|

市場調查報告書

商品編碼

1630396

服務整合與管理:全球市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Global Service Integration and Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

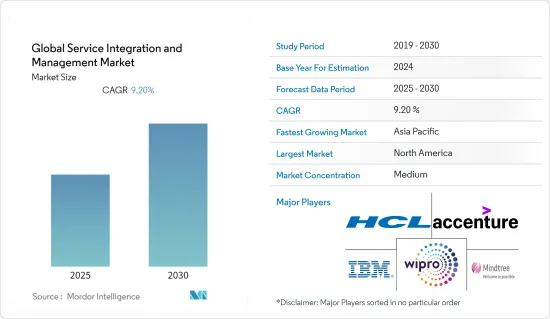

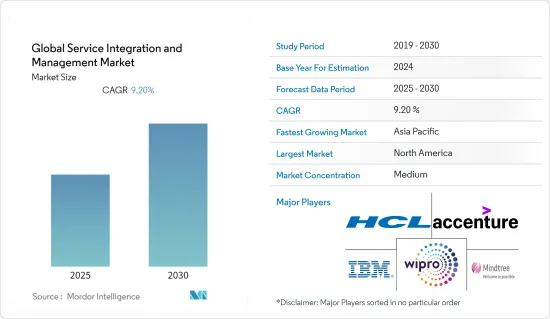

全球服務整合和管理市場在預測期內預計複合年成長率為 9.2%。

主要亮點

- 近年來,由於越來越多的供應商提供的混合技術和服務的興起,企業 IT 環境變得更加複雜。公司面臨的主要挑戰是克服以統一方式有效協調和管理多個供應商的複雜性。

- IT 支出的增加和降低成本的需求是推動市場成長的主要因素。根據 Flexera 2021 年技術支出狀況,全球近一半 (49%) 的企業預計在 2021 年增加 IT 支出。此外,降低成本是企業的首要任務,預計成本將從 2020 年的 9% 成長兩倍至 2021 年的 27%。服務整合和管理有助於降低管理多個業務和服務的成本。

- 此外,中小企業的外包趨勢也為SIAM市場創造了新的機會。根據提供客製自訂網頁開發和網頁設計的 Tech Behemoths 對中小型 IT 公司進行的一項調查(2021 年 6 月),大約 38.5% 的受訪者將計劃外包,76% 的受訪者指出了外包的好處成本效益和靈活性。此外,38.5%的受訪者建議更高的利潤率。 (n=來自 38 個國家的 324 家中小企業)。

- 然而,缺乏統一的 SLA 和監管協調預計將阻礙預測期內的市場成長。 2021 年 8 月,金融業監理局 (FINRA) 提醒企業委託第三方供應商的業務保持充分的監督。該機構也強調遵守網路安全規則 3110、規則 1220、規則 4370 和業務永續營運計畫等法規。

- 由於已開發國家和新興國家經濟暫時放緩,許多公司減少了綜合服務支出,因此 COVID-19 的傳播對市場產生了負面影響。對於大型企業來說,由於雲端基礎設施支出的增加,市場預計將穩定成長。隨著病毒影響的消退,由於管理服務和技術外包的成長,市場預計將擴大。

服務整合和管理市場趨勢

雲端技術顯著成長

- 隨著企業出於各種目的而採用雲,資料的數量、種類和來源呈爆炸式成長,推動了對即時利用資料的應用程式的需求。此外,整合來自多個供應商的本地、私有雲端和公共雲端中的資料和服務的需求不斷增加,正在推動整合平台即服務 (iPaaS) 市場的發展。

- 如今,隨著市場上基於 SaaS 的供應商的激增,企業面臨著為其公司選擇合適平台的問題。隨後,控制和管理駐留在組織防火牆內部邊界之外的資料的需求導致擴大採用雲端基礎的服務整合解決方案。

- 如果您的公司混合使用本地和雲端應用程式,則對這兩種應用程式使用單獨的整合工具會為IT基礎設施增加不必要的複雜性和延遲。混合整合消除了在雲端和私有雲之間來回移動時重寫整合的需要。

- 此外,資訊科技基礎設施庫是最廣泛採用的用於實施和記錄資訊技術服務管理 (ITSM) 的最佳實踐指導框架,它管理著向客戶提供的端到端 IT 服務的使用。由於其提供的廣泛優勢,將進一步擴大雲端服務整合和管理市場。

- 此外,Epicor Software 的年度洞察報告發現,2021 年 94% 的美國中型企業採用了雲,而 2020 年宣布雲作為戰略優先事項的比例為 25%。雲端遷移的關鍵促進因素包括加密、多重身份驗證 (MFA)、透過 24 小時監控提高安全性 (34%) 和品管(32%)。此外,COVID-19 在加速日本的雲端採用方面也發揮了重要作用,82% 的受訪者表示,COVID-19 加速了他們的雲端遷移計畫。

北美預計將佔據很大佔有率

- 北美地區預計在預測期內將顯著成長,這主要是由於多個行業參與者的存在以及該地區各個組織對雲端基礎的服務的快速採用。預計還有多種因素將推動對 IPaaS 解決方案的需求,包括對高度整合服務不斷成長的需求以及工作負載日益向雲端環境的轉移。

- 各種最終用戶公司正在擴大在該地區的業務,從而產生了外包 IT 職能的需求。 2021年8月,亞馬遜公司宣布計畫在美國開設多家大型百貨公司式零售店。開設大型門市的計畫標誌著這家網路購物公司線下零售的另一個擴張。

- 由於旨在提高生產力、員工滿意度和成本效益的 BYOD 政策的迅速採用,雲端基礎的ITSM 正在該地區不斷發展。此類政策需要遠端存取訊息,而雲端基礎的資訊技術服務管理解決方案可以促進這一點。

- 思科網際網路業務解決方案小組進行的一項研究發現,透過實施全面的 BYOD 政策,美國公司每年可為每位員工節省 3,150 美元。此外,員工每年平均在設備上花費 965 美元,在資料計劃上花費 734 美元。

- 該地區IT、通訊和BFSI行業的投資和發展的增加預計將為市場帶來機會。此外,COVID-19 加速了客戶對數位技術的需求,以確保全部區域公司業務營運的恢復,從而導致雲端基礎的產品取代了傳統產品。

服務整合與管理行業概覽

服務整合和管理市場適度分散,主要企業包括: IBM Corporation 和 SreviceNow Inc. 佔據重要佔有率,為了維持市場並留住客戶,這兩家公司正在採用多種競爭策略,包括產品創新和合作夥伴關係。

- 2021 年 9 月 - HCL Technologies (HCL)推出了專門的 HCL 思科生態系統部門,以開發加速客戶數位轉型的解決方案。 HCL 的思科生態系統部門開發利用思科技術的專業知識、解決方案和業務成果模型。目標是支援複雜的轉型舉措,例如軟體定義的網路轉型、網路即服務、數位化工作場所、多雲現代化、超自動化、安全性、增強的應用程式體驗、私人 5G 和電信現代化。

- 2021 年 7 月 - Zypro Technology Corporation (Xypro) 宣布擴大與 Hewlett Packard Enterprise (HPE) 的合作夥伴關係,透過 HPE NonStop 系統提供一整套產品。這將使 Zypro 能夠將關鍵任務資料庫管理、安全性和整合解決方案的可用性擴展到 HPE基本客群的新市場。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 評估 COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 服務管理複雜性

- 多供應商外包的需求增加

- 市場限制因素

- 缺乏統一的 SLA 和法規遵從性

第6章 市場細分

- 按成分

- 解決方案

- 商業解決方案

- 技術解決方案

- 按服務

- 解決方案

- 按組織規模

- 小型企業

- 主要企業

- 按最終用戶產業

- BFSI

- 資訊科技/通訊

- 衛生保健

- 零售

- 其他最終用戶產業

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 世界其他地區

第7章 競爭格局

- 公司簡介

- HCL Technologies

- Hewlett Packard Enterprise(HPE)

- IBM Corporation

- Infosys Limited

- Mindtree Limited

- Capgemini SE

- AtoS SE

- Accenture PLC

- Fujitsu Limited

- Wipro Limited

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 70785

The Global Service Integration and Management Market is expected to register a CAGR of 9.2% during the forecast period.

Key Highlights

- Lately, the enterprise IT environment has become more complex with the rise of hybrid technologies and services provided by an ever-increasing number of suppliers. The major challenge for the enterprises is to get their multiple suppliers to work together effectively and overcome the complexities of governing them uniformly, thus, giving rise to the adoption of service integration and management (SIAM) services and solutions.

- The increase in the IT spending and the need for cost savings are major factors that are contributing to the growth of the market. According to Flexera 2021 State of Tech Spend, almost half (49%) of the companies globally expect to increase IT spending in 2021. In addition, cost-saving is a top initiative for the companies, which is expected to triple from 9% in 2020 to 27% in 2021. Service integration and management assist in reducing the costs of managing multiple operations and services.

- Moreover, the outsourcing trend amongst small to medium enterprises is also creating new opportunities for the SIAM market. According to a survey of small and medium IT companies by Tech Behemoths (June 2021), a custom web development and web design provider, about 38.5% of the respondents outsourced their projects, and 76% of the respondents pointed out that they have both cost efficiency and flexibility benefits. In addition, 38.5% of the respondents suggested higher profit margins. (n=324 SME from 38 countries).

- However, the lack of uniform SLAs and regulatory compliances is expected to hinder the growth of the market over the forecast period. In August 2021, Financial Industry Regulatory Authority (FINRA) cautioned firms to maintain a sufficient supervisory system for activities outsourced to third-party vendors. The organization also emphasized following rules such as Rule 3110, Rule 1220, Rule 4370 for cybersecurity, business continuity plans, and others.

- The spread of COVID-19 has negatively impacted the market as many organizations would be reducing the integration services spending due to temporary slowdown in developed as well as emerging countries. In the case of large organizations, the market is expected to grow at a steady pace due to increased spending on the cloud infrastructure. As the impact of the virus subsides, the market is anticipated to grow due to the growth of managed services and technology outsourcing.

Service Integration & Management Market Trends

Cloud Technology to witness significant growth

- The increased adoption of cloud by businesses for various purposes has led to an explosion in the volume, variety, and sources of data, surging demand for applications that leverage data in real-time and an increasing need to integrate data and services that live on-premises, in private clouds, and in multiple vendors' public clouds and thus has boosted the market for Integration Platform as a Service (iPaaS).

- With the recent increase of SaaS-based providers in the market, enterprises are facing issues in choosing the right platform for their organizations. Subsequently, data that exists outside the internal boundary of the organization's firewall needs to be controlled and managed, thus increasing the adoption of cloud-based service integration solutions.

- When the enterprises have a mix of on-premise and on-cloud applications, using separate integration tools for both of them creates an unwanted complexity in the IT infrastructure as well as introduces latency. Hybrid integration eliminates the task of rewriting integration while moving back and forth from cloud to private.

- Moreover, the increased emphasis on the use of Information Technology Infrastructure Library (ITIL 4), the most widely adopted best-practices guidance framework for implementing and documenting Information Technology Service Management (ITSM) which is responsible for managing end-to-end delivery of IT services to customers will further proliferate the market for cloud service integration and management due to the wide range of benefits provided.

- Additionally, according to Epicor Software's annual insights report, 94% of mid-sized essential businesses in the United States are adopting cloud in 2021, up from 25%, which declared cloud a strategic priority in 2020. Some of the major drivers for cloud migration included improved security (34%) via encryption, multifactor authentication (MFA) and 24-hour monitoring, and quality control (32%). In addition, COVID-19 has also played a major role in pushing cloud adoption in the country, with 82% of the respondents suggesting that they accelerated their cloud migration plans because of COVID-19.

North America is Expected to Hold Major Share

- The North American region is expected to significant growth during the forecast period, primarily owing to the presence of multiple industry players, coupled with the rapid adoption of cloud-based services among various organizations in the region. Various factors, such as the increased need for advanced integration services and the increased shift of the workloads to the cloud environment, are also expected to drive the demand for IPaaS solutions.

- Various end-user companies are expanding their presence in the region, which creates a need for outsourcing IT functions. In August 2021, Amazon Inc. announced plans to open several large retail locations in the United States which would operate akin to the departmental stores. The plan to launch large stores marks a new expansion for the online shopping company in offline retail.

- The region is witnessing the growth of cloud-based ITSM, owing to the rapid adoption of BYOD policies for improved productivity, employee satisfaction, and cost-effectiveness. These policies require remote accessibility of information, which is facilitated by cloud-based Information Technology Service Management solutions.

- According to a study conducted by Cisco's Internet Business Solutions Group, the companies in the United States can save as much as USD 3,150 per employee every year if they implement a comprehensive BYOD policy. Moreover, employees are spending an average of USD 965 on their devices as well as USD 734 each year on data plans.

- The growing investments and developments in the IT and telecommunication and BFSI industry in the region are expected to create opportunities for the market. Furthermore, Covid-19 has accelerated customer demand for digital technologies to ensure resilient enterprise business operations across the region, resulting in cloud-based offerings replacing traditional products.

Service Integration & Management Industry Overview

The Service Integration and Management Market is moderately fragmented, with some major players such as IBM Corporation and SreviceNow Inc. occupying a significant share. To sustain the market and retain their clients, the companies are employing several competitive strategies, including product innovations and partnerships.

- September 2021 - HCL Technologies (HCL) has initiated a dedicated HCL Cisco Ecosystem Unit to develop solutions to help clients accelerate their digital transformations. HCL's Cisco Ecosystem Unit would develop expertise, solutions, and business outcome models using Cisco technology. Its goal is to make complicated transformation initiatives such as software-defined network transformation, network-as-a-service, digital workplace, multi-cloud modernization, hyper-automation, security, enhanced application experience, private 5G, and telco modernization a success.

- July 2021 - XYPRO Technology Corporation (XYPRO), announced the expansion of its partnership with Hewlett Packard Enterprise (HPE) to deliver its entire suite through HPE NonStop systems. The expansion would support XYPRO to extend the availability of mission critical database management, security and integration solutions into new markets within HPE's customer base.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 Assessment of impact of COVID-19 on the industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Complexities of Service Management

- 5.1.2 Increasing Demand for Multi-Vendor Outsourcing

- 5.2 Market Restraints

- 5.2.1 Lack of Uniform SLAs and Regulatory Compliances

6 MARKET SEGMENTATION

- 6.1 By Component

- 6.1.1 Solutions

- 6.1.1.1 Business Solutions

- 6.1.1.2 Technology Solutions

- 6.1.2 Services

- 6.1.1 Solutions

- 6.2 By Organization Size

- 6.2.1 Small and Medium Enterprises

- 6.2.2 Large Enterprises

- 6.3 By End user Industry

- 6.3.1 BFSI

- 6.3.2 IT and Telecom

- 6.3.3 Healthcare

- 6.3.4 Retail

- 6.3.5 Other End-user Industries

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia Pacific

- 6.4.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 HCL Technologies

- 7.1.2 Hewlett Packard Enterprise (HPE)

- 7.1.3 IBM Corporation

- 7.1.4 Infosys Limited

- 7.1.5 Mindtree Limited

- 7.1.6 Capgemini SE

- 7.1.7 AtoS SE

- 7.1.8 Accenture PLC

- 7.1.9 Fujitsu Limited

- 7.1.10 Wipro Limited

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219