|

市場調查報告書

商品編碼

1630385

組串式逆變器 -市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)String Inverter - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

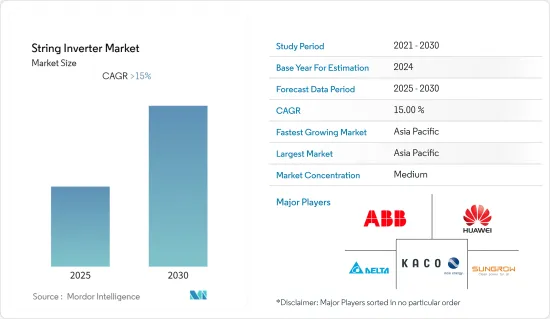

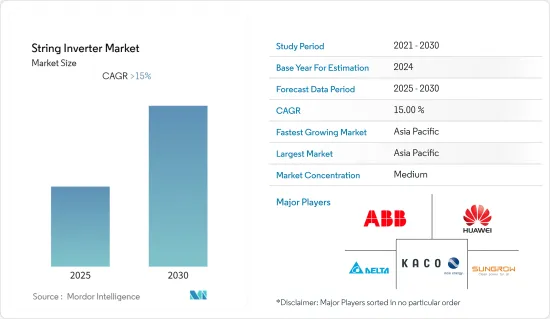

預計組串式逆變器市場在預測期內複合年成長率將超過 15%

COVID-19 對 2020 年市場產生了負面影響。市場現在可能達到大流行前的水平。

主要亮點

- 從長遠來看,太陽能發電工程部署的增加、政府的支持措施以及太陽能發電組件價格下降等因素預計將推動市場。世界各國政府正採取各種措施引入可再生能源作為替代能源。

- 另一方面,低度開發國家和新興經濟體住宅領域安裝光伏(PV)系統所需的資金籌措選擇預計將阻礙預測期內組串式逆變器市場的成長。

- 根據未來幾年的溫室氣體(GHG)排放目標,世界各國正在採取不同的目標來緩解氣候變遷。例如,美國最大的州之一加州的目標是到2030年將溫室氣體排放減少40%。此外,到 2030 年,全球電力需求預計將接近每小時 36,000兆瓦。不斷成長的電力需求和溫室氣體排放目標預計將推動太陽能發電等可再生能源裝置的增加,並可能為串聯逆變器公司在不久的將來擴大業務創造機會。

- 預計亞太地區在預測期內將顯著成長,其中大部分需求來自中國、日本和印度。

組串式逆變器市場趨勢

公共產業部門預計將顯著成長

- 公共產業規模的太陽能裝置是大型計劃,佔地許多英畝,產生的電力僅用於配電目的。組串式逆變器將太陽能板產生的直流電 (DC) 轉換為交流電 (AC)。

- 公共產業規模的太陽能發電設施透過多種技術發電,包括聚光型太陽光電(CPV)、聚光型太陽熱能發電(CSP)和光伏發電(PV)。其中,太陽能發電是應用最廣泛的組串式逆變器技術。

- 2021 年,全球太陽能發電裝置容量約為 940 吉瓦 (GW),由於各國為獲取永續和廉價能源來源而採取的各種舉措,預計在預測期內將增加。

- 公共產業領域的組串式逆變器主要是三相的,額定輸出超過80kW,具有承受極端氣候條件的獨特性能。隨著需求的增加,太陽能發電業務的投資逐年增加。中國和美國等國家是未來幾年重點開展許多公共產業計劃的主要國家之一。

- 此外,2022 年 9 月,美國少數太陽能逆變器製造商之一 Yaskawa Solectria Solar 與 First Solar 建立了合作夥伴關係。兩家公司正在努力最佳化用於 First Solar 薄膜碲化鎘太陽能模組的 Solectria XGI 1500-250 公用事業規模串式逆變器。此次夥伴關係旨在打造新型 XGI 1500-250 公用事業規模串式逆變器的一個版本,該逆變器允許接地直流輸入。

- 公共產業領域的此類舉措預計將導致組串式逆變器的大規模安裝,並有助於在預測期內佔據市場主導地位。

亞太地區正在經歷顯著成長

- 亞太地區是太陽能光電和組串式逆變器裝置容量容量最高的地區。 2021年,該地區太陽能發電裝置容量將達到近484.930吉瓦(GW),其中中國、日本和印度是領先國家。

- 中國是該地區的主要國家,2021年太陽能裝機量約為306.56GW。該國計劃在 2025 年將裝置容量增加一倍,這可能會在預測期內擴大組串式逆變器市場。

- 此外,中國的騰格里沙漠太陽能園區、龍羊峽大壩太陽能園區、印度的Kurnool超大型太陽能園區和Kamuthi太陽能電站是該地區少數採用組串式逆變器的大型計劃。

- 此外,2022年7月,科華數據宣布其SPI系列1500V/350kW組串式逆變器通過高壓穿越(HVRT)和低(零)電壓穿越(LVRT)檢驗,並立即獲得認證報告宣布確實如此。

- 此外,2022年6月,錦浪科技宣布投資29.25億元人民幣,預計用於組串式逆變器生產及分散式光電站計劃。據公告稱,新計畫總投資預計為1.6億美元,年產95萬台組串式逆變器。

- 考慮到上述幾點和近期趨勢,亞太地區預計將在預測期內主導組串式逆變器市場。

組串式逆變器產業概況

組串式逆變器市場適度細分。市場主要企業(排名不分先後)包括:KACO New Energy GmbH、Delta Energy Systems GmbH、ABB Ltd、陽光電源、華為技術、正泰電源、寧波錦浪科技、Fronius International GmbH、SMA Solar Technology AG、伊頓公司等。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第 2 章執行摘要

第3章調查方法

第4章市場概況

- 介紹

- 2027年的市場規模與需求預測:10億美元

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 階段

- 單相

- 三相

- 額定輸出

- 10kW以下

- 11~40kW

- 41~80kW

- 80kW以上

- 最終用戶

- 住宅

- 商業/工業

- 公共產業

- 地區

- 北美洲

- 亞太地區

- 歐洲

- 南美洲

- 中東/非洲

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- KACO New Energy GmbH

- Delta Energy Systems GmbH

- ABB Ltd.

- Sungrow Power Supply Co Ltd.

- Huawei Technologies Co. Ltd.

- Chint Power Systems Co. Ltd.

- Ningbo Ginlong Technologies Co Ltd

- Fronius International GmbH

- SMA Solar Technology AG

- Eaton Corporation Plc.

第7章 市場機會及未來趨勢

The String Inverter Market is expected to register a CAGR of greater than 15% during the forecast period.

COVID-19 negatively impacted the market in 2020. Presently the market is likely to reach pre-pandemic levels.

Key Highlights

- Over the long term, factors such as the increasing deployment of solar projects, supportive government initiatives, and the declining price of solar photovoltaic components are expected to drive the market. Governments worldwide have incorporated various policies to implement renewable energy as a source of alternative energy.

- On the other note, the need for financing options to install solar photovoltaic (PV) systems in the residential sector in underdeveloped and developing economies is expected to hinder the string inverter market growth during the forecasting period.

- With the targets to reduce Greenhouse Gas (GHG) emissions in the coming years, countries across the globe are adopting various targets to mitigate climate change. For instance, California, one of the prominent states in the United States, has targeted reducing greenhouse gas emissions to 40% by 2030. Moreover, it is estimated that by 2030, the global electricity demand will be nearly 36 thousand terra watts per hour. The increasing demands for electricity clubbed with the targets for GHG emissions are expected to promulgate the increase in renewable energy facilities like solar PV, which is likely to create an opportunity for the string inverter companies to expand its business in the near future.

- Asia-Pacific is expected to witness significant growth during the forecast period, with most of the demand coming from China, Japan, and India.

String Inverter Market Trends

Utility Segment Likely to Witness Significant Growth

- Utility-Scale solar photovoltaic installations are massive projects covering multiple acres of land to generate electricity solely for distribution purposes. The string inverters convert the generated Direct Current (DC) by the solar panels into Alternating Current (AC).

- The utility-scale solar facilities generate electricity through several technologies that include Concentrating Photovoltaics (CPV), Concentrating Solar Power (CSP), and Photovoltaics (PV). Among all, photovoltaic is the most widely implemented technology on which string inverters are getting used.

- In 2021, global solar PV installed capacity was nearly 940 gigawatts (GW) and was expected to increase during the forecast period on account of various initiatives taken by the countries to have a sustainable and cheaper form of energy source.

- Utility segment string inverters are primarily three-phase, have a power rating of more than 80kW, and have unique properties to withstand extreme climatic conditions. With increasing demand, investment in solar utility projects has been growing over the years. Countries like China and the United States are among the top countries concentrating on having many utility projects in the upcoming years.

- Moreover, in September 2022, Yaskawa Solectria Solar, one of the few US-based manufacturers of solar inverters, formed a partnership with First Solar. Both companies are working to optimize the Solectria XGI 1500-250 utility-scale string inverters for First Solar's thin-film cadmium telluride solar modules. The partnership aims to create a version of the new XGI 1500-250 utility-scale string inverter that allows a grounded DC input.

- Such steps in the utility sector are likely to have a large installation of string inverters and thus help dominate the market during the forecast period.

Asia-Pacific to Witness Significant Growth

- Asia-Pacific is dominating the region with the highest installed capacity of solar PV and string inverters. In 2021, the region has nearly 484.930 gigawatts (GW) of solar PV installed capacity, with China, Japan, and India as the major countries.

- China is the major country in the region with approximately 306.56 GW of solar installations in 2021. It is expected that the country is planning to double its installation capacity by 2025, which is likely to expand the string inverter market during the forecast period.

- Also, Tengger Desert Solar Park, Longyangxia Dam Solar Park of China, Kurnool Ultra Mega Solar Park, and Kamuthi Solar Power Station of India are the few key projects in the region that have installed string inverters.

- Moreover, in July 2022, Kehua Data Co., Ltd. has announced that its SPI series 1500V/350kW string inverter passed the High Voltage Ride Through (HVRT) and Low (zero) Voltage Ride Through (LVRT) tests and obtained the certification report at one time.

- Furthermore, In June 2022, Ginlong (Solis) Technologies Co. Ltd announced an investment of CNY 2.925 billion, which is expected to be used for the production of string inverters and distributed photovoltaic power station projects. According to the announcement, the total investment of the new project with an annual output of 950,000 units of string inverters is estimated to be USD 0.160 billion.

- Owing to the above points and the recent developments, the Asia-Pacific region is expected to dominate the string inverter market during the forecast period.

String Inverter Industry Overview

The String Inverter Market is moderately fragmented. Some of the key players in the market (not in particular order) include KACO New Energy GmbH, Delta Energy Systems GmbH, ABB Ltd, Sungrow Power Supply Co Ltd, Huawei Technologies Co. Ltd., Chint Power Systems Co. Ltd., Ningbo Ginlong Technologies Co Ltd, Fronius International GmbH, SMA Solar Technology AG, and Eaton Corporation Plc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Phase

- 5.1.1 Single Phase

- 5.1.2 Three Phase

- 5.2 Power Rating

- 5.2.1 Up to 10kW

- 5.2.2 11kW to 40kW

- 5.2.3 41kW to 80kW

- 5.2.4 Above 80kW

- 5.3 End-User

- 5.3.1 Residential

- 5.3.2 Commercial & Industrial

- 5.3.3 Utility

- 5.4 Geography

- 5.4.1 North America

- 5.4.2 Asia-Pacific

- 5.4.3 Europe

- 5.4.4 South America

- 5.4.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 KACO New Energy GmbH

- 6.3.2 Delta Energy Systems GmbH

- 6.3.3 ABB Ltd.

- 6.3.4 Sungrow Power Supply Co Ltd.

- 6.3.5 Huawei Technologies Co. Ltd.

- 6.3.6 Chint Power Systems Co. Ltd.

- 6.3.7 Ningbo Ginlong Technologies Co Ltd

- 6.3.8 Fronius International GmbH

- 6.3.9 SMA Solar Technology AG

- 6.3.10 Eaton Corporation Plc.