|

市場調查報告書

商品編碼

1630380

光電矽晶圓:市場佔有率分析、產業趨勢、成長預測(2025-2030)Solar Photovoltaic Wafer - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

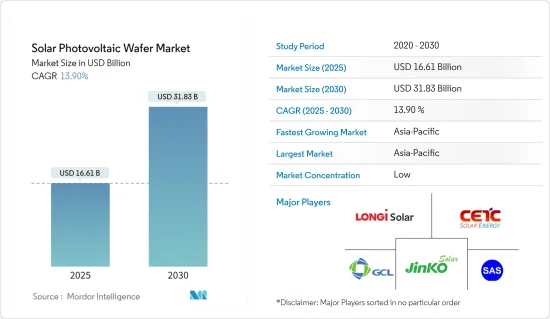

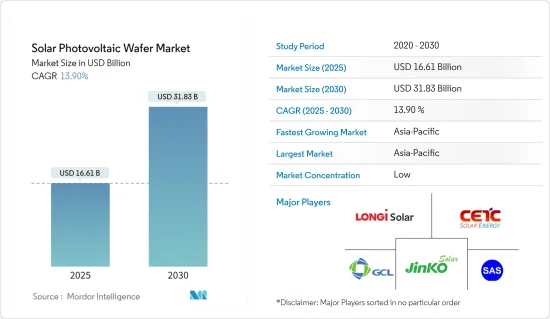

太陽能矽晶圓市場規模預計到2025年為166.1億美元,預計到2030年將達到318.3億美元,預測期內(2025-2030年)複合年成長率為13.9%。

主要亮點

- 從中期來看,全球對可再生能源的需求不斷成長以及政府的支持性政策預計將成為預測期內市場的關鍵成長要素。

- 另一方面,預計太陽能晶圓的成長在預測期內將受到限制,因為與市場上的薄膜等替代品相比,它們價格昂貴。

- 然而,晶圓技術的技術進步預計將在預測期內為市場創造一些機會。

- 由於即將推出的發電工程和政府的支持政策,預計亞太地區將主導市場。

太陽能發電矽晶圓市場趨勢

結晶太陽能矽晶片可望主導市場

- 太陽能晶圓是矽晶型薄片,可作為微型經濟元件的基板,用於製造光伏 (PV) 電池積體電路、吸收陽光並協助發電。

- 由於結晶太陽能板效率高且佔地面積小,預計結晶太陽能矽晶片將在預測期內主導市場。

- 根據 Fraunhofer ISE 的數據,結晶太陽能電池的效率是所有太陽能電池中最高的(26.7%)。這導致更高的發電量,特別是對於大型公共事業規模的計劃,進一步降低了電力均衡化的成本。

- 2023年8月,天合光能開始在越南生產210毫米結晶。該工廠每年將能夠生產6.5GW矽晶圓。這項新產能將使天合光能能夠在全球範圍內靈活供應產品。

- 印度是太陽能矽晶圓的重要市場。隨著該國太陽能產業的快速發展,該國也在擴大太陽能電池、矽晶圓和矽錠的產能,以滿足國內需求並減少對進口的依賴。

- 2022年12月,阿達尼太陽能推出印度最大矽晶型錠。新生產線將生產專門用於太陽能晶圓、電池和組件的矽錠。該工廠將生產大型矽晶型錠,能夠生產 M10 和 G12 晶圓。該公司表示,計劃在2023年終新增矽錠和矽晶圓產能2GW,2025年擴大至10GW。

- 因此,鑑於以上幾點,結晶光伏矽晶圓預計將在預測期內主導光伏矽晶圓市場。

亞太地區成長最快

- 預計亞太地區將成為預測期內成長最快的市場。印度、日本和中國等國家的目標是在未來大規模部署太陽能。

- 預計中國的大型計劃未來將產生對太陽能矽晶圓的巨大需求。此外,由於中國是全球太陽能硬體製造中心,晶科能源、晶澳太陽能、英利等中國製造商在太陽能電池、矽晶圓和矽錠技術的研發上處於領先地位,對市場產生了巨大的刺激。給予。

- 2023年上半年,根據北極星太陽能光電網統計,1-6月,中國矽晶圓產量達442GW,達57億美元。

- 2023年7月,澳洲政府宣布投資3,370萬美元發展可再生能源供應鏈。該資金將支持澳洲以及南亞和東南亞國家的計劃開發研究,特別是太陽能錠和晶圓製造以及電池組件製造。

- 到2022年,亞洲太陽能裝置容量預計將超過603吉瓦,並預計在預測期內穩定成長。隨著太陽能未來的成長,太陽能矽晶圓市場預計也將大幅成長。

- 亞太地區預計在預測期內將以最快的速度成長,大量計劃在建,各國制定了雄心勃勃的太陽能目標。

光電矽晶圓產業概況

太陽能矽晶圓市場較為分散。主要企業(排名不分先後)包括晶科能源控股有限公司、保利協鑫能源控股有限公司、隆基綠能科技、中國電科太陽能控股有限公司、中美矽製品有限公司等。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 2029年之前的市場規模與需求預測(單位:美元)

- 最新趨勢和發展

- 政府法規政策

- 市場動態

- 促進因素

- 可再生能源需求增加

- 政府扶持政策

- 抑制因素

- 與薄膜等替代品相比,高成本

- 促進因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 按類型

- 結晶

- 多晶片

- 按地區

- 北美洲

- 美國

- 加拿大

- 北美其他地區

- 歐洲

- 德國

- 法國

- 英國

- 義大利

- 西班牙

- 北歐的

- 土耳其

- 俄羅斯

- 其他歐洲國家

- 亞太地區

- 中國

- 印度

- 澳洲

- 日本

- 馬來西亞

- 越南

- 泰國

- 印尼

- 其他亞太地區

- 南美洲

- 巴西

- 阿根廷

- 智利

- 哥倫比亞

- 南美洲其他地區

- 中東/非洲

- 阿拉伯聯合大公國

- 沙烏地阿拉伯

- 南非

- 卡達

- 奈及利亞

- 卡達

- 埃及

- 北美洲

- 市場參與者排名

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Jinko Solar Holding Co., Ltd.

- GCL-Poly Energy Holdings Limited

- LONGi Green Energy Technology Co Ltd

- CETC Solar Energy Holdings Co

- Sino-American Silicon Products Inc

- Targray Technology International Inc

- Renewable Energy Corporation

- JA Solar Holdings, Co., Ltd.

- Market Player Ranking

第7章 市場機會及未來趨勢

- 晶圓技術的進步

簡介目錄

Product Code: 70307

The Solar Photovoltaic Wafer Market size is estimated at USD 16.61 billion in 2025, and is expected to reach USD 31.83 billion by 2030, at a CAGR of 13.9% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the growing global demand for renewable energy and supportive government policies are expected to be the primary growth driver for the market during the forecast period.

- On the other hand, photovoltaic wafers are costly compared to alternatives like thin films available in the market, which are expected to restrain growth in the forecast period.

- Nevertheless, the tecchnological advancement in wafer technology is expected to create several opportunities for the market during the forecast period.

- Asia pacific is expected to dominate the market owing to upcoming solar projects and supportive government policies.

Solar Photovoltaic Wafer Market Trends

Monocrystalline Solar Photovoltaic Wafer is Expected to Dominate the Market

- A solar wafer is a thin slice of crystalline silicon that works as a substrate for microeconomic devices for fabricating integrated circuits in photovoltaics (PVs) to manufacture solar cells and assist in power generation by absorbing sunlight.

- Due to the higher efficiency and lower space occupancy of monocrystalline solar panels, monocrystalline solar wafers are expected to dominate the market during the forecast period.

- According to Fraunhofer ISE, monocrystalline solar cells had the highest efficiency (26.7%) of any solar cell. This translates to higher electricity production, especially in large utility-scale projects, further reducing the levelized cost of electricity, which is expected to give the technology an advantage over other technology types, driving the segment during the forecast period.

- In August 2023, Trina Solar began producing 210mm Monocrystalline Wafers in Vietnam. The factory will be able to produce 6.5 GW of wafers annually. With this new capacity, Trina Solar will have greater flexibility in being able to deliver its products worldwide.

- India is a significant market for solar photovoltaic wafers. As the country's solar photovoltaic sector grows rapidly, it is also expanding its solar cell, wafer, and ingot production capacity to match domestic demand and reduce dependence on imports.

- In December 2022, Adani Solar unveiled India's largest monocrystalline silicon ingot. The new manufacturing line will produce silicon ingots exclusively for producing solar wafers, cells, and modules. The facility will produce large-sized monocrystalline silicon ingots capable of producing M10 and G12 wafers. According to the company, it aims to add 2 GW of ingot and wafer capacity by the end of 2023 and scale it up to 10 GW by 2025.

- Therefore, owing to the above points, the monocrystalline solar photovoltaic wafers segment is expected to dominate thesolar photovoltaic wafer market during the forecast period.

Asia-Pacific to Grow at Fastest Rate

- Asia-Pacific is expected to become the fastest-growing market in the forecast period. Countries like India, Japan, and China are aiming to instal solar power on a large scale in the future.

- Significant projects in China are expected to create a large demand for solar photovoltaic wafers in the upcoming period. Additionally, as China is the global hub for solar PV hardware manufacturing, Chinese manufacturers such as JinkoSolar, JA Solar, Yingli, etc. are at the forefront of research and development in solar cell, wafer, and ingot technology, which is expected to provide a significant impetus to the market.

- In first half of 2023, Accordng to Polaris Solar Photovoltaic Networks Statistics, Silicon wafer prodcution in china reached 442GW from January to June and was worth USD 5.7 billion.

- In July 2023, the Australian government announced USD 33.7 million in investment to develop renewable energy supply chains. The funding will support research to develop projects in Australia and southern and southeast Asian countries, particularly mentioning solar ingot and wafer production and battery cell component manufacturing.

- In 2022, the installed capacity of solar photovoltaic in Asia was estimated at more than 603 GW, which is expected to grow steadily during the forecast period. With the future growth of solar energy, the market for solar wafers is also estimated to grow considerably.

- With a large number of projects under construction and ambitious solar energy goals for countries in Asia-Pacific, the region is anticipated to grow at the fastest rate in the forecast period.

Solar Photovoltaic Wafer Industry Overview

The solar photovoltaic wafer market is fragmented. Some of the major companies (in no particular order) include Jinko Solar Holding Co., GCL-Poly Energy Holdings Limited Ltd, LONGi Green Energy Technology Co Ltd, CETC Solar Energy Holdings Co, and Sino-American Silicon Products Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definiton

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand for Renewable Energy

- 4.5.1.2 Supportive Government Policies

- 4.5.2 Restraints

- 4.5.2.1 High Cost Compared to Alternatives like Thin Films

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Monocrystalline Wafer

- 5.1.2 Polycrystalline Wafer

- 5.2 Geogrpahy

- 5.2.1 North America

- 5.2.1.1 United States

- 5.2.1.2 Canada

- 5.2.1.3 Rest of North America

- 5.2.2 Europe

- 5.2.2.1 Germany

- 5.2.2.2 France

- 5.2.2.3 United Kingdom

- 5.2.2.4 Italy

- 5.2.2.5 Spain

- 5.2.2.6 NORDIC

- 5.2.2.7 Turkey

- 5.2.2.8 Russia

- 5.2.2.9 Rest of Europe

- 5.2.3 Asia-Pacific

- 5.2.3.1 China

- 5.2.3.2 India

- 5.2.3.3 Australia

- 5.2.3.4 Japan

- 5.2.3.5 Malaysia

- 5.2.3.6 Vietnam

- 5.2.3.7 Thailand

- 5.2.3.8 Indonesia

- 5.2.3.9 Rest of Asia-Pacific

- 5.2.4 South America

- 5.2.4.1 Brazil

- 5.2.4.2 Argentina

- 5.2.4.3 Chile

- 5.2.4.4 Colombia

- 5.2.4.5 Rest of South America

- 5.2.5 Middle-East and Africa

- 5.2.5.1 United Arab Emirates

- 5.2.5.2 Saudi Arabia

- 5.2.5.3 South Africa

- 5.2.5.4 Qatar

- 5.2.5.5 Nigeria

- 5.2.5.6 Qatar

- 5.2.5.7 Egypt

- 5.2.1 North America

- 5.3 Market Player Ranking

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Jinko Solar Holding Co., Ltd.

- 6.3.2 GCL-Poly Energy Holdings Limited

- 6.3.3 LONGi Green Energy Technology Co Ltd

- 6.3.4 CETC Solar Energy Holdings Co

- 6.3.5 Sino-American Silicon Products Inc

- 6.3.6 Targray Technology International Inc

- 6.3.7 Renewable Energy Corporation

- 6.3.8 JA Solar Holdings, Co., Ltd.

- 6.4 Market Player Ranking

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancement in Wafer technology

02-2729-4219

+886-2-2729-4219