|

市場調查報告書

商品編碼

1630316

印刷設備:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Print Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

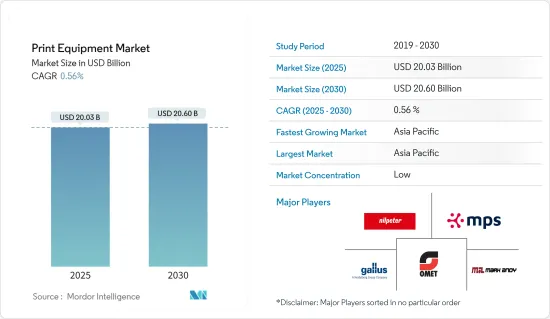

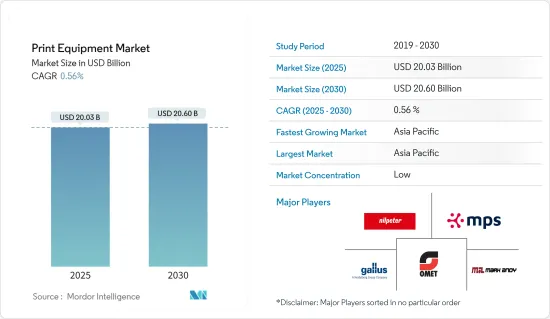

印刷設備市場規模預計到2025年為200.3億美元,預計2030年將達到206億美元,預測期間(2025-2030年)複合年成長率為0.56%。

主要亮點

- 公司和機構正在推動印刷設備市場的發展,將印刷用於各種應用,包括廣告、書籍、包裝、標籤和商業印刷。先進技術的滲透,例如更快的印刷設備和創新的墨水和碳粉解決方案,將提高生產能力並提高品質。此外,印刷技術的進步在大批量印刷的成長中發揮著至關重要的作用。

- 3D 列印使包裝公司能夠創造出具有 3D 紋理、浮雕效果和獨特形狀的產品來吸引客戶,從而增加印刷材料的視覺吸引力。 3D列印的採用拓寬了頻譜,使得在塑膠和金屬等多種材料上進行列印成為可能,為列印設備市場開闢了創造性途徑。

- 在全球範圍內,工業印表機因其在大批量列印方面的成本效益和效率而受到青睞。一個顯著的成長要素是對高品質印刷包裝材料的需求不斷成長,這對於廣告和品牌推廣至關重要。全球對電子商務領域包裝和標籤的需求,尤其是亞馬遜等採用創新設計工具的企業,正在為商業印刷市場提供重大推動力。

- 此外,廣告和商業印刷等行業正在透過數位印刷的整合而轉變。這項變更將使設計人員能夠更快地生產客製化產品。人工智慧、機器學習、物聯網和資料分析的技術進步正在顯著增強個人化。數位印刷的這一發展確保了即使是大訂單也能實現卓越的印刷個人化。

- 包裝印刷應用需求的快速成長預計將推動未來幾年的市場成長。此外,對數位印刷的需求不斷增加、軟包裝的吸引力、成本效益和減少包裝廢棄物的努力預計將推動市場的發展。

- 製造商面臨著升級技術以應對不斷變化的趨勢並保持競爭力的挑戰。小規模的升級可能影響不大,但整台機器大修對企業構成了重大挑戰。

印刷設備市場趨勢

柔印預計將大幅成長

- 柔版印刷設備主要是由高速生產和高效印刷的需求所驅動的。結果,柔版印刷的進步為油墨開闢了廣闊的市場。包裝表面印刷的成長趨勢,特別是在食品和消費品行業,正在推動柔印行業的成長。

- 人工智慧、機器學習和資料分析等技術正在推動個人化。特別是,物聯網(IoT)連線數量預計將從2022年的29億增加到2028年的60億以上。柔版印刷的這種技術融合提高了印刷的個人化,特別是對於大訂單。

- 柔版印刷用途廣泛,可在紙張和紙板等永續基材上印刷。使用生物基薄膜和可堆肥材料等軟包裝材料可以減少包裝對環境的影響。市場供應商正在提高柔印從設計到印刷品質的生產力、成本效率、永續性和一致性。在柔印技術中,低黏度墨水對於確保印刷單元內的墨水流暢流動至關重要。

- 柔印設備適應性強,可用於包裝和標籤等行業。這種靈活性使印刷公司能夠滿足各種訂單、擴大市場範圍並保持競爭力。

亞太地區預計將出現顯著成長

- 亞太地區預計將主導市場,由於包裝印刷領域強勁的最終用戶需求和豐富的市場發展機會,許多公司將在該地區投資。

- 在日本印刷設備市場,膠印佔據壓倒性地位,尤其是在書籍、雜誌、報紙等大量商業印刷領域。這家日本製造商的最新膠印設備以其精度、速度和卓越的品質而備受推崇。然而,隨著需求的發展,噴墨印刷等數位技術正迅速獲得關注,其在紡織應用中的興起證明了這一點。

- 印度印刷設備市場擴大採用數位技術,因為它比傳統方法更具成本效益、交付更快、更可客製化。從噴墨印表機到雷射印表機,數位設備的激增是由短版印刷、可變資料印刷和按需服務的需求推動的。

- 印度經濟的穩定成長和零售、製藥、包裝、廣告等行業的快速成長正在推動印刷設備的需求。隨著這些行業的擴張和多元化,對高品質印刷解決方案的需求不斷成長,以加強行銷、品牌、包裝和產品標識工作。

印刷設備產業概況

印刷設備市場分散,技術進步正在加劇國內和全球參與者之間的競爭。主要參與者包括 Mark Andy Inc.、OMET Srl、Nilpeter Holding A/S、Gallus (Heidelberger Druckmaschinen AG) 和 MPS Systems BV。

隨著戶外標誌、海報、黏性牆壁和地板印刷、客製化包裝等的需求持續飆升,對商業印表機的需求持續成長。因此,室內外標牌製造商和包裝設計師都需要高品質的商業印刷設備。這一趨勢將推動市場成長。

對膠印的需求顯著增加,特別是法律表格、文件、目錄、小冊子和日曆。對膠印的日益成長的需求正在推動對相關印刷設備的需求。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 生態系分析

第5章市場動態

- 市場促進因素

- 對數位印刷技術的需求不斷成長

- 加大包裝印刷設備機械投入

- 市場限制因素

- 與列印相關的高設定和營運成本

- 印刷業的關鍵創新與發展

- 影響全球設備市場的行業標準和法規

- 列印耗材需求洞察

- 由永續性和消耗品(例如水性和 UV 墨水)的作用所驅動的創新

- 未來市場趨勢及主要成長預期

第6章 市場細分

- 依技術

- 膠印輪轉印刷

- 柔版印刷

- 凹版印刷

- 網版印刷

- 數位的

- 按用途

- 圖書

- 商業印刷

- 廣告印刷

- 安全

- 貿易印刷

- 包裹

- 標籤

- 其他用途

- 按地區

- 北美洲

- 美國

- 加拿大

- 歐洲

- 德國

- 法國

- 義大利

- 英國

- 荷蘭

- 亞太地區

- 日本

- 印度

- 中國

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

- 北美洲

第7章 競爭格局

- 公司簡介

- Mark Andy Inc.

- OMET SRL

- Nilpeter A/S

- Gallus(Heidelberger Druckmaschinen AG)

- MPS Systems BV

- Lombardiconverting Machinery SpA

- Uteco Converting SpA

- Dg Press Services BV

- Fujifilm Holdings Corporation

- Bobst Group SA

- Heidelberger Druckmaschinen AG

- Koenig & Bauer AG

- Konica Minolta Inc.

- HP Inc.

- Paper Converting Machine Company(PCMC)

- Electronics for Imaging, Inc.

- Canon Inc.

- Seiko Epson Corporation

- Edale Limited

- Brothers Industries Ltd

- Agfa-Gevaert Group

- Ricoh Company Ltd

- Manroland AG(langley)

- AB Graphic International Limited

- Durst Image Technology US LLC

第8章投資分析

第9章 市場未來展望

The Print Equipment Market size is estimated at USD 20.03 billion in 2025, and is expected to reach USD 20.60 billion by 2030, at a CAGR of 0.56% during the forecast period (2025-2030).

Key Highlights

- Businesses and facilities drive the printing equipment market, utilizing printing for diverse applications, including advertising, books, packaging, labels, and commercial printing. The penetration of advanced technologies, such as faster presses and innovative ink and toner solutions, is set to boost production capacity and enhance quality. Moreover, technological advancements in printing play a pivotal role in the growth of high-volume printing.

- Through 3D printing, packaging companies can craft products that captivate customers with three-dimensional textures, embossed effects, and distinctive shapes, enriching the visual appeal of printed materials. The adoption of 3D printing broadens the spectrum, allowing printing on diverse materials like plastics and metals, thus unveiling creative avenues for the print equipment market.

- Globally, businesses are gravitating toward industrial printers, drawn by their cost-effectiveness and efficiency in high-volume printing. A notable growth driver is the rising demand for high-quality printed packaging materials, pivotal for advertising and branding. The e-commerce sector's global appetite for packaging and labeling, especially with players like Amazon embracing innovative design tools, significantly propels the commercial printing market.

- Moreover, industries like advertising and commercial printing are undergoing a transformation with the integration of digital printing. This shift empowers designers to produce customized products at an accelerated pace. Technological strides in AI, machine learning, IoT, and data analytics have markedly enhanced personalization. This digital printing evolution ensures superior print personalization, even for large-volume orders.

- The surging demand for packaging printing applications is poised to drive market growth in the coming years. Additionally, the rising appetite for digital printing, the allure of flexible packaging, cost-effectiveness, and a push to reduce packaging waste are expected to drive the market.

- Manufacturers grapple with the challenge of staying attuned to evolving trends and upgrading technologies to maintain a competitive edge. While minor upgrades might have a subdued impact, overhauling entire machines can pose significant challenges for businesses.

Print Equipment Market Trends

Flexographic Printing Expected to Witness Major Growth

- Flexographic printing machines are primarily driven by the demand for high production speeds and efficient printing. Consequently, advancements in flexographic printing have opened up a vast market for inks. The rising trend of printing on packaging surfaces, particularly in the food and consumer goods industries, has spurred the growth of the flexographic segment.

- Technologies like AI, machine learning, and data analytics are enhancing personalization. Notably, the number of Internet of Things (IoT) connections, which stood at 2.9 billion in 2022, is projected to surpass 6 billion by 2028. This technological convergence in flexographic printing is elevating print personalization, especially for large-volume orders.

- Flexographic printing is versatile and capable of being executed on sustainable substrates like paper and cardboard. Utilizing flexible packaging materials, such as bio-based films and compostable substances, mitigates the environmental footprint of packaging. Market vendors are enhancing the productivity, cost-effectiveness, sustainability, and consistency of flexo printing, from design to print quality. In flexible printing technology, low-viscosity inks are crucial for ensuring a smooth ink flow through the printing unit.

- Flexographic printing machinery boasts adaptability and is used across industries like packaging and labeling. This flexibility empowers print businesses to cater to diverse orders, broadening their market reach and maintaining a competitive edge.

Asia-Pacific Expected to Register Major Growth

- Asia-Pacific is poised to dominate the market, with numerous firms channeling investments into the region, driven by robust end-user demand and abundant development opportunities in packaging printing.

- In the Japanese market for print equipment, offset printing holds a dominant position, particularly for high-volume commercial tasks such as books, magazines, and newspapers. Japanese manufacturers' modern offset printing presses are celebrated for their precision, speed, and superior build quality. However, as demands evolve, digital technologies, such as inkjet printing, are swiftly gaining traction, which is evident in their rising prominence in textile applications.

- India's market for print equipment is progressively embracing digital technologies, drawn by their cost-effectiveness, quicker turnaround, and enhanced customization over traditional methods. The surge in digital equipment usage, from inkjet to laser printers, is propelled by demands for shorter print runs, variable data printing, and on-demand services.

- India's steady economic ascent and its burgeoning industries, such as retail, pharmaceuticals, packaging, and advertising, are driving the demand for print equipment. As these industries expand and diversify, there is an increasing need for high-quality printing solutions to bolster marketing, branding, packaging, and product identification efforts.

Print Equipment Industry Overview

The print equipment market is fragmented, and due to technological advancements, rivalry is increasing among local and global players. Key players include Mark Andy Inc., OMET Srl, Nilpeter Holding A/S, Gallus (Heidelberger Druckmaschinen AG), and MPS Systems BV.

As the demand for outdoor billboards, posters, adhesive wall and floor prints, and customized packaging surges, the need for commercial printers becomes increasingly vital. Consequently, manufacturers of both indoor and outdoor signage, along with packaging designers, are turning to high-quality commercial printers. This trend is poised to propel market growth.

There is a notable uptick in the demand for offset printing, particularly for legal forms, documents, catalogs, brochures, and calendars. This growing appetite for offset printing is, in turn, driving the demand for associated printing equipment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3 Industry Ecosystem Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Digital Printing Technology

- 5.1.2 Increasing Investment in the Packaging Printing Machinery

- 5.2 Market Restraints

- 5.2.1 High Setup and Operational Cost Associated With Printing

- 5.3 Key Innovations and Developments in the Printing Industry

- 5.4 Industry Standards and Regulations Impacting the Global Equipment Market

- 5.5 Insights on the Demand for Printing Consumables

- 5.6 Innovations Driven By Sustainability and Role of Consumables (Such as Water-based and UV Inks)

- 5.7 Future Market Trends and Key Growth Expectations

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Web Offset Lithographic

- 6.1.2 Flexographic

- 6.1.3 Gravure

- 6.1.4 Screen Printing

- 6.1.5 Digital

- 6.2 By Application

- 6.2.1 Books

- 6.2.2 Commercial Print

- 6.2.3 Advertising Print

- 6.2.4 Security

- 6.2.5 Transactional Print

- 6.2.6 Packaging

- 6.2.7 Labels

- 6.2.8 Other Applications

- 6.3 By Geography

- 6.3.1 North America

- 6.3.1.1 United States

- 6.3.1.2 Canada

- 6.3.2 Europe

- 6.3.2.1 Germany

- 6.3.2.2 France

- 6.3.2.3 Italy

- 6.3.2.4 United Kingdom

- 6.3.2.5 Netherlands

- 6.3.3 Asia-Pacific

- 6.3.3.1 Japan

- 6.3.3.2 India

- 6.3.3.3 China

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

- 6.3.1 North America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Mark Andy Inc.

- 7.1.2 OMET S.R.L.

- 7.1.3 Nilpeter A/S

- 7.1.4 Gallus (Heidelberger Druckmaschinen AG)

- 7.1.5 MPS Systems B.V.

- 7.1.6 Lombardiconverting Machinery S.p.A.

- 7.1.7 Uteco Converting SpA

- 7.1.8 Dg Press Services BV

- 7.1.9 Fujifilm Holdings Corporation

- 7.1.10 Bobst Group SA

- 7.1.11 Heidelberger Druckmaschinen AG

- 7.1.12 Koenig & Bauer AG

- 7.1.13 Konica Minolta Inc.

- 7.1.14 HP Inc.

- 7.1.15 Paper Converting Machine Company (PCMC)

- 7.1.16 Electronics for Imaging, Inc.

- 7.1.17 Canon Inc.

- 7.1.18 Seiko Epson Corporation

- 7.1.19 Edale Limited

- 7.1.20 Brothers Industries Ltd

- 7.1.21 Agfa-Gevaert Group

- 7.1.22 Ricoh Company Ltd

- 7.1.23 Manroland AG (langley)

- 7.1.24 AB Graphic International Limited

- 7.1.25 Durst Image Technology U.S. LLC