|

市場調查報告書

商品編碼

1630317

歐洲行車記錄器市場:佔有率分析、產業趨勢/統計、成長預測(2025-2030)Europe Dashboard Camera - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

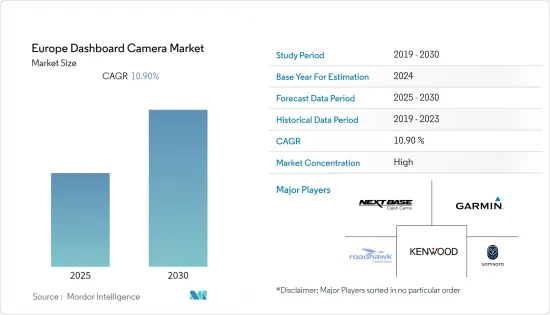

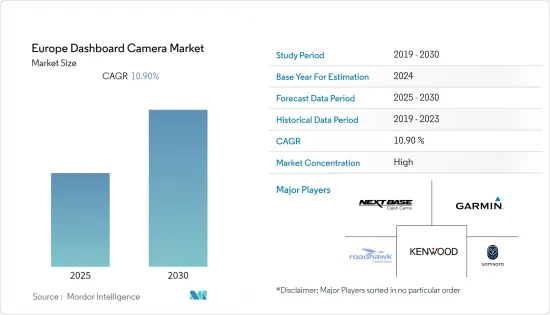

歐洲行車記錄器市場預計在預測期內複合年成長率為 10.9%

主要亮點

- 過去幾年,儀表板攝影機市場在整個歐洲迅速擴張。詐欺,根據英國國家統計局最近發布的《英格蘭和威爾斯犯罪》報告,2020/2021年英國發生了77,309起踏板自行車失竊案。此外,根據歐盟委員會公佈的快報,預計 2021 年將有 19,800 人死於道路交通事故。與2020年相比,增加了1,000人(增加5%),與2019年相比,死亡人數減少了近3,000人(減少13%)。

- 受訪市場的一個顯著趨勢是供應商正在利用人工智慧雙儀表板攝影機進行創新。 Garmin 最近推出了行車記錄器 Tandem,它提供 180 度視野,並配有語音控制的前後鏡頭。將人工智慧融入行車記錄器加速了市場的技術進步。多家供應商提供可用於車隊管理的智慧儀表板攝影機。

- 此外,隨著交通事故和汽車失竊的增加,保險公司對配備行車記錄器的汽車提供保險折扣,預計可以作為保險申請時的證據。

- 然而,地方政府對儀表板攝影機使用的不同看法可能會阻礙預測期內的市場成長。在奧地利、盧森堡和葡萄牙等國家,在公共場所使用錄音設備是違法的。同時,在比利時和法國,它只允許在私人空間使用,並且禁止將影像上傳到媒體平台。在英國和西班牙使用儀表板攝影機是完全合法的。因此,有關儀表板攝影機使用的各種法律可能對市場的成長構成最大的挑戰。

- 疫情對市場造成重大影響,大多數歐洲國家實行嚴格的封鎖和旅行限制,導致全球汽車產業營運、生產和銷售幾乎停滯。隨著 COVID-19 大流行暴露了人工智慧和資料分析能力的差距,對資料和人工智慧相關技能的需求預計將會增加。這也可能導致人工智慧技術在智慧行車記錄器中的採用,從而促進市場的技術進步。

歐洲行車記錄器市場趨勢

單一通路預計將佔據主要市場佔有率

- 顧名思義,單通道行車記錄器只能捕捉一個方向的影像。通常安裝在車輛的前部。這些相機具有 Wi-Fi、GPS、停車模式和夜視功能。此外,單聲道儀表板攝影機通常有各種配置,從單鏡頭到可以同時向前和向後記錄的多個鏡頭。先進的儀表板攝影機可記錄音頻,支援 GPS 記錄,並具有內建加速計以獲取速度資料。

- 駕駛者對單通道行車記錄器的需求不斷成長,用於保險申請、民事和刑事訴訟證據收集以及其他安全問題。此外,在車載相機模組中使用廣角鏡頭可提供更大的覆蓋範圍並提高影像質量,從而提高採用率。

- 增加雙攝影機會使行車記錄器變得更加昂貴和複雜,因為它們需要更多的儲存空間和佈線。一般配備6層全玻璃鏡頭,提供170度廣角。支援高動態範圍 (HDR) 和 WDR,以實現良好的夜視和性能。然而,單聲道儀表板攝影機比雙聲道儀表板攝影機相對便宜。此外,您可以設定兩個單通道行車記錄器,並將一個安裝在車輛後部,以獲得比雙通道行車記錄器更好的覆蓋範圍。預計這將在影響消費者意見方面發揮重要作用。

- 歐洲對電動車日益成長的需求預計將對儀表板攝影機的需求產生顯著影響,因為電動車通常配備更先進的安全和資訊娛樂設備。根據國際能源總署(IEA)統計,歐洲電動車銷量不斷成長,預計2021年將達230萬輛,與前一年同期比較成長約65%。然而,整體汽車市場尚未從疫情中完全恢復。

德國佔有很大的市場佔有率

- 德國是歐洲汽車製造大國。儘管德國汽車工業正在衰退,但在歐洲市場的影響力仍然強勁。世界頂級汽車品牌紛紛進軍德國,包括賓士、奧迪、寶馬、保時捷和福斯。其中許多公司提供高階車輛,因此廣泛使用儀表板攝影機。

- 根據德國貿易投資署 (GTAI) 的數據,德國約佔乘用車製造量的 25% 和新車註冊量的 20%。此外,我們在日本擁有約 44 個基地,大量集中了OEM工廠。此外,2021年,德國在歐盟的OEM市場佔有率超過55%。

- 此外,2021年,德國汽車製造商生產了超過1560萬輛汽車,其中乘用車超過310萬輛,商用車超過35.1萬輛。此外,德國輕型商用車和乘用車OEM製造商2021年的國外市場收益約為2,740億歐元。

- 產業相關人員增加的投資預計將支持汽車產業的進一步成長,進而推動對行車記錄器的需求。例如,2021年2月,福特汽車宣布將投資約10億美元在德國科隆建造電動車生產設施。

歐洲行車記錄器產業概況

歐洲行車記錄器市場是一個競爭激烈的市場。由於技術採用預計將進一步增加,一些全球供應商正在增加在歐洲市場的投資。在歐洲,受訪的供應商主要投資於產品陣容的增強以及與保險公司的合作,以吸引更多客戶。在該地區營運的主要企業包括 Vantrue Inc.、Nextbase UK、Garmin Ltd. 和 Samsara Inc.。

- 2022 年 9 月 - 在歐洲擁有重要影響力的領先汽車智慧公司 70mai 推出了最新的行車記錄器 Omni。這款行車記錄器採用該公司專利的360°旋轉設計,可提供寬廣的視野,防止影像失真。 Omni 利用 PureCel Plus-S HDR 技術,降低影像雜訊,讓您輕鬆平衡低照度和高對比環境中的曝光。

- 2022 年 8 月 -英國儀表板攝影機品牌 Nextbase Dash Cams 宣布與線上食品訂購和配送平台 Grubhub 建立合作夥伴關係,以提高駕駛員的安全性。 Nextbase 開發了一個客製化平台,可以無縫整合到 Grubhub 的驅動程式庫中。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 交通事故和竊盜增加

- 優惠的保險政策

- 市場限制因素

- 一些國家/地區限制使用行車記錄器的法律

第6章 市場細分

- 依技術

- 基本的

- 聰明的

- 依產品類型

- 單通道

- 雙通道

- 後視圖

- 按國家/地區

- 英國

- 德國

- 法國

- 西班牙

- 歐洲其他地區

第7章 競爭格局

- 公司簡介

- Blackvue(Pittasoft Co. Ltd)

- MIO(A brand of MiTAC Europe Limited)

- Vantrue Inc.

- Nextbase UK

- Garmin Ltd

- RoadHawk(Trakm8 Holdings PLC)

- Halfords Group PLC

- Kenwood Europe(JVC KENWOOD Corporation)

- Samsara Inc.

- Steelmate Automotive UK Ltd.

第8章投資分析

第9章 市場未來展望

The Europe Dashboard Camera Market is expected to register a CAGR of 10.9% during the forecast period.

Key Highlights

- The market expanded rapidly across Europe in the past few years due to a considerable number of accidents and thefts, resulting in governments mandating the installation of dash cams. For instance, a recent report named "Crime in England and Wales," published by the Office of National Statistics, indicated about 77,309 theft or unauthorized taking of pedal cycle incidents in 2020/2021 in the United Kingdom. Furthermore, according to the preliminary figures published by the European Commission, an estimated 19,800 people were killed on the road fatalities for 2021. This was an increase of 1,000 deaths (+5%) compared to 2020, representing almost 3,000 (-13%) fewer fatalities than in 2019.

- A notable trend in the market studied is vendors engaging in product innovation of AI dual dashboard cameras. Garmin recently launched the Dash Cam Tandem, which offers 180-degree views on front and rear-facing lenses that can be controlled by voice. The incorporation of AI into dashboard cameras augmented technological advancements in the market. Several vendors offer smart dashboard cameras that can be used for fleet management.

- The implementation of favorable policies by the insurance companies which offer discounts on insurance to the cars equipped with these cameras that could later serve as evidence in case of any claims for insurance for the companies with increasing road accidents and car thefts is also expected to drive the market for the dashcams industry.

- However, the differences in the opinions of regional governments regarding dashboard camera usage could hinder market growth over the forecast period. The laws for dashcams within Europe are very diverse; such as in Austria, Luxembourg, and Portugal, the usage of recording devices in public has been declared illegal. In contrast, nations such as Belgium and France allow for use only in private spaces and prevent people from uploading footage on media platforms. The use of dashcams in the UK and Spain is entirely legal. Hence, the various laws on the use of dashcams could be the biggest challenge to the market's growth.

- The pandemic has significantly impacted the market, with the operations, production, and sales in the automotive industry to almost a halt globally with the imposing of strict lockdowns and travel restrictions by most European countries. The demand for data and AI-related skills is expected to be in higher order, as the COVID-19 pandemic exposed gaps in AI and data analysis capabilities. This can also lead to the adoption of AI technologies in intelligent dashcams, aiding technological advancements in the market.

Europe Dashboard Camera Market Trends

Single-Channel Expected to Hold Significant Market Share

- As the name suggests, single-channel dashboard cameras can film only in one direction. These are usually placed at the front of the vehicle. These cameras have Wi-Fi, GPS, parking mode, and night vision features. Additionally, single-channel dashboard cameras are usually available in every possible configuration, ranging from single to multiple lenses that allow simultaneous front and rear recording. The advanced dashcams record sound, support GPS logging and have built-in accelerometers for speed data.

- The demand for single-channel dashboard cameras grows due to the rising demand for them among motorists, owing to their application in filing insurance claims and procuring evidence for civil and criminal lawsuits and other safety concerns. Furthermore, the use of wide-angle lenses in automotive camera modules witnessed increasing adoption due to comprehensive field coverage and enhanced picture quality.

- Adding dual cameras makes a dashcam more expensive and complicated, as it uses more storage space and requires more wiring. They generally come with a six-layer full-glass lens that provides a wide 170-degree angle. Both high dynamic range (HDR) and WDR are supported for good night vision and performance. However, single-channel dashboard cameras are relatively cheaper than dual-channel dashcams. Furthermore, a setup of two single-channel dashcams, one mounted in the rear of the vehicle, would provide better coverage than dual-channel dashcams. This is expected to play a vital role in influencing consumers' opinions.

- The growing demand for electric vehicles in the European region is expected to notably impact the need for dash cams, as EVs usually contain more sophisticated safety and infotainment devices. According to the International Energy Agency (IEA), electric car sales increased in the European region, reporting growth of about 65% year-on-year to reach 2.3 million in 2021. Although, the overall automotive market has not recovered entirely from the pandemic.

Germany to Hold Significant Market Share

- Germany is the leading automotive manufacturing country in the European region. Although the German automotive industry has witnessed a decline, it still continues to hold a strong market presence in Europe. Some top global automotive brands, including Mercedes-Benz, Audi, BMW, Porsche, Volkswagen, etc., are present in the country. As most of these companies offer automobiles in the premium segment, these companies widely use dashboard cameras.

- According to German Trade & Invest (GTAI), Germany accounts for around 25% of all passenger cars manufactured and almost 20 percent of all new vehicle registrations. The country also boasts a large concentration of OEM plants, with about 44 sites in the country. Furthermore, in 2021, the German OEM market share in the EU was more than 55 percent.

- Furthermore, in 2021, German automobile manufacturers produced over 15.6 million vehicles, including more than 3.1 million passenger cars and 351,000 commercial vehicles. Additionally, the German light commercial vehicle and passenger car OEMs generated foreign market revenue of about EUR 274 billion in 2021.

- Increasing investment by the industry stakeholders is expected to support further the growth of the automotive industry, which in turn will drive the demand for dashboard cameras. For instance, in February 2021, Ford Motors announced an investment of about USD 1 billion in an electric vehicle production facility in Cologne, Germany.

Europe Dashboard Camera Industry Overview

The European Dashboard Camera market is Competitive. Some global vendors are increasingly investing in the European market as technology adoption is estimated to increase further. In Europe, most studied market vendors mainly invest in enhancing their product offerings and collaborating with insurance companies to attract more customers. Some key players operating in the region include Vantrue Inc., Nextbase UK, Garmin Ltd, and Samsara Inc.

- September 2022 - 70mai, a leading auto intelligence company having a notable presence in the European region, launched its latest Dash Cam Omni. The dash cam has been designed using the company's patented 360° rotating design, which prevents image distortion due to its large field of view. By leveraging PureCel Plus-S HDR technology, Omni can reduce image noise and easily adjust exposure balance in low-light or high-contrast environments.

- August 2022 - Nextbase Dash Cams, a UK-based dash cam brand, announced a partnership with Grubhub, an online food ordering and delivery platform, to enhance the security and safety of drivers. To allow a seamless integration into Grubhub's driver base, Nextbase has developed a bespoke platform.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increase in the Number of Road Accidents and Thefts

- 5.1.2 Favorable Insurance Policies

- 5.2 Market Restraints

- 5.2.1 Laws Restricting the Use of Dash Cams in Some Countries

6 MARKET SEGMENTATION

- 6.1 By Technology

- 6.1.1 Basic

- 6.1.2 Smart

- 6.2 By Product Type

- 6.2.1 Single-Channel

- 6.2.2 Dual-Channel

- 6.2.3 Rear-View

- 6.3 By Country

- 6.3.1 United Kingdom

- 6.3.2 Germany

- 6.3.3 France

- 6.3.4 Spain

- 6.3.5 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Blackvue (Pittasoft Co. Ltd)

- 7.1.2 MIO (A brand of MiTAC Europe Limited)

- 7.1.3 Vantrue Inc.

- 7.1.4 Nextbase UK

- 7.1.5 Garmin Ltd

- 7.1.6 RoadHawk (Trakm8 Holdings PLC)

- 7.1.7 Halfords Group PLC

- 7.1.8 Kenwood Europe (JVC KENWOOD Corporation)

- 7.1.9 Samsara Inc.

- 7.1.10 Steelmate Automotive UK Ltd.