|

市場調查報告書

商品編碼

1630416

歐洲石油和天然氣用電動潛油泵:市場佔有率分析、產業趨勢和成長預測(2025-2030)Europe Oil and Gas Electric Submersible Pump - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

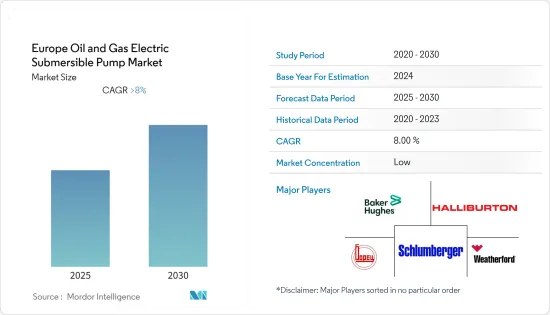

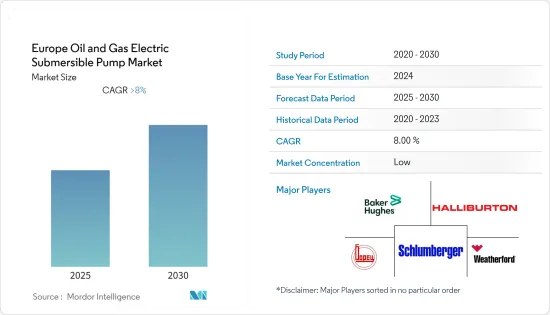

歐洲石油和天然氣電動潛油泵市場預計在預測期內複合年成長率將超過 8%。

市場受到 COVID-19 爆發和油價暴跌導致的區域封鎖的負面影響,導致正在進行和即將進行的計劃延遲。目前市場處於大流行前的水平。

主要亮點

- 最近俄羅斯和挪威上游活動的激增可能會推動市場。此外,在挪威,Johan Sverdrup 的開始營運預計將推動對 ESP 的需求。

- 另一方面,挪威、丹麥和義大利的產量下降預計將抑制預測期內調查市場的成長。

- 隨著陸上蘊藏量下降以及海上深水井和水平井的開發,預計海上市場在預測期內將顯著成長。

- 俄羅斯在石油和天然氣電動潛水泵市場上處於領先地位。預計俄羅斯將在預測期內保持其主導地位。

歐洲油氣電潛泵市場趨勢

海上業務預計將顯著成長

- 隨著北海中部高壓高溫 Culzean天然氣田運作,英國最大的Start-Ups之一預計將於 2023 年實現石油和天然氣電動潛水泵系統的成長。

- 英格蘭北部的鮑蘭頁岩、蘇格蘭的米德蘭谷和英格蘭南部的韋爾德盆地預計將產生未來的鑽探和完井機會,並將推動石油和天然氣電動潛水泵市場。

- 此外,挪威議會已開放北海、挪威海和巴倫支海南部(包括東南部)的大部分地區進行石油活動。因此,預計探勘和生產活動的增加將在預測期內及之後推動 ESP 市場的發展。

- 在歐洲,隨著油田成熟,原油產量下降至 1.602 億噸,預計對 ESP 的需求將會增加,以彌補生產損失。

- 儘管北海地區大部分蘊藏量正在下降,但俄羅斯正在進行大規模探勘活動,海上領域的油氣電潛泵市場預計將大幅成長。

俄羅斯主導市場

- 2021年,俄羅斯將佔全球鑽探活動的20%佔有率,其次是美國。由此,從長遠來看,俄羅斯預計將為石油和天然氣電動潛油泵市場創造重大機會。

- 2021年俄羅斯冷凝油油產量達5.364億噸。這是崩壞後俄羅斯原油和天然氣產量持續成長的最高產量記錄。

- Gazprom Neft 繼續探勘 Bazhenov 油田,目標是 2023 年頁岩產量達到 4 萬桶/日。除此之外,預計在預測期內對 ESP 的需求將會龐大。

- 俄羅斯遠東、東西伯利亞和北極圈地區新區塊的採用預計將取代傳統區塊的產量,並進一步創造對ESP的需求。

- 在鑽機數量大幅增加和產量增加的推動下,俄羅斯對石油和天然氣電動潛油泵系統的需求預計將隨著鑽井量而持續增加。

歐洲石油天然氣潛油電泵產業概況

歐洲油氣電潛泵市場適度整合。主要企業(排名不分先後)包括 Borets International Limited、Halliburton Company、Weatherford International plc、Baker Hughes Company 和 Schlumberger Limited。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 調查範圍

- 市場定義

- 研究場所

第2章調查方法

第3章執行摘要

第4章市場概況

- 介紹

- 至2028年市場規模及需求預測(單位:十億美元)

- 最新趨勢和發展

- 政府法規和措施

- 市場動態

- 促進因素

- 抑制因素

- 供應鏈分析

- 波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間敵對關係的強度

第5章市場區隔

- 部署地點

- 離岸

- 陸上

- 地區

- 挪威

- 英國

- 俄羅斯

- 歐洲其他地區

第6章 競爭狀況

- 併購、合資、聯盟、協議

- 主要企業策略

- 公司簡介

- Halliburton Company

- Weatherford International plc

- National Oilwell Varco Inc.

- Baker Hughes Company

- Borets International Limited

- Alkhorayef Petroleum Company

- DOS Canada Inc.

- Schlumberger Limited

第7章 市場機會及未來趨勢

The Europe Oil and Gas Electric Submersible Pump Market is expected to register a CAGR of greater than 8% during the forecast period.

The market was negatively impacted by the outbreak of COVID-19 due to the crude oil price crash and regional lockdowns, leading to delays in ongoing and upcoming projects. Currently, the market has reached pre-pandemic levels.

Key Highlights

- A recent surge in upstream activities in Russia and Norway is likely to drive the market. Additionally, the start of the Johan Sverdrup is expected to drive demand for ESP in Norway.

- On the other hand, declining production in Norway, Denmark, and Italy is expected to restrain the growth of the market studied in the forecast period.

- With declining onshore reserves and the development of offshore deepwater and horizontal wells, the offshore market is expected to witness significant growth in the forecast period.

- Russia is leading the market for the oil and gas electric submersible pump. It is expected to continue its dominance in the forecast period as well.

Europe Oil And Gas Electric Submersible Pump Market Trends

Offshore Segment is Expected to Witness Significant Growth

- Oil and gas-electric submersible pump systems are expected to witness growth in the United Kingdom in 2023 as the high-pressure, high-temperature Culzean gas field in the central North Sea, one of the biggest start-ups, comes online.

- The Bowland Shale in Northern England, the Midland Valley of Scotland, and the Weald Basin in Southern England are expected to create drilling and completion opportunities in the future, driving the market for the oil and gas-electric submersible pump.

- Moreover, the Norwegian parliament opened most of the North Sea, the Norwegian Sea, and the Barents Sea South (including the Southeast) for petroleum activities. Therefore, an increase in exploration and production activities is expected to drive the ESP market during and beyond the forecast period.

- The declining crude oil production to 160.2 million metric tons in Europe due to maturing oilfields is expected to drive the need for ESPs to compensate for the production loss.

- Although most of the reserves in the North Sea area are in decline, with large-scale exploration activities in Russia, the market for oil and gas-electric submersible pumps in the offshore segment is expected to grow significantly.

Russia to Dominate the Market

- In 2021, Russia held a 20% share of global drilling activities, followed by the United States. With this, Russia is expected to create significant opportunities for the oil and gas-electric submersible pump market in the long run.

- Russian oil and gas condensate production totaled 536.4 million tons in 2021. This marked the highest production level for Russia's post-Soviet era, which saw a consistent rise in crude oil and natural gas production.

- Gazprom Neft continues to conduct studies on its Bazhenov acreage and is targeting 40,000 b/d of production from shale by 2023. With this, significant demand for the ESPs can be expected in the forecast period.

- The steady increase in oil and gas production has been the main driver of Russia's electric submersible pump (ESP) market in recent years.The introduction of new fields in the Russian Far East, Eastern Siberia, and the Arctic region replaced the production from the traditional fields, which is further expected to create demand for ESPs.

- Demand for the oil and gas-electric submersible pump system in Russia is expected to continue to increase in line with the drilling volume, driven by the considerable increase in the number of rigs and increasing production.

Europe Oil And Gas Electric Submersible Pump Industry Overview

The European oil and gas electric submersible pump market is moderately consolidated. Some of the major companies (in no particular order) include Borets International Limited, Halliburton Company, Weatherford International plc, Baker Hughes Company, and Schlumberger Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definiton

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Offshore

- 5.1.2 Onshore

- 5.2 Geogrpahy

- 5.2.1 Norway

- 5.2.2 The United Kingdom

- 5.2.3 Russia

- 5.2.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Halliburton Company

- 6.3.2 Weatherford International plc

- 6.3.3 National Oilwell Varco Inc.

- 6.3.4 Baker Hughes Company

- 6.3.5 Borets International Limited

- 6.3.6 Alkhorayef Petroleum Company

- 6.3.7 DOS Canada Inc.

- 6.3.8 Schlumberger Limited