|

市場調查報告書

商品編碼

1631577

超音波流量計 -市場佔有率分析、產業趨勢/統計、成長預測 (2025-2030)Ultrasonic Flow Meters - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

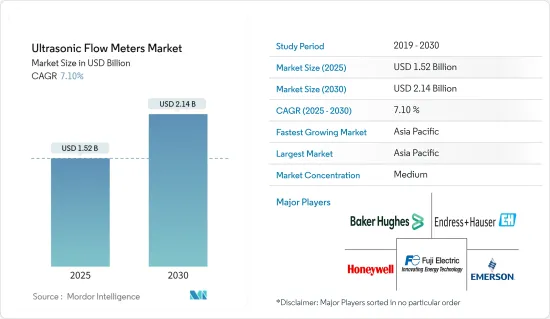

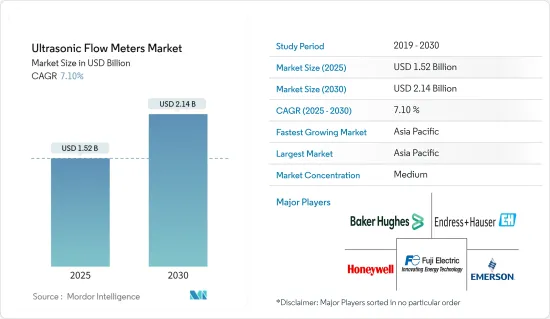

超音波流量計市場規模預計到 2025 年為 15.2 億美元,預計到 2030 年將達到 21.4 億美元,預測期內(2025-2030 年)複合年成長率為 7.1%。

就出貨量而言,預計將從2025年的448,000台成長到2030年的631,280台,預測期間(2025-2030年)複合年成長率為7.10%。

超音波流量計是一種利用超音波技術測量流經管道的流體速度的裝置。它的工作原理是發射聲波並分析聲波穿過流體所需的時間。該技術無需移動部件即可實現精確的流量測量,因此高度可靠且免維護。

主要亮點

- 超音波流量計以其高精度而聞名,測量不確定度通常小於 +-1%。這種精度水準對於水處理、石油和天然氣以及製藥等行業至關重要,在這些行業中,準確的流量測量對於製程控制和法規遵循至關重要。這些流量計的可靠性進一步增強,因為它們能夠在各種條件下(包括溫度和壓力變化)持續運作。

- 超音波流量計可用於多種應用,包括純水、污水、化學品,甚至氣體。其多功能性使其適用於食品和飲料、暖通空調和製造等多種行業。這種適應性使公司能夠標準化不同業務的測量流程並簡化培訓和維護。

- 超音波流量計利用聲波來測量液體和氣體的流量。超音波流量計的工作原理是透過介質傳輸超音波訊號並測量訊號在換能器之間傳播所需的時間。根據上游和下游訊號之間的傳輸時間差計算流速,並將其轉換為流量。

- 在石油和天然氣、化學加工和製藥等行業,安全至關重要。非侵入式流量測量降低了與需要侵入式探頭和配件的傳統測量方法相關的洩漏和溢出風險。由於這些技術不需要與危險物質進行物理接觸,因此可以提高職場的安全性,減少發生事故的可能性,並滿足監管風險管理要求。

- 中東地區的地緣政治擔憂依然存在,各國主要投資於國防和軍事支出,阻礙了該地區的市場成長。此外,通膨上升和經濟放緩限制了該地區消費者的購買力,預計這將對市場成長產生負面影響。例如,在中東和北非地區(MENA),伊朗的通貨膨脹率最高,2023年比2022年上漲41.5%。其次是埃及、阿爾及利亞、突尼斯和摩洛哥,這些國家 2023 年通膨增幅最大。

超音波流量計市場趨勢

夾接式預計將大幅成長

- 外夾式超音波流量計是一種非侵入式設備,用於測量管道中液體和氣體的流量,而無需切入管道系統。超音波技術透過管壁發送和接收超音波訊號來測量流體流速。

- 這些流量計通常由兩個夾在管道外部的超音波換能器組成。換能器發射超音波脈衝,穿過管壁進入流體。此儀表可以根據傳輸時間原理,透過測量超音波訊號向上和向下傳播所需的時間來計算流速。此方法對於許多類型的流體都有效,包括透明流體和含有一定程度顆粒物質的流體。

- 外夾式超音波流量計廣泛應用於水處理廠和污水設施中,用於監測流量和管理配水系統。其非侵入性特性使其可以輕鬆安裝到現有管道中而不會中斷服務,使其適合尋求最佳化用水並提高處理過程效率的公共產業公司。

- 將智慧技術和物聯網 (IoT) 整合到工業流程中,為外夾式超音波流量計創造了新的機會。這些設備可配備無線通訊功能,實現即時監控和資料分析,以提高業務效率和決策水準。

- 例如,根據全球行動通訊系統(GSMA)的預測,從2020年到2030年,全球物聯網(IoT)連線數量將幾乎呈線性成長,預計2030年企業物聯網連線數量將達到約240億個。因此,企業物聯網的增加預計將進一步推動外夾式超音波流量計在各種工業應用中的物聯網滲透。

亞太地區預計將錄得強勁成長

- 超音波流量計是夾式或線上設備,不需要穿透石油和天然氣管道,從而降低了氣體或石油洩漏和污染的風險,特別是對於危險或腐蝕性流體。亞太地區石油和天然氣、金屬和採礦產量的成長有可能進一步提振市場需求。

- 隨著石油和天然氣需求的增加,該領域產能擴張的投資大幅成長。例如,2024年2月,印度政府宣布未來5至6年對印度天然氣產業進行670億美元的戰略投資計畫。該國石油和天然氣行業投資的增加預計將對市場成長產生積極影響。

- 由於電動車 (EV) 產量和銷量的增加以及政府對大力促進電動車銷售的支持,超音波流量計在該地區越來越受歡迎。印度汽車銷售的成長促使政府實施更嚴格的排放法規,以防止對環境造成重大影響。

- 此外,到 2025 年,印度電動車 (EV) 市場預計將達到 70.9 億美元(5,000 億印度盧比)。根據CEEW能源金融中心的報告,到2030年,印度電動車潛在商機達2,060億美元,這將需要在汽車製造和充電基礎設施方面進行1,800億美元的巨額投資。

- 此外,根據中國汽車工業協會的數據,中國新能源汽車銷量為59.7萬輛,其中乘用電動車55.9萬輛,商用電動車3.8萬輛。在電動車中,超音波流量計對於增強溫度控管至關重要,從而提高效率、安全性和耐用性,因此在電動車領域越來越受歡迎。

超音波流量計產業概況

超音波流量計市場已成為半固體,多家供應商提供各種動作溫度範圍、介質壓力、流量計尺寸和結構材料的超音波流量計。主要參與企業包括貝克休斯公司、Endress+Hauser Group Services AG、富士電機、霍尼韋爾國際公司、艾默生電氣公司和其他新興參與企業。

流量計市場擁有西門子公司、艾默生電氣公司和霍尼韋爾國際公司等主要製造商,導致競爭公司之間的敵對關係升級。此類供應商已深入滲透流量計市場。

退出障礙較高,因為開發流量計所需的資金較高,導致產品的整體成本較高。因此,退出障礙對競爭企業之間的對抗關係有正面的影響。

此外,大規模投資的介入提高了現有參與企業的退出障礙。超音波流量計市場較為分散,主要企業基於創新和品牌形象來塑造市場。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 關鍵測量技術分析

- COVID-19 後遺症和其他宏觀經濟因素對市場的影響

- 物聯網相容超音波流量計的發展趨勢及趨勢分析

第5章市場動態

- 市場促進因素

- 對液體和氣體非侵入式流量測量的需求不斷成長

- 超音波技術在石油天然氣和石化領域的優勢

- 市場限制因素

- 高成本且測量能力有限

第6章 市場細分

- 依安裝方式分

- 夾住

- 排隊

- 按最終用戶產業

- 石油和天然氣

- 用水和污水

- 化工/石化

- 工業(食品飲料、航太、汽車)

- 其他最終用戶產業(生命科學、採礦/金屬等)

- 按地區

- 北美洲

- 歐洲

- 亞洲

- 澳洲/紐西蘭

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- Baker Hughes Company

- Endress+Hauser Group Services AG

- Fuji Electric Co. Ltd

- Honeywell International Inc.

- Emerson Electric Co.

- Badger Meter Inc.

- Omega Engineering Inc.

- KROHNE Group

- INTEGRA Metering

- Bronkhorst High-Tech BV

- Siemens AG

- FTI Flow Technology Inc.(Roper Technologies Inc.)

- KOBOLD Instruments Pvt. Ltd

- GAO Tek & GAO Group Inc.

- Belimo Aircontrols Inc.

- Gentos Measurement & Control Co. Ltd

- Itron Inc.

- Neptune Technology Group Inc.

- Sensus USA

- Kamstrup A/S

- Mueller Systems LLC.

- Diehl Metering GmbH

- Axioma Metering

- Arad Group

- Landis+Gyr AG

- SICK AG

- Aichi Tokei Denki Co. Ltd

- Apator SA

- Azbil Kimmon Co. Ltd

- WEIHAI PLOUMETER CO. LTD

第8章投資分析

第9章 市場機會及未來趨勢

The Ultrasonic Flow Meters Market size is estimated at USD 1.52 billion in 2025, and is expected to reach USD 2.14 billion by 2030, at a CAGR of 7.1% during the forecast period (2025-2030). In terms of shipment volume, the market is expected to grow from 448.00 thousand units in 2025 to 631.28 thousand units by 2030, at a CAGR of 7.10% during the forecast period (2025-2030).

Ultrasonic flow meters are devices that measure the velocity of a fluid flowing through a pipe using ultrasonic technology. They operate by emitting sound waves and analyzing the time it takes for these waves to travel through the fluid. This technology allows for accurate flow measurement without the need for moving parts, making them reliable and maintenance-free.

Key Highlights

- Ultrasonic flow meters are known for their high accuracy, often achieving measurement uncertainties of less than +-1% of the reading. This level of precision is crucial in industries such as water treatment, oil and gas, and pharmaceuticals, where accurate flow measurement is essential for process control and regulatory compliance. The reliability of these meters is further enhanced by their ability to operate consistently across a wide range of conditions, including varying temperatures and pressures.

- Ultrasonic flow meters can be utilized for various applications, including clean water, wastewater, chemicals, and even gases. Their versatility makes them suitable for a wide array of industries, such as food and beverage, HVAC, and manufacturing. This adaptability allows companies to standardize their measurement processes across different operations, simplifying training and maintenance.

- Ultrasonic flow meters utilize sound waves to measure the flow rate of liquids and gases. They operate on the principle of transmitting ultrasonic signals through the medium and measuring the time it takes for the signals to travel between transducers. The difference in transit time between upstream and downstream signals is used to calculate the flow velocity, which can then be converted into flow rate.

- Safety is paramount in industries such as oil and gas, chemical processing, and pharmaceuticals. Non-invasive flow measurement reduces the risk of leaks and spills associated with traditional measurement methods that require invasive probes or fittings. By eliminating the need for physical contact with hazardous materials, these technologies enhance workplace safety and reduce the likelihood of accidents, aligning with regulatory risk management requirements.

- The ongoing geopolitical concerns in the Middle East hinder the region's market growth as countries mainly invest in defense and military expenditure. Further, increased inflation and economic slowdown restrict the consumer purchasing power in the region, which is expected to impact market growth negatively. For instance, In MENA, Iran led with the highest inflation rate, which increased by 41.5% in 2023 compared to 2022. Following it, Egypt, Algeria, Tunisia, and Morrocco witnessed a significant increase in the inflation rate in 2023.

Ultrasonic Flow Meters Market Trends

The Clamp-on Mounting Method is Expected to Grow Significantly

- Clamp-on ultrasonic flow meters are noninvasive devices used to measure the flow of liquids or gases in pipes without cutting into the piping system. They utilize ultrasonic technology to determine the fluid's velocity by sending and receiving ultrasonic signals through the pipe wall.

- These flow meters typically consist of two ultrasonic transducers clamped onto the pipe's outside. The transducers emit ultrasonic pulses that travel through the pipe wall and into the fluid. The meter can calculate the flow velocity based on the transit time principle by measuring the time it takes for the ultrasonic signals to travel upstream and downstream. This method is effective for various types of fluids, including those that are clear or contain some level of particulates.

- Clamp-on ultrasonic flow meters are extensively used in water treatment plants and wastewater facilities to monitor flow rates and manage distribution systems. Their noninvasive nature allows for easy installation on existing pipelines without interrupting service, making them suitable for utilities seeking to optimize water usage and enhance the efficiency of treatment processes.

- Integrating smart technologies and IoT (Internet of Things) into industrial processes creates new opportunities for clamp-on ultrasonic flow meters. These devices can be equipped with wireless communication capabilities, allowing for real-time monitoring and data analysis, which enhances operational efficiency and decision-making.

- For instance, according to GSMA (Global System for Mobile Communications), the global number of Internet of Things (IoT) connections is expected to grow almost linearly through the period from 2020 to 2030, with an expected number of about 24 billion enterprise IoT connections in 2030. Hence, an increase in enterprise IoT will further drive the IoT penetration in Clamp-on ultrasonic flow meters across different industrial applications.

Asia-Pacific is Expected to Register Major Growth

- Ultrasonic flow meters are clamp-on or in-line devices that do not require any penetration into the oil and gas pipeline, which reduces the risk of gas or oil leakage and contamination, especially for hazardous or corrosive fluids. The increasing output of oil and gas, metals, and mining in Asia-Pacific has the potential to boost market demand even more.

- As the demand for oil and gas increases, the sector is witnessing notable growth in investments to enhance its capacity. For instance, in February 2024, the Indian Government announced a strategic investment plan of USD 67 billion for the Indian gas sector over the next 5-6 years. Such rising investment in the country's oil and gas sector will positively impact market growth.

- Ultrasonic flow meters are gaining traction in the region, driven by the rising production and sales of electric vehicles (EVs) and the government's strong push for EV sales. The government is prompted to enforce stringent emissions regulations due to the increasing automotive sales in the nation to prevent significant environmental repercussions.

- Moreover, the Indian electric vehicle (EV) market is projected to achieve a value of USD 7.09 billion (INR 50,000 crore) by 2025. According to a report from the CEEW Centre for Energy Finance, there is a potential USD 206 billion opportunity for electric vehicles in India by 2030, which will require a significant investment of USD 180 billion in vehicle manufacturing and charging infrastructure.

- Further, according to CAAM, China's new energy vehicle sales amounted to 597,000 units, of which 559,000 were passenger electric vehicles and 38,000 were commercial electric vehicles. In electric vehicles, ultrasonic flow meters are pivotal in enhancing thermal management, leading to boosts in efficiency, safety, and durability, thus gaining more popularity in the EV sector.

Ultrasonic Flow Meters Industry Overview

The Ultrasonic Flow Meters market is semi-consolidated, with multiple vendors providing ultrasonic flowmeters in various operating temperature ranges, media pressures, meter sizes, and construction materials. Major players are Baker Hughes Company, Endress+Hauser Group Services AG, Fuji Electric Co. Ltd, Honeywell International Inc., Emerson Electric Co. along with other emerging players.

The flow meter market has some major manufacturers, such as Siemens AG, Emerson Electric, Honeywell International Inc., and others, contributing to the intensity of competitive rivalry. Such vendors are established and have deep penetration in the market for flow meters.

The barriers to exit are high as the capital requirements for developing flow meters are high, leading to the overall cost of the products. Thus, the barriers to exit have a positive effect on the intensity of competitive rivalry.

Moreover, the involvement of large-scale investment increases the barriers to exit for the existing players. The market for ultrasonic flow meters is fragmented, with major players molding the market based on innovations and brand image.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Analysis of Key Measuring Technology

- 4.4 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

- 4.5 Analysis of Trends and Dynamics of IoT-enabled Ultrasonic Flow Meters

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Requirement for Non-invasive Flow Measurement of Liquids and Gases

- 5.1.2 Ultrasonic Technology Benefits for Oil and Gas and Petrochemical

- 5.2 Market Restraint

- 5.2.1 High Cost and Limitations in Measurement Capabilities

6 MARKET SEGMENTATION

- 6.1 By Mounting Method

- 6.1.1 Clamp-on

- 6.1.2 In-line

- 6.2 By End-User Industry

- 6.2.1 Oil and Gas

- 6.2.2 Water and Wastewater

- 6.2.3 Chemical and Petrochemical

- 6.2.4 Industrial (F&B, Aerospace, and Automotive)

- 6.2.5 Other End-user Industries (Life Sciences, Mining and Metals, etc.)

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Baker Hughes Company

- 7.1.2 Endress+Hauser Group Services AG

- 7.1.3 Fuji Electric Co. Ltd

- 7.1.4 Honeywell International Inc.

- 7.1.5 Emerson Electric Co.

- 7.1.6 Badger Meter Inc.

- 7.1.7 Omega Engineering Inc.

- 7.1.8 KROHNE Group

- 7.1.9 INTEGRA Metering

- 7.1.10 Bronkhorst High-Tech BV

- 7.1.11 Siemens AG

- 7.1.12 FTI Flow Technology Inc. (Roper Technologies Inc.)

- 7.1.13 KOBOLD Instruments Pvt. Ltd

- 7.1.14 GAO Tek & GAO Group Inc.

- 7.1.15 Belimo Aircontrols Inc.

- 7.1.16 Gentos Measurement & Control Co. Ltd

- 7.1.17 Itron Inc.

- 7.1.18 Neptune Technology Group Inc.

- 7.1.19 Sensus USA

- 7.1.20 Kamstrup A/S

- 7.1.21 Mueller Systems LLC.

- 7.1.22 Diehl Metering GmbH

- 7.1.23 Axioma Metering

- 7.1.24 Arad Group

- 7.1.25 Landis+Gyr AG

- 7.1.26 SICK AG

- 7.1.27 Aichi Tokei Denki Co. Ltd

- 7.1.28 Apator SA

- 7.1.29 Azbil Kimmon Co. Ltd

- 7.1.30 WEIHAI PLOUMETER CO. LTD