|

市場調查報告書

商品編碼

1630383

非洲小型基地台-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Africa Small Cell - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

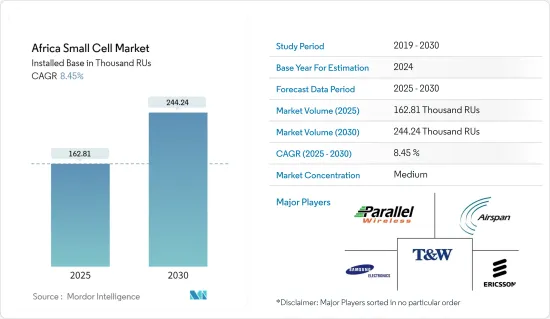

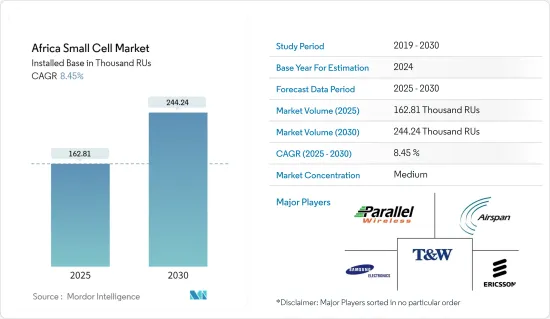

非洲小型基地台市場規模預計將從 2025 年的 162,810 RUS 成長到 2030 年的 244,240 RUS,在預測期間(2025-2030 年)複合年成長率為 8.45%。

小型基地台非常適合在宏天線無法到達的位置使用。它還描述瞭如何為戶外環境(從體育場館和學校校園到市中心的「峽谷」和農村社區)快速部署精確和客製化網路的力量。

主要亮點

- 小型基地台預計將構成 5G 網路的大部分。小型基地台對於 5G 網路的運作至關重要,因為它們可以提供 5G 所需的額外資料容量。此外,它還可以消除昂貴的屋頂系統和安裝費用,幫助通訊業者降低成本。它還有望幫助改善功能和電池壽命。

- 此外,5G 將在已使用的行動電話頻率上實施。儘管如此,通訊業者仍有潛力進行擴展以支援更高的無線電頻率(20GHz 以上)並提供行動服務。此外,由於訊號無法穿牆,這些頻率只能部署在有限的空間內。這對室內應用的小型蜂巢基地台的發展大有裨益,為智慧型手機和物聯網 (IoT) 設備提供卓越的連接性。

- 全球對行動裝置的需求不斷成長、網路技術和連網型設備的進步正在推動市場發展。這些需求正在推動 IT 服務交付的變革,並為參與企業提供了鞏固其市場地位的重要機會。

- 小型基地台的發展帶來了新的挑戰,例如小型基地台網路的回程傳輸開發。

- COVID-19 大流行迫使人們整天待在家裡(因為許多國家已實施封鎖)、在家工作、與同事遠端聯繫、並轉向網路服務來工作和娛樂,這增加了對網路的需求。這導致了線上流量的激增,並且是推動易於安裝、經濟高效的小型基地台網路成長的關鍵因素。

非洲小型基地台市場趨勢

戶外佔很大佔有率

- 小型基地台透過網際網路連接到主要行動網路,在室內透過雲端連接,在室外使用寬頻技術無線連接。該策略將有助於保持當前第四代 (4G) LTE 網路和正在開發的 5G 網路的最佳覆蓋範圍和容量。

- 小型基地台技術擴大實現室外網路的緻密化,而不僅僅是提供體育場館和建築物等結構內部的覆蓋。所有主要通訊服務供應商(CSP) 都表達了網路緻密化的雄心,其中一些已經開始將小型基地台整合到其網路中。這種情況可能會鼓勵在戶外安裝微蜂窩。

- 此外,隨著對 5G 服務和設備的需求增加,網路將持續發展以滿足更好、更快覆蓋的需求。因此,小型室外蜂窩是這些服務增強部署的重要組成部分。

- 在人口密集的都市區部署戶外小型基地台時,傳輸資源成為關鍵瓶頸,難以實現全部區域所有站點的有線傳輸。

南非預計將經歷顯著成長

- 非洲地區在 5G 部署以及與全球小型基地台公司的策略夥伴關係方面正在不斷發展,這是該地區的主要市場驅動力。

- 非洲供應商正在努力擴大行動網路覆蓋範圍,這將推動對該地區小型基地台市場的需求。沃達豐正在莫三比克和剛果民主共和國積極試驗開放式 RAN 技術,以擴大其潛在供應商基礎並擴大農村地區的網路存取。

- 此外,多家全球公司正在向莫三比克擴張,透過建立具有所需速度、容量和低延遲的室內覆蓋的密集環境來促進消費者的 5G 體驗。

- 該地區專網的成長也是支持該地區市場發展的重要趨勢。專用網路描述了使用小型基地台的局部網路基礎設施供私人使用的覆蓋範圍和連接。

非洲小型基地台產業概況

非洲小型基地台市場是細分的。在這個市場上營運的公司正在進行併購、策略聯盟和市場開發以產品推出。主要企業包括三星電子、Parallel Wireless Inc. 和 Airspan Networks Inc.。

- 2023年9月-Asprin Newtork 14日宣布,與韓國水電核電合作,Ilshin EDI和Eruon聯合開發的核能發電廠無線通訊系統將是災難安全通訊網路(PS)-LTE、5G、5G Wi -特點是Fi6整合到一個系統中。

- 2023 年 5 月 - Parallel Wireless 宣布推出新一代敏捷智慧 RAN 解決方案。 PW RAN 版本 7.x。隨著應用程式容器化和在 Kubernetes 上實施,Parallel Wireless 一流的 All-G Open RAN 解決方案有望徹底改變蜂窩市場。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 產業相關人員分析

第5章市場動態

- 市場促進因素

- 該地區行動資料流量快速成長

- 透過更換小型蜂窩塔來提高營運效率和減少資本投資變得越來越重要

- 現有營運商安裝數量穩定成長

- 市場問題

- 對與 5G 網路部署相關的國家法規和業務挑戰的擔憂

- 行業標準和法規

- COVID-19 對小型基地台部署和連接的影響

- 小型蜂窩塔安裝的主要影響和技術考慮因素

- 目前的所有權模式和小型基地台租賃/共享機制的出現

- 非洲連結技術現況(3G、4G、5G)

第6章 非洲5G藍圖分析

第7章 市場區隔

- 按用途

- 戶外的

- 室內的

- 按地區

- 北非/西非

- 南非

- 其他非洲

第8章 競爭格局

- 公司簡介

- Parallel Wireless Inc.

- Airspan Networks Inc.

- T&W Electronics Co Ltd.

- Samsung Electronics Co. Ltd

- Telefonaktiebolaget LM Ericsson

- Huawei Technologies Co. Ltd

- ZTE Corporation

- Baicells Technologies Co. Ltd

- NEC Corporation

- Nokia Corporation

第9章投資分析及市場展望

The Africa Small Cell Market size in terms of installed base is expected to grow from 162.81 thousand rus in 2025 to 244.24 thousand rus by 2030, at a CAGR of 8.45% during the forecast period (2025-2030).

Small cells are ideal for utilization where macro-antennas cannot reach them. They also provide a way to rapidly deploy the power of a network with precision and customization for outdoor environments, from sports venues and school campuses to downtown street "canyons" and rural neighborhoods.

Key Highlights

- Small cells are projected to make up most of the 5G networks. Small cells are necessary to run 5G networks because they only make the additional data capacity that 5G requires possible. Additionally, by eliminating pricey rooftop systems and installation fees, they aid carriers in cutting expenses. They are also anticipated to aid in improving functionality and battery life.

- Moreover, 5G would be implemented on already-used cellular radio frequencies. Still, it might allow operators to expand and address higher radio frequencies (beyond 20 GHz) to make them functional for mobile services. Moreover, because the signal cannot pass through walls, these frequencies can only be deployed in limited spaces. This encourages tiny cells for in-building applications since they provide superior connectivity for smartphones and Internet of Things (IoT) gadgets.

- The global increase in demand for mobile devices and the advancement of network technology and connected devices are pushing the market. Such demand has been driving the change in the delivery of IT services and has given the market's players a substantial opportunity to strengthen their position there.

- Small cell deployment has introduced new difficulties, such as the backhaul development of small cell networks, even though tiny cells can provide better network coverage at a lower cost.

- The COVID-19 pandemic increased demand for wireless internet as people were restricted to their homes all day (due to lockdowns in many countries) and forced to work from home, connect remotely with their peers, and use the internet services for work and entertainment. This led to a surge in online traffic, which acted as a key factor driving the growth of small cell networks, which are easy to install and cost-effective.

Africa Small Cell Market Trends

Outdoor to Have Significant Share

- A tiny cell is linked to the main mobile network via the internet, either through the cloud indoors or wirelessly outside, utilizing broadband technologies. This strategy aids in preserving optimal coverage and capacity across both the current fourth-generation (4G) LTE networks and the developing 5G networks.

- Increasingly, small cell technologies are enabling the densification of outdoor networks rather than only providing coverage inside structures like arenas or buildings. Every significant communications service provider (CSP) has stated ambitions for network densification, and several have even begun integrating tiny cells into their networks. Such circumstances are likely to encourage the installation of a tiny cell in an outdoor setting.

- Also, networks grow to satisfy the demand for better and quicker coverage as 5G services and devices see an increase in demand. Small outdoor cells are therefore an essential component of these service-improving deployments.

- As transmission resources are a key bottleneck for the deployment of small outdoor cells across densely populated urban areas, it is, therefore, difficult to achieve wired transmission for all sites across the region.

South Africa is Expected to Witness Significant Growth

- The Africa region is growing in terms of 5G deployment and strategic partnerships with global small cell companies, which are significant drivers for the market in the area.

- Vendors in Africa are working to increase mobile network coverage, which will drive demand for the small cell market in the region. Vodafone is actively trialing open RAN technology in Mozambique and the Democratic Republic of the Congo to broaden its potential base of suppliers and extend rural Internet access.

- In addition, various global companies are stepping into the country to drive 5G experiences for consumers by creating a dense environment for indoor coverage with the required speed, capacity, and low latency.

- The growth in private networks in the region is also a significant trend that is assisting in the development of the market in the area. A private network uses a localized network infrastructure using small cells to provide coverage and connectivity for private use.

Africa Small Cell Industry Overview

Africa's small cell market is fragmented. The companies operating in the market are executing mergers and acquisitions, strategic partnerships, and product development to introduce new products. Significant players include Samsung Electronics Co. Ltd, Parallel Wireless Inc., and Airspan Networks Inc.

- September 2023 - Asprin Newtork has announced on the 14th collobrated with Korea Hydro & Nuclear Power Co., Ltd. to supply and build wireless communication systems to Saeul Nuclear Power Plant No. 3 and 4. The nuclear power plant wireless communication system developed jointly by Ilshin EDI and Eruon is a disaster safety communication network (PS)- LTE, 5G and 5G Wi-Fi 6 It is characterized by combining Wi-Fi6 into one system.

- May 2023 - Parallel Wireless has announced the launch of its new generation of agile and intelligent RAN solutions. Version 7.x of the PW RAN. With the transition to containerizes applications and implementation over Kubernetes, Parallel Wireless' best in class all-G open RAN solutions are ready to revolutionize the Cellular market.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Stakeholder Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid Increase in Mobile Data Traffic in the Region

- 5.1.2 Growing Emphasis on Operational Efficiency and Reduction of Capital Expenditure through Replacement of Older Networks with Small Cell Towers

- 5.1.3 Steady Growth in Installations by Market Incumbents

- 5.2 Market Challenges

- 5.2.1 Concerns with State Regulations and Operatonal Challenges Related to Deployment in 5G Networks

- 5.3 Industry Standards & Regulations

- 5.4 Impact of COVID-19 on the Small Cell Deployments and Connectivity

- 5.5 Major Implications and Technical Considerations Related to Installation of Small Cell Towers

- 5.6 Current Ownership Models and Emergence of Small Cell Leasing/Sharing Mechanism

- 5.7 Current Breakdown of the Connectivity Technology in Africa (3G, 4G & 5G)

6 ANALYSIS OF 5G ROADMAP IN AFRICA

7 MARKET SEGMENTATION

- 7.1 By Application

- 7.1.1 Outdoor

- 7.1.2 Indoor

- 7.2 By Region

- 7.2.1 North & West Africa

- 7.2.2 South Africa

- 7.2.3 Rest of Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Parallel Wireless Inc.

- 8.1.2 Airspan Networks Inc.

- 8.1.3 T&W Electronics Co Ltd.

- 8.1.4 Samsung Electronics Co. Ltd

- 8.1.5 Telefonaktiebolaget LM Ericsson

- 8.1.6 Huawei Technologies Co. Ltd

- 8.1.7 ZTE Corporation

- 8.1.8 Baicells Technologies Co. Ltd

- 8.1.9 NEC Corporation

- 8.1.10 Nokia Corporation