|

市場調查報告書

商品編碼

1630312

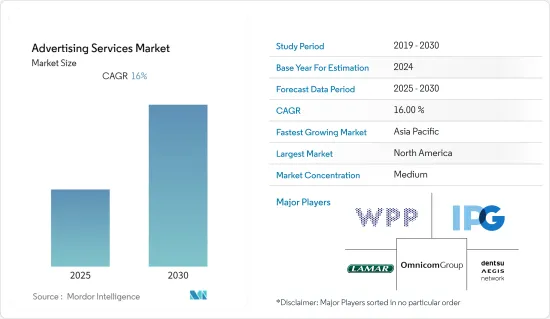

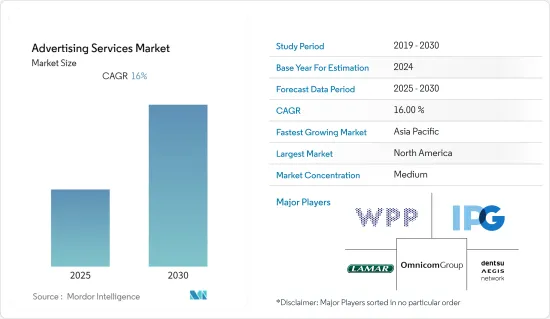

廣告服務:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Advertising Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

廣告服務市場預計在預測期內複合年成長率為 16%

主要亮點

- 網路的快速發展以及新興經濟體網路用戶數量不斷增加導致商業用途的擴大等技術發展,透過各種廣告模式塑造了廣告服務的演變。更容易使用電腦導致智慧型手機的使用增加,世界各地的現代化使人們有機會更頻繁、更方便地使用網路。

- 對社群媒體廣告服務不斷成長的需求可協助您利用最具成本效益和針對性的廣告形式,並在社群媒體上產生即時效果。社交網路是最受歡迎的線上活動之一。根據活躍使用情況,Facebook 是最受歡迎的線上網路之一。 Facebook(Meta)數據顯示,截至 2021 年第四季的每月有效用戶數約為 29.1 億。截至 2021 年 10 月,印度擁有最多的 Facebook 用戶數量,約 3.5 億,其次是美國,約 1.93 億。

- 此外,隨著網路時代的到來,數位廣告公司的隨選服務不斷擴大,消費者的興趣也從傳統媒體格式轉向更數位化的格式。透過線上平台的廣告已成為一個強大的行業。由於新公司和新技術的湧入,廣告成本不斷增加。

- Facebook 表示,其約 15 億日有效用戶每天在該平台上平均花費 41 分鐘,使其成為所有社群媒體平台中最大、參與度最高的用戶群之一。為了有效地透過用戶收益,該公司為廣告商建立了最好的定位工具和最具成本效益的廣告。由於品牌和代理商擔心自然覆蓋率下降,Instagram 等平台繼續擴大其廣告產品,包括 Instagram 瀏覽器頁面上的付費展示位置。這有效地增加了可銷售的廣告量。

- 此外,世界各個新興經濟體中行動電話用戶數量的增加預計將增加對線上廣告服務的需求。據愛立信稱,全球約有 60 億智慧型手機用戶。預計未來幾年銷售量將增加數億台,2027年將達到76億台。智慧型手機用戶數量最多的國家包括中國、印度和美國。

- 此外,6秒廣告格式在各種社群媒體平台上變得越來越流行。廣告研究基金會的一項新研究表明,電視上 6 秒的短廣告每秒比較長的廣告獲得的關注度高 8% 到 11%。

- 2022 年 5 月,Microsoft Advertising 將擴展到拉丁美洲和亞太地區的 32 個新國家。就在幾個月前,該公司宣佈在歐洲和非洲推出 29 個新市場,標誌著該公司今年全球擴張的第一階段。第二階段在世界上的存在更加重要。這是一種重要的方法,可以讓廣告主從 Workday 消費者獨特社群的擴大覆蓋範圍中受益。

- 雖然 COVID-19 大流行可能會在短期內減少廣告支出,但它可能會導致公司在未來探索廣告和行銷領域的未知領域。即使在封鎖期間,許多組織也試圖使用線上廣告和行銷工具來吸引受眾。由於後 COVID-19 消費者都待在室內並上網,行銷策略的模式轉移已成為小型企業和大型企業的必須。

廣告服務市場趨勢

零售業預計將佔據較大市場佔有率

- 隨著網路平台的採用和電子商務時代的到來,零售業的廣告成本正在迅速增加。此外,隨著越來越多的人使用行動電話瀏覽網路並享受基於網際網路的購物服務,電子商務和行動商務趨勢的興起將進一步推動行動平台上的網路廣告的成長。

- 零售業出現了各種發展,包括公司的擴張活動和合作夥伴關係。例如,2022 年 2 月,Criteo SA 宣布與北美藝術品和工藝品零售商 Michaels 建立零售媒體廣告夥伴關係。此次合作將使 Michaels 能夠透過一系列解決方案和功能(包括贊助產品、展示和異地廣告)來擴展其零售媒體計劃。

- 此外,Albertsons 於 2021 年 11 月推出了零售媒體網路,為 CPG 公司開發數位廣告和其他品牌內容。 Albertsons Media Collective 將由 Christy Argilan 領導,並將於 2022 年 2 月啟動廣告宣傳。

- 零售業的主要企業正致力於透過在不同地區開設更多商店來擴大其足跡,從而擴大其市場機會。 2022 年 9 月 Costco 繼續擴張,計劃在未來幾個月內開設至少 11 家新店,從 2022 年 5 月的猶他州 Riverton 到 2022 年 8 月的韓國慶尚南道金海市。 (好市多已經在海外擁有大量業務)。

- 此外,陽獅集團於 2021 年 7 月宣布收購 CitrusAd,這是一個軟體即服務 (SaaS) 平台,可直接在零售商網站內最佳化品牌行銷績效。

北美預計將佔據很大佔有率

- 隨著智慧型手機和網路的普及以及消費者擴大在線購買商品和服務,北美的廣告支出正在迅速成長。

- 這鼓勵廣告商進行多樣化和嚴格的宣傳活動,預計將在預測期內推動全部區域的市場成長。此外,由於許多公司僅透過行動應用程式營運,因此公司正在重新定義其行銷策略並在線上推廣其產品和服務。

- 廣告支出向數位媒體的轉變繼續推動該地區的變化,數位廣告,特別是搜尋、社交和行動廣告收入超過了電視廣告收入。在國內,媒體和娛樂支出持續增加。

- 該地區是許多世界主要零售商的所在地,包括沃爾瑪、好市多和亞馬遜。這些公司的大部分銷售額都產生於國內市場,使其成為美國零售業的主導力量。特別是,由於美國電子商務的成長,亞馬遜的收益正在以極高的水平成長。

- 美國零售業在廣告支出總額中佔很大比例。因此,廣告支出的增加預計將推動廣告服務市場的需求。根據美國人口普查局統計,截至2021年終,全國零售總額達約6.6兆美元,比前一年增加約10億美元。

- 該地區很少有參與企業專注於在全球範圍內擴展服務,幫助提高市場能力。例如,2022 年 5 月,總部位於舊金山的 Instacart 宣布計劃將廣告業務擴展到海外。 Instacart Ads 現已在加拿大推出,讓 CPG 品牌和媒體機構能夠在加拿大消費者搜尋和發現產品時與他們互動。

- 2022 年 8 月,微軟在其部落格上宣布了九項新升級。新增了新的汽車廣告、垂直廣告和其他功能。在北美和歐洲進行測試後,廣告將在未來幾週內向亞太地區和拉丁美洲的行銷人員推出。

廣告服務業概況

廣告服務市場競爭適中,由多家大公司組成。目前,參與企業在市場佔有率方面佔據市場主導地位。然而,隨著各種廣告服務的進步,新參與企業正在透過與國際參與企業合作擴大其在新興經濟體的業務基礎來增加其在市場上的影響力。

- 2022 年 6 月 - Walmart Connect 是美國領先零售商的閉合迴路全通路媒體業務,使廣告主能夠透過沃爾瑪網站和應用程式、店內和網路接觸沃爾瑪消費者。聯盟。此次合作是 Walmart Connect 與代理商控股公司的首次合作。

- 2022 年 2 月 - WPP 與 Instacart 簽署協議,讓客戶能夠搶先體驗該線上雜貨平台的最新廣告格式。 WPP 和 Instacart 將共同開發 Instacart 廣告代理商認證計劃,幫助代理商人才掌握平台的應用程式和產品。

- 2021 年 9 月 - Roku, Inc. 宣佈在其加拿大電視廣告產品中新增 OneView 廣告平台。 OneView 利用 Roku 串流平台的電視辨識資料,為廣告主提供跨電視串流、桌面和行動宣傳活動的廣告管理自助服務平台。 IPG 附屬機構 Matterkind 被任命為 Roku 的首個加拿大 OneView宣傳活動合作夥伴。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查先決條件

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 對社群媒體參與的需求不斷成長

- 需求從傳統管道轉向數位管道

- 市場限制因素

- 透過提高品牌價值實現營運相容性

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按平台

- 線上

- 離線

- 按服務管道

- 社群媒體發布

- 廣播電台商業廣告

- 電視廣告

- 直郵

- 印刷媒體

- 其他

- 按最終用戶產業

- 零售

- 電子商務

- 旅遊/旅遊

- 媒體與娛樂

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭狀況

- 公司簡介

- WPP Plc(Ogilvy, Y&R, Grey)

- The Interpublic Group of Companies Inc.(McCann Worldgroup, MullenLowe US)

- Omnicom Group Inc(BBDO, DDB Worldwide)

- Dentsu Aegis Network Ltd.(Dentsu Inc.)

- MDC Partners Inc.

- Lamar Advertising Company(Lamar Media Corp.)

- Publicis Groupe SA

- Wieden+Kennedy Inc

- Havas SA

- Droga5 LLC

第7章 投資分析

第8章 市場機會及未來趨勢

簡介目錄

Product Code: 67330

The Advertising Services Market is expected to register a CAGR of 16% during the forecast period.

Key Highlights

- Technological developments in regard to the rapid growth of the internet combined with its increasing commercial use due to the growing number of Internet users across emerging economies have shaped the evolution of advertising services through different Modes of advertising. Easier access to a computer increased the utilization of smartphones, and the modernization of countries around the world gave people the opportunity to use the internet more frequently and with more convenience.

- The growing demand for social media advertising services helps generate immediate results on social media, thereby leveraging the most cost-effective and targeted form of advertising available. Social networking is one of the most popular online activities. Facebook is one of the most popular online networks based on active usage. According to Facebook (Meta), there were around 2.91 billion monthly active users as of Q4 2021. As of October 2021, Facebook's audience base was highest in India, with almost 350 million users, followed by the United States, with approximately 193 million users.

- Furthermore, there are growing on-demand services from digital advertising agencies with the rise of the Internet era, which has led to a divergence of consumer attention away from traditional forms of media toward more digital formats. Advertising via online platforms has emerged as a powerful industry. Ad spending is still on the rise owing to the influx of new companies and technologies.

- With almost 1.5 billion daily active users who spend an average of 41 minutes on the platform every day, Facebook stated that it has one of the largest and most engaged user bases out of all the social media platforms. To effectively monetize its audience, the company built the best targeting tools and the most cost-effective ads for advertisers. As brands and agencies worry about declining organic reach, platforms such as Instagram have continued to expand their ad offerings to include paid placement on the Instagram Explore page. This effectively increased the volume of ads they could sell.

- Additionally, the increasing number of mobile phone users across various emerging economies in the world is expected to drive the demand for online-based advertisement services. According to Ericsson, the number of smartphone subscriptions worldwide is around six billion. It is expected to grow further by several hundred million in the next few years, reaching 7.6 billion by 2027. The countries with the highest smartphone users include China, India, and the United States.

- Moreover, a 6-second ad format is increasingly gaining popularity on various social media platforms. According to new research by the Advertising Research Foundation, short-form, six-second ads on TV capture 8% to 11% more attention per second than longer ads.

- In May 2022, Microsoft Advertising expanded into 32 new countries in Latin America (LATAM) and Asia Pacific (APAC). This advertising opportunity comes just a few months after they announced the debut of 29 new markets in Europe and Africa, marking the first phase of their global expansion this year. This second phase delivers even more significant growth in the worldwide presence. It is a critical approach in which we enable advertisers to benefit from the expanded reach of a unique community of Workday Consumers.

- The COVID-19 pandemic might have reduced the ad spending in the short term, but it would make companies look into unexplored areas of ads and marketing in the future. Even during the lockdown, many organizations tried to reach their audience using online ads and marketing tools. The post-COVID-19 consumer is indoors and available online, making the paradigm shift in marketing strategy a must for small and big businesses.

Advertising Services Market Trends

Retail Segment is Expected to Have Significant Share in the Market

- Advertising spending in the retail industry has been increasing rapidly with the introduction of online platforms and the eCommerce era. Moreover, the rise in the trend of e-commerce and m-commerce further propelled the growth in internet advertising on the mobile platform as more people use their mobile phones to browse the internet and enjoy internet-based shopping services.

- There have been various developments by companies in the retail industry, such as expansion activities and partnerships. For instance, in February 2022, Criteo SA announced a retail media advertising partnership with Michaels, a specialty arts and crafts retailer in North America. The partnership authorizes Michaels to scale its retail media program with a full suite of solutions and capabilities, including sponsored products, display, and off-site advertising.

- Moreover, In November 2021, Albertsons launched its retail media network to develop digital ads and other branded content for CPG companies. The Albertsons Media Collective will be led by Kristi Argyilan and will begin running ad campaigns in February 2022.

- The key players in the Retail Industry are focusing on expanding their footprints by increasing their stores across various regions, also resulting in increasing the market opportunities. In September 2022, Costco is expanding, with at least 11 additional shops set to open in the next months, ranging from Riverton, Utah, in May 2022 to Gimhae, South Gyeongsang Province, South Korea, in August 2022. (Costco already has a large international presence.)

- Moreover, In July 2021, Publicis Groupe announced the acquisition of CitrusAd, a software as a service (SaaS) platform optimizing brands' marketing performances directly within retailer websites.

North America is Expected to Hold Significant Share

- The advertising spending in the North America region is increasing rapidly, owing to the ascending smartphone and internet penetration and consumers' willingness to purchase goods and services online.

- It is encouraging advertisers to run diverse and rigorous campaigns, that is expected to drive market growth across the region over the forecast period. Moreover, with the plethora of companies having their operation solely based on mobile applications, the companies are redefining their marketing strategies and online promotion of their products and services.

- The migration of ad spending to digital media continued to drive change in the region, especially from digital ads, including search, social, and mobile, which has surpassed TV ad revenue. There is a continual increase in the expenditure on media and entertainment in the country.

- The region is home to many of the leading retail companies in the world, including Walmart, Costco, and Amazon. Most of these companies' sales are generated within their domestic market, and as such, they are the dominating players within the American retail industry as well. Amazon, in particular, hasseen extreme levels of growth in revenue in tandem with the increase of e-commerce in United States.

- The retail industry in the United states has a higher percentage of total spend on advertising. Therefore, the rise in advertisement spending is predicted to fuel the demand for the advertising services market. According to the US Census Bureau, by the end of 2021, total retail sales in the country reached approximately USD 6.6 trillion, around USD one billion increase from the year before.

- Few players in this region focus on expanding their services globally, which assists them in increasing their market capability. For instance, In May 2022, Based in San Francisco, Instacart announced plans to expand its advertising business abroad. Instacart Ads is now available in Canada, allowing CPG brands and media agencies to engage with Canadian consumers as they search and discover products.

- In August 2022, Microsoft announced nine new upgrades on its blog. New Automotive Ads, vertical-based ads, and other features have been added. Following a test in North America and Europe, the ads will be made available to marketers in the Asia Pacific and Latin America in the following weeks.

Advertising Services Industry Overview

The advertising services market is moderately competitive and consists of several significant players. Some of the players currently dominate the market in terms of market share. However, with the advancement in various advertisement services, new players are increasing their market presence, collaborating with international players to expand their business footprint across emerging economies.

- June 2022 - Walmart Connect, America's prominent retailer's closed-loop omnichannel media business that allows advertisers to reach Walmart shoppers on Walmart's site and app, across its physical locations, and across the web, announced a strategic partnership with Omnicom Media Group, the media services division of Omnicom Group Inc. The collaboration is the first of its kind between Walmart Connect and an agency holding firm.

- February 2022 - WPP entered an agreement with Instacart that provides clients early access to the online grocery platform's latest ad formats. WPP and Instacart co-developed an Instacart Ads agency certification program to ensure the agency workforce is up to snuff navigating the platform's app and products.

- September 2021 - Roku, Inc. announced the addition of the OneView advertising platform to its Canadian TV advertising offering. OneView offers advertisers a self-service platform for managing advertising across TV streaming, desktop, and mobile campaigns, leveraging TV identification data from the Roku streaming platform. Matterkind, an IPG affiliate company, was named Roku's first Canadian OneView campaign partner.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand of the Social Media Engagement

- 4.2.2 Shifting Demand from Traditional to Digital Channels

- 4.3 Market Restraints

- 4.3.1 Operational Compatibility Due to Growing Brand Value

- 4.4 Industry Attractiveness - Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers/Consumers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Platform

- 5.1.1 Online

- 5.1.2 Offline

- 5.2 By Channel of Service

- 5.2.1 Social Media Publishing

- 5.2.2 Radio Commercials

- 5.2.3 TV Ads

- 5.2.4 Direct Mail

- 5.2.5 Print Media

- 5.2.6 Other Types

- 5.3 By End-user Industry

- 5.3.1 Retail

- 5.3.2 Ecommerce

- 5.3.3 Travel & Tourism

- 5.3.4 Media & Entertainment

- 5.3.5 Other End-user Industry

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle East & Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 WPP Plc (Ogilvy, Y&R, Grey)

- 6.1.2 The Interpublic Group of Companies Inc. (McCann Worldgroup, MullenLowe U.S.)

- 6.1.3 Omnicom Group Inc (BBDO, DDB Worldwide)

- 6.1.4 Dentsu Aegis Network Ltd. (Dentsu Inc.)

- 6.1.5 MDC Partners Inc.

- 6.1.6 Lamar Advertising Company (Lamar Media Corp.)

- 6.1.7 Publicis Groupe SA

- 6.1.8 Wieden + Kennedy Inc

- 6.1.9 Havas SA

- 6.1.10 Droga5 LLC

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219