|

市場調查報告書

商品編碼

1630308

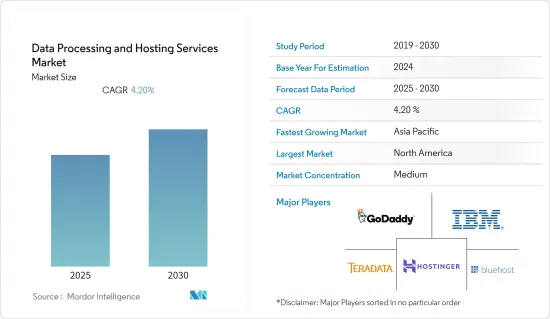

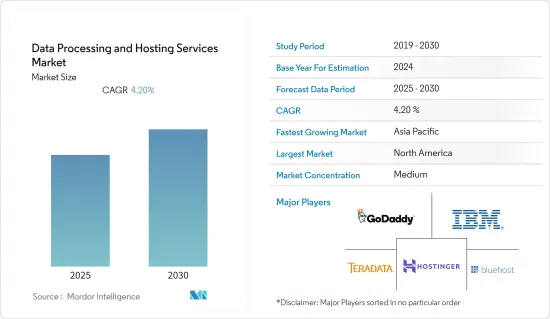

資料處理與託管服務:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Data Processing and Hosting Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

資料處理和託管服務市場預計在預測期內複合年成長率為 4.2%。

主要亮點

- 隨著消費者擴大使用線上遊戲、網路購物、透過線上訊息服務進行通訊以及線上串流內容,世界各地的各種最終用戶產業正在迅速數位化。這一趨勢預計將增加對資料處理和託管服務的需求,這些服務可以分析日益複雜和不斷增加的收集資料,以獲得對業務有用的見解。

- 新興市場的公司擴大將其IT基礎設施需求外包,這使託管提供者受益並進一步推動市場需求。此外,零售商和其他企業對線上展示的需求不斷成長,也提高了對託管服務的要求。

- 此外,資料在組織中的價值至關重要,因為它可以增強卓越營運並實現快速存取資訊。因此,組織正在迅速外包資料處理服務,以獲得高效率的業務洞察和成果。這些趨勢進一步推動了所研究的市場。

- 資料分析的重要部署還提高了利用多種資料分析技術成功準備來自多個來源的資料的風險,從而清理、合併和轉換投資回報率現在顯著更具永續性。人工智慧 (AI) 可能已經熟悉巨量資料,但物聯網 (IoT) 等應用正在將其提升到一個新的水平。分析大型資料集以獲取見解並增加網路流量的需求正在推動對資料處理和託管服務的需求。

- COVID-19 大流行刺激了各行業對雲端服務的採用,因為它們迅速轉向支援遠距工作和協作。據 Verizon 稱,實施隔離措施後,電玩遊戲的尖峰時段使用量每週猛增約 75%。這些娛樂選項的激增使得世界上許多 ISP 無法跟上流量的成長,從而增加了對市場研究的需求。

資料處理和託管服務的市場趨勢

隨著雲端基礎平台的出現,網頁寄存成為驅動力

- 網站寄存服務越來越受歡迎,因為它們滿足了客戶對其選擇的合適網站寄存服務日益成長的需求。此外,在預測期內,組織擴大採用雲端服務也為網路託管領域創造了機會。

- 雲端的出現對於資料管理和託管服務的現代化具有里程碑意義。對於企業來說,這是一種經濟高效的方式,可以利用最新的技術和架構,而無需花費大量的前期成本來購買、安裝和配置必要的硬體、軟體和基礎設施。

- 大型企業也能夠透過非常有效地利用現有資源和管理能力來快速適應不斷發展的資料主導市場。此外,世界各地的中小企業也見證了對雲端基礎的託管服務的需求不斷成長,預計這將在預測期內推動網站託管行業的發展。例如,根據 Digital Ocean 的數據,到 2021 年,74% 的企業將使用雲端託管/基礎設施服務。此外,66% 的科技中小企業和 44% 的傳統中小企業使用雲端託管服務。

- BFSI 在北美、亞太和歐洲全部區域的強大影響力是數位服務日益普及的重要支持。對多種資料處理技術產生的大量資料進行分析的巨大需求,刺激了預測期內的市場需求。

亞太地區在預測期內成長最快

- 亞太地區在全球網路人口中所佔比例很高,隨著大大小小的企業迅速轉向雲端服務,預計在預測期內將出現強勁成長。 IBM、亞馬遜等國際市場廠商正進軍該地區,而華為投資控股公司等國內巨頭也正在改變IT格局。

- 此外,包括中國、日本和印度在內的所有行業日益數位化,將顯著增加對資料處理和託管服務的需求。不斷發展的技術和大多數新服務相對較低的附加成本意味著許多最終用戶行業經常升級現有服務並提供新服務,以吸引和留住客戶。

- 政府的大力支持和私營部門的大量投資正在推動雲端運算產業的成長。韓國政府引入了雲端運算技術,以利用該國超快的網路連接和穩定的 LTE 可用性,並改善電子政府服務。憑藉超快的網路連線和穩定的 LTE 可用性,韓國政府引入了雲端運算技術來改善電子政府服務。

- 此外,由於中小企業的投資,該地區預計將實現成長。中小型企業正在投資更多地採用基於雲端基礎的技術先進的解決方案。例如,根據中小微型企業部的最新資料,印度擁有5,000萬家中小企業,是全球最大的中小企業之一。鑑於政府和中小企業依賴高度擴充性的IT系統和解決方案,他們將流程和敏感資訊轉移到雲端,從而顯著推動市場成長是可以理解的。

資料處理與託管服務產業概述

資料處理和託管服務市場競爭適度,主要參與者包括: GoDaddy Operating Company LLC.、Bluehost (Endurance International Group)、HostGator.com LLC、Hostinger International, Ltd. 和 Amazon Web Services Inc. 目前,一些參與者在市場佔有率方面佔據主導地位。參與者正在增加其市場佔有率,擴大其業務足跡,從而形成新興經濟體。

- 2022 年 11 月 - Teradata 和 Vicinity 宣佈建立合作夥伴關係,幫助企業創建單一可用的資料集以提高業務效率,並創建多樣化的分散式資料以獲取業務洞察。該組合解決方案透過提高速度、效能和跨距離部署靈活性、降低資料管理成本以及提高多地點、多重雲端和混合環境中的全球領先企業的效率來節省成本。

- 2022 年 10 月 - Hostinger 推出了用於 API 和輔助系統的下一代網路託管解決方案 Node 叢集,以簡化的格式提供更好的性能,以降低成本、擴展、硬體故障和維護一種耐時的解決方案,可縮短網站所需的時間響應並可供所有客戶使用。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買家/消費者的議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 技術簡介

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 擴大雲端運算的採用以實現規模經濟

- 資料處理服務外包需求不斷成長

- 市場限制因素

- 託管基礎設施缺乏靈活性和擴充性

第6章 市場細分

- 按組織

- 主要企業

- 中小企業 (SME)

- 按服務

- 資料處理服務

- 資料輸入服務

- 資料探勘服務

- 資料清理和格式化

- 資料掃描和索引

- 託管服務

- 網路託管

- 雲端託管

- 共用(經銷商)託管

- 虛擬專用伺服器 (VPS) 託管

- WordPress 託管

- 應用程式託管

- 資料處理服務

- 按最終用戶產業

- 資訊科技/通訊

- BFSI

- 零售

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- GoDaddy Operating Company LLC.

- Bluehost(Endurance International Group)

- HostGator.com LLC

- Hostinger International, Ltd.

- Amazon Web Services Inc.

- SiteGround Hosting Ltd.

- A2Hosting

- DreamHost LLC.

- GreenGeeks.com

- IBM Corporation

- Teradata Corporation

- Hewlett Packard Enterprise Development LP

- SAP SE

- Oracle Corporation

- Alteryx Inc.

- Cloudera Inc.

- Salesforce.com Inc.

第8章投資分析

第9章 市場機會及未來趨勢

The Data Processing and Hosting Services Market is expected to register a CAGR of 4.2% during the forecast period.

Key Highlights

- The rapid digital transformation of various end-user industries worldwide as consumers increasingly play online video games, shop online, communicate via online-based messenger services, and stream content online. This trend is expected to increase demand for data processing and hosting services to analyze the increasingly complex, growing volume of collected data for helpful business insights.

- Businesses across emerging markets have increasingly outsourced their IT infrastructure needs, benefiting hosting operators and driving market demand further. In addition, the growing demand from companies such as retail for online presence is causing the condition for hosting services.

- Further, the data value in an organization is significant since it enhances operational excellence and allows for quick access to information. Using additional staffing to handle data processing is expensive for small or large organizations; thus, organizations rapidly outsource data processing services for efficient business insights and outcomes. Such a trend further drives the studied market.

- The significant data analytics deployment also elevated the stakes for successful data preparation from many sources utilizing multiple data analysis techniques, thereby maintaining substantial ROI cleaning, combining, and transforming unstructured data. Though Artificial intelligence (AI) may have familiarized big data, applications such as the internet of things (IoT) are taking it to the next level. The need to analyze large datasets to develop insights and increase internet traffic is increasing the demand for data processing and hosting services.

- The COVID-19 pandemic spurred cloud services adoption across all industries as they rapidly pivoted to support remote work and collaboration. According to Verizon, video game usage during peak hours had shot up by approximately 75% a week after the quarantine was imposed. These surges for entertainment options have left many ISPs globally unable to cope with the increased traffic, directing the need for the market studied.

Data Processing and Hosting Service Market Trends

Web Hosting is Gaining Traction Due to Emergence of Cloud-based Platform

- Web hosting services are gaining traction to cater to the rising demand from the client requirement that is suitable as per the selected web hosting service. In addition, the growing cloud services adoption in organizations is also creating opportunities for the web hosting segment over the forecast period.

- The cloud emergence is monumental in modernizing data management and hosting services. It is a cost-effective method for companies to take advantage of modern technology and architecture without the enormous upfront cost of purchasing, installing, and configuring the required hardware, software, and infrastructure.

- Also, the large enterprises were able to adapt to an evolving data-driven marketplace very quickly, with the help of their existing resources and capabilities to manage them very effectively. Further, SMBs worldwide also witness a growing demand for cloud-based hosting services, which is expected to drive the web hosting segment over the forecast period. For instance, according to Digital Ocean, in 2021, 74% of enterprises indicated using cloud hosting/infrastructure services. Moreover, 66% of tech-based SMBs and 44% of traditional SMBs indicated using cloud hosting services.

- The substantial presence of BFSI across the emerging regions of North America, Asia Pacific, and Europe have significantly driven an increased digital services penetration. It generates massive demand for analyzing enormous data generated through multiple data processing techniques, thereby fueling the market demand during the forecast period.

Asia Pacific to Register as the Largest Growth During the Forecast Period

- The Asia-Pacific region is expected to witness significant growth over the forecast period, owing to the region's high percentage of the World Internet Population and rapid shift towards cloud services by large organizations and SMEs. Besides international market vendors like IBM and Amazon setting up in the region, some homegrown giants like Huawei Investment & Holding Company are transforming the IT landscape.

- Further, the growing digitalization in every industry across countries like China, Japan, and India will significantly drive the demand for data processing and hosting services. Due to constantly evolving technology and the relatively low additional cost of most new services, many end-user industries frequently upgrade their existing services and offer new ones to attract or retain customers.

- Strong government backing and substantial private sector investments are boosting the cloud computing industry's growth. The South Korean government deployed cloud computing technologies to improve its e-government services, banking on the country's super-fast internet connectivity and stable LTE availability. It is expected to positively contribute to the market's growth over the forecast period.

- Additionally, the region is expected to witness growth, owing to small and medium organizations' investments. SMEs are investing to increase the adoption of cloud-based and technologically advanced solutions. For instance, according to recent data from the Ministry of Micro, Small, and Medium Enterprises, India includes 50 million MSMEs, making it among the world's largest MSMEs. Given that the government and MSMEs are relying on scalable IT systems and solutions, it is understandable that they shift their processes and sensitive information to the cloud, thus significantly driving the market's growth.

Data Processing and Hosting Service Industry Overview

The Data Processing and Hosting Services Market is moderately competitive and consists of major players such as GoDaddy Operating Company LLC., Bluehost (Endurance International Group), HostGator.com LLC, Hostinger International, Ltd., and Amazon Web Services Inc. Some of the players currently dominate the market in terms of market share. However, with the advancement in hosting solutions across professional services, new players are increasing their market presence, thereby expanding their business footprint across emerging economies.

- November 2022 - Teradata and Vicinity announced a partnership to help companies create a single, available dataset for operational efficiency and diverse and dispersed data for business insight. The combined solution offers increased speed, performance, and deployment flexibility across distances, lowering costs by reducing data management expenses and increasing the efficiency of the world's leading global enterprises across multi-location, multi-cloud and hybrid environments.

- October 2022 - Hostinger launched a next-generation web hosting solution nodes cluster for APIs and helper systems to provide a better performance in a simplified format keeping the cost low and making the solution available for all customers that is resilient to scaling, hardware failure, and maintenance time, reducing the time needed for website response.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Technology Snapshot

- 4.4 Assessment of COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Cloud Computing to Accomplish Economies of Scale

- 5.1.2 Rising Demand for Outsourcing Data Processing Services

- 5.2 Market Restraints

- 5.2.1 Lack of Flexibility and Scalability in terms of Hosting Infrastructure

6 MARKET SEGMENTATION

- 6.1 By Organisation

- 6.1.1 Large Enterprise

- 6.1.2 Small & Medium Enterprise (SME)

- 6.2 By Offering

- 6.2.1 Data Processing Services

- 6.2.1.1 Data Entry Services

- 6.2.1.2 Data Mining Services

- 6.2.1.3 Data Cleansing and Formatting

- 6.2.1.4 Data Scanning and Indexing

- 6.2.2 By Hosting Services

- 6.2.2.1 Web Hosting

- 6.2.2.2 Cloud Hosting

- 6.2.2.3 Shared (Reseller) Hosting

- 6.2.2.4 Virtual Private Server (VPS) Hosting

- 6.2.2.5 WordPress Hosting

- 6.2.2.6 Application Hosting

- 6.2.1 Data Processing Services

- 6.3 By End-user Industry

- 6.3.1 IT & Telecommunication

- 6.3.2 BFSI

- 6.3.3 Retail

- 6.3.4 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia-Pacific

- 6.4.4 Latin America

- 6.4.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 GoDaddy Operating Company LLC.

- 7.1.2 Bluehost (Endurance International Group)

- 7.1.3 HostGator.com LLC

- 7.1.4 Hostinger International, Ltd.

- 7.1.5 Amazon Web Services Inc.

- 7.1.6 SiteGround Hosting Ltd.

- 7.1.7 A2Hosting

- 7.1.8 DreamHost LLC.

- 7.1.9 GreenGeeks.com

- 7.1.10 IBM Corporation

- 7.1.11 Teradata Corporation

- 7.1.12 Hewlett Packard Enterprise Development LP

- 7.1.13 SAP SE

- 7.1.14 Oracle Corporation

- 7.1.15 Alteryx Inc.

- 7.1.16 Cloudera Inc.

- 7.1.17 Salesforce.com Inc.