|

市場調查報告書

商品編碼

1630349

網路安全防火牆 -市場佔有率分析、產業趨勢/統計、成長預測 (2025-2030)Network Security Firewall - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

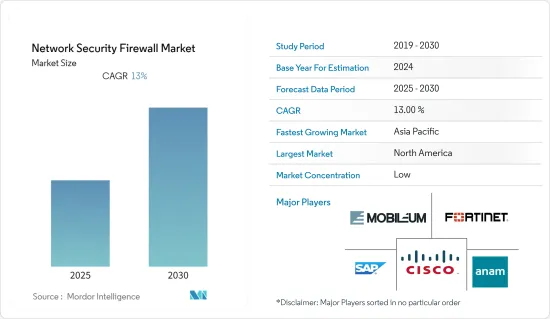

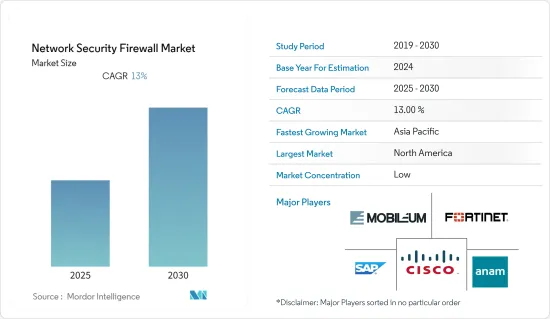

網路安全防火牆市場預計在預測期內複合年成長率為 13%

主要亮點

- 網路防火牆的眾多優勢,特別是易於安裝和高速,正在推動市場成長。此外,在網路中實施防火牆比單獨保護每台電腦便宜得多。然而,缺乏主動的防火牆維護基礎設施以及硬體和系統相容性低是阻礙市場成長的關鍵因素。

- 市場成長的推動因素是維護外部和內部網路之間的網路安全的需求不斷成長,以保護通訊管道免受未授權存取和濫用資訊,並保護企業免受詐欺和資料洩露並支持成長。

- 此外,Web應用程式的快速使用、雲端技術的快速採用以及對降低網路攻擊風險的保全服務的需求不斷成長也推動了網路安全防火牆市場的成長。最終用戶公司擴大部署網路安全防火牆,以保護資料和資訊免受安全漏洞和網路攻擊。因此,它正在推動整個網路安全防火牆市場的成長。

- 一方面,冠狀病毒(COVID-19)大流行使全球經濟的主要部分停滯。另一方面,有些人懷有惡意,他們利用混亂和不確定性發展詐騙和網路釣魚技術,對世界各地的每個人構成重大威脅。

- 谷歌最近報告稱,從 4 月 6 日到 13 日的短短一周內,該公司每天收到超過 1800 萬封與 COVID-19詐騙相關的惡意軟體和網路釣魚電子郵件,每天收到超過1800 萬封與冠狀病毒相關的垃圾郵件。由於此類活動的增加,網路安全防火牆市場可能會成長,因為防火牆是始終開啟的關鍵安全元件,組織需要網路防火牆來保護其網路基礎架構。

網路安全防火牆市場趨勢

解決方案部門預計將顯著成長

- 通訊服務供應商偵測和保護詐騙、使用者位置追蹤和拒絕服務(DoS)等 SS7 漏洞的安全通訊協定的持續開發,推動了解決方案領域在全球網路安全防火牆市場中佔據主導地位。

- 2022 年 9 月,Netskope 宣布增強其雲端防火牆解決方案。該公司表示,SASE平台的防火牆即服務(FWaaS)組件旨在幫助客戶簡化操作、防止威脅,並在全球範圍內提供一致的防火牆覆蓋範圍,無論用戶位於何處。

- 隨著通訊業者擴大採用簡訊防火牆解決方案,解決方案領域預計在預測期內將實現最快的複合年成長率。 SMS 防火牆解決方案用於網路安全防火牆應用程式,以偵測通訊業者網路上的惡意軟體。

- 通訊業直徑攻擊的增加也推動了防火牆解決方案的採用,從而促進了網路安全防火牆解決方案市場的成長。

北美佔最大市場佔有率

- 北美在網路安全防火牆市場中佔有最大佔有率,由於該地區存在多家領先的網路安全供應商,預計在預測期內將保持其主導地位。

- 此外,由於行動安全技術的快速進步,預計北美將在未來幾年佔據網路安全防火牆市場收益的最大佔有率。該地區的巨大佔有率主要是由於網路攻擊大幅增加而對資料安全進行了大量投資。

- 過去幾年,許多網路攻擊都針對北美地區的組織。因此,防火牆解決方案正在獲得認可並被不同地區的主要企業採用,從而促進了市場的成長。

- 國家和個人的網路攻擊和勒索軟體攻擊在該地區十分活躍。例如,根據網路安全和基礎設施安全局(CISA)和美國聯邦調查局(FBI)的說法,2022年2月下旬,俄羅斯對商業衛星通訊網路發動網路攻擊,試圖擾亂烏克蘭在該地區的指揮和控制。

- 根據不斷發展的情報,俄羅斯政府正在考慮未來網路攻擊的替代方案。最近俄羅斯國家主導的網路行動包括針對烏克蘭政府和關鍵基礎設施公司的分散式阻斷服務 (DDoS) 攻擊以及有害惡意軟體的部署。

- 政府基礎設施和私人公司也是美國駭客的主要目標。例如,2021 年 8 月,中國駭客組織 Hafnium 在 Microsoft Exchange 中發現了一個漏洞,該漏洞允許存取美國至少 30,000 家公司和全球 250,000 家公司的電子郵件帳戶。在微軟宣布該問題並開始修補其郵件伺服器中的漏洞後不久,至少有十幾個高級持續威脅組織開始利用該安全漏洞進行硬幣挖掘和間諜活動。

網路安全防火牆產業概況

網路安全防火牆市場高度分散。主要企業正在透過新產品發布、擴張、協議、合資、夥伴關係和收購等策略擴大在這個市場的足跡。主要市場發展情形如下。

- 2022 年 8 月 - Comcast Business 宣布與全面、整合和自動化網路安全解決方案的全球領導者 Fortinet® 建立戰略合作夥伴關係。該合作夥伴關係為企業提供了一套新的安全存取服務邊際(SASE) 和保全服務邊緣(SSE) 解決方案,以使用雲端交付的安全實施方法來保護分散式員工並擴展康卡斯特業務的託管服務專業知識。

- 2022 年 8 月 - IT 和網路技術整合領域的領導者 NEC Corporation 與為通訊服務供應商(CSP) 提供全面、整合、自動化網路安全解決方案的全球領導者Fortinet® 簽署了一項國際協議,共同構建安全的5G 網路。透過此次合作,Fortinet 列出了全面、一流的安全解決方案,包括全球部署最廣泛的新一代防火牆和效能最高的超大規模防火牆 FortiGate。同時,NEC基於其在通訊業的良好業績記錄提供專業服務,以實現5G所需的電信級永續網路。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 下一代網路技術介紹

- 鼓勵網路安全應用防火牆的行政法規

- 通訊產業數位轉型的進展

- 市場限制因素

- 缺乏基本的網路防火牆恢復

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 評估 COVID-19 對網路安全防火牆市場的影響

第5章市場區隔

- 按成分

- 解決方案

- 訊號防火牆

- 簡訊防火牆

- 服務

- 託管服務

- 專業服務

- 解決方案

- 按類型

- 封包過濾

- 狀態資料包檢查

- 新一代防火牆

- 統一威脅管理

- 按發展

- 本地

- 雲

- 網路功能虛擬(NFV)

- 按最終用戶

- 通訊/IT

- BFSI

- 教育

- 消費品/零售

- 製造業

- 醫學生命科學

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 其他

第6章 競爭狀況

- 公司簡介

- SAP SE

- Cisco System Inc.

- Mobileum Inc

- ANAM Technologies

- Fortinet Inc.

- BICS SA

- Cellusys

- Amd Telecom Private Limited

- NetNumber Inc.

- Openmind Networks

- Juniper Networks Inc.

- Watchguard Technology Inc.

- Checkpoint Software Technology Limited

- Palo Alto Networks Inc.

第7章 投資分析

第8章 市場機會及未來趨勢

簡介目錄

Product Code: 69588

The Network Security Firewall Market is expected to register a CAGR of 13% during the forecast period.

Key Highlights

- Owing to the numerous advantages of a firewall in a network, especially the easy installation and the high speed are fuelling the market growth. Additionally, implementing a firewall for a network is also much less costly than having to secure each computer individually. However, the lack of preventive firewall maintenance infrastructure and poor hardware and system compatibility are a few major factors hindering the market growth.

- The increasing need to secure communication paths from unlawful access and information misuse and maintain network safety between the external and internal networks to safeguard the company from fraud and data violations is helping the market expand and grow.

- The rapid use of web applications, rapid adoption of cloud technologies, and the increasing demand for security services to mitigate the risk of cyberattacks are also driving the growth of the network security firewall market. To protect the data & information from security breaches and cyber-attacks, the implementation of network security firewalls is growing across various end-use enterprises. Consequently, driving the growth of the overall network security firewalls market.

- Due to the coronavirus (Covid-19) pandemic, on one side, there is shutting down major parts of the global economy. On the other side, there are those with nefarious ends who are trying to take advantage of chaos and uncertainty and are evolving scams and phishing techniques which is a big threat to everyone globally.

- Google recently reported that in just one week, from 6 to 13 April, it saw more than 18 million daily malware and phishing emails related to Covid-19 scams, and that's in addition to the 240 million daily spam messages it saw related to coronavirus. Due to the rise in such activities network security firewall market is likely to grow as the firewall is a critical security component for connections that are always on, and organizations need network firewalls to protect network infrastructure.

Network Security Firewall Market Trends

Solution Segment is Expected to Witness Significant Growth

- The solution segment claimed the majority of share in the global network security firewall market owing to the continuous development in security protocols of telecom service providers to detect and protect against SS7 vulnerabilities, such as fraud, user location tracking, and denial of service (DoS).

- In September 2022, Netskope launched enhancements to the cloud firewall solution. The company states that the firewall-as-a-service (FWaaS) component of its converged SASE platform is designed to help customers simplify operations, prevent threats, and provide consistent firewall coverage worldwide anywhere their users are located.

- The solutions segment is also expected to witness the fastest CAGR over the forecast period owing to telecom organizations' growing adoption of SMS firewall solutions. SMS firewall solutions are used in network security firewall applications to detect malware over the operator's network.

- The growing number of diameter attacks in the telecom industry also supports the deployment of firewall solutions, thus, contributing to the growth of the network security firewall solutions market.

North America to Account for Largest Market Share

- North America accounted for the largest share of the network security firewall market and is expected to maintain its dominance throughout the forecast period as the region is home to several leading network security providers.

- North America is also anticipated to capture the largest share of the network security firewalls market in terms of revenue over the coming years, owing to rapid advancements in mobile security technologies in this region. The large share of this region is mainly attributed to its considerable investments in data security due to the significant rise in cyber-attacks.

- Over the past few years, many cyberattacks have targeted organizations in the North American region. This has led to a greater awareness of firewall solutions and their adoption among major companies across different regional sectors, thus contributing to market growth.

- The region is active in state-sponsored and individual cyberattacks and ransomware attacks. For instance, according to the CISA (Cybersecurity and Infrastructure Security Agency) and the Federal Bureau of Investigation (FBI) US, Russia conducted cyberattacks against commercial satellite communications networks in late February 2022 to disrupt Ukrainian command and control during the Russian invasion, with spillover effects in other European countries.

- According to evolving intelligence, the Russian government is considering alternatives for prospective cyberattacks. Recent Russian state-sponsored cyber operations have included distributed denial-of-service (DDoS) attacks against the Ukrainian government and critical infrastructure companies and the deployment of harmful malware.

- The government infrastructure and private companies are also major targets for hackers in the United States. For instance, in August 2021, Hafnium, a Chinese hacker gang, discovered Microsoft Exchange vulnerabilities that provided them access to the email accounts of at least 30,000 firms in the United States and 250,000 globally. At least ten more advanced persistent threat groups began exploiting the security holes for coin mining and espionage shortly after Microsoft publicized the problems and began patching the email server vulnerabilities.

Network Security Firewall Industry Overview

The network security firewall market is highly fragmented. The major players use strategies such as new product launches, expansions, agreements, joint ventures, partnerships, acquisitions, and others to increase their footprints in this market. Some of the key developments in the market are:

- August 2022 - Comcast Business announced a strategic partnership with Fortinet(R), a global leader in comprehensive, integrated, and automated cybersecurity solutions. This collaboration will deliver enterprises a new set of secure access service edge (SASE) and security service edge (SSE) solutions to help enterprises protect their distributed workforces using a cloud-delivered approach to security policy enforcement and expand Comcast Business's managed services expertise.

- August 2022 - NEC Corporation, a leader in the integration of IT and network technologies, and Fortinet(R), a global leader in comprehensive, integrated, and automated cybersecurity solutions, have entered an international agreement to jointly build secure 5G networks for communication service providers (CSPs). Through the partnership, Fortinet will provide its comprehensive, best-in-class security solutions, including FortiGate - the world's most deployed next-generation firewall and highest performing hyper-scale firewall. At the same time, NEC will offer professional services built on its solid track record in the telecom industry to deliver carrier-grade, sustainable networking required in 5G.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Implementation of Next-Generation Networking Technologies

- 4.2.2 Administrative Regulations Encouraging Network Security Application Firewall

- 4.2.3 Advancement of Digital Transformation in the Telecommunications Industry

- 4.3 Market Restraints

- 4.3.1 The Absence of Basic Network Firewall Restoration

- 4.4 Industry Value Chain Analysis

- 4.5 Industry Attractiveness - Porter's Five Forces Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Assessment of Impact of Covid-19 on the Network Security Firewall Market

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Solutions

- 5.1.1.1 Signaling Firewall

- 5.1.1.2 SMS Firewall

- 5.1.2 Services

- 5.1.2.1 Managed Services

- 5.1.2.2 Professional Services

- 5.1.1 Solutions

- 5.2 By Type

- 5.2.1 Packet Filtering

- 5.2.2 State full Packet Inspection

- 5.2.3 Next Generation Firewall

- 5.2.4 Unified Threat Management

- 5.3 By Deployment

- 5.3.1 On-Premises

- 5.3.2 Cloud

- 5.3.3 Network Functions Virtualization (NFV)

- 5.4 By End-User

- 5.4.1 Telecommunication and IT

- 5.4.2 BFSI

- 5.4.3 Education

- 5.4.4 Consumer Goods and Retail

- 5.4.5 Manufacturing

- 5.4.6 Healthcare and Life Sciences

- 5.4.7 Other End-Users

- 5.5 By Geography

- 5.5.1 North America

- 5.5.2 Europe

- 5.5.3 Asia-Pacific

- 5.5.4 Rest of the World

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 SAP SE

- 6.1.2 Cisco System Inc.

- 6.1.3 Mobileum Inc

- 6.1.4 ANAM Technologies

- 6.1.5 Fortinet Inc.

- 6.1.6 BICS SA

- 6.1.7 Cellusys

- 6.1.8 Amd Telecom Private Limited

- 6.1.9 NetNumber Inc.

- 6.1.10 Openmind Networks

- 6.1.11 Juniper Networks Inc.

- 6.1.12 Watchguard Technology Inc.

- 6.1.13 Checkpoint Software Technology Limited

- 6.1.14 Palo Alto Networks Inc.

7 INVESTMENT ANALYSIS

8 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219