|

市場調查報告書

商品編碼

1630356

中東和北非的 MVNO(虛擬行動服務業者):市場佔有率分析、行業趨勢和統計、成長預測(2025-2030 年)MENA Mobile Virtual Network Operator - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

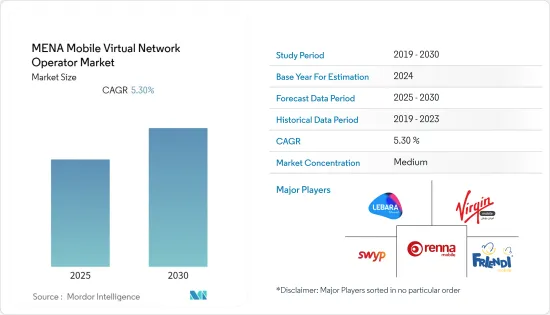

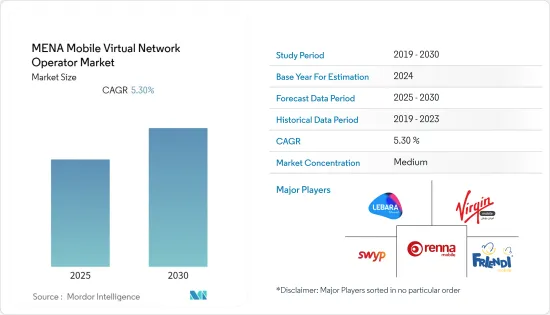

中東和北非 MVNO(虛擬行動服務業者)市場預計在預測期內複合年成長率為 5.3%。

主要亮點

- 對利用增強的網路基礎設施的通訊服務的需求不斷成長,這主要推動了全球行動 MVNO(虛擬行動服務業者)市場的發展。基於雲端基礎方案、機器對機器(M2M)交易和行動貨幣等數位服務的日益普及也是推動成長的關鍵因素。此外,旨在改善消費者獲得網路服務和增強數位服務的新政府措施的推出正在推動整個歐洲對 MVNO 的需求。

- 由於競爭對手減少、政府措施活性化以及企業對雲端服務的採用增加,虛擬行動服務業者(MVNO) 正進入新興經濟體。例如,去年11月,監管沙烏地阿拉伯資訊與通訊科技產業的通訊與資訊科技委員會(CITC)向Root Mobile授予「CITC許可證」。這項開發將使 Route Mobile 能夠透過其整個 CPaaS 產品套件(包括 A2P SMS)為沙烏地阿拉伯商業客戶和中小企業部門提供服務。

- 此外,中東和北非國家的通訊用戶數量正在增加,這將推動市場。據通訊監管局稱,截至去年 6 月,阿拉伯聯合大公國 (UAE) 約有 190 萬份活躍固網合約。同月,阿拉伯聯合大公國網路用戶數約 370 萬。

- 此外,提供VoLTE、ViLTE和VoWiFi等服務的LTE基礎設施的發展正在對全球市場產生積極影響。在整個預測期內,嵌入式SIM 卡的日益普及以及為提供低延遲和有效的通訊服務而對 5G MVNO 技術進行的大量投資等其他幾個因素虛擬行動服務業者。

- 此外,為了確保所有公民和國家都能充分受益於網際網路及其經濟和社會潛力,有必要建立國內網際網路基礎設施,並在此基礎設施之上建立數位經濟,我們必須採取行動發展。 COVID-19 的情況極大地提高了人們對這些問題的認知,並且在許多情況下加速了解決方案的發展。從長遠來看,建立新的基礎設施是可能的,它在許多方面滿足當前的需求,同時適應危機期間出現的新的網路使用。各國政府可以透過制定或修改國家寬頻計畫來開始為此做好準備,以擴大網路基礎設施的可用性並確保更廣泛的數位包容性。

中東和北非MVNO(虛擬行動服務業者)市場趨勢

5G技術的推出預計將推動市場發展

- 根據愛立信的行動報告,中東和北非地區預計將在預測期內迎來首批5G用戶,今年的用戶數量約為1700萬。此外,同期該地區的 LTE 用戶數量將增加約五倍,從 1.9 億增加到 8.6 億。

- 5G的不斷普及也將刺激物聯網,加速產業數位轉型,並為該地區的行動通訊業者提供開發新收益來源的機會。例如,土耳其和非洲的智慧農業工作、沙烏地阿拉伯災害期間油井和臨時網路的遠端監控,以及南非用於公共工程和智慧計量的窄頻物聯網 (NB-IoT)。簡而言之,5G和物聯網等技術將透過產業數位化開闢新的收入來源並提高中東和北非國家的生活水準,從而滿足該地區多元化營運商的需求。

- 由於企業領域蘊藏豐富的商機,大多數國際服務供應商都計劃推出服務以實現利潤最大化。例如,義大利服務供應商 Sparkle 宣佈在摩洛哥開設新的聯絡點 (PoP)。該中心位於 Orange摩洛哥的開放資料中心內,將為希望在摩洛哥拓展業務的跨國公司提供企業通訊服務。我們也為義大利和歐洲跨國公司提供乙太網路和虛擬專用IP-VPN網路,實現公司內部通訊並連接其位於摩洛哥的總部和分店。

- COVID-19 的疫情可能會加速對敏捷和靈活工作模式的需求,並進一步推動採用可增強工作與生活平衡的通訊服務。然而,在全球疫情大流行的背景下,通訊監管機構延後了5G頻譜競標計畫。

新技術可望推動市場

- 世界數位轉型預計將推動物聯網 (IoT) 和機器對機器 (M2M) 的採用,主要是在中東和北非國家。因此,MVNO 預計將探索物聯網 (IoT)、機器對機器 (M2M)、區塊鏈、5G 和人工智慧等新技術的商機。

- 在科威特,有 3 家公司提供行動通訊服務:stc、Zain Kuwait 和 Ooredoo Kuwait。 ICT 產業的監管機構通訊與資訊科技監管局 (CITRA) 計畫提高科威特行動市場的競爭力,並打造更便利且更具成本競爭力的行動服務。

- 根據該公司最近發布的最新版《全球物聯網支出指南》,隨著政府和舉措加大對數位轉型措施的投資,中東和非洲地區的物聯網支出較去年成長了15.9%。 。公共和私營部門也專注於改善客戶服務交付、提高產品和服務質量,以縮短上市時間、降低成本並提高盈利,而這得益於新興技術的使用預計將提振市場。

- MVNO 的成長取決於技術進步。消費市場及其各個細分市場,例如外籍勞工和年輕人,是該經營模式首先考慮的市場領域。隨著5G技術和物聯網生態系統的發展,MVNO越來越定位為B2B服務供應商。 MVNO經營模式促進了新業務融入全球通訊生態系統。例如,MVNO 用於汽車和貨運行業,提供直接面對消費者的通訊服務,特別是在傳統網路未涵蓋的城市中心之外。

中東和北非MVNO(虛擬行動服務業者)產業概況

中東和北非MVNO(虛擬行動服務業者)市場集中在幾家主要營運商手中,例如Virgin Mobile KSA、Lebara Mobile KSA、Swyp(Etisalat UAE)、Majan T communications LLC(Renna Mobile)、FRiENDi mobile,其受控。這些擁有壓倒性市場佔有率的大公司正致力於擴大海外基本客群。這些公司利用策略合作計劃來增加市場佔有率和盈利。然而,隨著技術進步和產品創新,中小企業正在透過贏得新合約和開拓新市場來增加其市場佔有率。 2022 年 6 月,總部位於杜拜的維珍移動中東非洲公司 (VMMEA) 推出了科威特第一家虛擬行動服務業者(MVNO)——維珍移動科威特公司。 Wafra 國際投資公司、Impulse International for Te communications 和 VMMEA 為科威特的擴張提供了資金。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 波特五力

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業價值鏈分析

- COVID-19 對 MVNO 市場的影響

第5章技術概況

第6章市場動態

- 市場促進因素

- 政府加強商業環境並鼓勵跨產業採用國際最佳實踐的策略

- 人口大國行動用戶的巨大成長機會

- 部署市場領先的5G技術

- 市場挑戰

- 中東國家基礎建設破壞、人道危機與安全問題

第7章通訊業業主要統計數據

- 行動電話合約數量(單位:萬台)

- 每100人行動電話簽約數

- 行動總收入和 ARPU

- 行動通訊業者(MNO)市場佔有率

- 行動作業系統市場佔有率

- 行動裝置供應商市場佔有率

第8章市場區隔

- 用戶

- 商業

- 消費者

- 按國家/地區

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 阿曼

- 伊朗

- 其他中東和非洲

第9章 競爭格局

- 供應商市場佔有率

- 併購

- 公司簡介

- Lebara Mobile KSA

- Virgin Mobile KSA

- Swyp(Etisalat UAE)

- Majan Telecommunication LLC(Renna Mobile)

- FRiENDi mobile

- Integrated Telecommunications Oman(TeO)

- Awasr-Oman

- Amin Smart Mobile Communications

- AzarTel

第10章投資分析

第11章市場的未來

The MENA Mobile Virtual Network Operator Market is expected to register a CAGR of 5.3% during the forecast period.

Key Highlights

- The growing need for communication-based services with enhanced network infrastructure primarily drives the global market for mobile virtual network operators (MVNOs). Another vital reason for spurring growth is the rising popularity of digital services, including cloud-based solutions, machine-to-machine (M2M) transactions, mobile money, etc. In addition, the introduction of novel government initiatives designed to improve consumer access to network services and advance digital services across Europe is boosting demand for MVNOs.

- Mobile virtual network operators are entering developing economies due to low competitors, increasing government initiatives, and the rising adoption rate of cloud services by business organizations. For instance, in November last year, The Communications and Information Technology Commission (CITC) of Saudi Arabia, which is in charge of policing the country's information and communication technology industry, also granted Route Mobile a "CITC License." With this development, Route Mobile will be able to serve enterprise clients and the Small and Medium Business sector in Saudi Arabia with its whole CPaaS product suite, including A2P SMS.

- Moreover, the number of telecommunications subscribers is increasing in Middle East &North African countries, which will drive the market. According to the Telecommunication Regulatory Authority, Around 1.9 million fixed-line subscriptions were active in the United Arab Emirates (UAE) as of June last year. In that month, there were approximately 3.7 million internet subscribers in the UAE.

- Additionally, the development of LTE infrastructures, which offer services like VoLTE, ViLTE, and VoWiFi, is positively impacting the world market. Throughout the forecast period, several additional factors, such as the rising popularity of embedded SIM cards and significant investments in 5G MVNO technology to provide effective communication services with low latency, are anticipated to support the global mobile virtual network operator (MVNO) market.

- Further, to ensure that all citizens and nations can fully benefit from the Internet and its economic and social potential, actions must be taken to build Internet infrastructure in a country and develop a digital economy on top of this infrastructure. The COVID-19 situation has dramatically increased awareness of these issues and, in many cases, has hastened the development of solutions. Long-term, new infrastructure can be built, which in many ways meets current needs while adjusting to new Internet uses that emerged during the crisis. Governments can start preparing for this phase by creating or modifying a national broadband plan to expand the availability of Internet infrastructure and guarantee broader digital inclusion.

MENA Mobile Virtual Network Operators Market Trends

Deployment of 5G Technologies is Expected to Drive the Market

- According to the Ericsson mobility report, the first 5G subscriptions in the Middle East & North Africa are expected during the forecasted period and will reach around 17 million subscriptions this year. Further, the region will witness a nearly five-fold increase in LTE subscriptions, from 190 million to 860 million in the same timeframe.

- Increased 5G penetration will also fuel the Internet of Things, facilitating the digital transformation of industries and providing mobile operators in the region with opportunities to explore new revenue streams. For instance, smart agriculture initiatives in Turkey and Africa, remote monitoring of oil wells and temporary networks in case of disasters in Saudi Arabia, and Narrowband-IoT (NB-IoT) being used to address utilities and smart meters in South Africa. So, technologies like 5G and IoT will serve the region's diverse operator needs by opening new revenue streams as a result of industry digitization, improving standards of livings in countries across MENA.

- Due to an abundance of opportunities in the enterprise sector, most International service providers are planning to launch their services to maximize their profit. For instance, Sparkle, an Italian service provider, has announced opening of a new Point of Presence (PoP) in Morocco. It will be located in Orange Maroc's open data center and provide corporate communication services to multinational enterprises aiming to expand their business in Morocco. It will also offer ethernet and virtual private IP-VPN networks to Italian and European multinationals to enable intracompany communication and connect their headquarters with their branches in Morocco.

- The COVID-19 outbreak will accelerate the demand for agile and flexible work styles and further push the adoption of communication services that enhance work-life balance. However, telecom regulators have postponed their 5G spectrum auction plans amidst the global pandemic.

Emerging Technologies is Expected to Drive the Market

- Digital transformation across the world is expected to increase the adoption of mainly the Internet of Things (IoT) and machine-to-machine (M2M) in Middle Eastern and North African countries. Hence, it is expected that MVNOs will explore opportunities for emerging technologies such as the Internet of Things (IoT), machine-to-machine (M2M), blockchain, 5G, and Artificial Intelligence.

- Three local carriers-stc, Zain Kuwait, and Ooredoo Kuwait-offer mobile telecommunications services in Kuwait. The ICT sector's regulatory body, the Communication and Information Technology Regulatory Authority (CITRA), has plans to make Kuwait's mobile market more competitive and to produce more readily available and price-competitive mobile services.

- According to a recent update to the company's Worldwide Semiannual Internet of Things Spending Guide, as governments and businesses increase their investments in digital transformation initiatives, IoT spending in the MEA region will increase 15.9% year over year in last year and reach $17.63 billion this year. Public and private sectors are also focusing on improving their provision of customer services, improving the quality of products and services that accelerate their time to market, reducing costs, and increasing their profitability which will encourage them to utilize the emerging technologies and is expected to boost the market growth.

- The growth of MVNOs depends on technological advancements. The consumer market and its various niches, such as foreign workers and younger consumers, were the initial market sector examined by this business model. There is increasing potential for MVNOs to position themselves as B2B service providers due to the development of 5G technology and the internet-of-things ecosystem. The MVNOs business model has made it easier to include new businesses into the global telecoms ecosystem. For instance, MVNOs are used by the automotive and freight industries to provide direct-to-consumer communication services, especially outside urban centers that traditional networks do not cover.

MENA Mobile Virtual Network Operators Industry Overview

The MENA mobile virtual network operator market is concentrated and dominated by a few major players like Virgin Mobile KSA, Lebara Mobile KSA, Swyp (Etisalat UAE), Majan Telecommunication LLC (Renna Mobile), and FRiENDi mobile. With a prominent market share, these major players focus on expanding their customer base across foreign countries. These companies leverage strategic collaborative initiatives to increase their market share and profitability. However, with technological advancements and product innovations, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping new markets. In June 2022, the first mobile virtual network operator (MVNO) in Kuwait, Virgin Mobile Kuwait, was introduced by the Dubai-based Virgin Mobile Middle East and Africa (VMMEA). Wafra International Investment Company, Impulse International for Telecommunications, and VMMEA contributed funding to the expansion into Kuwait.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Porter Five Forces

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 on the MVNO Market

5 TECHNOLOGY SNAPSHOT

6 MARKET DYNAMICS

- 6.1 Market Drivers

- 6.1.1 Government Strategy to Enhance Business Environment, and Foster the Adoption of International Best Practices Across Industry

- 6.1.2 Significant Growth Opportunities for Mobile Subscriptions in Largely Populated Countries

- 6.1.3 Deployment of 5G technology to drive the market

- 6.2 Market Challenges

- 6.2.1 Issue Regarding Infrastructure Destruction, Humanitarian Crises, and Security Concerns in Middle East Countries

7 KEY TELECOM INDUSTRY STATISTICS*

- 7.1 Number of Mobile Cellular Subscriptions (in million)

- 7.2 Number of Mobile Cellular Subscriptions per 100 inhabitants

- 7.3 Total Mobile Revenue and ARPU

- 7.4 Market Share of Mobile Network Operators(MNOs)

- 7.5 Market Share of Mobile Operating Systems

- 7.6 Market Share of Mobile Device Vendors

8 MARKET SEGMENTATION

- 8.1 By Subscriber

- 8.1.1 Business

- 8.1.2 Consumer

- 8.2 By Country

- 8.2.1 United Arab Emirates

- 8.2.2 Saudi Arabia

- 8.2.3 Oman

- 8.2.4 Iran

- 8.2.5 Rest of Middle East & North Africa

9 COMPETITIVE LANDSCAPE

- 9.1 Vendor Market Share

- 9.2 Mergers and Acquisitions

- 9.3 Company Profiles

- 9.3.1 Lebara Mobile KSA

- 9.3.2 Virgin Mobile KSA

- 9.3.3 Swyp (Etisalat UAE)

- 9.3.4 Majan Telecommunication LLC (Renna Mobile)

- 9.3.5 FRiENDi mobile

- 9.3.6 Integrated Telecommunications Oman (TeO)

- 9.3.7 Awasr-Oman

- 9.3.8 Amin Smart Mobile Communications

- 9.3.9 AzarTel