|

市場調查報告書

商品編碼

1630375

中國發電機組市場:佔有率分析、產業趨勢與統計、成長預測(2025-2030)China Generator Sets - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

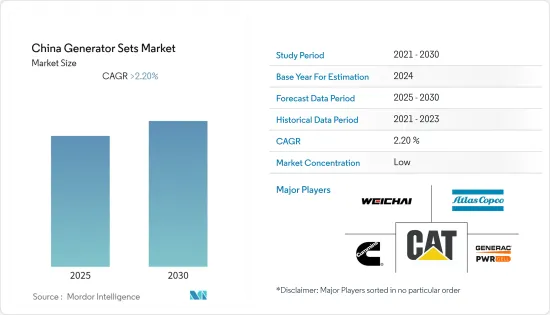

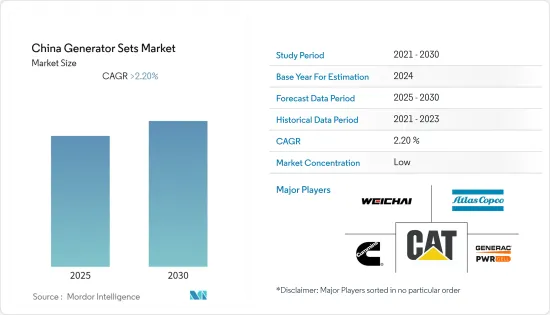

預計預測期內中國發電機組市場複合年成長率將超過2.2%

COVID-19 對 2020 年市場產生了負面影響。目前,市場尚未達到大流行前的水平,預計將在一年內達到這一水平。

主要亮點

- 從中期來看,缺乏可靠的電網基礎設施以及偏遠和農村地區對緊急備用電源解決方案的需求等因素預計將推動中國發電機組市場的發展。

- 另一方面,為了實現綠能供應,擴大引入太陽能和風電等可再生能源發電,預計將成為中國發電機組市場的限制因素。

- 然而,新技術,例如日益普及的混合發電機組,可以使用電池、可再生能源或電網電力作為初級能源。因此,預計未來中國發電機組市場將出現若干機會。

中國發電機組市場趨勢

柴油引擎領域預計將主導市場

- 發電機組(也稱為發電機)是由引擎和發電機組成的提供能量的可攜式設備。發電機通常用於停電頻繁且停電可能導致特別嚴重和危險問題的開發中地區或離網地區,例如礦井深處或醫院使用的地方。它被用作初級能源或在尖峰時段作為輔助電源。

- 柴油發電機以柴油為燃料,將化學能轉換為機械能,進而轉換為電能。由於高效率的工作輸出和最大的燃料能量密度等因素,它比燃氣和其他燃料發電機組更具成本效益,並有可能帶動柴油發電機組細分市場。

- 中國國內對基礎建設計劃的需求是世界上最大的,對國家基礎設施的需求也很大。作為上述背景,2020 年,大量人員受到了 COVID-19 的影響。隨著需要加護治療的人數迅速增加,政府建立了多家醫院來治療受害者。醫院基礎建設採用發電機組作為初級能源或作為24小時供電的備用電源。

- 2022 年,該國也出現了類似的 COVID-19 趨勢,導致對用於醫療基礎設施備用電源的柴油發電機的需求增加。

- 因此,鑑於上述幾點,柴油發電機組很可能在預測期內主導中國發電機組市場。

工業化進步帶動市場

- 中國是人口最多的國家,能源需求不斷增加。對不斷電系統的不斷成長的需求預計也將推動該國發電機組市場的發展。

- 該國的天然氣生產產業正在蓬勃發展,這可能會推動該國的發電機組市場。由於油井位置偏遠,天然氣產業是大量使用發電機組為天然氣生產場所供電的產業之一。 2021年,中國天然氣產量為2,092億立方米,高於2020年的1,940億立方米。

- 此外,中國鋼鐵產量佔全球鋼鐵產量的50%,是柴油發電機的龐大市場。鋼鐵業是能源密集型產業,其運作高度依賴停電期間柴油發電機組產生的電力。

- 這些發電機用於發電,2021年總發電量為8,534兆瓦時(TWh),高於2020年的7,779兆瓦時(TWh)。即便如此,發電量的成長並沒有跟上國家的能源需求,全國仍多次出現停電情況。能源供需之間的差距預計將推動該國發電機組市場的發展。

- 截至2022年,中國有54座核子反應爐在運作中,22核子反應爐正在建造或處於開發階段。由於燃煤發電廠的過度使用及其造成的污染,中國政府的長期目標是使用更多閉式循環核能來滿足其能源需求。這些核能發電廠預計將在停電和緊急情況下使用發電機組。

- 因此,鑑於以上幾點,工業化的發展預計將在預測期內帶動中國發電機組市場。

中國發電機組產業概況

中國發電機組市場細分。該市場的主要企業包括(排名不分先後)威海控股集團、Caterpillar公司、康明斯公司、阿特拉斯·科普柯公司和 Generac Holdings Inc.。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2027年之前的市場規模與需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- PESTLE分析

第5章市場區隔

- 燃料類型

- 柴油引擎

- 天然氣

- 其他

- 容量

- 75kVA以下

- 75~350kVA

- 350kVA以上

- 最終用戶

- 住宅

- 商業的

- 工業的

第6章 競爭狀況

- 合併、收購、聯盟和合資企業

- 主要企業策略

- 公司簡介

- Doosan Corporation(Bobcat)

- Generac Holdings Inc.

- Atlas Copco AB

- Rolls-Royce Holding PLC

- Himoinsa(Yanmar Co., Ltd.)

- Cummins Inc.

- Caterpillar Inc.

- Mitsubishi Corp

- Kohler Co.

- Weichai Holding Group Co.,Ltd.

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 70278

The China Generator Sets Market is expected to register a CAGR of greater than 2.2% during the forecast period.

COVID-19 negatively impacted the market in 2020. Currently., the market has not reached pre-pandemic levels and is expected to do so in one year.

Key Highlights

- Over the medium term, factors such as lack of reliable grid infrastructure and the need for emergency backup power solutions in remote and rural areas are likely going to drive the China generator sets market.

- On the other hand, increasing the installation of renewable energy sources such as solar and wind to provide a cleaner power supply is expected to restrain the China generator sets market.

- However, new technology, such as the increasing popularity of hybrid generator sets, can use batteries, renewable energy, or grid power as a primary energy source. This is expected to create several opportunities for China's generator sets market in the future.

China Generator Sets Market Trends

Diesel Segment Expected to Dominate the Market

- A generator set, also known as a Genset, is a piece of portable equipment consisting of an engine and a generator used to provide energy. Gensets are usually used in developing areas and other areas not connected to the power grid, where power outages are frequent and where an outage can cause especially significant or dangerous problems, such as deep in a mine or hospital. They can serve as the primary source of energy or as a supplementary power source, perhaps during peak usage hours.

- Diesel-based gensets use diesel as a fuel for converting chemical energy to mechanical energy and then to electrical energy. Factors such as high-efficiency work output and maximum fuel energy density make it more cost-effective than the gas and other fuel-based generator sets and likely drive the diesel-based generator sets segment.

- The internal need for infrastructure projects in China has been the largest in the world and the country's requirement for infrastructure. Backing the above, in 2020, several numbers of people got affected by COVID-19. Due to such a sharp rise in the number of people that require intensive care, the government built several hospitals to treat the affected ones. The infrastructures of the hospitals were built using generator sets as a primary energy source or a backup power source for 24 hours of energy supply.

- A similar trend of COVID-19 was also observed in the country in 2022, leading to a rise in demand of diesel-based generators for power backup for health infrastructure.

- Hence, owing to the above points, diesel-based generator sets are likely going to dominate the china generator sets market during the forecast period.

Growing Industrialization Expected to Drive the Market

- China has the largest population, because of which there is a constant increase in the energy demand that requires an increasing number of industrial operations in the country and is expected to drive the generator sets market in the country. The continually growing demand for uninterrupted power supply in the country is also expected to drive the generator sets market in the country.

- The country's gas production industry is booming at a reasonable rate, which is likely going to drive the generator sets market in the country. The gas sector is one of the sectors where generator sets are used in an extensive amount to provide power to the site of gas production because of the remote areas in which wells are located. In 2021, China produced 209.2 billion cubic metres (bcm) of natural gas, which was higher than what was produced in 2020, 194 billion cubic metres (bcm).

- Moreover, steel production in China accounts for 50% of global steel production, which makes it a massive market for diesel generators. The steel industry is exceptionally energy-intensive, and its operations are highly dependent on power generated from diesel generator sets during the power outages.

- The generator sets are used for generating electricity, and in 2021 the total electricity generated in the country was 8534 terawatt-hours (TWh), which was higher than what country produced in 2020, 7779 terawatt-hours (TWh). Still increasing electricity generation cannot match the country's energy demand; there are still several electricity cuts in the country. This gap between demand and supply of energy is expected to drive the generator sets market in the country.

- As of 2022, China had 54 operational nuclear power reactors and 22 under construction or in the development phase. Due to the excessive use of coal-fired power plants and the pollution it causes, China government has a long term target to use more of closed-cycle nuclear power to satisfy its energy demand. These nuclear power plants are expected to use generator sets in case of a power outage or emergency.

- Hence, due to the above points, growing industrialization is expected to drive the China generator set market during the forecast period.

China Generator Sets Industry Overview

The China Generator Sets Market is fragmented. Some of the key players in this market include (not in particular order) Weihai Holding Group Co., Ltd., Caterpillar Inc., Cummins Inc., Atlas Copco AB, and Generac Holdings Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Fuel Type

- 5.1.1 Diesel

- 5.1.2 Natural Gas

- 5.1.3 Others

- 5.2 Capacity

- 5.2.1 Below 75kVA

- 5.2.2 75-350kVA

- 5.2.3 Above 350kVA

- 5.3 End-User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.3.3 Industrial

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers, Acquisitions, Collaboration and Joint Ventures

- 6.2 Strategies Adopted by Key Players

- 6.3 Company Profiles

- 6.3.1 Doosan Corporation (Bobcat)

- 6.3.2 Generac Holdings Inc.

- 6.3.3 Atlas Copco AB

- 6.3.4 Rolls-Royce Holding PLC

- 6.3.5 Himoinsa (Yanmar Co., Ltd.)

- 6.3.6 Cummins Inc.

- 6.3.7 Caterpillar Inc.

- 6.3.8 Mitsubishi Corp

- 6.3.9 Kohler Co.

- 6.3.10 Weichai Holding Group Co.,Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219