|

市場調查報告書

商品編碼

1630407

北美風力發電設備:市場佔有率分析、產業趨勢、成長預測(2025-2030)North America Wind Power Equipment - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

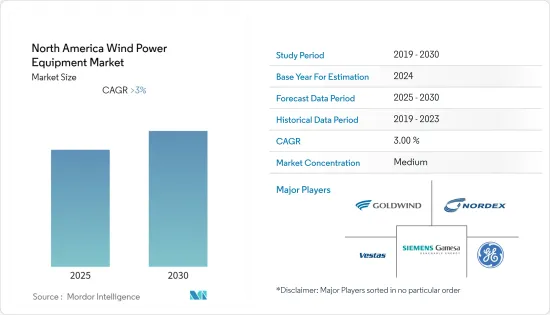

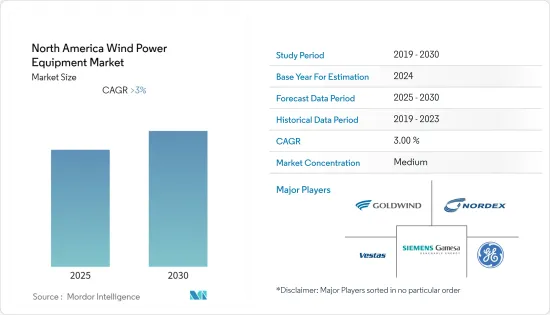

預計北美風力發電設備市場在預測期內將維持3%以上的複合年成長率。

2020年,COVID-19對市場產生了負面影響。目前,市場已達到疫情前水準。

主要亮點

- 從中期來看,風電場投資增加和風力發電成本下降等因素預計將推動北美風能設備市場的發展。

- 另一方面,擴大採用太陽能和水力發電等清潔替代能源預計將抑制市場。

- 加拿大致力於在 2030 年將溫室氣體排放減少 30%,並認知到清潔電網對支持此目標的重要性。這一目標的一部分可能透過風力發電來實現,這對市場相關人員來說可能是一個機會。

- 由於美國在風電領域的投資不斷增加且擁有該地區最高的風電裝置容量,預計將成為該地區風電設備市場的最大市場。

北美風力發電設備市場趨勢

土地領域主導市場

- 陸域風電是指安裝在陸地上、利用風力發電的風力發電廠。由於成本較低、土地稀疏以及大平原等地區的高速風,陸上風電場在北美地區佔據主導地位。

- 北美陸上風電裝置容量從2021年的154,436兆瓦增加到2022年的163,428兆瓦,成長了5.8%。由於投資增加,預計裝置容量在預測期內將進一步增加。

- 加拿大政府的目標是到2025年將風電容量增加到55GW,滿足該國20%的能源需求。然而,要實現這一目標,仍需新增超過42吉瓦的風電裝置容量。預計這將成為浮體式海上風電發電工程開發商的投資機會。

- 此外,根據國際可再生能源機構(IRENA)的數據,平準化能源成本(LCOE)和全球加權平均總裝置成本將從2016年的0.060美元/kWh和1,652美元/千瓦增加到2020年的0.039美元/千瓦。此外,由於資本成本降低、隨著該領域的不斷成熟而競爭加劇以及預測期內的技術改進,預計平準化電成本和加權平均成本將進一步下降。

- 根據GWEC統計,2021年美國陸上風電產業年度新增裝置容量位居全球第二,運作約1,274千萬瓦。美國陸上風電裝置受到計劃逐步取消生產稅額扣抵的推動,這也對風電設備市場產生了直接影響,因為計劃開發商必須按時完成任務。

- 因此,由於陸域風電設備市場的投資增加和新技術的進步,預計在預測期內將顯著成長。

美國主導市場

- 美國是總設備容量第二大國家,2022年裝置容量為141GW,佔北美總設備容量的86%以上。在美國,2021年風力發電淨發電量為3,797.7億度,約佔當年提供電力的9%。此外,有 10 個州 20% 以上的電力來自風能:堪薩斯州、愛荷華州、奧克拉荷馬州州、北達科他州、南達科他州、科羅拉多、科羅拉多州、明尼蘇達州、新墨西哥州和緬因州。

- Orsted A/S 在公共服務企業集團 (PSEG) 的支持下,將建造新澤西州第一個公用事業規模的離岸風力發電。該1,100MW計劃計劃於2020年代開始建設,並於2024年投入運作。 Orsted A/S 將在新澤西州海岸附近的 1,100 兆瓦海洋風電站部署 12 兆瓦 Haliade-X風力發電機。預計新計畫將在預測期內增加對風電設備的需求。

- 2022年4月,離岸風力發電開發商Trident Winds向BOEM提交了一份2,000兆瓦申請的租賃申請,以在華盛頓州海岸開發一個名為Olympic Wind的浮體式海上風電發電工程。

- 2022 年 4 月,海洋能源管理局宣布了大西洋中部資訊請求和擬議提名區域。截至 2022浮體式5 月,提案區域佔地 3,897,388 英畝,將能夠開發約 30,000美國的發電能力,離岸風力發電可能支持固定底部和浮體式風力發電機的部署。領域。

- 在離岸風力發電領域,美國各州都制定了近4.5萬兆瓦的離岸風力發電採購目標。此外,還將開發12個離岸風力發電計劃,預計到2026年將運作離岸風力發電約1030萬千瓦的投產。

- 因此,由於美國在該領域的大量投資和技術進步,預計將主導北美風電設備市場。

北美風力發電設備產業概況

北美風電設備市場適度細分。市場的主要企業(排名不分先後)包括 Nordex SE、通用電氣公司、西門子歌美颯再生能源公司、維斯塔斯風力系統公司和新疆金風科技。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:十億美元)

- 2028年風力發電裝置容量及預測(單位:GW)

- 北美可再生能源結構(2022)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 位置

- 陸上

- 離岸

- 設備類型

- 轉子/葉片

- 塔

- 變速箱

- 發電機

- 其他設備類型

- 地區

- 美國

- 加拿大

- 其他北美地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Nordex SE

- Xinjiang Goldwind Science & Technology Co., Ltd.

- General Electric Company

- Siemens Gamesa Renewable Energy SA

- Vestas Wind Systems AS

- Emergya Wind Technologies BV

- Acciona, SA

- Envision Energy

- Enercon GmbH

第7章 市場機會及未來趨勢

簡介目錄

Product Code: 71148

The North America Wind Power Equipment Market is expected to register a CAGR of greater than 3% during the forecast period.

In 2020, COVID-19 had a detrimental effect on the market. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors such as rising investments in wind farms and reducing the cost of wind energy are likely to drive the North American wind power equipment market.

- On the other hand, increasing adoption of alternate clean power sources such as solar and hydropower is expected to restrain the market.

- Nevertheless, Canada has committed to reducing greenhouse gas emissions by 30 percent by 2030 and recognizes the importance of a clean electricity grid in supporting that objective. A part of the target is expected to be completed using wind energy, which may act as an opportunity for market players.

- The United States is expected to be the largest market for the region's wind power equipment market due to increasing investment in the sector and the highest installed capacity of wind energy in the region.

North America Wind Power Equipment Market Trends

Onshore Segment to Dominate the Market

- Onshore wind power refers to wind farms that are located on land and use the wind to generate electricity. The North American region is overwhelmingly composed of onshore wind farms due to their cheaper cost, sparse land, and high-speed winds that can be found in areas such as the Great Plains.

- Onshore installed wind capacity in North America increased by 5.8%, from 154,436 megawatts in 2021 to 163,428 megawatts in 2022. The installed capacity is expected to further increase in the forecast period due to increasing investments.

- The Canadian government aims to increase wind power capacity to 55 GW by 2025 to meet 20% of the country's energy needs. However, the country still needs to add more than 42 GW of new capacity to meet the targets. This, in turn, is expected to provide investment opportunities for floating offshore wind project developers.

- Further, according to the International Renewable Energy Agency (IRENA), the levelized cost of energy (LCOE) and global weighted average total installed cost decreased from 0.060 USD/kWh and 1652 USD/kW in 2016 to 0.039 USD/kWh and 1355 USD/kW in 2020. In addition, the LCOE and the weighted average cost are expected to decline further owing to reductions in capital costs, increased competition as the sector continues to mature, and improvements in technology during the forecast period.

- According to the GWEC, the United States' onshore wind sector reported the second-highest annual new installations in the world in 2021, with around 12.74 GW commissioned. The onshore wind installation in the United States was driven primarily by the planned Production Tax Credit phase-out as project developers had to meet their deadline, which also directly aided the wind power equipment market.

- Hence, the onshore wind power equipment market is expected to grow significantly in the forecast period due to increasing investments and new technological advances in the field.

United States to Dominate the Market

- The United States was the second-largest country in terms of total installed wind energy capacity, recording 141 GW of capacity in 2022, or more than 86% of the total wind energy capacity in North America. In the United States, the net electricity generation from wind power reached 379.77 billion kilowatt-hours in 2021, which is about 9% of the electricity delivered in the year. Moreover, wind provided more than 20% of the electricity produced in ten states, namely Kansas, Iowa, Oklahoma, North Dakota, South Dakota, Nebraska, Colorado, Minnesota, New Mexico, and Maine.

- Orsted A/S, with the support of Public Service Enterprise Group (PSEG), is expected to construct New Jersey's first utility-scale offshore wind farm. The 1,100 MW project was expected to start construction in the 2020s, with the wind farm becoming operational in 2024. Orsted A/S will deploy Haliade-X 12MW wind turbines on the 1,100MW Ocean Wind off the coast of New Jersey. New projects are expected to increase the demand for wind power equipment in the forecast period.

- In April 2022, offshore wind energy developer Trident Winds submitted a 2,000-MW unsolicited lease application to BOEM to develop a floating offshore wind project called Olympic Wind off Washington State.

- In April 2022, the Bureau of Ocean Energy Management announced its Central Atlantic draft Call for Information and Nominations Area. The proposed areas amounting to 3,897,388 acres were likely to enable the development of approximately 30,000 MW of generating capacity and support the deployment of both fixed-bottom and floating wind turbines, and as of May 2022, there were 11 call areas for offshore wind energy in the United States, with five areas allotted for floating structures.

- In the offshore wind sector, various states in the United States have established nearly 45,000 MW of offshore wind procurement targets. Additionally, around 10.3 GW of offshore wind energy is expected to come online by 2026 with the development of 12 offshore wind energy projects.

- Hence, the United States is expected to dominate the North American wind power equipment market due to significant investments and technological advancements in the sector.

North America Wind Power Equipment Industry Overview

The North American wind power equipment market is moderately fragmented. Some of the key players in this market (in no particular order) include Nordex SE, General Electric Company, Siemens Gamesa Renewable Energy S.A., Vestas Wind Systems AS, and Xinjiang Goldwind Science & Technology Co., Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Wind Energy Installed Capacity and Forecast in GW, till 2028

- 4.4 North America Renewable Energy Mix, 2022

- 4.5 Recent Trends and Developments

- 4.6 Government Policies and Regulations

- 4.7 Market Dynamics

- 4.7.1 Drivers

- 4.7.2 Restraints

- 4.8 Supply Chain Analysis

- 4.9 Porter's Five Forces Analysis

- 4.9.1 Bargaining Power of Suppliers

- 4.9.2 Bargaining Power of Consumers

- 4.9.3 Threat of New Entrants

- 4.9.4 Threat of Substitute Products and Services

- 4.9.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Equipment Type

- 5.2.1 Rotor/Blade

- 5.2.2 Tower

- 5.2.3 Gearbox

- 5.2.4 Generator

- 5.2.5 Other Equipment Types

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Nordex SE

- 6.3.2 Xinjiang Goldwind Science & Technology Co., Ltd.

- 6.3.3 General Electric Company

- 6.3.4 Siemens Gamesa Renewable Energy S.A.

- 6.3.5 Vestas Wind Systems AS

- 6.3.6 Emergya Wind Technologies BV

- 6.3.7 Acciona, S.A.

- 6.3.8 Envision Energy

- 6.3.9 Enercon GmbH

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219