|

市場調查報告書

商品編碼

1630315

熱感列印:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Thermal Printing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

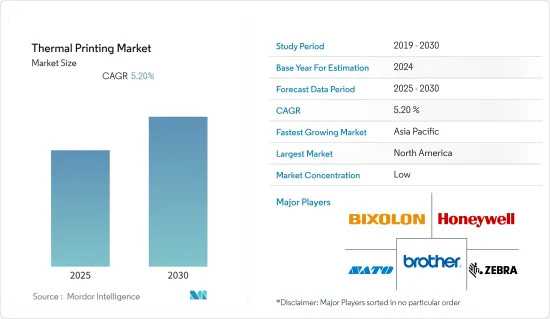

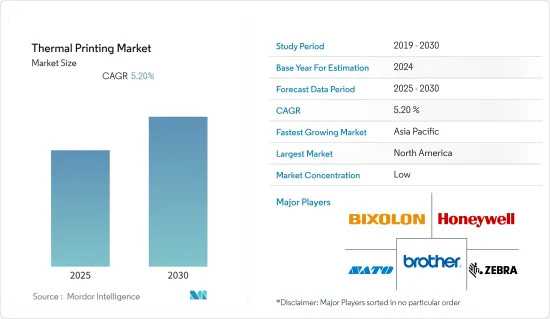

熱感列印市場預計在預測期內複合年成長率為 5.2%。

主要亮點

- 透過引入AIDC(自動識別和資料擷取)技術提高工作效率,行業領先。借助條碼,公司可以儲存和檢索有關條碼產品的大量資訊。條碼通常在醫療保健和醫院中用於識別患者並存取有關病歷、藥物過敏和其他重要詳細資訊的資訊。

- 此外,在需要時,特別是在緊急情況下,使用智慧標籤可以幫助即時追蹤患者和醫療設備。標籤和標籤與醫療保健行業的許多業務相容,經常使用熱感印表機列印,以幫助改善患者流量、床位利用率和資產分配。

- 無線技術在可攜式印表機中的日益普及正在推動市場的發展。由於可以與 PC通訊並執行商業控制的 PDA(個人數位助理)的普及,設備製造商正在放棄當今的一體化行動資訊設備(手持終端)。

- 此外,需要小輸出(2.9“x4.1”或4.1“x5.8”)的高解析度文字和圖形的應用程式以及Brother的超薄和輕型移動印表機是另一個例子。 MW 系列採用 MFi 藍牙無線技術和通用作業系統相容性,可與 iPhone、iPad、iPod、Windows、Windows Mobile 和 Android 裝置進行簡單的無線通訊。此外,支援藍牙的行動電話可透過 2.4GHz 射頻與 33 英尺範圍內的無線印表機通訊。

- 然而,這些印表機也有缺點。列印產生的額外熱量經常會損壞列印頭,從而增加維修和更換成本。

- 此外,幾乎每個行業都受到了新冠病毒問題的負面影響,供應鏈中斷,國家封鎖,一些組織正在考慮長期甚至永久遠距工作的想法。許多公司目前正在適應 COVID-19 對印刷業複雜而廣泛的影響。

熱感列印市場趨勢

零售業佔據較大市場佔有率

- 小型企業和大型企業經常依靠熱感條碼印表機來標記和追蹤運輸中的產品。這是條碼印表機在熱感印表機市場主導的關鍵方面之一。

- 全球零售商店的成長使得條碼技術對於精實且適應性強的零售業至關重要。許多企業很難在保持貨物流動的同時追蹤貨物的移動。除了用於收據和發票的傳統印表機之外,所有者還可以添加條碼產生器來建立組織庫存和文件、分發產品等所需的標籤。使用耐用、防褪色、熱敏標籤材料建立條碼,以確保您的組織的工作隨著時間的推移保持完好無損。

- 許多公司正在引入新技術來改進智慧列印解決方案,以適應不斷變化的支付方式。一個例子是 BIXOLON 的 SRP-Q300 3 吋(80 毫米)直熱感立方桌上型印表機系列,該產品將於 2019 年 11 月展出。該系列以合理的價格提供多功能的 mPOS 列印。這款熱轉印印表機非常適合商店標籤和庫存管理。

- 零售商透過為客戶提供快速有效的服務,繼續優先考慮銷售點 (POS) 體驗。與傳統擊打式印表機相比,熱感印表機通常被用作改進且更快的解決方案。此外,熱感印表機比傳統印表機更便宜,這也推動了它們的使用。

- 此外,歐洲、北美和歐洲的零售店正在從擊打式印表機轉向熱敏印表機。 CMI研究預測,未來五年,APEJ將佔全球前50個國家銷售額的近一半,北美零售市佔率將翻倍。

- 此外,在數位資訊和安全政策需求的推動下,中國大多數公司和組織已開始從傳統辦公室設備轉向本地產品,而不是知名的全球大品牌。預計國產印表機和列印耗材的很大一部分將很快取代現有品牌。

- 此外,中國生產商正專注於特殊用途印表機。 UV平板印表機、標籤印表機、藍圖印表機等隨著越來越多的中國企業進入印表機市場,中國的OEM可能不僅在國內市場而且在國際市場上擴大並發揮重要作用。

北美佔據主要市場佔有率

- 由於智慧包裝、庫存管理、倉儲、運輸和物流等零售應用的需求不斷增加,北美目前佔據全球熱感列印市場的大部分。北美的許多零售商已經從擊打式印表機轉向更先進的熱敏印表機。公司正致力於降低列印成本、環境影響、維護成本等。

- 此外,該地區使用熱敏印表機的主要行業是製造/工業、零售、運輸/物流和醫療保健/餐旅服務業。該地區有許多公司銷售熱敏印表機及相關產品,進一步刺激了北美熱敏印表機市場的擴張。

- 該地區的領先公司,如斑馬技術、Honeywell和艾利丹尼森,正在為零售、運輸和物流行業提供高品質的服務,預計將進一步推動北美熱感列印市場的發展。例如,2021 年 2 月,Honeywell國際公司與增強身分領域的全球領導者 IDEMIA 合作開發和維護智慧建築生態系統,為營運商和居住者提供更無縫和改進的體驗,並宣布與該公司達成戰略協議。此次合作將 IDEMIA 的生物識別門禁系統與Honeywell的安全和建築管理解決方案結合,無縫打造更安全、更有效率的建築。

- 此外,Zebra 是北美最大的熱感轉換器之一。 Zebra 幾乎為所有應用提供解決方案,並擁有最廣泛的經過測試的優質標籤、吊牌、收據紙、腕帶、卡片和色帶。熱感列印市場規模逐年擴大,是該領域中分佈最大的。

熱敏列印產業概況

熱感列印市場高度分散,全球和本地企業都在競相創新熱感列印新技術,以提高各個最終用戶產業的工作效率。主要參與者包括 Zebra Technologies Corp.、Sato Holdings Corp.、Honeywell International Inc.、Bioxolon 和 Brother International Corporation。

- 2022 年 3 月 - Zebra Technologies Ltd. 在澳洲和紐西蘭推出 Reflexis 解決方案,將其產品組合擴展全部區域亞太地區。 Reflexis 解決方案為企業提供存取和業務資料的工具,提供更高層級的安全性和控制,並提供新的分析來提高業務績效。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 採用自動識別和資料擷取(AIDC)技術提高生產力

- 行動印表機擴大採用無線技術

- 市場限制因素

- 維修/更換成本高

- 價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按印表機格式

- 條碼

- 標籤

- POS(銷售點)/自助服務終端

- 其他印表機格式

- 依技術

- 直熱感

- 熱轉印

- 按最終用戶

- 零售

- 衛生保健

- 工業/製造業

- 運輸

- 政府機構

- 其他最終用戶

- 地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 英國

- 德國

- 法國

- 其他歐洲國家

- 亞太地區

- 中國

- 日本

- 印度

- 其他亞太地區

- 拉丁美洲

- 中東/非洲

- 北美洲

第6章 競爭狀況

- 公司簡介

- Zebra Technologies Corporation

- Sato Holdings Corporation

- Honeywell International Inc.

- Bioxolon

- Brother International Corporation

- Star Micronics Co., Ltd

- Toshiba Tec Corporation

- TSC Auto ID Technology Co., Ltd

- Avery Dennison Corporation

- Xiamen Rongta Technology Co., Ltd

- Axiohm

第7章 投資分析

第8章 市場機會及未來趨勢

簡介目錄

Product Code: 67424

The Thermal Printing Market is expected to register a CAGR of 5.2% during the forecast period.

Key Highlights

- The industry is driven by introducing AIDC (Automatic Identification and Data Capture) technology to increase work rates. Businesses can save and retrieve much information about the product that a barcode is on, thanks to barcodes. They are commonly used in medical and hospitals to identify patients and access information on medical histories, medicine allergies, and other crucial details.

- Moreover, when needed, especially in an emergency, the usage of smart labels aids in the immediate tracking of patients and medical equipment. Labels and tags compatible with numerous operations in the healthcare industry are frequently printed using thermal printers, which helps to increase patient flow, bed utilization, and asset allocation.

- The growing use of wireless technology in portable printers has driven the market. Device manufacturers are turning away from the current all-in-one type of mobile information devices (handheld terminals) due to the widespread use of PDAs (Personal Digital Assistants), which can communicate with PCs and be controlled commercially.

- Further, Examples include applications that require high-resolution text or graphics in small-format output (2.9"x4.1" or 4.1"x5.8") and the ultra-slim, a lightweight mobile printer from Brother. The MW Series provides simple, wireless communication with iPhone, iPad, iPod, Windows, Windows Mobile, and Android devices thanks to MFi Bluetooth wireless technology and universal operating system compatibility. Furthermore, Bluetooth-enabled phones can communicate with wireless printers within 33 feet via radio frequency at 2.4GHz.

- However, there are drawbacks to these printers, too, as the extra heat from this printing frequently damages the print head and raises the cost of repair and replacement.

- Moreover, almost every industry has been negatively impacted by the COVID19 problem, which has disrupted supply chains, nationwide lockdowns, and organizations considering the idea of long-term or even permanent remote working. Many businesses are currently adjusting to account for Covid-19's complex and wide-ranging consequences on the print industry.

Thermal Printing Market Trends

Retail Holds the Significant Share in The Market

- Small, medium and big firms utilize thermal barcode printers frequently to label and track the products transported. It is one of the important aspects contributing to barcode printers' dominant position in the thermal printer Market.

- Global retail store growth has made barcoding technology a must for a lean, adaptable retail industry. Many businesses struggle to keep products flowing while keeping track of them as they travel. Owners can produce the labels required to organize inventory and files, distribute goods, and more by adding a barcode maker to the mix in addition to traditional printers for receipts and invoices. Using strong, fade-resistant, heat-sensitive label stock to create barcodes assures the organization's work will not be undone over time.

- Many players are presenting new technology to improve intelligent printing solutions for changing payment methods. One example is the SRP-Q300 3-inch (80mm) Direct Thermal cube desktop printer series from BIXOLON, which will be on display in November 2019. This series offers versatile mPOS printing at a reasonable price. For store labeling and inventory management, this thermal transfer printer is perfect.

- Retailers continually prioritize their point of sale (POS) experience by providing customers with quick and effective services. Thermal printing is often employed for improved and fast solutions compared to traditional impact printers. Additionally, thermal printers are more affordable than conventional printers, which encourages their use.

- Moreover, retail establishments in Europe, North America, and Europe have switched from impact printers to thermal printers. According to a CMI study, in the next five years, APEJ is predicted to account for almost half of their sales made by the top fifty economies in the globe and double North America's share of the retail market.

- Furthermore, most businesses and organizations in China have begun to switch from traditional office equipment to local items rather than the well-known large global brands, motivated by the need for digital information and a security policy. Shortly, it will be anticipated that a sizable share of domestic printers and printing supplies will displace the current brands.

- Additionally, Chinese producers are concentrating on printers for a specialized purpose. These consist of UV flatbed printers, label printers, and printers for blueprints. Chinese OEMs will expand and play a significant role not only in the domestic market but also in the international market as more and more Chinese firms enter the printer market.

North America Account for Significant Market Share

- Due to the rising demand for retail applications, including smart packaging, inventory management, warehousing, transportation, and logistics, North America currently retains the lion's share of the global market for thermal printing. Numerous retailers in North America have already switched, replacing their impact printers with more sophisticated, thermal-only alternatives. Businesses emphasize lowering printing costs, environmental effects, maintenance costs, etc.

- Furthermore, the primary industries in the region where thermal printers are used are manufacturing and industrial, retail, transportation and logistics, and healthcare and hospitality. This area is home to many businesses that sell thermal printers and related products, further fueling the expansion of the thermal printer market in North America.

- Significant players in the region, such as Zebra Technologies, Honeywell, Avery Dennison, etc., serve highly in retail, transportation, and logistics industries, which is expected to further boost the thermal printing market in North America. For instance, in February 2021, To develop and maintain an intelligent building ecosystem that offers a more seamless and improved experience for operators and occupants alike, Honeywell International Inc. announced a strategic agreement with IDEMIA, the world leader in augmented identity. The cooperation will combine IDEMIA's biometric access control systems with Honeywell's security and building management solutions to create seamless, safer, and more effective buildings.

- Moreover, One of the biggest thermal supply converters in North America is Zebra. Zebra offers a solution for almost any application and has the broadest assortment of pre-tested, premium labels, tags, receipt paper, wristbands, cards, and ribbons. The thermal printing market is expanding yearly because of its greatest spread in this area.

Thermal Printing Industry Overview

The thermal printing market is highly fragmented as various global and local players are in the race to innovate new technologies under thermal printing to improve work efficiency in various end-user industries. Key players are Zebra Technologies Corp., Sato Holdings Corp., Honeywell International Inc., Bioxolon, and Brother International Corporation.

- March 2022 - Zebra Technologies Corporation launches its Reflexis solutions across Australia and New Zealand inorder to expand their portfolio across the Asia Pacific region. In contrast, Reflexis solutions provide businesses the tools to access their data to work, allowing for higher levels of security and manageability along with new analytics, which can elevate their business performance.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Adoption of Automatic Identification and Data Capture (AIDC) Technologies for Productivity Improvement

- 4.2.2 Increasing Adoption of Wireless Technologies in Mobile Printers

- 4.3 Market Restraints

- 4.3.1 High Repair and Replacement Costs

- 4.4 Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 By Printer Format

- 5.1.1 Barcode

- 5.1.2 Label

- 5.1.3 POS (Point of Sale)/ Kiosk

- 5.1.4 Other Printer Formats

- 5.2 By Technology

- 5.2.1 Direct Thermal

- 5.2.2 Thermal Transfer

- 5.3 By End-User

- 5.3.1 Retail

- 5.3.2 Healthcare

- 5.3.3 Industrial & Manufacturing

- 5.3.4 Transportation

- 5.3.5 Government

- 5.3.6 Other End-Users

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 United Kingdom

- 5.4.2.2 Germany

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia-Pacific

- 5.4.3.1 China

- 5.4.3.2 Japan

- 5.4.3.3 India

- 5.4.3.4 Rest of Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle-East & Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Zebra Technologies Corporation

- 6.1.2 Sato Holdings Corporation

- 6.1.3 Honeywell International Inc.

- 6.1.4 Bioxolon

- 6.1.5 Brother International Corporation

- 6.1.6 Star Micronics Co., Ltd

- 6.1.7 Toshiba Tec Corporation

- 6.1.8 TSC Auto ID Technology Co., Ltd

- 6.1.9 Avery Dennison Corporation

- 6.1.10 Xiamen Rongta Technology Co., Ltd

- 6.1.11 Axiohm

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219