|

市場調查報告書

商品編碼

1630348

交易監控:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Transaction Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

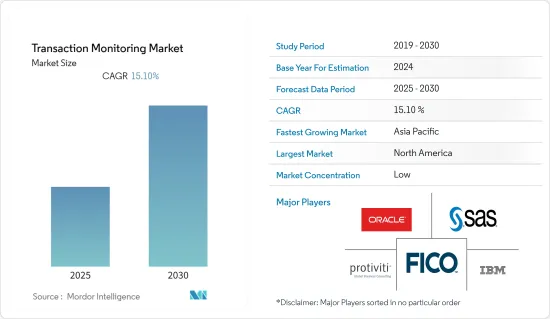

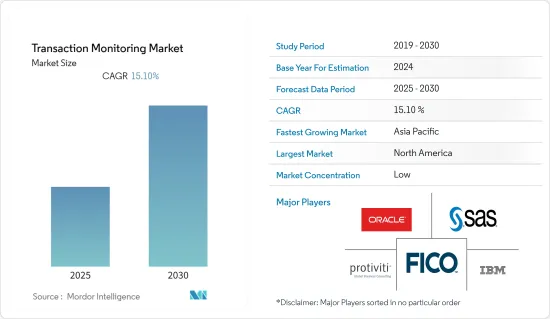

預計交易監控市場在預測期內的複合年成長率為 15.1%。

主要亮點

- 交易監控資料主要用於可疑活動報告 (SAR) 備案和其他符合多項反洗錢和反恐融資 (CTF) 法規的報告業務。世界各地的金融監管機構開始將交易監控作為一項法律要求。

- 機器學習和人工智慧最終將被證明對市場有利。這種最尖端科技提供了更高的安全性,保護使用者的敏感資訊。進階分析將提供主動保護和安全防範危害,從而提高交易監控技術的國際聲譽。

- 電子商務企業必須使用安全的付款閘道,並遵守在線開展業務和接收付款的最新嚴格法律和準則。這是影響交易監控市場成長率的一個重要方面。

- 由於資料保護條例收緊以及付款網路基礎設施內缺乏昂貴的安全解決方案,預計中小企業類別在預測期內將成長更快。

- 由於需要更多訓練有素、技術熟練的 IT 員工以及維護跨境合規性的難度日益增加,交易監控市場的擴張需要改善。

隨著越來越多的人使用信用卡和其他線上付款方式在線購物,新型冠狀病毒(COVID-19) 的爆發是交易監控行業成長放緩的一個主要因素,這為駭客的行動創造了更多機會。

交易監控市場趨勢

服務預計將成長

- 在快速發展的數位環境中,數位交易管理正在成為越來越多採用的軟體解決方案。雲端基礎的軟體解決方案擴大用於數位化監控和管理許多客戶交易流程,包括匯款、存款和提款。

- 預計數位交易監控解決方案將在預測期內佔據重要的市場佔有率。數位交易監控解決方案誕生於這些創新的雲端服務,主要用於追蹤基於文件的客戶交易。

- 雲端處理技術和反洗錢(AML)解決方案的發展使金融機構變得更有效率並降低了開發IT基礎設施的成本。

- 對於安全資源有限的企業,雲端基礎的平台以基於 SaaS 的安全服務的形式提供了一種保護業務應用程式的單一方法。由於線上購買模式的增加,零售和製造業正受益於交易監控系統的實施。

- 此外,科技的發展使交易監控和篩檢過程更加成功。分析師 80% 以上的時間都花在檢索資料而不是解決問題上,因此有新的方法可以加快資訊收集過程。進階分析、機器學習和人工智慧 (AI) 正在取得進展。此外,還專注於加快 KYC 入門、調查行為趨勢以及利用技術驗證身份。

- 該市場的特點是多元化參與者的存在。這些供應商始終如一地提供符合技術進步的創新解決方案,以滿足各個最終用戶行業垂直領域客戶不斷成長的需求。

北美地區佔據主要市場佔有率

- 目前北美地區從交易監控業務中獲得的收益最多。這是因為美國和北美其他地區目前佔全球電子商務交易的大部分。

- 其餘兩個北美國家墨西哥和加拿大在市場收益方面緊追在美國。隨著電子商務在該地區的日益普及,墨西哥、加拿大和美國政府正在製定「了解你的客戶」(KYC) 規則和法規。

- 這些法規旨在最大限度地減少卡片詐騙和洗錢。還有一些旨在盡可能防止這兩種行為的系統。

- 監管 KYC 的法規和標準也旨在盡可能防止恐怖組織的融資。因此,這些法規通常包括複雜的分析。

- 這種尖端分析可以通知信用卡公司卡片詐騙或恐怖分子融資很可能發生在當時(最好是之前)或至少發生後不久。北美市場的成長預計將受到所有這些因素的推動。

交易監控產業概述

交易監控市場本質上是分散的,主要企業採用各種技術,如新產品推出、業務擴張、合併和收購,可能會導致市場競爭激烈。

2022 年 9 月,FICO 宣布並授予了 11 項與詐欺、人工智慧 (AI)/機器學習 (ML) 和數位決策相關的新專利。最新的 11 項專利專注於各種軟體解決方案、詐欺分析和增強的機器學習演算法,使客戶能夠利用專有的 AI 和 ML 演算法創建負責任且有效的 AI 決策系統。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場概況

- 市場促進因素

- 結合人工智慧和機器學習的交易監控解決方案的進步

- 更嚴格的監理合規性

- 市場限制因素

- 目前的軟體解決方案誤報率很高

- 區域間資訊共用結構概述(美國-314(b)、英國-JMLIT(聯合洗錢情報工作小組)等)

- 更有效資訊共用的技術推動因素(包括 Verafin 和 Fintel 等供應商的努力和方法)

第6章 市場細分

- 按成分

- 解決方案

- 服務

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Fair Isaac Corporation(FICO)

- SAS Institute Inc.

- Oracle Corporation

- Protiviti Inc.

- IBM Corporation

- Fidelity National Information Services Inc.(FIS)

- BAE Systems PLC

- Infrasoft Technologies

- Beam Solutions Inc.

- Experian PLC

- ACTICO GmbH

第8章投資分析

第9章 市場機會及未來趨勢

The Transaction Monitoring Market is expected to register a CAGR of 15.1% during the forecast period.

Key Highlights

- Transaction monitoring data is primarily used to submit Suspicious Activity Reports (SARs) and other reporting duties in compliance with several AML and counter-terrorist financing (CTF) regulations. Financial regulators worldwide are beginning to make transaction monitoring a legal necessity.

- Machine learning and artificial intelligence will ultimately be beneficial for the market. Such cutting-edge technologies provide a higher level of security and protect the user's sensitive information. Advanced analytics offers protection and safety against preventative hazards; as a result, this will boost the reputation of transaction monitoring technology internationally.

- Businesses conducting e-commerce must use secure payment gateways and adhere to the most recent and stringent laws and guidelines for conducting business and receiving payments online. This is a crucial aspect influencing the transaction monitoring market's growth rates.

- The SMEs category is anticipated to grow more quickly throughout the projection period due to increasing data protection regulations and a lack of expensive security solutions within the payment network infrastructure.

- The expansion of the transaction monitoring market needs to be improved by the need for more trained and skilled IT workers and the growing difficulty of maintaining cross-border compliance.

As more people purchase online using credit cards and other online payment methods, increasing the opportunity for hackers to act, the outbreak of COVID-19 was a significant factor in the decline in the growth of the transaction monitoring industry.

Transaction Monitoring Market Trends

Service to Witness the Growth

- In the rapidly evolving digital landscape, digital transaction management has become an increasingly adopted software solution. Cloud-based software solutions are increasingly being used to digitally monitor and manage many customer transaction processes involving transfers, deposits, and withdrawals.

- It is projected that digital transaction monitoring solutions will hold a sizeable market share during the forecast period. Digital transaction monitoring solutions have arisen from these ground-breaking cloud services, primarily designed to track document-based customer-based transactions.

- Financial institutions' efficiency has grown due to the development of cloud computing technology and anti-money laundering (AML) solutions, which have also allowed them to cut the cost of developing an IT infrastructure.

- For companies with limited resources for security measures, the cloud-based platform offers a single way to secure business applications in the form of SaaS-based security services. The retail and manufacturing industries have benefited from the deployment of transaction monitoring systems due to the rise in online buying patterns.

- Additionally, technological developments help transaction monitoring and screening processes succeed better. Since analysts spend over 80% of their time acquiring data rather than resolving problems, there are new methods to speed up the information-gathering process. Advanced analytics, machine learning, and artificial intelligence (AI) are improving. The use of technology to speed up KYC onboarding, examine behavioral trends, and verify identification is also emphasized.

- The presence of well-diversified players characterizes the market. These vendors consistently provide innovative solutions in line with the advancement in technologies that cater to customers' increasing needs across various end-user industry verticals.

North American Accounts to Hold Significant Market Share

- The North American region now generates the most revenue from the transaction monitoring business. This is because the United States and the rest of the North American region currently account for most global e-commerce transactions.

- The two remaining North American countries, Mexico and Canada, follow the United States in terms of market revenue generation. The governments of Mexico, Canada, and the United States are enacting Know Your Customer (KYC) rules and regulations as e-commerce grows in popularity in this region.

- These regulations are meant to minimize credit card fraud and money laundering. They also have systems that are intended to stop both actions from happening as often as feasible.

- Regulations and standards governing KYC are also intended to prevent as much funding as possible for terrorist organizations. Because of this, advanced analytics are frequently included in these laws and regulations.

- These cutting-edge analytics are intended to notify credit card firms of probable credit card fraud or terrorist financing activities either at the time they take place (preferably before they do) or, at the least, shortly after. The North American market growth is anticipated to be fueled by all of these factors.

Transaction Monitoring Industry Overview

The transaction monitoring market is fragmented in nature, and the major players have employed various methods, including introducing new products, expansions, mergers, and acquisitions, among others, which may result in the emergence of a highly competitive market.

In September 2022, FICO announced and granted eleven new patents related to fraud, artificial intelligence (AI)/machine learning (ML), and digital decisioning. The latest 11 patents focus on various software solutions, fraud analytics, and enhanced machine learning algorithms to help its customers build responsible and effective AI decisioning systems leveraging purpose-built AI and ML algorithms.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Assessment of Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Overview

- 5.2 Market Drivers

- 5.2.1 Advancement in Transaction Monitoring Solution incorporating AI and ML

- 5.2.2 Increasing Stringent Regulatory Compliance

- 5.3 Market Restraints

- 5.3.1 High Percentage of False Positives with Current Software Solutions

- 5.4 Overview of Information-Sharing Structures across regions (US - 314(b), UK - Joint Money Laundering Intelligence Taskforce (JMLIT), etc.)

- 5.5 Technology Enablers for More Effective Information Sharing (Including initiatives and approaches of vendors such as Verafin, Fintel, etc.)

6 MARKET SEGMENTATION

- 6.1 Component

- 6.1.1 Solutions

- 6.1.2 Services

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Latin America

- 6.2.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fair Isaac Corporation (FICO)

- 7.1.2 SAS Institute Inc.

- 7.1.3 Oracle Corporation

- 7.1.4 Protiviti Inc.

- 7.1.5 IBM Corporation

- 7.1.6 Fidelity National Information Services Inc. (FIS)

- 7.1.7 BAE Systems PLC

- 7.1.8 Infrasoft Technologies

- 7.1.9 Beam Solutions Inc.

- 7.1.10 Experian PLC

- 7.1.11 ACTICO GmbH