|

市場調查報告書

商品編碼

1851845

聲學攝影機:市場佔有率分析、行業趨勢、統計數據和成長預測(2025-2030 年)Acoustic Camera - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

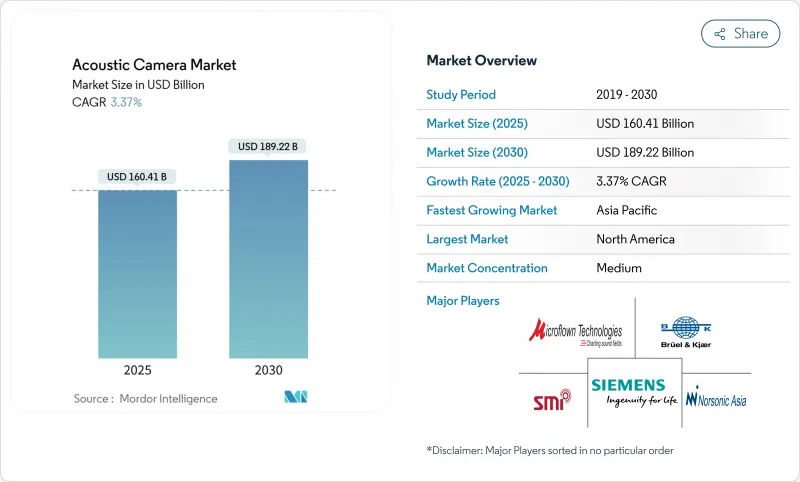

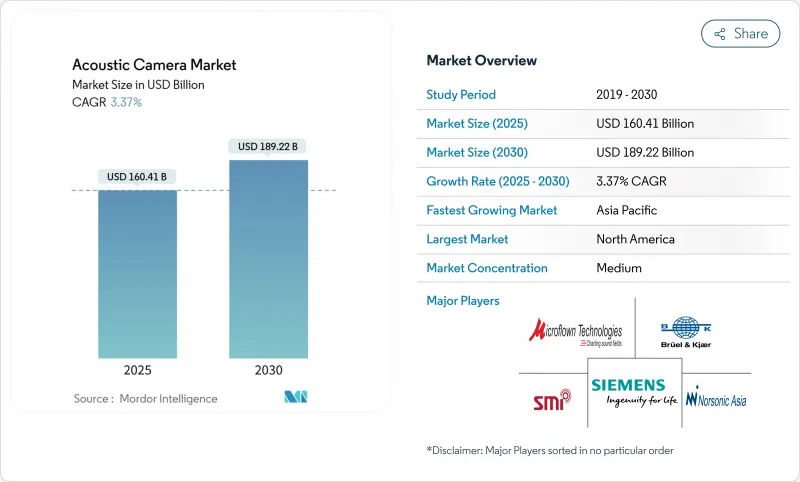

預計到 2025 年,聲學相機市場價值將達到 1,604.1 億美元,到 2030 年將達到 1,892.2 億美元,年複合成長率為 3.37%。

MEMS麥克風陣列成本的下降和緊湊型邊緣AI處理器的出現,正推動系統成本降至5000美元以下,使聲學成像技術從實驗室走向工廠車間和城市街道。市政部門正在部署噪音監視錄影機,汽車工程師正在將電動車的NVH測試數位化,公用事業公司正在將波束成形模組與預測性維護平台結合。邊緣分析現在可以在設備端運行,從而降低雲端頻寬和延遲,同時擴展遠端資產的應用場景。競爭的焦點不再是規模,而是演算法效率和軟體生態系統,這使得小眾創新者能夠與各種測試設備製造商競爭。

全球聲學相機市場趨勢與洞察

加強全球城市噪音管制

市政噪音法規正從使用聲級計進行點測量轉向空間成像測量,以識別違規車輛。歐洲和北美的一些城市將於2024年安裝基於攝影機的噪音雷達,其中像SoundVue這樣的解決方案可達到1級精度,滿足法律證據要件。歐盟的目標是到2030年將交通噪音降低30%,促使各方長期採購堅固耐用的戶外聲學攝影機。採購重點正從移動拖車轉向永久性路邊設備,以滿足多年的硬體需求和服務合約。

電動交通平台NVH的快速數位化

電動動力傳動系統減少了燃燒遮罩,使馬達、逆變器和空調管道的聲學特徵更加明顯。汽車製造商正在增加聲學測試預算,直至2024年。現代汽車已採用3D掃描鑽機對車內環境進行全面測繪。即時波束成形技術使工程師能夠在實際駕駛過程中可視化輻射模式,並在生產開始前完成校正。越來越多的商用貨車和城市公車也採用相同的技術來滿足舒適性和當地的噪音法規要求。

3D MEMS陣列裝置的初始投資很高。

測量級3D配置的成本可能超過10萬美元,因為數百個相位匹配的麥克風、精密外殼和高頻寬轉換器會推高材料和組裝成本。目前,光學MEMS麥克風的信噪比可達80 dB,但製程工具和產量比率的學習曲線限制了價格的大幅下降。在成本低於5萬美元的模組化陣列普及之前,規模較小的公司將使用共享實驗室或租賃3D系統。

細分市場分析

預計到2024年,2D聲學相機仍將佔據53%的市場佔有率,這主要得益於其久經考驗的可靠性和低廉的價格。它們在工廠洩漏檢測和汽車零件檢測等應用領域佔據主導地位。同時,由於車內噪音映射、都市區空中運動測試以及在複雜機器外殼內實現100%定位等應用,3D聲學相機預計將以16.2%的複合年成長率成長。配備192個麥克風的Octagon系統可提供20 Hz至10 頻寬的解析度。隨著MEMS成本的降低,3D聲學相機平台的市場規模預計將縮小與主流產品的差距。基於人工智慧的模式辨識技術提高了命中率,使得更小的孔徑也能達到傳統聲學相機的性能。

系統整合商正在將即時視覺化功能整合到CAD儀錶板中,使工程師能夠在幾分鐘內而非幾天內完成聲學處理方案的迭代。這種工作流程的簡化使得航太和豪華汽車產業能夠獲得更高的溢價。預計原型3D陣列將於2024年出貨,售價低於6萬美元,預示著中型供應商和大學實驗室將廣泛採用此技術。

由於明確的標準和可控的環境,近場聲學設備在2024年實現了61%的收入成長。艙室測試、變速箱分析和桌上型研發仍然是其主要應用場景。遠場系統的需求正以14.8%的複合年成長率成長,這與風力發電機噪音審核、智慧城市聲學測繪和飛機飛越測試等需求的成長趨勢相符。即使在吵雜的背景雜訊下,最小方差、低失真響應演算法也能分離50公尺以外的聲音來源。因此,預計到2030年,遠距聲學相機市場的規模將翻倍。基礎設施管理人員可以將數據整合到地理空間儀表板中,並將聲學指標疊加到設施藍圖上,以便快速派遣維修人員。

現場操作人員青睞堅固耐用的 IP65+機殼和低功耗邊緣處理器,這些處理器可透過 4G 或 LoRaWAN 傳輸警報。注重易於安裝和雲端 API 的供應商正在贏得市政競標和可再生能源電站專案。

聲學相機市場按陣列類型(2D陣列、3D陣列)、測量類型(近場、遠場)、應用(雜訊源定位、洩漏偵測等)、終端用戶產業(汽車及出行等)及地區進行細分。市場預測以美元計價。

區域分析

到2024年,歐洲將佔據聲學攝影機市場31%的佔有率,這得益於嚴格的環境法規和完善的汽車供應鏈。德國汽車製造商正在實施整車NVH(噪音、振動與聲振粗糙度)項目,將攝影機資料連鎖到數位雙胞胎中;法國各市正在進行為期多年的城市噪音攝影機試點項目,目標是到2030年將交通噪音降低30%。歐盟「地平線歐洲」計畫的資金籌措機制將加速產學研聯盟的發展,以改善3D波束形成軟體。

亞太地區將達到14.3%的複合年成長率。中國已根據GB/T 37153-2018標準對聲學車輛預警系統進行立法,並鼓勵一級供應商使用成像工具檢驗揚聲器的特徵訊號。深圳和新加坡的智慧城市計畫正在十字路口安裝永久性聲學測繪節點。一家以六標準差品質管理著稱的日本電子工廠正在貼片線上安裝鏡頭,以檢測真空洩漏的嘶嘶聲,從而確保區域訂單。印度不斷擴展的地鐵網路正在為壓縮空氣煞車系統指定聲學洩漏偵測裝置。

北美在航太領域保持著舉足輕重的地位,航空航太企業紛紛遵守美國聯邦航空管理局 (FAA) 的噪音認證要求,而美國職業安全與健康管理局 (OSHA) 也擴大了噪音暴露指南的範圍。工業終端用戶正在將聲學攝影機與振動、溫度和電能品質感測器整合到一個統一的控制面板中。墨西哥灣沿岸的油氣生產商正在為用於儲存槽檢查的機器人履帶配備鏡頭,從而降低進入密閉空間的風險。

南美洲、中東和非洲是新興但充滿潛力的地區。智利的礦業公司正在測試可攜式成像器,以識別通風扇共振;墨西哥灣沿岸的電力公司正在試用攝影機檢查沙漠中的輸電線路,因為在沙漠中,目視無人機難以應對眩光和沙塵。雖然這些地區的普及速度預計會比已開發地區慢兩到三年,但仍將為全球普及率做出貢獻。

其他福利:

- Excel格式的市場預測(ME)表

- 3個月的分析師支持

目錄

第1章 引言

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章 市場情勢

- 市場概覽

- 市場促進因素

- 加強全球城市噪音管制

- 電動車平台NVH的快速數位化

- 智慧工廠中攜帶式聲級計向影像感測器的轉變

- 提高航太客艙舒適度認證基準值

- 聲學相機市場:邊緣AI波束成形模組可實現低於5美元的物料清單成本

- 整合到自主機器人檢測有效載荷中

- 市場限制

- 3D MEMS陣列裝置的初始投資較高

- 區域內現場校準標準短缺

- 圍繞延遲求和波束成形智慧財產權的專利叢林

- 適用於惡劣天氣的耐用型公用設施選擇有限。

- 價值/供應鏈分析

- 監管環境

- 技術展望

- 波特五力分析

- 新進入者的威脅

- 買方的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭對手之間的競爭

第5章 市場規模與成長預測

- 按數組類型

- 2D數組

- 3D陣列

- 按測量類型

- 近場近場

- 遠場

- 透過使用

- 聲源探勘

- 洩漏測試

- 故障診斷

- 其他(生物聲學、研發)

- 按最終用戶行業分類

- 汽車與出行

- 航太/國防

- 電子和半導體

- 能源與電力

- 其他行業

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 英國

- 法國

- 其他歐洲地區

- 亞太地區

- 中國

- 日本

- 印度

- 亞太其他地區

- 中東和非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 其他中東和非洲地區

- 南美洲

- 巴西

- 阿根廷

- 其他南美洲國家

- 北美洲

第6章 競爭情勢

- 市場集中度

- 策略趨勢

- 市佔率分析

- 公司簡介

- Hottinger Brel and Kjr Sound and Vibration Measurement A/S

- gfai tech GmbH

- Teledyne FLIR LLC

- SM Instruments Inc.

- Fluke Corporation

- CAE Software and Systems GmbH

- Norsonic AS

- Microflown Technologies BV

- SINUS Messtechnik GmbH

- Sorama BV

- Polytec GmbH

- Visisonics Corporation

- Signal Interface Group LLC

- NL Acoustics Oy

- Ziegler-Instruments GmbH

- Siemens Digital Industries Software

第7章 市場機會與未來展望

The acoustic camera market was valued at USD 160.41 billion in 2025 and is forecast to reach USD 189.22 billion by 2030, expanding at a 3.37% CAGR.

Cost reductions in MEMS microphone arrays and the arrival of compact edge-AI processors have lowered system bills-of-materials below USD 5,000, moving acoustic imaging from research laboratories into factory floors and city streets. Municipal authorities are deploying noise-enforcement cameras, automotive engineers are digitizing NVH testing for electric vehicles, and utilities are pairing beamforming modules with predictive-maintenance platforms. Edge analytics now runs on-device, trimming cloud bandwidth and latency while widening use cases in remote assets. Competitive activity centers on algorithm efficiency and software ecosystems rather than scale, allowing niche innovators to stand alongside diversified test-instrument majors.

Global Acoustic Camera Market Trends and Insights

Tightening Global Urban-Noise Regulations

Municipal agencies are moving from point sound-level meters to spatial imaging that links violations to individual vehicles. European and North American cities installed camera-based noise radars during 2024, and solutions such as SoundVue deliver Class 1 accuracy that satisfies legal-evidence requirements. The European Union targets a 30% cut in transport noise by 2030, spurring long-term procurement of rugged outdoor acoustic cameras. Preference is shifting toward permanent roadside units over mobile trailers, anchoring multi-year hardware demand and service contracts.

Rapid NVH Digitalization in E-Mobility Platforms

Electric powertrains silence combustion masking, unveiling tonal signatures from motors, inverters, and HVAC ducts. Automakers boosted acoustic test budgets during 2024; Hyundai adopted 3-D scanning rigs for full interior mapping. Real-time beamforming lets engineers visualize radiation patterns under actual driving, closing corrective loops before start-of-production. Growing fleets of commercial vans and city buses adopt the same methodologies to meet comfort and regional noise-homologation rules.

High Upfront Capex for 3-D MEMS-Array Rigs

Research-grade 3-D configurations can exceed USD 100,000 because hundreds of phase-matched microphones, precision housings, and high-bandwidth converters raise material and assembly costs. Optical MEMS microphones now deliver 80 dB SNR, yet process tooling and yield learning curves postpone sweeping price drops. Small enterprises lean on shared-service laboratories or rent 3-D systems until modular arrays below USD 50,000 proliferate.

Other drivers and restraints analyzed in the detailed report include:

- Shift from Handheld Sound-Level Meters to Imaging Sensors on Smart Factories

- Rising Aerospace Cabin-Comfort Certification Thresholds

- Scarcity of Field-Calibration Standards Across Regions

For complete list of drivers and restraints, kindly check the Table Of Contents.

Segment Analysis

2-D architectures retained 53% share of the acoustic camera market in 2024 owing to proven reliability and lower pricing. They dominate plant leak surveys and automotive component checks. Meanwhile, 3-D units are moving at a 16.2% CAGR as cabin noise mapping, urban-air-mobility trials, and complex machinery enclosures call for full-volume localization. The Octagon system with 192 microphones demonstrates resolution across 20 Hz to 10 kHz bands. As MEMS costs ease, the acoustic camera market size for 3-D platforms is expected to close the gap with mainstream options. Artificial-intelligence pattern recognition is improving hit rates, allowing smaller apertures to match legacy performance.

System integrators embed real-time visualization within CAD dashboards, so engineers iterate acoustic treatments in minutes rather than days. This workflow compression justifies premiums in aerospace and luxury vehicle segments. Prototype 3-D arrays shipped in 2024 at under USD 60,000, signalling a trajectory toward broader adoption among mid-tier suppliers and university labs.

Near-field setups commanded 61% revenue in 2024 thanks to clear standards and controlled environments. Chamber testing, gearbox analysis, and benchtop RandD remain anchor use cases. Far-field demand is climbing at a 14.8% CAGR in step with wind turbine noise audits, smart city sound mapping, and aircraft pass-by trials. Minimum variance distortion less response algorithms now separate sources more than 50 m away despite heavy background traffic. As a result, the acoustic camera market size for long-range systems is projected to double through 2030. Infrastructure managers integrate data into geospatial dashboards that overlay acoustic metrics on facility blueprints for quick dispatch of repair crews.

Field operators value rugged enclosures rated IP65 or higher and low-power edge processors that relay alerts over 4G or LoRaWAN. Vendors emphasizing ease of installation and cloud APIs are winning bids in municipal tenders and renewable-energy farms.

The Acoustic Camera Market Segmented by Array Type (2-D Arrays, 3-D Arrays), Measurement Type (Near-Field, Far-Field), Application (Noise Source Identification, Leak Detection and More), End-User Industry (Automotive & Mobility and More), Geography. The Market Forecasts are Provided in Terms of Value (USD).

Geography Analysis

Europe held 31% of the acoustic camera market in 2024, anchored by stringent environmental regulations and a sophisticated automotive supply chain. German OEMs run full-vehicle NVH programs that cascade camera data into digital twins, while French municipalities engage multi-year urban noise-camera pilots to secure 30% transport noise cuts by 2030. Funding instruments from Horizon Europe accelerate academic-industry consortia that refine 3-D beamforming software.

APAC is set for a 14.3% CAGR. China legislated acoustic vehicle alerting systems under GB/T 37153-2018, pushing tier-one suppliers to validate loudspeaker signatures with imaging tools. Smart-city programs in Shenzhen and Singapore embed permanent acoustic mapping nodes at intersections. Japanese electronics plants, known for Six Sigma quality, fit cameras over pick-and-place lines to catch vacuum-leak hiss, driving consistent regional orders. India's expanding metro-rail footprint is specifying acoustic leak detection on compressed-air braking systems.

North America retains an influential role as aerospace primes comply with FAA noise certification and as OSHA broadens exposure guidelines. Industrial end users integrate acoustic cameras with vibration, thermal, and power-quality sensors in unified dashboards. Oil and gas producers in the Gulf Coast mount cameras on robotic crawlers for storage tank inspections, mitigating confined-space entry risks.

South America and the Middle East and Africa form nascent but promising territories. Mining operators in Chile test portable imagers to pinpoint vent fan resonance, while Gulf utilities trial cameras for desert power-line inspections where visual drones struggle with glare and sand. Uptake here is expected to trail advanced regions by two to three years yet remains additive to global volumes.

- Hottinger Brel and Kjr Sound and Vibration Measurement A/S

- gfai tech GmbH

- Teledyne FLIR LLC

- SM Instruments Inc.

- Fluke Corporation

- CAE Software and Systems GmbH

- Norsonic AS

- Microflown Technologies BV

- SINUS Messtechnik GmbH

- Sorama BV

- Polytec GmbH

- Visisonics Corporation

- Signal Interface Group LLC

- NL Acoustics Oy

- Ziegler-Instruments GmbH

- Siemens Digital Industries Software

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET LANDSCAPE

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Tightening global urban-noise regulations

- 4.2.2 Rapid NVH digitalisation in e-mobility platforms

- 4.2.3 Shift from handheld sound-level meters to imaging sensors on smart factories

- 4.2.4 Rising aerospace cabin-comfort certification thresholds

- 4.2.5 Edge-AI beamforming modules enable sub-$5 k BOM acoustic camera

- 4.2.6 Integration into autonomous-robot inspection payloads

- 4.3 Market Restraints

- 4.3.1 High upfront capex for 3D MEMS-array rigs

- 4.3.2 Scarcity of field-calibration standards across regions

- 4.3.3 Patent thickets around delay-and-sum beam-forming IP

- 4.3.4 Limited ruggedised options for harsh-weather utilities

- 4.4 Value / Supply-Chain Analysis

- 4.5 Regulatory Landscape

- 4.6 Technological Outlook

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Threat of New Entrants

- 4.7.2 Bargaining Power of Buyers

- 4.7.3 Bargaining Power of Suppliers

- 4.7.4 Threat of Substitutes

- 4.7.5 Competitive Rivalry

5 MARKET SIZE AND GROWTH FORECASTS (VALUE)

- 5.1 By Array Type

- 5.1.1 2-D Arrays

- 5.1.2 3-D Arrays

- 5.2 By Measurement Type

- 5.2.1 Near-Field

- 5.2.2 Far-Field

- 5.3 By Application

- 5.3.1 Noise Source Identification

- 5.3.2 Leak Detection

- 5.3.3 Mechanical Fault Diagnostics

- 5.3.4 Others (Bio-acoustics, RandD)

- 5.4 By End-user Industry

- 5.4.1 Automotive and Mobility

- 5.4.2 Aerospace and Defense

- 5.4.3 Electronics and Semiconductor

- 5.4.4 Energy and Power

- 5.4.5 Other Industries

- 5.5 By Geography

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 United Kingdom

- 5.5.2.3 France

- 5.5.2.4 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 Japan

- 5.5.3.3 India

- 5.5.3.4 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 United Arab Emirates

- 5.5.4.2 Saudi Arabia

- 5.5.4.3 South Africa

- 5.5.4.4 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration

- 6.2 Strategic Moves

- 6.3 Market Share Analysis

- 6.4 Company Profiles (includes Global level Overview, Market level overview, Core Segments, Financials as available, Strategic Information, Market Rank/Share, Products and Services, Recent Developments)

- 6.4.1 Hottinger Brel and Kjr Sound and Vibration Measurement A/S

- 6.4.2 gfai tech GmbH

- 6.4.3 Teledyne FLIR LLC

- 6.4.4 SM Instruments Inc.

- 6.4.5 Fluke Corporation

- 6.4.6 CAE Software and Systems GmbH

- 6.4.7 Norsonic AS

- 6.4.8 Microflown Technologies BV

- 6.4.9 SINUS Messtechnik GmbH

- 6.4.10 Sorama BV

- 6.4.11 Polytec GmbH

- 6.4.12 Visisonics Corporation

- 6.4.13 Signal Interface Group LLC

- 6.4.14 NL Acoustics Oy

- 6.4.15 Ziegler-Instruments GmbH

- 6.4.16 Siemens Digital Industries Software

7 MARKET OPPORTUNITIES AND FUTURE OUTLOOK

- 7.1 White-space and Unmet-Need Assessment