more consumer attention and drives higher sales. Moreover, the growing consumption of packaged beverages is further accelerating the shrink and stretch sleeve labels market.

- Shrink and stretch sleeve labels are gaining traction primarily due to their design versatility. They conform seamlessly to containers, whether bottles, jars, or irregular shapes, making them an optimal choice for diverse products. This adaptability enables brands to implement innovative designs that traditional labels cannot achieve.

- Companies now incorporate matte finishes, metallic effects, and tactile elements, enhancing the consumer's visual and tactile experience. Such advanced packaging capabilities are essential for brands aiming to differentiate themselves in a competitive market.

Asia-Pacific Holds a Significant Share of the Shrink and Stretch Sleeve Labels Market

- The Asia-Pacific shrink and stretch sleeve labels market, primarily driven by China and India, owes its growth to several factors. These include increased urbanization, increased packaged food consumption, the ready availability of polymer films, and a cost-effective labor force. Urbanization has spurred greater demand for consumer goods, subsequently driving the need for efficient packaging solutions.

- Meanwhile, the uptick in packaged food consumption, attributed to evolving lifestyles and rising disposable incomes, has made convenience foods more mainstream. The easy accessibility of polymer films, crucial for crafting these sleeves, ensures a consistent raw material supply. Furthermore, the region's competitive labor costs help curb production expenses, rendering these labeling solutions more cost-effective for manufacturers.

- Southeast Asia, known for its price-sensitive market, is poised for significant growth in introducing shrink and stretch sleeves. These sleeves, known for their cost-effective embellishment of containers with intricate designs, are gaining favor in the regional market. With polymer films readily available and labor costs affordable, the market's momentum is further bolstered. Given the region's price sensitivity, shrink and stretch sleeves emerge as an appealing choice for manufacturers seeking to balance cost-efficiency with premium packaging. Moreover, the intricate designs achievable with these sleeves enable brands to stand out on crowded shelves, enhancing their appeal to consumers.

- While China and India lead the Asia-Pacific market, each country in the region responded uniquely to the COVID-19 pandemic. Notably, in nations where packaging significantly contributes to the GDP, the manufacturing and production of packaging and labeling industries have persevered. The pandemic underscored packaging's pivotal role in safeguarding product safety and integrity, sustaining demand in these industries. Countries with robust packaging industries have not only maintained economic stability but also bolstered their GDP through continuous production and innovative labeling solutions.

- Across regional countries, there has been a marked uptick in processed food demand. Manufacturers are increasingly turning to stretch and shrink films, drawn by their versatility, durability, and cost-effectiveness. This heightened adoption not only aids food manufacturers in delivering safer, higher-quality products but also fuels the demand for stretch sleeves and shrink labels.

- The films' adaptability allows them to fit various container shapes and sizes, catering to diverse packaging needs. Their durability ensures labels remain intact and legible throughout the product's lifecycle, while their cost-effectiveness appeals to manufacturers aiming to optimize packaging budgets. Consequently, the demand for these labeling solutions continues to rise, bolstering the Asia-Pacific market's overall expansion.

Shrink And Stretch Sleeve Labels Industry Overview

The shrink and stretch sleeve labels market exhibits a highly fragmented competitive landscape characterized by numerous regional small and medium-sized enterprises. The increasing demand for customization is fueling the emergence of these smaller players, each addressing a specific segment of customers' tailored requirements.

Key players are adopting strategic acquisitions and partnerships and bringing innovative solutions to the market. Key players in the shrink and stretch sleeve labels market are strategically acquiring and partnering with other companies to enhance their product portfolios and introduce innovative solutions. These strategies aim to strengthen their market position and meet the evolving demands of consumers.

- In June 2024, Amcor, a global player in sustainable packaging solutions, partnered with Lorenz Snacks, a prominent snack manufacturer, to introduce a recyclable package for its Lentil Coated Peanuts product.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Industry Attractiveness - Porter's Five Forces Analysis

- 4.1.1 Bargaining Power of Suppliers

- 4.1.2 Bargaining Power of Buyers/Consumers

- 4.1.3 Threat of New Entrants

- 4.1.4 Threat of Substitute Products

- 4.1.5 Intensity of Competitive Rivalry

- 4.2 Impact of Macroeconomic Factors on Market

- 4.3 Analysis of Key Trends in the Overall Labeling Industry (Share Comparison of Shrink and Sleeve Labels)

5 MARKET DYNAMICS

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Ability to Conform to any Size and Shape, and Yet Provide the Necessary Protection

- 5.2.2 Demand to Increase On-shelf Appeal of Various Products

- 5.2.3 Need for Tamper-evident Protection Will Drive the Shrink Sleeves Market

- 5.3 Market Challenges

- 5.3.1 Growing Demand for Stand-up Pouches in the Beverage Industry and Elaborate Nature of the Overall Recycling Process

- 5.4 Market Opportunities

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Shrink Sleeve

- 6.1.2 Stretch Sleeve

- 6.2 By Material

- 6.2.1 PVC

- 6.2.2 PET

- 6.2.3 PE

- 6.2.4 OPP & OPS

- 6.2.5 Other Materials (PO, PLA, etc.)

- 6.3 By End User

- 6.3.1 Food

- 6.3.2 Soft Drinks

- 6.3.3 Alcoholic Drinks

- 6.3.4 Cosmetics & Household

- 6.3.5 Pharmaceutical

- 6.3.6 Other End Users

- 6.4 By Geography

- 6.4.1 North America

- 6.4.1.1 United States

- 6.4.1.2 Canada

- 6.4.2 Europe

- 6.4.2.1 United Kingdom

- 6.4.2.2 Germany

- 6.4.2.3 France

- 6.4.3 Asia

- 6.4.3.1 China

- 6.4.3.2 India

- 6.4.3.3 Japan

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

- 6.4.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Bemis Company

- 7.1.2 Berry Plastic Group Inc.

- 7.1.3 Klockner Pentaplast Group

- 7.1.4 Amcor PLC

- 7.1.5 Clondalkin Group Holdings BZ

- 7.1.6 Huhtamaki Oyj

- 7.1.7 Schur Flexibles

- 7.1.8 Cenveo Group

- 7.1.9 Taghleef Industries

8 KEY RESIN SUPPLIERS OF SHRINK AND SLEEVE LABELS

- 8.1 Exxon Mobil Corporation

- 8.2 Eastman Chemicals

- 8.3 Lyondell Basell

- 8.4 The Dow Chemical Company

- 8.5 Celanese Corporation

- 8.6 Indorama Group

- 8.7 LG Chem Limited

- 8.8 Carmel Olefins Limited

- 8.9 Borealis Group

- 8.10 Nova Chemicals

- 8.11 SABIC Group