|

市場調查報告書

商品編碼

1630347

個人機器人:市場佔有率分析、產業趨勢/統計、成長預測(2025-2030)Personal Robots - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

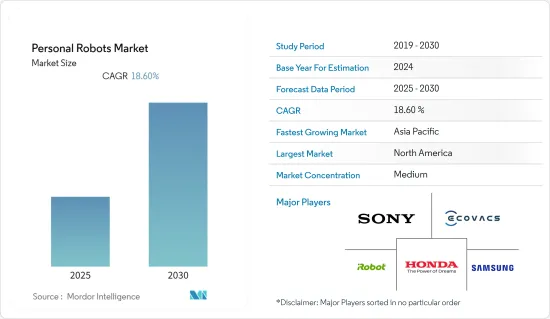

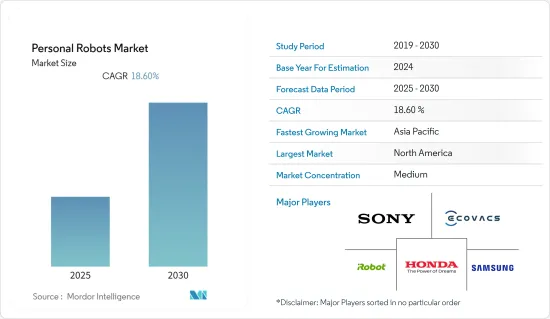

預計個人機器人市場在預測期內的複合年成長率為 18.6%。

主要亮點

- 日本和中國等亞太地區的老齡化社會正在推動醫療技術領域的成長,從而為該地區的個人輔助機器人帶來了巨大的市場。日本統計局預計,日本65歲及以上人口預計將從2021年的3,639萬人增加到2040年的3,921萬人。這鼓勵公司投資該地區的老年人產品。 Paro 就是一個已經投入使用的此類機器人,它是一種小海豹,旨在幫助患有阿茲海默症疾病的患者。

- 認知、互動、操控等各領域的技術創新使得個人機器人更具吸引力。技術和其他組件提供者正在幫助推動機器人生態系統向前發展。

- 機器學習、電腦視覺、自然語言處理和手勢控制等人工智慧 (AI) 技術正在改變個人機器人在家庭和醫院中的部署方式。隨著個人機器人變得更加智慧,它們將能夠了解周圍環境,避開靜態和動態物體,理解情緒,進行交流,並能夠在擁擠的空間(例如家庭)中四處走動。

- 此外,隨著機器視覺相機的不斷發展,該公司正在使用這些由人工智慧技術支援的2D 和3D 機器視覺相機,透過識別門檻和地毯等障礙物,有效地繪製樓梯、垃圾桶、電纜和門等地板的邊緣。

- 然而,個人機器人技術缺乏標準化、操作這些機器人所涉及的技術複雜性以及在各種使用案例中整合這些系統的複雜性對個人機器人市場的成長構成了重大限制。

- 冠狀病毒大流行對製造業和科技業造成了嚴重破壞。機器人領域的一些全球和地區公司面臨嚴重的零件和原料短缺,這直接影響了他們的產品。大多數國家的國家封鎖擾亂了全球供應鏈網路並減少了產品銷售。

- 此外,由於對機器人技術的興趣增加,ABB 和羅克韋爾自動化等公司的股價在 COVID-19 大流行期間上漲。 2020年,ForwardXRobotics最近宣布資金籌措1,500萬美元,以進軍北美市場。同時,幾週來,Brain Corp. 的地板清潔機器人需求不斷增加,尤其是那些被勒令關閉的企業。

- 儘管這些趨勢對研究市場的成長產生了負面影響,但更多人對先進技術的認知有所提高,特別是自疫情爆發以來,這對研究市場的長期成長產生了負面影響預計影響將是正面的。

個人機器人市場趨勢

用於家務的個人機器人預計將佔據主要市場佔有率

- 機器人伴同性/助手/類人機器人、吸塵、掃地、割草、泳池清潔、窗戶清潔等是個人機器人家庭領域逐漸流行的主要機器人類型。根據國際機器人聯合會(IFR)和Loup Ventures提供的資料,預計到2025年機器人吸塵器的出貨量約為2,210萬台,銷售額約49.8億美元。

- 家用機器人中,自動吸塵器和曳引機是各家企業商業化程度最高、開發最多的產品。該公司繼續投資開發更緊湊、整合的吸塵和拖地機器人,以適應家庭中較小的空間。公司正在整合語音辨識和雷射技術等先進技術來繪製地板結構圖。例如,2022年2月,全球領先的高科技公司之一的美的集團公佈了美的Robozone科技製造的新一代掃地機器人S8+自動集塵機器人的詳細資訊。

- iRobot、Robomow 和 Mayfield Robotics 等公司正在開發家用機器人。人類行為檢測和語音辨識等技術創新正在增強客戶信心,從而促進清潔、洗衣和其他支援語音的物聯網活動等家庭用途的自動化部署。

- 此外,隨著機器視覺相機的不斷發展,企業現在正在使用由AI技術支援的2D和3D機器視覺相機來有效地繪製樓梯、電纜、垃圾桶和門等地板的邊緣和邊緣,並識別障礙物。框架和地毯。透過結合機器學習、人工智慧和臉部辨識等技術,家用機器人也迎來了創新。例如,2019年2月,研發和營運雲端AI和機器人解決方案的達闥科技發布了服務機器人“XR-1”,該機器人基於雲端AI,具有出色的合規性。

亞太地區佔主要市場佔有率

- 該地區家庭醫療保健和援助應用機器人引進快速成長的主要因素是人口老化。日本政府宣布將資助老年護理機器人的開發,以填補2025年38萬名技術純熟勞工的短缺。因此,預計在不久的將來,養老機器人的引進也將在老年住宅中推廣。

- 機器人輪椅在該地區也越來越受歡迎。像Panasonic這樣的開發公司越來越注重開發能夠滿足各種使用案例的創新輪椅。例如,2021 年 2 月,日本全日空航空 (ANA) 與Panasonic Corporation建立夥伴關係,測試自動駕駛電動輪椅。此次合作是一項更廣泛計劃的一部分,該計劃旨在增加東京成田國際機場的流動性和無障礙選項。

- 中國最近努力成為機器人領域的世界領導者,因此有望成為個人機器人部署的領先國家。例如,2021年12月,中國工業和資訊化部聯合其他14個政府部門宣布了在「十四五」規劃中發展中國機器人產業的計畫。

- 印度等國家正在廣泛採用 5G,預計這也將支援安全和監控機器人的部署,因為居民可以隨時隨地存取資料。印度等國家預計將在未來幾年加速5G的採用,這有望為個人機器人市場創造有利的市場前景。

- 此外,亞太地區可能會在幾乎所有主要應用中採用類人機器人。隨著老年人口的增加,人形機器人預計將在中國和日本等亞太國家用於個人支援和照護。

個人機器人產業概況

個人機器人市場的競爭格局仍然極為活躍。一些新興企業正在進入市場,以滿足各種應用中的新客戶需求。該市場的一些主要參與者包括Sony Corporation、本田工業有限公司、iRobot 公司和科沃斯機器人公司。近期市場趨勢如下。

- 2022 年 8 月 - 亞馬遜公司宣布將以約 17 億美元現金交易收購機器人吸塵器製造商 iRobot Corp.。透過此次收購,該公司將專注於擴大其在個人機器人和智慧家居設備市場的影響力。

- 2022 年 5 月 - 消費機器人領域的領導者 iRobot Corp. 宣布推出 iRobot OS,這是其 Genius Home Intelligence 平台的演進版。新的 iRobot 作業系統使機器人更加智慧,並提供有價值的新功能,讓所有客戶受益。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 殘障人士和老年人對輔助機器人的需求不斷增加

- 個人機器人價格較低

- 市場限制因素

- 與機器人操作相關的技術複雜性

第6章 市場細分

- 按類型

- 家庭使用

- 娛樂

- 對老年人和殘障人士的支持

- 家庭安全和監控

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭格局

- 公司簡介

- Sony Corporation

- Honda Motor Company Ltd

- Ecovacs Robotics Inc.

- iRobot Corporation

- Neato Robotics Inc.(Vorwerk Corporation)

- Samsung Group

- Gecko Systems International Corporation

- Hanool-Robotics Corp.

- Segway Inc.(Ninebot Company)

- F&P Robotics AG

第8章投資分析

第9章 市場的未來

簡介目錄

Product Code: 69565

The Personal Robots Market is expected to register a CAGR of 18.6% during the forecast period.

Key Highlights

- The aging societies of the Asia-Pacific, like Japan and China, are driving growth in the medical technology sector, thus, creating a massive market for personal assistive robots in the region. According to the Statistics Bureau of Japan, the country's population (65 and over) is forecasted to grow from 36.39 million in 2021 to 39.21 million in 2040. This encourages companies to invest in products for the elderly in the region. One such robot that is already deployed is Paro (baby seal), designed to help patients with diseases like Alzheimer's.

- The technological innovations in various fields, such as cognition, interaction, and manipulation, make personal robots much more appealing. The technology and other component providers have been instrumental in driving the robotics ecosystem forward.

- Artificial intelligence (AI) technologies, including machine learning, computer vision, natural language processing, and gesture controls, are transforming how personal robots are deployed in homes and hospitals. As personal robots become more intelligent, they will be capable of comprehending their surroundings, avoiding static and dynamic objects, comprehending emotions, and communicating, allowing them to move around in congested and congested spaces like homes.

- Additionally, with the increasing developments in machine vision cameras, companies are using these 2D and 3D machine vision cameras with AI technologies to effectively map the edges of the floor, such as a staircase, and recognize obstacles, such as dustbins and cables, doorsills, and rugs which are expected to pave the way for next-generation robots.

- However, the lack of personal robot technology standardization, technical complexity associated with operating these robots, along with complications in the integration of these systems across various use cases are some of the major factors challenging the growth of the personal robots market.

- The coronavirus pandemic caused havoc in the manufacturing and technology industries. Several global and regional players in the robotics sector witnessed severe component and raw material shortages, which had a direct impact on their offerings. The worldwide supply chain network got disrupted by the nationwide lockdown in most nations, resulting in a drop in product sales.

- Moreover, due to the growing interest in robotic technologies, companies like ABB and Rockwell Automation have seen their stock values rise during the COVID-19 pandemic. In 2020, ForwardXRobotics recently announced USD 15 million in funding to expand into the North American market, while Brain Corp has experienced increasing demand for its floor-cleaning robots, especially among enterprises under closure orders for the previous few weeks.

- Such trends have had a negative impact on the growth of the studied market; however, with the awareness about advanced technologies growing within a larger section of the audience, especially since the outbreak of the pandemic, the long-term impact on the growth of the studied market is expected to be positive.

Personal Robots Market Trends

Personal Robots for Household Work is Expected to Hold a Major Share of the Market

- Robot companions/assistants/humanoids, vacuuming, floor cleaning, lawn mowing, pool cleaning, and window cleaning, among others, are some of the major types of robots that are increasingly gaining popularity in the household segment of personal robots. According to the data provided by the International Federation of Robotics (IFR) and Loup Ventures, about 22.1 million robotic vacuum cleaners are expected to be shipped by 2025, generating a revenue of approximately USD 4.98 billion.

- Among all the household robots, automated vacuum cleaners and moppers are the companies' most commercialized and developed products. The companies are continuously investing in developing more compact and integrated vacuum cleaners and mopping robots to reach little places at home. The companies are integrating advanced technologies like voice recognition and laser-based technologies to map the floor structure. For instance, in February 2022, Midea Group, a leading global high-technology company, announced details of Midea's S8+ auto-dust-collection robot, its next-gen robot vacuum cleaner, made by Midea Robozone Technology, one of its subsidiaries.

- Companies like iRobot, Robomow, and Mayfield Robotics, are among the prominent players, innovating robots for household space. Innovations, like detecting human behavior and voice recognition, are increasing customer confidence, thus, driving the automated deployment for household purposes, like cleaning, laundry, and other voice-enabled IoT activities.

- Additionally, with the increasing developments in machine vision cameras, companies are also using these 2D and 3D machine vision cameras with AI technologies to map and edges of the floor like staircases effectively and to recognize obstacles such as cables, dustbins, doorsills, and rugs. Incorporating technologies like machine learning, AI, and facial recognition, are also bringing innovations into household robots. For instance, in February 2019, CloudMinds Technology, a developer and operator of cloud AI and robotic solutions, launched its cloud AI-based, highly compliant service robot, the XR-1.

Asia Pacific to Hold Significant Market Share

- The aging population is a primary factor for the significant growth in the deployment of robots in domestic healthcare and assistance applications in the region. The Japanese government has announced funding for the development of eldercare robots to fill the estimated gap of 380,000 skilled workers by 2025. This is expected to drive the adoption of elderly care robots also at their residences in the recent future.

- Robotic wheelchairs are also gaining attraction in the region. Companies like Panasonic are increasingly making efforts to develop innovative wheelchairs that can fulfill different use cases. For instance, in February 2021, All Nippon Airways (ANA) Japan and Panasonic Corporation entered a partnership to test self-driving electric wheelchairs. The collaboration is part of a far-reaching plan to increase mobility and accessibility options at Tokyo Narita International Airport.

- China is expected to become the leading country in terms of personal robot adoption as the country has been making significant efforts lately to become a global leader in the field of robotics. For instance, in December 2021, China's Ministry of Industry and Information Technology, in collaboration with 14 other government departments, unveiled its plans to grow the country's robotics industry in its 14th five-year plan.

- The growing 5G penetration in countries like India is also expected to help push the deployment of security and surveillance robots as the residents can access the data on the go. Countries like India are expected to speed up the deployment of 5G in the coming years, which is expected to create a favorable market scenario for the personal robots market.

- Moreover, APAC is likely to adopt humanoids for almost all major applications. Humanoids are anticipated to be used in personal support and caregiving applications in APAC countries such as China and Japan as the senior population grows.

Personal Robots Industry Overview

The competitive landscape of the personal robotic market remains exceptionally dynamic. Several startups are entering the market to meet emerging customer needs for various applications. Some of the major players operating in the market include Sony Corporation, Honda Motor Company Ltd., iRobot Corporation, Ecovacs Robotics Inc., etc. Some of the recent developments in the market are as follows:-

- August 2022 - Amazon.com Inc announced the acquisition of iRobot Corp, the maker of robot vacuum cleaners, in an all-cash deal for about USD 1.7 billion. Through this acquisition, the company focuses on further expanding its presence in the personal robots and smart home devices market.

- May 2022 - iRobot Corp., a leader in consumer robots, introduced iRobot OS, an evolution of the company's Genius Home Intelligence platform. iRobot OS delivers a new customer experience for a healthier, cleaner, and smarter home. The new iRobot OS enables the robots to get smarter, delivering valuable new features and functionality that benefit all customers.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitute Products

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing demand for Assistive Robots for Handicapped and Elderly People

- 5.1.2 Reducing Price of Personal Robots

- 5.2 Market Restraints

- 5.2.1 Technical Complexity Associated with Operating these Robots

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Household Work

- 6.1.2 Entertainment

- 6.1.3 Elderly and Handicap Assistance

- 6.1.4 Home Security and Surveillance

- 6.1.5 Other type

- 6.2 By Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Sony Corporation

- 7.1.2 Honda Motor Company Ltd

- 7.1.3 Ecovacs Robotics Inc.

- 7.1.4 iRobot Corporation

- 7.1.5 Neato Robotics Inc. (Vorwerk Corporation)

- 7.1.6 Samsung Group

- 7.1.7 Gecko Systems International Corporation

- 7.1.8 Hanool-Robotics Corp.

- 7.1.9 Segway Inc. (Ninebot Company)

- 7.1.10 F&P Robotics AG

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219