|

市場調查報告書

商品編碼

1630318

揮發性有機化合物氣體感測器:市場佔有率分析、產業趨勢、成長預測(2025-2030)Volatile Organic Compound Gas Sensor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

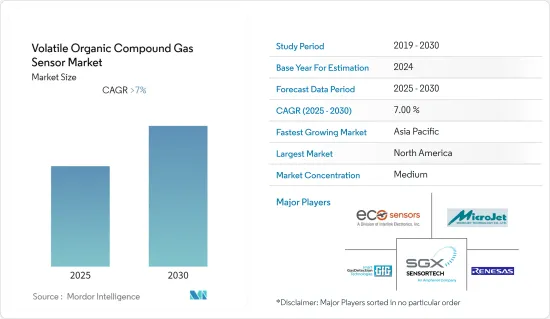

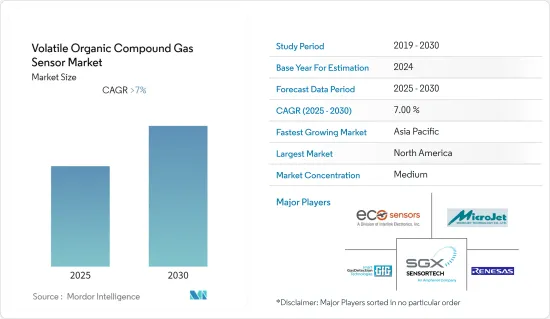

揮發性有機化合物氣體感測器市場預計在預測期內複合年成長率將超過 7%。

揮發性有機化合物 (VOC) 氣體會造成環境空氣污染,並且很少有 VOC 氣體被證明是疾病的生物標記。大氣中VOC氣體的檢測引起了人們的高度關注,並且在洩漏檢測設備的發展中變得越來越重要。 VOC感測器由於其檢測性能高、便攜、尺寸緊湊等獨特的特點,被用於空氣監測設備中來監測排放水平。

主要亮點

- 此外,人們對室內和室外空氣品質的認知不斷提高,推動了工業和民用環境監測的需求。預計這一因素將在預測期內為市場創造機會。

- 政府機構正在採取積極措施,強制在潛在危險場所使用感測器。感測器廣泛應用於化學、工業、醫療和汽車行業,主要用於空氣品質監測和可燃性氣體檢測。 。例如,美國環保署和礦山安全與健康管理局等政府機構不斷加強的法規和政策導致各行業大規模採用。

- 水和污水處理產業的成長是推動VOC氣體市場擴大的關鍵因素。污水污水病毒、細菌、朊病毒和寄生蟲等病原體,紙纖維、頭髮、食物、糞便、嘔吐物、植物材料、藥物等有機顆粒,二氧化碳、甲烷和硫化氫等氣體,以及其他以揮發性有機化合物(VOC) 形式存在的有害物質。

- 2019 年 5 月,德里用水和污水委員會 (DJB) 於週三核准了在奧克拉 (Okhla) 新建一座污水處理廠 (STP)。該處理廠將能夠每天處理1.24億加侖污水,將在三年內建成,耗資116.1億印度盧比。預計此類案例將在預測期內推動市場成長。

- VOC 氣體感測器擴大應用於石油和天然氣行業,用於檢測鑽探平臺(上游)、管道、拖車、油輪(中游)以及精製和倉儲設施(下游)的洩漏。由於石油和天然氣消費量的增加,預計該行業將成長,並且市場預計在預測期內將成長。

- 然而,席捲多個國家的COVID-19疫情對整個感測器產業產生了負面影響。由於員工感染 COVID-19 導致勞動力短缺,以及許多情況下保持社交距離的實際挑戰,業務連續性可能會變得越來越複雜。

揮發性有機化合物氣體感測器市場趨勢

石油和天然氣產業推動市場成長

- 各國政府和相關監管機構正在加強滿足不斷成長的能源需求,並且不斷推出新計劃來實現這一目標。隨著能源產業排放大量揮發性氣體,引入 VOC 氣體感測器等解決方案的呼聲日益高漲。

- 2020 年 2 月,ADNOC 宣布與 Petrofac Emirates LLC 簽訂兩份契約,為達爾馬天然氣開發計劃建造海上設施。這兩份EPC合約預計價值超過60.6億迪拉姆,預計2022年完成。預計此類案例將在預測期內推動該技術的採用。

- 對燃料和天然氣的需求不斷增加正在推動該地區的參與企業增加產量或尋求產能擴張。預計此類案例將在預測期內推動 VOC 氣體感測器的採用。

- 根據BP《2019年世界能源統計年鑑》顯示,全球石油產量增加220萬桶/日。美國幾乎佔了全部淨增量,其產量增量(220萬桶/日)創下了任何國家任何年份的記錄。其他地區,加拿大(41萬桶/日)和沙烏地阿拉伯(39萬桶/日)的產量增加了委內瑞拉(下降58萬桶/日)和伊朗(下降31萬桶/日)的產量下降。

- 然而,油價暴跌和持續的價格不確定性加劇了 COVID-19 疫情對石油和天然氣公司帶來的挑戰。對此,OPEC+集團宣布了全球最大的減產協議,即每天減產1,000萬桶。此外,世界各地許多行業被迫關閉。

北美佔據主要市場佔有率

- 該地區各國政府正在強調法律規範和必要/強制的基礎設施,以使公共產業公司能夠以最佳水平運作。在市場波動時期,公共產業是一個安全的賭注,因為它們主要為文明的基礎提供動力,而社會需要這種基本需求,以便在貨幣層面之外發揮作用。隨著政府的持續參與,保護職場的措施必須被視為最重要的。這為氣體感測器製造商描述了巨大的市場機會。

- 例如,截至 2020 年 1 月,能源部已選擇 16 個計劃以獲得約 2,500 萬美元的聯邦資金,用於成本分攤計劃,以加速天然氣基礎設施技術開發。與成本相關的關鍵部分之一是維修。特別是,開發低成本維修技術,例如空氣管理系統、整合感測器和雲端連接控制系統,預計將減少排放。

- 另一方面,石油和天然氣領域的幾起事件證實需要對揮發性燃料運輸進行密切監控。 2010 年加州聖布魯諾瓦斯爆炸事件中,PG&E 沒有配備足夠的檢測設備,但該公司也未能定期測試其傳輸裝置。

- 必須持續感測和監控各種模式,包括溫度、壓力、振動和應變/應力,以確保陸上和海上石油和天然氣生產、儲存和運輸基礎設施的完整性。

- 此外,為了確保石油生產的安全性和可靠性,已經開發了多種先進的感測技術來滿足高壓高溫(HPHT)環境下現代石油和天然氣應用的特定感測要求。

揮發性有機化合物氣體感測器產業概況

隨著ABB、Alphasense等主要企業的出現,塑膠加工機械市場上競爭企業之間的競爭已慢慢鞏固。這些公司透過研究和開發不斷創新其產品和服務,從而獲得了競爭優勢。透過策略夥伴關係關係、併購,這些公司已經能夠在市場上站穩腳跟,並進一步發展他們的技術。

- 2020年3月,ABB Limited同意收購Cylon Controls Ltd.,以加強ABB電氣化業務在商業建築領域的地位。 Cylon擁有約100名員工,提供自動化和HVAC控制解決方案建置。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 市場促進因素

- 嚴格的政府法規監管 VOC排放

- 更多地使用無線和智慧感測技術

- 市場限制因素

- 互通性問題

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 對市場的影響

第5章市場區隔

- 地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲和紐西蘭

- 拉丁美洲

- 中東/非洲

第6章 競爭狀況

- 公司簡介

- EcoSensors

- SGX Sensortech Limited

- GfG Europe Ltd.

- MicroJet Technology Co., Ltd.

- Renesas Electronics Corporation

- Aeroqual Limited

- Alphasense

- ABB Ltd.

- Ion Science Ltd

第7章 投資分析

第8章市場的未來

The Volatile Organic Compound Gas Sensor Market is expected to register a CAGR of greater than 7% during the forecast period.

Volatile organic compound (VOC) gases contribute to air pollution in the environment; few of the VOC gases are proven to be disease biomarkers. The detection of VOC gases in the air has received considerable attention, becoming increasingly important in the development of leak detection devices. VOC sensors are used in air monitoring devices to observe emission levels due to their unique properties, such as high sensing performance, portability, and compact size.

Key Highlights

- Additionally, growing awareness about indoor and outdoor air quality is driving the demand in industrial and private environmental monitoring. This factor is expected to create opportunities for the market over the forecast period.

- Governmental agencies have been taking proactive measures to enforce the use of sensors in potentially hazardous locations, where they are seen as a vital cog for triggering emergency procedures across industries in case of an abnormal rise in the concentration of gases that are actively used for monitoring the air quality and detection of combustible gases majorly in the chemical, industrial, medical, and automotive industries. For instance, the increasing imposition of regulations and policies by government associations, such as the U.S. Environmental Protection Agency and Mine Safety and Health Administration, has resulted in the large-scale adoption in various industries.

- The growth of the water and wastewater treatment industry is a crucial factor driving the expansion of the VOC gas market. The wastewater comprises of pathogens such as viruses, bacteria, prions, and parasitic worms, organic particles such as paper fibers, hairs, food, feces, vomit, plant material, pharmaceuticals, gases such as carbon dioxide, methane, hydrogen sulfide, and other hazardous substances which act as Volatile Organic Compounds (VOCs) present in wastewater.

- In May 2019, The Delhi Jal Board (DJB) Wednesday approved setting up of a new sewage treatment plant (STP) at OkhlaThe Delhi Jal Board (DJB) Wednesday approved setting up of a new sewage treatment plant (STP) at Okhla that would be capable of treating 124 million gallons of wastewater per day and will come up at the cost of Rs 1,161 crore in three years. Such instances are expected to fuel market growth over the forecast period.

- The VOC gas sensors are increasingly being used in the oil and gas industry to detect leaks on drilling platforms (upstream), pipelines, trailers and tanker vessels (midstream), and refining and storage facilities (downstream). With the industry poised to grow due to the increased consumption of oils and natural gas in the sector, the market is poised to witness growth over the forecast period.

- However, the COVID-19 outbreak that has been ravaging various countries has adversely affected the overall sensor industry. The continued operations may become increasingly complicated due to workforce shortages, as employees are infected by COVID-19 and the practical difficulties in many cases of social distancing.

Volatile Organic Compound Gas Sensor Market Trends

Oil & Gas Industry to Drive the Market Growth

- The increasing initiatives by the government and the related regulatory bodies to meet the growing energy demand are increasingly launching new projects to accomplish the objective. Since the energy sector is prone to the emission of volatile gases, it would propel such bodies to install solutions such as VOC gas sensors.

- In February 2020, ADNOC announced two contracts for the construction of offshore facilities for the Dalma Gas Development Project to Petrofac Emirates LLC. The two EPC contracts have an estimated value of over AED 6.06 billion and are expected to be completed by 2022. Such instances are expected to boost the adoption of the technology over the forecast period.

- The increasing demand for fuels and natural gases have propelled the players in the region to either boost their production or to look for expansion of their production capabilities. Such instances are expected to fuel the adoption of the VOC gas sensors over the forecast period.

- According to the BP Statistical Review of World Energy of 2019, Global oil production rose by 2.2 million b/d. Almost all of the net increase was accounted for by the US, with their growth in production (2.2 million b/d) a record for any country in any year. Elsewhere, production growth in Canada (410,000 b/d) and Saudi Arabia (390,000 b/d) was outweighed by declines in Venezuela (-580,000 b/d) and Iran (-310,000 b/d).

- However, the challenge from the COVID-19 outbreak for oil and gas companies has been heightened by the oil-price collapse and continuing price uncertainty. In response, the Opec+ group announced the world's largest-ever supply cut deal, by 10m barrels per day. Moreover, many industrial operations across the world have been shut down owing to the outbreak.

North America to Hold Major Market Share

- The region's governments have underlined the regulatory framework and required/mandated infrastructure for utility companies to function at optimal levels. Utilities primarily run the base of civilization, and society needs this basic need to function on more than just a financial level, making it a safe bet for volatile times in the market. Due to the continuous involvement of the government, the measures to safeguard the workplace need to be handled with the utmost importance. This provides a huge market opportunity for gas sensor manufacturers.

- For instance, as of January 2020, the DOE selected 16 projects to receive nearly USD 25 million in federal funding for cost-shared projects to advance natural gas infrastructure technology development. One of the major areas where cost is associated belongs to retrofits. The developments across building a low-cost retrofit technology, specifically to an air management system, integrated sensors, and a cloud-connected control system, are expected to reduce emissions.

- On the other hand, The region witnessing a few incidents in the oil and gas domains has confirmed the need for meticulous monitoring of the transportation of volatile fuels. The 2010 gas explosion in San Bruno, California, revealed that PG&E failed to have appropriate detection equipment in place, but the utility was negligent across periodic testing of its transmission lines.

- Different modalities, including temperature, pressure, vibration, and strain/stress, are required to sense and monitor continuously to guarantee the integrity of oil and gas production, storage, and transport infrastructure onshore and offshore.

- Also, with the safety and reliability of oil production to be assured, multiple advanced sensing techniques have been developed to cater to the specific sensing requirements under high-pressure-high-temperature (HPHT) environments across oil and gas applications in recent decades.

Volatile Organic Compound Gas Sensor Industry Overview

The competitive rivalry in the plastic processing machinery market is moderately consolidated owing to the presence of some key players such as ABB and Alphasense. Through research and development, these companies have gained a competitive advantage by continually innovating their offerings. Through strategic partnerships, mergers, and acquisitions, these players have gained a strong footprint in the market and can further develop the technology.

- March 2020: ABB limited agreed to acquire Cylon Controls Ltd for enhancing the ABB Electrification business position in the commercial buildings segment. Cylon consists of approximately 100 employees and offers to build automation and HVAC control solutions.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Stringent Government Regulations to Control VOC Emissions

- 4.2.2 Increasing Use of Wireless and Smart Sensing Technology

- 4.3 Market Restraints

- 4.3.1 Interopereability Issues

- 4.4 Industry Attractiveness - Porter's Five Force Analysis

- 4.4.1 Threat of New Entrants

- 4.4.2 Bargaining Power of Buyers

- 4.4.3 Bargaining Power of Suppliers

- 4.4.4 Threat of Substitute Products

- 4.4.5 Intensity of Competitive Rivalry

- 4.5 Industry Value Chain Analysis

- 4.6 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Geography

- 5.1.1 North America

- 5.1.2 Europe

- 5.1.3 Asia

- 5.1.4 Australia and New Zealand

- 5.1.5 Latin America

- 5.1.6 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 EcoSensors

- 6.1.2 SGX Sensortech Limited

- 6.1.3 GfG Europe Ltd.

- 6.1.4 MicroJet Technology Co., Ltd.

- 6.1.5 Renesas Electronics Corporation

- 6.1.6 Aeroqual Limited

- 6.1.7 Alphasense

- 6.1.8 ABB Ltd.

- 6.1.9 Ion Science Ltd