|

市場調查報告書

商品編碼

1630338

中東和非洲的紙和紙板:市場佔有率分析、行業趨勢和成長預測(2025-2030)Middle East And Africa Paper And Paperboard - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

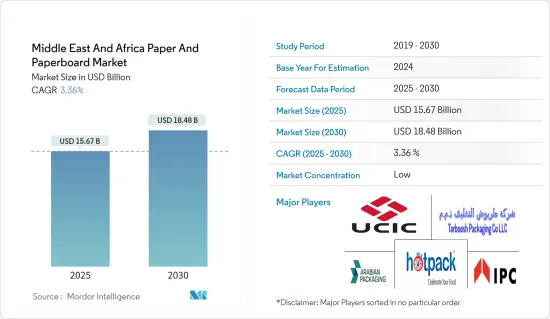

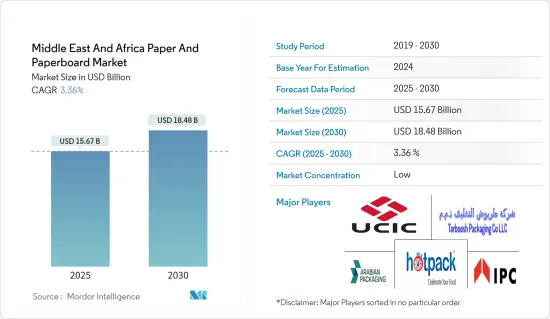

中東和非洲紙和紙板市場規模預計到2025年為156.7億美元,預計到2030年將達到184.8億美元,預測期內(2025-2030年)複合年成長率為3.36%。

在食品和飲料、個人護理、醫療保健和電子商務等行業成長的推動下,中東和非洲的紙和紙板包裝市場預計將穩步擴張。此外,該地區的永續性努力正在推動可回收紙和紙板產品的採用。

主要亮點

- 紙漿由木材和非木材原料製成,是紙和紙板包裝的生產基地。木漿的重要來源是廢紙。由於其永續性和經濟性,木漿已被用於紙張和紙板包裝的各種最終用途行業。

- 中東永續包裝產品市場正在崛起,這主要是由於減少傳統包裝材料碳排放的意識不斷增強。根據 2030 年國家願景,卡達政府啟動了多項綠色經濟計劃,以遏制對不可再生資源的依賴並最大限度地減少廢棄物排放。

- 與食品和飲料行業的趨勢類似,隨著注重健康的消費者選擇雜貨宅配和餐套件,食品供應商的外帶偏好顯著增加。此外,麥當勞等全球速食巨頭正抓住環保食品包裝的勢頭,推動市場成長。據估計,零售包裝可以顯著節省成本,有可能將貨架補貨和處理成本降低 50%。這項好處正在影響食品宅配服務,使他們更加關注環保紙質包裝。

- 此外,快速的都市化和旅遊業的繁榮導致遊客更喜歡更安全的加工食品,刺激了對包裝食品和飲料的需求。據沙烏地阿拉伯統計總局稱,食品和飲料行業銷售額預計將從 2020 年的 144.6 億美元增至 2025 年的 160.3 億美元。這種上升趨勢預計將推動食品和飲料領域對永續包裝解決方案的需求,例如折疊紙盒和盒子。

- 此外,電子商務的繁榮和技術進步預計將刺激運輸和工業包裝的成長。鑑於市場前景廣闊,紙業領域的國內外投資者都熱衷於加強其影響力並提高區域產品能力。網路購物需求的增加進一步凸顯了人們對紙漿和紙製品日益成長的興趣。

- 然而,對紙包裝不斷成長的需求面臨不負責任的砍伐森林的嚴峻挑戰。這不僅威脅紙板包裝產業的原料供應,也對關鍵生態系統構成風險。永續的紙張生產可能導致生態劣化和社會衝突,特別是在這種做法仍然猖獗的地區。

中東和非洲紙及紙板市場趨勢

電子商務成長推動了對瓦楞紙箱的需求

- 隨著永續性成為整個供應鏈的關鍵議題,瓦楞包裝正逐漸普及。紙漿和造紙工業正在使現代瓦楞紙板的原料更加可回收。此外,人們越來越喜歡紙板形式的保護,而不是聚苯乙烯泡沫塑膠等基於發泡聚苯乙烯的替代品。

- 電子商務的興起徹底改變了零售業的面貌。這一趨勢改變了消費行為和零售經營模式,目前正在中東地區擴張,為產業相關人員創造了重大機會。推動中東電子商務成長的關鍵因素包括高人均收入、強大的運輸和物流網路、不斷上升的網路普及率以及技術進步。

- 由於瓦楞紙箱等永續包裝解決方案的環境和經濟效益,國家監管機構和政府機構越來越重視它們。這項重點進一步支持市場擴張。例如,2023年7月,Apex Business Trading在阿曼薩梅爾工業城設施大樓開設了紙板工廠新分店,並同時推出了四款創新產品。

- 根據國際貿易局預測,到2025年,非洲電商用戶數量預計將超過5億人。雜貨業出現了 54% 的快速成長,主要是由於大流行和隨後的關閉。類似的成長趨勢在各種食品配送平台中都很明顯,包括雜貨和快餐業。消費者對價格敏感,並經常利用線上促銷和優惠券。

- 沙烏地阿拉伯雄心勃勃地將自己定位為全球電子商務的關鍵參與企業,旨在建立重要的國家、區域和國際影響力。國際領先的數位商務新聞媒體《Cross Border》雜誌預測,到 2027 年,沙烏地阿拉伯的線上銷售成長率將維持每年 13.5% 的強勁成長率。預計到2027年,該國電子商務銷售額將飆升至300億美元,到2030年將飆升至440億美元。電子商務的激增預計將推動對輕量、無空氣瓦楞紙箱以及二級和三級包裝解決方案的需求。

阿拉伯聯合大公國預計將確認最快的市場成長

- 在阿拉伯聯合大公國,由於食品和非食品領域終端用戶行業的大幅擴張,預測期內對瓦楞紙板、折疊紙盒和瓦楞紙箱的需求將增加。由於成年人口的成長,整個研究全部區域的飲食習慣發生了明顯的變化。這項變化正在增加食品領域對包裝食品、新鮮蔬菜和水果的需求。

- 阿拉伯聯合大公國的紙和紙板包裝市場正在加速成長。這種快速成長歸因於公眾環保意識的不斷增強、對永續包裝解決方案的需求不斷成長以及對適當包裝的需求不斷成長。因素包括電子商務市場的快速成長以及經濟成長和人均收入增加刺激的對電子產品、家居用品和個人保健產品的需求增加。

- 為了回應一次性塑膠禁令,各行業正在轉向可回收和可重複使用的包裝解決方案。對生物分解性包裝紙和紙板的需求不斷成長,進一步推動了這個市場的擴張。一個著名的例子是 KEZAD 集團的阿布達比哈利法經濟區。該公司最近宣佈建立一家新工廠,專門生產再生牛皮紙大捲軸。此舉使該公司的產品範圍多樣化,符合阿拉伯聯合大公國對生物分解性包裝材料快速成長的需求。

- 已調理食品經常使用紙盒進行二次包裝。截至 2024 年 4 月,阿拉伯聯合大公國擁有 568 家製造商和加工商(主要是中小企業)以及該領域的 2,000 多家製造公司。值得注意的是,阿拉伯聯合大公國的食品加工產業能夠滿足國內需求以及區域和全球市場的需求。

- 線上食品配送服務和外帶的成長預計也將支持該國對紙包裝產品的需求。食品零售是阿拉伯聯合大公國第四大電子商務領域。食品電子商務是指零售商和餐廳在網路上銷售的產品,例如雜貨、包裝食品和已調理食品。根據美國農業部對外農業服務局預測,2023年阿拉伯聯合大公國食品電商零售額將從6.41億美元增加到10.72億美元。由於對折疊紙盒和食品包裝盒等產品的需求不斷增加,預計未來一段時間也會出現這種成長。

中東和非洲紙和紙板行業概況

中東和非洲的紙和紙板市場是細分的。它由多家領先公司組成,包括 International Packaging Company LLC、Arabian Packaging Co、United Carton Industries Company 和 Hotpack Packaging Industries。永續性意識的供應商正在利用策略合作計劃和收購作為競爭優勢,並加強其產品線,以進一步擴大基本客群並獲得市場佔有率。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

第5章市場動態

- 市場促進因素

- 對輕量、永續材料的需求不斷成長

- 電子商務的成長創造了對各種紙和紙板包裝的需求

- 市場限制因素

- 原料成本上漲

第6章 市場細分

- 依產品類型

- 折疊式紙盒

- 瓦楞紙箱

- 其他

- 按最終用戶產業

- 食物

- 飲料

- 醫療保健

- 個人護理

- 電

- 其他

- 按國家/地區

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 埃及

- 摩洛哥

- 南非

- 奈及利亞

第7章 競爭格局

- 公司簡介

- International Packaging Company LLC

- Arabian Packaging Co. LLC

- United Carton Industries Company(UCIC)

- Tarboosh Packaging Co. LLC

- Hotpack Packaging Industries LLC

- International Paper

- Al Rumanah Packaging

- Green Packaging Boxes Ind LLC

- Matco Packaging LLC

- Global Carton Boxes Manufacturing LLC

第8章 市場機會及未來趨勢

The Middle East And Africa Paper And Paperboard Market size is estimated at USD 15.67 billion in 2025, and is expected to reach USD 18.48 billion by 2030, at a CAGR of 3.36% during the forecast period (2025-2030).

Driven by the growth of industries like food and beverages, personal care, healthcare, and e-commerce, the MEA paper and paperboard packaging market is poised for steady expansion. Additionally, the region's commitment to sustainability is boosting the adoption of recyclable paper and paperboard products.

Key Highlights

- Pulp, derived from wood and non-wood materials, is the foundation for producing paper and paperboard packaging. A significant source of wood pulp comes from recycled paper. Given its sustainability and affordability, wood pulp has become the go-to choice for various end-use industries in paper and paperboard packaging.

- In the Middle East, the market for sustainable packaging products is on the rise, primarily due to heightened awareness about reducing the carbon footprint of conventional packaging materials. In alignment with its National Vision 2030, the Qatari government has initiated multiple green economy programs to curtail reliance on non-renewable resources and minimize waste output.

- Similar to trends in the food and beverage sector, a surge in health-conscious consumers opting for grocery delivery and meal kits has led to a notable uptick in take-out preferences among food suppliers. Furthermore, global fast-food giants like McDonald's are seizing the momentum of eco-friendly food packaging, propelling market growth. Retail-ready packaging offers significant cost savings, with estimates suggesting a potential 50% reduction in shelf restocking and handling costs. This advantage has influenced food delivery services and heightened their focus on environmentally friendly, paper-based packaging.

- Moreover, rapid urbanization and a boom in tourism, with visitors prioritizing safer processed foods, have spurred the demand for packaged food and beverages. According to the General Authority for Statistics in Saudi Arabia, the food and beverage sector's revenue is projected to rise from USD 14.46 billion in 2020 to an estimated USD 16.03 billion by 2025. This upward trajectory is set to boost the demand for sustainable packaging solutions, like folding cartons and boxes, in the food and beverage domain.

- Furthermore, the e-commerce boom and technological advancements will likely spur growth in transport and industrial packaging. Given the market's promising outlook, domestic and international investors in the paper-based sector are keen on bolstering their presence and enhancing regional product capacity. The uptick in online shopping demand further underscores the rising interest in pulp and paper products.

- However, the burgeoning demand for paper packaging faces a daunting challenge: irresponsible deforestation. This not only threatens the paperboard packaging industry's raw material supply but also poses risks to vital ecosystems. Unsustainable practices in paper production can lead to ecosystem degradation and even social conflicts, especially in regions where such practices are still rampant.

Middle East And Africa Paper And Paperboard Market Trends

Demand For Corrugated Boxes Backed By E-commerce Growth

- As sustainability becomes a pivotal concern across the supply chain, corrugated packaging is gaining traction. The pulp and paper industry's advancements in producing modern containerboards from raw materials enhance its recyclability. Moreover, there's a growing preference for corrugated protective formats over polymer-based alternatives like foams.

- The rise of e-commerce has reshaped the retail landscape. This trend, which has altered consumer behavior and retail business models, is now expanding in the Middle East, presenting substantial opportunities for industry stakeholders. Key drivers fueling e-commerce growth in the Middle East include high per capita income, robust transportation and logistics networks, rising internet penetration, and technological advancements.

- Regulatory and governmental bodies nationwide are increasingly prioritizing sustainable packaging solutions, such as corrugated boxes, for their environmental benefits and financial advantages. This emphasis is further propelling market expansion. For example, in July 2023, Apex Business Trading inaugurated a new branch of its Corrugated Boxes Factory at the Facility Building in Samail Industrial City, Oman, and simultaneously launched four innovative products.

- According to the International Trade Administration, Africa is projected to have over 500 million e-commerce users by 2025. The grocery sector witnessed a 54% surge, primarily driven by the pandemic and subsequent lockdowns. Similar growth trends were evident across various food delivery platforms, encompassing both the grocery and fast food sectors. Consumers displayed price sensitivity, often capitalizing on online promotions and coupons.

- Saudi Arabia is ambitiously positioning itself as a key player in the global e-commerce landscape, aiming to establish a significant national, regional, and international presence. Cross Border Magazine, a prominent international digital commerce news outlet, projects Saudi Arabia's online revenue growth to maintain a robust annual rate of 13.5% through 2027. E-commerce sales in the kingdom are anticipated to soar to USD 30 billion by 2027, further escalating to USD 44 billion by 2030. This surge in e-commerce engagement is expected to drive demand for lightweight, air-free corrugated boxes and secondary and tertiary packaging solutions.

United Arab Emirates is Expected Witness the Fastest Market Growth

- As end-user industries expand significantly in the food and non-food sectors in the United Arab Emirates, the demand for containerboard, folding cartons, and corrugated boxes will rise during the forecast period. Changing food habits, driven by a growing adult population, are evident across the studied regions. This shift has intensified the food sector's demand for packaged foods, fresh vegetables, and fruits.

- The paper and paperboard packaging market in the United Arab Emirates is witnessing accelerated growth. This surge can be attributed to heightened environmental awareness among the populace, a rising demand for sustainable packaging solutions, and the need for appropriate packaging. Contributing factors include the burgeoning e-commerce market and an uptick in demand for electronic goods, household items, and personal care products, all spurred by economic growth and increasing per capita incomes.

- In light of the ban on single-use plastics, industry players are pivoting towards recyclable and reusable packaging solutions. The growing appetite for biodegradable packaging papers and boards further fuels this market expansion. A notable example is Khalifa Economic Zones Abu Dhabi (KEZAD Group), which recently announced the establishment of a new plant dedicated to producing recycled Kraft Paper Jumbo reels. This move diversifies the company's product offerings and aligns with the surging demand for biodegradable packaging materials in the United Arab Emirates.

- Ready-to-eat meal products prominently utilize cartons as their secondary packaging. Data from the USDA's Foreign Agricultural Service highlights the robust food and beverage landscape in the United Arab Emirates; as of April 2024, the country boasted 568 manufacturers and processors in this sector, predominantly small to medium-sized enterprises, and over 2,000 manufacturing companies. Notably, the United Arab Emirates's food processing sector caters to domestic needs and regional and global markets.

- Also, the growth in online food delivery services and takeaways would bolster the country's demand for paper packaging products. Food retail is the fourth largest e-commerce segment in the United Arab Emirates. Food e-commerce refers to items sold online from retailers or restaurants, whether groceries, packaged food, or ready-to-eat meals. According to the USDA Foreign Agricultural Service, the retail value of food e-commerce in the United Arab Emirates increased from USD 641 million to USD 1072 million in 2023. This growth is expected to be witnessed in the upcoming period with the rise in demand for products like folding cartons and boxes for packaging food.

Middle East And Africa Paper And Paperboard Industry Overview

The Middle East and African paper and paperboard market is fragmented. It consists of several major players, including International Packaging Company LLC, Arabian Packaging Co, United Carton Industries Company, Hotpack Packaging Industries, and others. Vendors with a focus on sustainability are enhancing the product line, leveraging strategic collaborative initiatives and acquisitions as a competitive advantage to expand their customer base further and gain market share.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand for Lightweight and Sustainable Materials

- 5.1.2 Increasing Growth of E-commerce Creates Demand for Various Paper and Paperboard Packaging Types

- 5.2 Market Restraint

- 5.2.1 Increasing Costs of Raw Materials

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Folding Cartons

- 6.1.2 Corrugated Boxes

- 6.1.3 Other Product Types

- 6.2 By End-user Industry

- 6.2.1 Food

- 6.2.2 Beverage

- 6.2.3 Healthcare

- 6.2.4 Personal Care

- 6.2.5 Electrical

- 6.2.6 Other End-user Industries

- 6.3 By Country

- 6.3.1 United Arab Emirates

- 6.3.2 Saudi Arabia

- 6.3.3 Egypt

- 6.3.4 Morocco

- 6.3.5 South Africa

- 6.3.6 Nigeria

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 International Packaging Company LLC

- 7.1.2 Arabian Packaging Co. LLC

- 7.1.3 United Carton Industries Company (UCIC)

- 7.1.4 Tarboosh Packaging Co. LLC

- 7.1.5 Hotpack Packaging Industries LLC

- 7.1.6 International Paper

- 7.1.7 Al Rumanah Packaging

- 7.1.8 Green Packaging Boxes Ind LLC

- 7.1.9 Matco Packaging LLC

- 7.1.10 Global Carton Boxes Manufacturing LLC