|

市場調查報告書

商品編碼

1630398

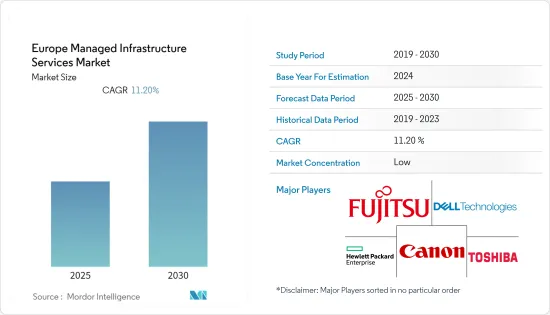

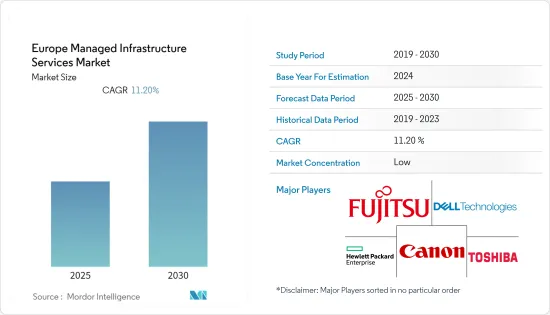

歐洲託管基礎設施服務:市場佔有率分析、行業趨勢和成長預測(2025-2030)Europe Managed Infrastructure Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

歐洲託管基礎設施服務市場預計在預測期內複合年成長率為 11.2%。

主要亮點

- 歐洲 MSP 領域的託管雲端服務是成長最快的服務之一,因為該公司專注於遠端連接、輕鬆存取、資料安全和快速資料復原解決方案的存取。歐洲市場是一些全球知名企業的所在地。 AWS 佔據市佔率第一。然而,塔塔諮詢服務等其他供應商正逐漸獲得市場佔有率。

- 人們對數位化的日益重視以及企業提供的基於網際網路的產品和服務的轉變正在為中小企業的發展創造有利的條件。

- 此外,市場正在轉向標準化遠端服務,以減少前置作業時間和成本,同時提高品質。該地區的服務提供者預計將專注於提供統一的技術堆疊,為客戶提供一致性。

- 該地區的雲端服務供應商應嚴格遵守 GDPR。此外,託管桌面服務提供者也將受到此法規的約束。

- 由於政府法規和 COVID-19 大流行導致的封鎖措施,該地區對託管雲端服務的需求增加。這迫使公司轉向遠端工作、採用雲端基礎的解決方案並擴大其需求。

歐洲託管基礎設施服務市場的趨勢

中小企業實現顯著成長

- 基礎設施管理外包服務為中小型企業提供完整的服務包,包括初始設定、主動監控和管理、安全性和其他支援。外包基礎設施管理可將支援和維護成本降低約 40%。

- 分析、雲端、物聯網和認知運算等技術趨勢正在創造新的業務需求。公司正在採用這些數位技術來創建創新的經營模式、最佳化業務流程、賦予員工權力、個人化客戶體驗等等。對於組織要想在數位化之旅中取得成功,IT 和業務的協調至關重要。

- 因此,中小型企業擴大選擇託管基礎設施服務提供商,這些提供者提供標準化且經濟高效的服務,可以最大限度地降低風險、提高基礎設施執行時間,並提高您在獲得技術的同時可以專注於核心業務。

- 此外,小型企業佔 MSP收益的很大一部分,因為它們在擴展時需要更高的 IT 和網路靈活性。與大公司相比,小型企業通常有獨特的需求,並且經常面臨資源有限和預算有限的挑戰。因此,中小企業尋求MSP的協助。

伺服器和儲存解決方案佔據主要市場佔有率

- IT 市場對託管桌面服務的興趣似乎與日俱增。隨著企業尋求解決不斷上升的列印成本問題,託管桌面也持續獲得發展動能。 Microsoft 提供 Microsoft 託管桌面 (MMD) 服務。這是一項訂閱服務,該公司向企業用戶收取在 Windows 10 PC 上設定和管理更新的費用。最初,該服務僅支援微軟的Surface PC,但現在戴爾和惠普的各種PC也包含在MMD相容硬體清單中。

- Computacenter 是一家領先的英國經銷商和服務公司,也是 Microsoft 最新產品 MMD 的第一個全球合作夥伴。 Computacenter 是最早提供 MMD 的公司之一,它允許 Microsoft 管理員工設備。

- 由於員工在家工作的可行性,COVID-19 大流行預計將增加企業(尤其是 IT 和通訊行業)對文件同步和共用的需求。

- 此外,大流行還增加了網路攻擊。 Acronis 發現加密劫持事件顯著增加,勒索軟體攻擊激增。歐洲刑警組織的歐洲網路犯罪中心也發布了一份關於 COVID-19 大流行期間網路犯罪策略變化的報告。此類案例增加了對虛擬桌面的需求,並增加了所研究市場的需求。

歐洲託管基礎設施服務產業概述

歐洲的託管基礎設施服務市場較為分散,不同的領先公司都在創新解決方案並獲得內部開發的創新硬體解決方案。此外,市場上的服務供應商正在推出新的解決方案來適應市場的成長。

- 2022 年 9 月 - 戴爾科技集團宣布推出新的通訊雲端基礎設施解決方案。與 Wind River 合作開發,旨在降低複雜性並加速通訊服務供應商(CSP) 的雲端原生網路部署,同時支援採用完全開發的雲端原生基礎設施區塊的新技術,從而加速並降低營運成本。

- 2022年5月-富士通宣布與亞馬遜網路服務(AWS)簽訂策略合作協議。我們將在AWS上開發新服務,以加速金融和零售業客戶的數位轉型(DX)。我們將創建新的解決方案,作為富士通雲端服務「富士通混合IT服務」的重要組成部分,並支援各種雲端服務的部署。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- 產業相關人員分析

- COVID-19 對市場的影響

- 主要行業法規和標準

- MSP各種分銷通路分析

- 歐洲管理服務市場前景

- MSP引入趨勢

第5章市場動態

- 市場促進因素

- 透過外包實現成本和營運效率

- 中小企業的採用率增加

- 對非核心 IT 硬體業務外包的關注日益增加

- 市場限制因素

- MSP 面臨的營運和監管問題

- 市場機會

- 人們越來越重視數位化和向基於網際網路的產品的轉變

第6章 市場細分

- 按組織規模

- 小到中尺寸

- 大規模

- 按服務類型

- 伺服器和儲存解決方案

- 列印和記錄

- 桌面

- 其他服務

- 按國家/地區

- 德國

- 英國

- 法國

- 西班牙

- 荷蘭

- 義大利

- 其他歐洲國家

第7章 競爭格局

- 公司簡介

- Fujitsu Limited

- Dell Technologies

- Canon Inc.

- Hewlett Packard Enterprise

- Toshiba Corporation

- Ricoh Company Limited

- Konica Minolta Inc.

- Lexmark International

- IBM Corporation

- Hetzner Online GmbH

- HP Development Company

第8章 歐洲主要純粹營運 MSP 列表

第9章投資分析

第10章市場機會與未來趨勢

簡介目錄

Product Code: 70824

The Europe Managed Infrastructure Services Market is expected to register a CAGR of 11.2% during the forecast period.

Key Highlights

- Managed cloud services in the European MSP space are one of the fastest-growing services due to the enterprise's emphasis on access to remote connection, easy access, data security, and swift data recovery solutions. The European market is home to some of the prominent global players. AWS holds a leading share of the market. However, other vendors, such as Tata Consultancy Services, are slowly gaining market share in the region.

- The growing emphasis on moving toward digitization and internet-based products and services offered by businesses is increasingly gaining traction, creating favorable conditions for the growth of SMEs.

- Morover, The market is moving toward standardized remote offerings that help reduce lead time and costs while improving quality. Service providers in the region are expected to focus on offering a uniform technology stack that gives consistency to the customers.

- Cloud service providers in the area are expected to stringently adhere to the GDPR. In addition to this, managed desktop service providers also come under the umbrella of this regulation

- The region's demand for managed cloud services is increasing due to government regulations and lockdown measures due to the COVID-19 pandemic. It forces businesses to move toward remote working modes, leading companies to adopt cloud-based solutions or expand their requirements.

Europe Managed Infrastructure Services Market Trends

Small and Medium Enterprises to Witness Significant Growth

- Outsourcing infrastructure management services offer a complete package, including initial setup, proactive monitoring and management, security, and other support, too small and medium enterprises. Overall, outsourcing infrastructure management can reduce around 40% of the support and maintenance costs.

- Technology trends like analytics, Cloud, IoT,and Cognitive Computing are creating new business imperatives. Companies adopt these digital technologies to build innovative business models, optimize business processes, empower their workforce, and personalize the customer experience. Aligning IT to the business is primary to the success of an organization on this digital journey.

- Thus, SMEs are shifting toward managed infrastructure service providers to get standardized and cost-efficient services, which allows them to focus on their core business while minimizing the risk, increasing infrastructure uptime, and gaining access to newer technologies.

- Further, SMEs form a significant portion of revenues for the MSPs, considering the need for IT and network flexibility as they scale. Small businesses typically have unique need compared to large enterprises, and they are often challenged with limited resources and a more modest budget. Small and medium enterprises are, therefore seeking help from the MSPs.

Server and Storage Solutions Accounts for the Significant Market Share

- There appears to be growing interest in the IT market for managed desktop services. The managed desktop also continues to gain momentum as businesses seek to tackle escalating print costs. Microsoft offers its Microsoft Managed Desktop (MMD) service, a subscription offering under which the company sets up updates and manages business users' Windows 10 PCs for a fee. The service initially only supported Microsoft Surface PCs but now includes various Dell and HP PCs in its MMD-supported hardware list.

- UK and German reseller and services giant, Computacenter, is among the first global partners for Microsoft's newest offering, MMD. Computacenter is one of the first businesses to provide MMD, which enables Microsoft to manage its employees' devices.

- The outbreak of the COVID-19 pandemic across the world is anticipated to augment the demand for enterprise file synchronization and sharing, especially among the IT and telecom sectors, due to the feasibility of employees' work from home.

- Further, the pandemic has increased cyberattacks. Acronis has seen a significant increase in crypto-jacking,while ransomware attacks are also proliferating. Also, Europol's European Cybercrime Centre issued a report about the changes in cybercriminal tactics during the COVID-19 pandemic. Such instances have increased the need for virtual desktops, thereby increasing the demand in the market studied.

Europe Managed Infrastructure Services Industry Overview

The Europe Managed Infrastructure Services Market is fragmented as various prominent players are increasingly innovating their solutions and have access to innovative hardware solutions that are developed in-house. Also, the service providers in the market are increasingly launching new solutions which cater to the market growth.

- September 2022 - Dell Technologies has announced introducing a new telecom cloud infrastructure solution; collaborating With Wind River, we can assist communications service providers (CSPs) in reducing complexity and expediting the deployment of cloud-native networks while the fully developed, cloud-native infrastructure blocks speed up the adoption of new technologies and cut down on operating costs.

- May 2022 - Fujitsu announced that it had signed a strategic collaboration agreement with Amazon Web Services (AWS). Hasten the digital transformation (DX) of its clients in the financial and retail industries; this agreement calls for the development of new services on AWS. The new arrangement, which focuses on the economic and retail sectors, will generate new solutions that are an integral element of the FUJITSU Hybrid IT Service, Fujitsu's cloud service, and will enable Fujitsu to deploy a variety of cloud services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Stakeholder Analysis

- 4.4 Impact of COVID-19 on the Market

- 4.5 Major Industry Regulations and Standards

- 4.6 Analysis of the Various Distribution Channels for MSP

- 4.7 Europe Managed Services Market Outlook

- 4.8 MSP Deployment Trends

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Cost and Operational Efficiency Realized Through Outsourcing

- 5.1.2 Growing Adoption from SMEs

- 5.1.3 Increasing Focus on Outsourcing of Non-core IT Hardware Operations

- 5.2 Market Restraints

- 5.2.1 Operational and Regulatory Concerns Faced by MSP

- 5.3 Market Opportunities

- 5.3.1 The Growing Emphasis of Moving Toward Digitization and Internet-Based Products

6 MARKET SEGMENTATION

- 6.1 Organization Size

- 6.1.1 Small- and Medium-scale

- 6.1.2 Large-scale

- 6.2 Service Type

- 6.2.1 Servers and Storage Solutions

- 6.2.2 Print and Document

- 6.2.3 Desktop

- 6.2.4 Other Services

- 6.3 Country

- 6.3.1 Germany

- 6.3.2 United Kingdom

- 6.3.3 France

- 6.3.4 Spain

- 6.3.5 Netherlands

- 6.3.6 Italy

- 6.3.7 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Fujitsu Limited

- 7.1.2 Dell Technologies

- 7.1.3 Canon Inc.

- 7.1.4 Hewlett Packard Enterprise

- 7.1.5 Toshiba Corporation

- 7.1.6 Ricoh Company Limited

- 7.1.7 Konica Minolta Inc.

- 7.1.8 Lexmark International

- 7.1.9 IBM Corporation

- 7.1.10 Hetzner Online GmbH

- 7.1.11 HP Development Company

8 LIST OF MAJOR PURE-PLAY MSPS IN EUROPE

9 INVESTMENT ANALYSIS

10 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219