|

市場調查報告書

商品編碼

1630339

顯示器驅動器 -市場佔有率分析、行業趨勢和促進因素、成長預測 (2025-2030)Display Driver - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

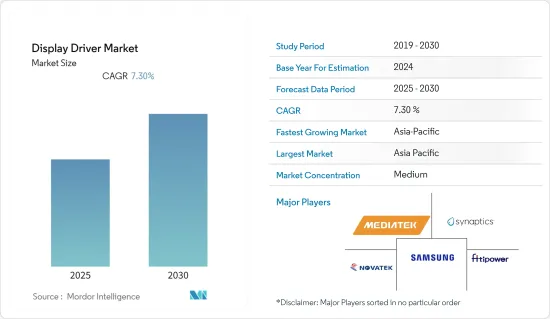

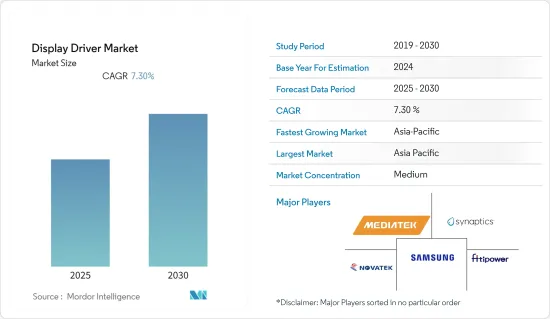

預計顯示驅動器市場在預測期內複合年成長率為 7.3%

主要亮點

- 顯示驅動器主要是半導體積體電路,描述微處理器、微控制器、ASIC 和通用周邊介面之間的介面功能。它們主要應用於智慧型手錶、筆記型電腦、顯示器、智慧型手機、平板電腦、電視和車載顯示器等外圍顯示設備。行動和平板裝置對 OLED 和軟性顯示器的需求不斷增加,以及智慧型穿戴裝置和 AR/VR 裝置的快速採用等因素正在增加顯示器製造商的數量,並推動全球顯示器驅動器的發展。

- 該市場是由滿足不同最終用戶垂直細分市場的創新所驅動的。例如,晶門科技有限公司於2021年2月推出SSD7317,這是一款針對智慧家庭產品的觸控與顯示器驅動器整合(「TDDI」)IC。這項創新現在旨在提高產品使用者體驗的標準。 SSD7317將觸控微電子裝置和顯示器微電子裝置整合在一顆晶片上,用於智慧家用電子電器、穿戴式裝置和醫療設備中常用的PMOLED(被動矩陣OLED)面板。

- 此外,2022 年 5 月,Nvidia 發布了安全公告,通知客戶 Nvidia GPU 顯示驅動程式進行了新的軟體安全升級。此更新修復了先前的驅動程式版本中可能導致「拒絕服務、資訊外洩或資料篡改」的安全缺陷。

- 顯示驅動器市場正迅速受到全球智慧型手機市場發展的推動。智慧型手機已成為人類生活的重要組成部分,因為它們具有高品質和高性能,並且可以像電腦一樣即時提供資訊。技術升級導致的生命週期較短,迫使主要參與企業迅速投資於研究,以開發具有先進功能的產品並使其脫穎而出。

- 此外,5G 網路將提供高速度,讓您可以在幾秒鐘內下載電影長片,預計這將激增對 5G 智慧型手機的需求。因此,該公司正在投資開發和設計具有更高解析度和更大內存容量的行動電話,以便人們可以在全尺寸主機上下載和玩電動遊戲。

- 智慧型手機產業因 COVID-19 在全球範圍內的傳播而受到嚴重打擊。大多數國家都實施了封鎖措施,幾乎所有國家的製造業活動都停止了。中國疫情已經消退,智慧型手機工廠正積極擴大生產。

顯示市場趨勢和促進因素

OLED顯示器技術推動市場成長

- OLED顯示驅動器市場預計在預測期內將顯著成長,增加對高效能顯示器驅動器IC的需求並推動市場成長擴張。由於 OLED 顯示器和軟性顯示器在智慧型手機、穿戴式裝置(智慧型手錶、AR/VR HMD)和智慧型電視等智慧型裝置中的使用不斷增加,因此在顯示器產業中不斷湧現。

- 顯示驅動器市場正受到全球智慧型手機市場發展的迅速推動。智慧型手機透過提供即時資訊來提供像電腦一樣的高品質、高效能和功能。智慧型手機已成為人類生活的重要組成部分。技術升級的快速步伐和較短的使用壽命迫使各大公司投資於研發,以開發具有先進功能的產品並使其脫穎而出。

- 例如,2021年8月,三星正式發表了人們期待已久的「三星Galaxy Z Fold 3」智慧型手機,這款智慧型手機配備7.6吋Dynamic AMOLED 2X顯示器(主動矩陣有機發光二極體)並顛覆了品類。折疊式顯示器可讓使用者將其轉變為類似平板電腦的裝置。

- 由於對 OLED 和軟性顯示器的需求增加、採用高成本和先進的顯示器驅動器以及汽車顯示器市場的擴大,該市場正在擴大。由於 4K 和 8K 電視的使用不斷增加、超高清內容的可用性以及 DDIC 在分立元件和單一整合晶片中的作用日益增強,顯示驅動器 IC 市場正在不斷擴大。

- OLED顯示技術因其簡單優雅的結構、靈活的外形規格、色彩深度和高對比度而近年來受到歡迎。 OLED顯示器正在快速滲透顯示器生態系統,推動OLED顯示器驅動器市場的成長。

- 根據消費者科技協會2022年1月發布的預測,2022年美國智慧型手機銷售量預計將成長17億美元,達到747億美元。

預計中國將在預測期內主導亞太市場

- 中國顯示器驅動器市場的特點是家用電子電器產品銷量增加、3D和高清圖像需求增加、媒體和廣告數位電子看板需求增加、穿戴式設備需求增加、汽車顯示產品銷量增加等。

- 主要市場參與企業正在大力投資提高產能,主要是大規模生產產品,以滿足不斷成長的需求。例如,2022年6月,顯示驅動IC公司聯詠微電子擴大了產品系列。該公司已實現產品多元化,包括 SoC、LCD 時序控制器 (T-Con) 晶片和電源管理 IC,同時將 DDI 的目標市場擴展到汽車和 VR/AR 產品領域。 Novatec 正在為汽車和 VR/AR 相關顯示產品日益成長的需求做好準備,這些產品需要高速傳輸和低功耗。

- 隨著電動車的迅速普及和消費者需求的增加,中國汽車工業正在煥發活力。市場參與企業正在形成策略聯盟和合併,以加強產品系列。例如,2022 年 6 月,Volvo汽車宣布與 Epic Games 合作,將逼真的視覺化技術引入其下一代電動車。該公司使用 Epic Games 的虛幻引擎。此次合作將提供具有更清晰渲染、更豐富色彩和 3D 動畫的資訊娛樂顯示器。

- 材料技術的發展正在推動軟性電子產品新應用的開發。預計軟性顯示器將在預測期內佔據市場需求和收益的主要佔有率。

- 例如,2021年11月,中國顯示面板供應商維信諾科技宣布,由於軟性顯示器的需求不斷增加,將推出以AMOLED技術為核心的筆記型電腦、平板電腦、車載螢幕等中尺寸顯示產品。

顯示驅動器行業概況

顯示器驅動器市場由 Mediatek、Fitipower Integrated Technology、Rohm Semiconductor、Novatek MicroElectronics、Synaptics、Himax Technologies 和 Silicon 等主要公司主導和鞏固。這些擁有壓倒性市場佔有率的大公司正致力於擴大海外基本客群。這些公司正在利用策略合作措施來提高市場佔有率和盈利。

- 2022 年 8 月-聯發科發布了適用於固定無線接入路由器和行動熱點等 5G CPE 設備的 T830 平台。 T830平台幫助業者使用6GHz以下蜂窩基礎設施實現高達7Gbps的5G通訊。該平台具有帶有顯示驅動程式的整合式 3D GPU。

- 2022 年 1 月 - Magnachip Semiconductor Corp 正在開發用於汽車顯示器的 OLED 驅動器積體電路 (DDIC)。此 OLED DDIC 基於 40nm 製程技術,專為中控台顯示器和儀表組顯示器而設計。該公司計劃於 2023 年上半年向歐洲優質汽車製造商供應這款新產品。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 市場影響評估

- 技術藍圖/進展

第5章市場動態

- 市場促進因素

- 行動裝置、電視和電腦顯示器對 LCD 面板的需求增加

- 增加汽車領域創新顯示器的投資

- 市場問題

- 關於車輛安全和安保的收緊法規:每個國家都有不同

第6章 市場細分

- 按外形規格

- 大型DDIC

- 中小型DDIC

- 按用途

- 液晶顯示器

- 桌面顯示器

- 筆記型電腦

- 液晶電視

- 錠劑

- 液晶智慧型手機

- 其他

- 有機發光二極體

- 有機發光二極體電視

- 有機發光二極體手機

- 其他

- 液晶顯示器

- 按地區

- 中國

- 台灣

- 韓國

- 美洲

- 其他

第7章 競爭格局

- 公司簡介

- MediaTek

- Fitipower Integrated Technology Inc

- Novatek Microelectronics

- Synaptics Incorporated

- Samsung Electronics Co. Ltd

- Raydium

- Sitronix

- Magnachip Semiconductor

- Focaltech

- Himax

- LX Semicon

第 8 章供應商市場佔有率- 2021 年

第9章投資分析

第10章市場機會與未來趨勢

The Display Driver Market is expected to register a CAGR of 7.3% during the forecast period.

Key Highlights

- The display driver is mainly a semiconductor integrated circuit that provides an interface function between a microprocessor, microcontroller, ASIC, or general-purpose peripheral interface. These are primarily used in peripheral display devices, such as smartwatches, laptops, monitors, smartphones, tablets, TVs, and automotive displays. Factors such as growing demand for OLED and flexible displays for mobile and tablet devices and rapid adoption of smart wearables and AR/VR devices are increasing the number of display manufacturers and, therefore, driving the display driver globally.

- The market is driven by innovations catering to various end-user verticals. For instance, in February 2021, Solomon Systech Limited launched the SSD7317, the touch and Display Driver Integration ("TDDI") IC for targeted use in smart home products. The innovation is now positioned to raise the bar for product user experience. The SSD7317 combines touch and display microelectronics into a single chip for use in PMOLED (Passive Matrix OLED) panels, commonly used in smart home appliances, wearables, and healthcare equipment.

- Also, in May 2022, Nvidia issued a security bulletin informing customers of a new software security upgrade for the Nvidia GPU display driver. The update corrects security flaws in previous driver versions that could result in "denial of service, information exposure, or data tampering."

- The display driver market is promptly driven by the development of the smartphone market around the world. Smartphones offer high quality and performance and act like a computer by providing real-time information, and have thus become an integral part of human lives. A short life span due to the upgradation of technology rapidly forces significant players to invest in research to develop and differentiate their offerings with advanced functionality.

- Moreover, the 5G network will offer high speed to download full-length movies in seconds and will spike the demand for 5 G-enabled smartphones. Hence, companies are investing in developing and designing phones with higher resolution and increased memory capacity so that people can download or play video games on full-sized consoles.

- The spread of COVID-19 across the globe has hit the smartphone industry significantly. The majority of countries are under lockdown, which halted manufacturing activities in almost all countries. In China, the outbreak is under control, and smartphone factories are ramping up production aggressively.

Display Driver Market Trends

OLED Display Technology Drive the Market Growth

- The OLED display driver market is expected to grow significantly during the forecast period, increasing demand for high-performance display driver ICs and driving the market to increase growth. Because of their rising usage in smart devices such as smartphones, wearables (smartwatches, AR/VR HMDs), and smart TVs, OLED and flexible displays are rising in the display industry.

- The display driver market is promptly driven by the development of the smartphone market around the world. Smartphones offer high quality and performance and act like a computer by providing real-time information. They became an integral part of human lives. A short life span due to the upgradation of technology at a rapid speed is forcing major players to invest in research to develop and differentiate their offerings with advanced functionality.

- For instance, Samsung officially launched its much-awaited 'Samsung Galaxy Z Fold 3' smartphone in August 2021, which defies the category with a 7.6-inch Dynamic AMOLED 2X display (active-matrix organic light-emitting diode). The foldable display allows users to transform it into a tablet-like device.

- The market is expanding due to rising demand for OLED and flexible displays, the adoption of high-cost, advanced display drivers, and the expansion of the automotive display market. The market for display driver ICs is growing due to the increased use of 4K and 8K televisions, the availability of UHD content, and the rising role of DDICs in individual components and single integration chips.

- With qualities including a simple-cum-elegant structure, Flexible form factors, color depth, and a high contrast ratio, OLED display technology has increased in popularity in recent years. OLED displays are rapidly penetrating the display ecosystem, which is fueling the growth of the OLED display driver Market.

- According to Consumer Technology Association forecasts released in January 2022, it is anticipated that the United States will have a USD 1.7 billion increase in the sales value of smartphones sold in 2022 and will reach USD 74.7 billion.

China is Expected to Dominate the Asia Pacific Market Over the Forecast Period

- The display driver market in China is developing with respect to increasing sales of consumer electronics, rising demand for 3D and high-definition pictures, increase in demand for digital signage for media & advertising, rising demand for wearable gadgets, and increasing sales of display products in automotive.

- The major market players are investing vast sums in enhancing their production facilities, primarily to mass-produce products, catering to the increasing demand. For instance, In June 2022, Novatek Microelectronics, a Display driver IC company, expanded its product portfolio. The company has diversified its offerings to include SoCs, LCD timing controller (T-Con) chips, and power management ICs while expanding the target markets of its DDIs to include automotive and VR/AR product segments. Novatek is gearing up for a rise in demand for automotive and VR/AR-related display products requiring high-speed transmission and low power.

- The automotive sector in China is boosted due to the quick adoption of electric cars and increased customer spending power. Market players are strategically performing partnerships and mergers in order to enhance their product portfolio. For instance, In June 2022, Volvo cars announced a partnership with Epic Games to introduce photorealistic visualization technology in its next generation of electric vehicles. The company will use epic Games' unreal engine. The partnership will offer infotainment displays that will have sharper rendering, richer colors, and 3D animations.

- Advancements in material technologies are driving the development of new applications of flexible electronics. Flexible displays are expected to account for a significant share of the market demand and revenues over and beyond the forecast period.

- For instance, in November 2021, Visionox Technology Inc, a China-based display panel supplier, announced that it would launch medium-size display products like laptops, tablets, and vehicle-mounted screens with a focus on AMOLED technology, owing to the increasing demand for flexible displays.

Display Driver Industry Overview

The Display Driver Market is consolidated as it is dominated by major players like Mediatek, Fitipower Integrated Technology, Rohm Semiconductor, Novatek Microelectronics, Synaptics, Himax Technologies, and Silicon. These major players, with a prominent share in the market, are focusing on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability.

- August 2022 - MediaTek announced the launch of the T830 platform for 5G CPE devices, including fixed wireless access routers and mobile hotspots. The T830 platform helps operators to deliver 5G speeds up to 7Gbps using the sub-6GHz cellular infrastructure. The platform includes an integrated 3D GPU with a display driver.

- January 2022 - Magnachip Semiconductor Corp is developing an OLED driver integrated circuit (DDIC) for automotive displays. The OLED DDIC is based on the 40nm process technology, designed for center stack displays and instrument cluster displays. The company plans to supply the new product to premium European car manufacturers in the first half of 2023.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porters Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Market

- 4.5 Technological Roadmap/Advances

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for LCD Panels for Mobile Devices, TVs, and PC Monitors

- 5.1.2 Increase Investment in Innovative Display for the Automotive Sector

- 5.2 Market Challenges

- 5.2.1 Increase in Stringent Rules and Regulations for Safety and Security of Vehicles Varies in Many Countries

6 MARKET SEGMENTATION

- 6.1 By Form Factor

- 6.1.1 Large DDIC

- 6.1.2 Small and Medium DDIC

- 6.2 By Application

- 6.2.1 LCD

- 6.2.1.1 Desktop Monitor

- 6.2.1.2 Notebook PC

- 6.2.1.3 LCD TV

- 6.2.1.4 Tablet

- 6.2.1.5 LCD Smartphone

- 6.2.1.6 Others

- 6.2.2 OLED

- 6.2.2.1 OLED TV

- 6.2.2.2 OLED Smartphone

- 6.2.2.3 Others

- 6.2.1 LCD

- 6.3 By Geography

- 6.3.1 China

- 6.3.2 Taiwan

- 6.3.3 Korea

- 6.3.4 Americas

- 6.3.5 Others

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 MediaTek

- 7.1.2 Fitipower Integrated Technology Inc

- 7.1.3 Novatek Microelectronics

- 7.1.4 Synaptics Incorporated

- 7.1.5 Samsung Electronics Co. Ltd

- 7.1.6 Raydium

- 7.1.7 Sitronix

- 7.1.8 Magnachip Semiconductor

- 7.1.9 Focaltech

- 7.1.10 Himax

- 7.1.11 LX Semicon