|

市場調查報告書

商品編碼

1630384

汽車乙太網路 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Automotive Ethernet - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

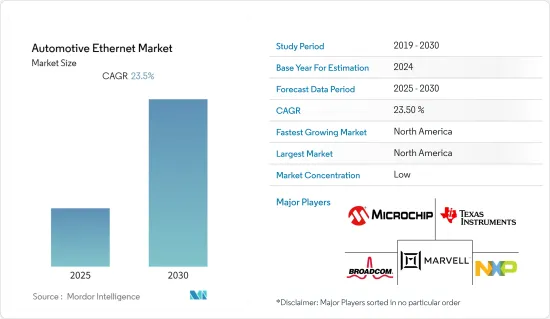

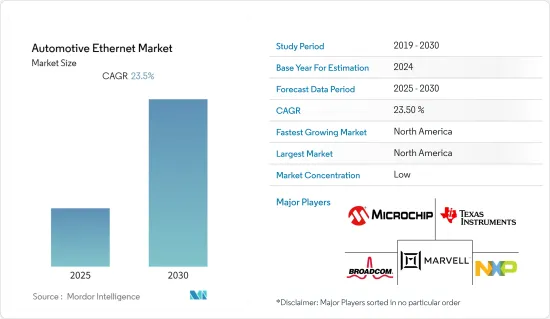

汽車乙太網路市場預計在預測期內複合年成長率為 23.5%

主要亮點

- 隨著ADAS(高級駕駛輔助系統)、資訊娛樂和自動駕駛汽車開發的快速發展,以及乙太網路成本的降低,與傳統線束相比,汽車乙太網路在有效連接車輛電子系統方面發揮著重要作用,因此我們取得了顯著的成就。

- 汽車乙太網路描述了跨汽車應用的連接,包括動力傳動系統、底盤、車身、舒適性、ADAS 和資訊娛樂系統。它透過支援高速或低速運行的高頻寬應用,解決了設計人員和工程師在整合不同系統時面臨的挑戰。

- 乙太網路往往會繞過傳統的佈線進行連接,從而允許所有車輛組件透過更輕、更有效的佈線進行連接。僅此一項就可以讓製造商降低 80% 的連接成本和 30% 的電纜重量。這也可以作為具有成本效益的聯網汽車開發的潛在應用。

- 高效能導航系統、高階娛樂和遠端資訊處理要求聯網汽車中的系統「始終開啟」。車載資料通訊頻寬的增加正在推動乙太網路部署市場。

- 由於最近的COVID-19爆發,汽車乙太網路市場短期內成長放緩,主要汽車製造廠因世界各國實施的封鎖措施而暫停生產。

汽車乙太網路市場趨勢

對 ADAS(高級駕駛輔助系統)的需求不斷成長正在推動市場成長

- 隨著越來越多的車輛配備自動駕駛功能,汽車乙太網路的成長機會預計將擴大。自動駕駛在很大程度上依賴高清地圖以及基於道路的資訊,例如車道尺寸、人行橫道和路標。高清地圖是根據感測器收集的資料建構的。需要乙太網路來連接這些元件以保持高效的資料傳輸,從而促進汽車乙太網路的成長。

- 目前,在汽車領域,由於與ADAS相關的MEMS的引入、連網汽車的出現以及資訊娛樂和物聯網設備的技術進步,汽車中電控系統的含量正在增加。汽車中擴大採用物聯網解決方案,為各種現代、高度互聯的 ADAS 和自動駕駛功能創造了成長機會。將汽車與周圍的一切連接起來,或者說車對一切(V2X),是邁向自動駕駛汽車網際網路絡的重要一步。乙太網路相容性在將車輛連接到智慧基礎設施方面的優勢使其成為重要的車輛組件。

- 根據國際汽車工業協會 (OICA) 統計,去年全球汽車產量約 8,000 萬輛。隨著車輛數量的增加以及對避免碰撞和事故的安全功能的需求的增加,公司正在提供提醒駕駛員潛在問題的技術。許多汽車製造商都高度採用ADAS,包括緊急煞車輔助、主動車距控制巡航系統、盲點偵測、後方橫向車流警示、交通標誌輔助、智慧燈、智慧速度輔助、車道/道路偏離警告等等。

- 與安全相關的政府法規也是推動汽車乙太網路成長的關鍵因素。其中許多系統都包含在當前車型中,有些系統是強制性的,因為它們有助於道路安全。例如,2019年3月,歐盟委員會宣布了新法規,要求去年生產的所有新型輕型車輛都配備智慧速度輔助系統(ISA)。歐洲 NCAP 和美國公路交通安全管理局 (NHTSA) 安全評估進一步推動了 ADAS 的採用,並在評估中納入了安全輔助系統的可用性和性能。

亞太地區實現顯著成長

- 乘用車產量的增加是推動亞太地區市場成長的關鍵因素之一。梅賽德斯-奔馳、福特和大眾等汽車製造商正在印度推出擴張計劃,以最大限度地提高製造能力和產量,並最大限度地減少當地市場的供需缺口。這些計劃預計將擴大印度對時間敏感的汽車網路組件市場。因此,汽車乙太網路市場預計在整個研究期間將經歷強勁成長。

- 隨著越來越多的目標商標產品製造商 (OEM ) 在生產的每款新車型中提供新的聯網汽車功能,印度的聯網汽車市場正在取得重大進展。消費者對舒適性、便利性、安全性和保障性的需求日益成長,推動了具有增強型 HMI 功能、增強型互聯技術和整合 ADAS(高級駕駛員輔助系統)解決方案的車輛市場不斷成長。

- 印度大多數優質OEM現在都將智慧型手機連接或嵌入式連接作為標準配置,但基本型除外。相比之下,大眾市場汽車製造商僅在中階和高階車型中配備智慧型手機和嵌入式連線功能。印度市場聯網汽車的發展是由於消費者對聯網汽車服務的認知不斷提高以及願意付款更高價格的選擇而推動的。

- 對於包括中國、印度、馬來西亞和東南亞其他新興市場在內的大多數地區而言,GDP加速成長和雄心勃勃的亞洲消費者將成為未來幾年最大的兩個成長要素。在聯網汽車和自動駕駛汽車消費方面,北美和歐洲仍然處於領先地位,原因是 Marvell Technology Group Ltd 和 Broadcom Incorporated 等主要參與者的存在、對先進技術的高度接受以及車載以太網的採用增加它已成為主流車型中的一個強大領域。

- 然而,考慮到印度的停產趨勢,SIAM估計印度汽車製造商和零件製造商在疫情期間每天損失近2.8億美元的收益。印度馬魯蒂鈴木、現代汽車、本田、馬恆達、豐田基洛斯卡汽車、塔塔汽車、起亞汽車和名爵汽車印度等主要製造商已暫時關閉其工廠。市場可能會遇到潛在的組件供應鏈中斷,導致汽車乙太網路銷售和產量減少。

汽車乙太網路產業概況

汽車乙太網路市場競爭激烈且細分。分散的市場主要受到有關設立和營運的監管要求的約束。此外,隨著技術創新、收購和聯盟的增加,未來市場的競爭可能會變得更加激烈。主要市場參與企業包括 Broadcom Inc.、NXP Semiconductors NV、Marvell Technology Group Ltd.、Microchip Technology Inc. 和 Texas Instruments Inc.。

- 2022 年 5 月 - Broadcom Inc. 的高頻寬汽車乙太網路切換器設備 BCM8958X交付。該設備的開發是為了滿足車載網路應用不斷成長的頻寬需求,並加速軟體定義車輛 (SDV) 的採用。 BCM8958X 具有 16 個乙太網路連接埠(其中最多 6 個支援 10 Gbps)、1,000BASE-T1 和 100BASE-T1 PHY 整合以及更高的交換容量,提供汽車區域電控系統(ECU) 架構所需的靈活性。包括改進的性能和對中央處理ECU 架構的支援。該交換器還具有最先進的基於規則的資料包過濾引擎,可適應不同的車輛操作模式,以提高駕駛安全性。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 市場促進因素

- 對資訊娛樂和 ADAS 的需求不斷成長

- 低成本乙太網路技術的快速採用

- 市場限制因素

- 組件之間的互通性和應用程式的可計算性

- 評估 COVID-19 對產業的影響

第5章市場區隔

- 按成分

- 硬體

- 軟體和服務

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭狀況

- 公司簡介

- Broadcom Inc.

- NXP Semiconductors NV

- Marvell Technology Group Ltd

- Molex Incorporated

- Microchip Technology Inc.

- Texas Instruments Inc.

- Cadence Design Systems Inc.

- TTTech Auto AG

- Xilinx Inc.

- TE Connectivity Ltd

- Toshiba Corporation

第7章 投資分析

第8章 市場機會及未來趨勢

The Automotive Ethernet Market is expected to register a CAGR of 23.5% during the forecast period.

Key Highlights

- The increased deployment of Advanced Driver Assistant System (ADAS), infotainment, rapid progress in the development of autonomous vehicles, and the low cost of ethernet has led to the immense growth of automotive ethernet as it serves the purpose of connecting in-vehicle electronic system efficiently as compared to traditional harness.

- Automotive ethernet offers connectivity across automotive applications, such as powertrain, chassis, body and comfort, ADAS, and infotainment systems. Supporting high bandwidth applications operating at high or low speed addresses the challenges designers and engineers face in integrating different systems.

- Ethernet tends to bypass traditional cabling for connectivity, allowing all vehicle components to connect with lighter and more effective wires. This alone has enabled manufacturers to reduce connectivity costs by 80% and cabling weight by 30%. This also serves as a potential application for the cost-effective development of a connected car.

- High-performance navigation systems, high-end entertainment, and telematics require the system to remain 'always on' in a connected car. The increasing bandwidth for in-vehicle data communications has driven the ethernet deployment market.

- With the recent outbreak of COVID-19, the automotive ethernet market is witnessing a decline in growth in the short run due to major automotive manufacturing plants having stopped their production in response to the lockdown being enforced by many countries across the world.

Automotive Ethernet Market Trends

Increased Demand for Advanced Driver Assistance System (ADAS) to boost the Market Growth

- It has been estimated that as the number of vehicles equipped with autonomous driving increases, automotive ethernet is expected to witness increased opportunities for growth. Autonomous driving heavily depends on HD maps with road-based information like lane sizes, crosswalks, and road signs. HD maps are built with data collected from sensors. Ethernet is needed to connect these components to maintain efficient data transfer and, therefore, will contribute to the growth of automotive ethernet.

- Currently, in the automotive sector, the introduction of MEMS associated with ADAS, the emergence of connected vehicles, and the technological advancements of infotainment and IoT equipment is leading to an increase in electronic control unit contents in automobiles. The growing adoption of IoT solutions in automotive provides growth opportunities to a wide range of highly connected modern ADAS and autonomous driving functions. Having vehicles connected to everything in their vicinity or Vehicle-to-Everything (V2X) is an essential step toward a connected network of autonomous vehicles. Ethernet compatibility advantages when connecting vehicles to smart infrastructure make it an essential vehicle part.

- According to the International Organization of Motor Vehicle Manufacturers (OICA), approximately 80 million vehicles were produced globally last year. With growing volumes of vehicles and the rising demand for safety features designed to avoid collisions and accidents, companies are offering technologies that alert the driver about potential problems. Many vehicle manufacturers highly adopt ADAS to provide customers with Emergency Brake Assist, Adaptive Cruise Control, Blind Spot Detection, Rear Cross-Traffic Alert, Traffic Sign Assist, Intelligent Lights, Intelligent Speed Assist, and Lane/Road Departure Alert.

- Government regulations revolving around safety and security are also major drivers for the growth of automotive ethernet. While many of these systems are embedded in current models of cars, some of them will become mandatory as they contribute towards road safety. For instance, in March 2019, the European Commission announced a new rule to make Intelligent Speed Assistance (ISA) mandatory for all newly manufactured light vehicles starting in the last year. Euro NCAP and the US NHTSA safety assessment are additional driving forces behind ADAS adoption, which include the availability and the performance of safety assistant systems in their ratings.

Asia-Pacific to Witness Significant Growth

- Increased production of passenger vehicles is one of the major factors driving the market growth in the Asian-Pacific Region. Automakers like Mercedes-Benz, Ford, and Volkswagen are rolling out expansion plans in India to maximize manufacturing capacity and output and minimize the local market's supply-demand gap. With these plans, the Indian market for time-sensitive in-vehicle networking components will increase. Thus the automotive ethernet market is poised for strong growth through the studied period.

- With more original equipment manufacturers (OEMs) providing new connected car capabilities with each new model produced, the connected car market in India is seeing significant advancements. The market for vehicles with enhanced HMI features, more connected technologies, and the integration of advanced driver assistance system (ADAS) solutions has grown in response to rising consumer demands for comfort, convenience, safety, and security.

- Except for the base variation, most premium OEMs in India now include smartphone connectivity or embedded connectivity as a standard feature. In contrast, volume OEMs only include smartphones or embedded connectivity on mid- and high-end variants. The development of connected automobiles in the Indian market has been facilitated by consumers' growing awareness of connected car services and willingness to pay for pricier options.

- Faster GDP growth and highly aspirational Asian consumers are the two major growth drivers for most regions, such as China, India, Malaysia, and the other developing markets in Southeast Asia in the coming years. In terms of consumption of connected and autonomous vehicles, North America and Europe remain the prominent regions owing to the presence of significant players such as Marvell Technology Group Ltd and Broadcom Incorporated, among others, the high acceptance rate of advanced technology and increasing adoption of Ethernet in-vehicle networks for mainstream models.

- However, closure trends in India led the SIAM to estimate that nearly USD 280 Million per day was revenue loss for Indian automakers and component manufacturers amidst the pandemic. Significant players like Maruti Suzuki India, Hyundai, Honda, Mahindra, Toyota Kirloskar Motor, Tata Motors, Kia Motors, and MG Motor India have temporarily shut down their plants. The market is very likely to suffer from potential component supply chain disruption, leading to reduced sales and production of an automotive ethernet.

Automotive Ethernet Industry Overview

The automotive ethernet market is fragmented in nature due to high competition. Despite the fragmentation, the market is primarily tied by the regulatory requirements for establishment and operation. Furthermore, with increasing innovation, acquisitions, and partnerships, market rivalry tends to rise in the future. Some major market players are Broadcom Inc., NXP Semiconductors NV, Marvell Technology Group Ltd, Microchip Technology Inc., and Texas Instruments Inc.

- May 2022 - The BCM8958X, a high bandwidth monolithic automotive Ethernet switch device from Broadcom Inc., was delivered. It was created to meet the expanding bandwidth need for in-vehicle networking applications and to promote the adoption of software-defined vehicles (SDV). With its 16 Ethernet ports, up to six of which are 10 Gbps capable, integrated 1000BASE-T1 and 100BASE-T1 PHYs, and higher switching capacity, the BCM8958X offers the increased flexibility and central compute ECU architecture support needed for automotive zonal electronic control unit (ECU) architectures. This switch also has a cutting-edge rule-based packet filter engine that can adjust to various vehicle operation modes to improve driving security.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Market Drivers

- 4.4.1 Increased Demand for Infotainment and ADAS

- 4.4.2 Rapid Adoption of Low cost Ethernet Technology

- 4.5 Market Restraints

- 4.5.1 Interoperability Among Components and Application Computability

- 4.6 Assessment of Impact of Covid-19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Component

- 5.1.1 Hardware

- 5.1.2 Software and Services

- 5.2 Geography

- 5.2.1 North America

- 5.2.2 Europe

- 5.2.3 Asia-Pacific

- 5.2.4 Latin America

- 5.2.5 Middle East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Broadcom Inc.

- 6.1.2 NXP Semiconductors NV

- 6.1.3 Marvell Technology Group Ltd

- 6.1.4 Molex Incorporated

- 6.1.5 Microchip Technology Inc.

- 6.1.6 Texas Instruments Inc.

- 6.1.7 Cadence Design Systems Inc.

- 6.1.8 TTTech Auto AG

- 6.1.9 Xilinx Inc.

- 6.1.10 TE Connectivity Ltd

- 6.1.11 Toshiba Corporation