|

市場調查報告書

商品編碼

1631600

美國鋁飲料罐:市場佔有率分析、產業趨勢與成長預測(2025-2030)United States Aluminum Beverage Cans - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

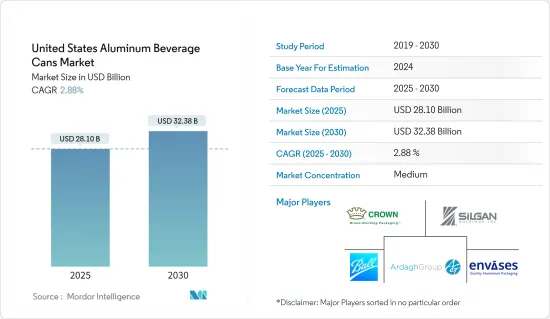

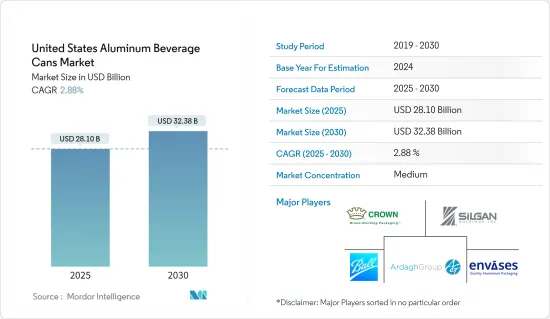

預計2025年美國鋁製飲料罐市場規模為281億美元,預計2030年將達323.8億美元,預測期內(2025-2030年)複合年成長率為2.88%。

主要亮點

- 鋁罐具有許多優點,包括剛性、穩定性和阻隔性。這些品質使其適合儲存保存期限長或需要遠距運輸的產品。製造商和行業更喜歡鋁罐,因為鋁罐柔軟且重量輕,有助於降低物流成本。

主要亮點

- 鋁罐廣泛用於飲料行業,因為它們易於處理且可回收。它也具有延長產品保存期限的作用。飲料鋁罐的主要終端使用者包括碳酸飲料、機能飲料和酒精飲料。

- 消費者對較小尺寸和多包裝包裝形式的偏好正在促進鋁罐銷售的成長和設計創新。鋁罐特別適合忙碌生活方式的消費者,其主要優點是方便。鋁罐很容易運送到節慶、海灘、戶外活動、運動場館等。

主要亮點

- 回收鋁可節省生產新金屬所需能源 90% 以上,進而降低生產成本。在美國,每三個運輸的鋁罐中有兩個被回收。預計這些因素將推動未來市場的成長。

- 鋁包裝面臨塑膠、紙張和玻璃等替代包裝解決方案的競爭。塑膠包裝仍然是金屬包裝的主要競爭對手。飲料業是鋁罐的最大用戶,也開始採用可回收的塑膠包裝解決方案。塑膠罐是透明的,使品牌能夠突出其飲料的品質。

主要亮點

- 2023 年 3 月,美國、加拿大和墨西哥 PET 包裝產業貿易協會國家 PET 包裝資源協會 (NAPCOR) 發布了生命週期評估 (LCA)。該評估表明, 寶特瓶對環境的影響低於玻璃或鋁製容器。

美國鋁製飲料罐市場趨勢

三片罐有望大幅成長

- 三片罐是由三個主要部分組成的包裝:圓柱體、底端和頂蓋。機身由捲成圓柱形的單片金屬製成,下端和上蓋是單獨的圓形件,牢固地連接到機身的每一端。

- 對耐用且安全的包裝解決方案的需求極大地推動了三片式金屬罐的成長。寵物食品需要能夠保持新鮮度、風味和營養價值的包裝。三片式金屬罐可提供出色的保護,免受水分、氧氣和光線等外部因素的影響,長期確保您的寵物食品的品質和安全。

- 有機包裝食品通常含有天然成分,不含合成防腐劑。據有機貿易協會稱,對有機包裝食品的需求正在增加。預計2018年將增加174.59億美元,2025年將增加250.6億美元。

- 這種不斷成長的需求為三片罐市場提供了一個蓬勃發展的機會,因為它可以提供可靠的產品保護、延長的保存期限、消費者的青睞、永續性的認證以及產品的多功能性。

能量飲料成長顯著

- 消費者健康意識的提高正在推動對低糖、低熱量和人工成分的非酒精飲料的需求。消費者偏好的這種轉變導致健康飲料市場快速成長。消費者願意為被認為是高品質、天然和有機的飲料支付高價。由於新興國家中產階級的成長以及對健康和方便飲料選擇的日益偏好,非酒精飲料市場正在擴展到新的地區和人口結構。

- 近年來,能量飲料在美國越來越受歡迎。根據飲料業雜誌報道,2017年美國能量飲料銷售額為110億美元,2023年將達到約185億美元。能量飲料市場的特點是競爭激烈,品牌定期推出新口味、尺寸和包裝選項。這種持續的創新刺激了對不同類型鋁罐的需求,包括專業設計和大規格。因此,罐頭製造商受益於這個充滿活力的細分市場不斷擴大的包裝需求。

- 據 Monster Beverage 稱,到 2023 年,美國的能量飲料銷量將從 2018 年的 11.5 億輛增至約 16 億輛。能量飲料銷售的成長預計將推動對鋁罐作為包裝選擇的需求。鋁罐因其輕量、可回收性和便利性而成為飲料包裝的首選。

美國鋁製飲料罐產業概況

美國飲料鋁罐市場由 Ardagh Group、Ball Corporation 和 Crown Holdings Inc 等幾家主要市場參與企業進行細分。預計透過設計、技術和應用的創新獲得永續的競爭優勢。由於食品和飲料需求的增加,鋁飲料罐的市場滲透率在過去十年中增加。此外,市場競爭對手正在採取夥伴關係等競爭策略,並強調研發和創新活動。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月的分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 金屬罐回收業標準與法規

第5章市場動態

- 市場促進因素

- 非酒精飲料產業的需求不斷成長

- 金屬包裝回收率高

- 市場問題

- 對替代品的需求不斷成長

第6章 市場細分

- 按類型

- 2 件

- 3 件

- 按用途

- 碳酸飲料

- 啤酒

- 水

- 能量飲料

- 其他用途(葡萄酒、烈酒、調味飲料、酒精飲料、果汁、乳類飲料)

第7章 競爭格局

- 公司簡介

- Ball Corporation

- Ardagh Group

- Crown Holdings Inc.

- Silgan Holdings

- Envases Group

- CANPACK GROUP

- Mauser Packaging Solutions(Bway Holding Corporation)

- Independent Can Company

第8章投資分析

第9章 市場未來展望

The United States Aluminum Beverage Cans Market size is estimated at USD 28.10 billion in 2025, and is expected to reach USD 32.38 billion by 2030, at a CAGR of 2.88% during the forecast period (2025-2030).

Key Highlights

- Aluminum cans offer numerous advantages, including rigidity, stability, and high barrier properties. These qualities make them suitable for storing goods with extended shelf lives and those requiring long-distance transportation. Manufacturers and industries prefer aluminum cans due to their softness and lightweight nature, which helps reduce logistics costs.

- The beverage industry widely uses aluminum cans because of their easy disposal and recyclability. They also extend product shelf life. Major end-user segments for aluminum beverage cans include carbonated soft drinks, energy drinks, and alcoholic beverages.

- Consumer preferences for small sizes and multi-pack packaging formats contribute to the growth of aluminum can volume and design innovations. Aluminum cans are particularly suitable for consumers with on-the-go lifestyles, offering convenience as a primary benefit. These cans are easily transportable to festivals, beaches, outdoor events, and sports venues.

- Recycling aluminum saves over 90% of the energy required to produce new metal, reducing production costs. Two of every three aluminum cans shipped are recycled in the United States. These factors are expected to drive market growth in the future.

- Aluminum packaging faces competition from alternative packaging solutions such as plastic, paper, and glass. Plastic packaging remains the primary competitor to metal packaging. The beverage industry, the largest user of aluminum cans, has begun adopting recyclable plastic packaging solutions. Plastic cans offer transparency, allowing brands to showcase their beverage quality.

- In March 2023, the National Association for PET Container Resources (NAPCOR), the trade association for the PET packaging industry in the United States, Canada, and Mexico, presented a life cycle assessment (LCA). This assessment indicated that PET bottles have a lower environmental impact than glass and aluminum containers.

Key Highlights

Key Highlights

Key Highlights

United States Aluminum Beverage Cans Market Trends

3-Piece is Anticipated to Witness Significant Growth

- 3-piece metal cans are packaging comprising three main components: the cylindrical body, the bottom end, and the top lid. The body is formed from a single piece of metal sheet rolled into a cylinder, while the bottom end and top lid are separate circular pieces securely attached to the ends of the body.

- The demand for durable and secure packaging solutions has significantly driven the growth of 3-piece metal cans. Pet food requires packaging that can preserve freshness, aroma, and nutritional value. 3-piece metal cans provide excellent protection against external elements such as moisture, oxygen, and light, ensuring the quality and safety of the pet food over an extended period.

- Organic packaged foods often contain natural ingredients and lack synthetic preservatives. 3-piece cans protect against external contaminants and maintain product freshness, which is crucial for organic foods that lack preservatives. According to the Organic Trade Association, the demand for organic packaged food is increasing. It is expected to account for a value increase of USD 17,459 million in 2018 to USD 25,060 million in 2025.

- This growing demand creates opportunities for the 3-piece cans market to thrive by offering reliable product protection, extended shelf life, positive consumer perception, sustainability credentials, and versatility in product offerings.

Energy Drinks is Observing a Notable Growth

- Increasing consumer health awareness has increased demand for non-alcoholic beverages with reduced sugar, calories, and artificial ingredients. This shift in consumer preferences has resulted in a surge in the market for healthier beverage options. Consumers are willing to pay premium prices for beverages perceived as high-quality, natural, and organic. The non-alcoholic beverage market is expanding into new geographical regions and demographic segments, driven by the growth of the middle class in emerging economies and an increasing preference for healthy and convenient drink options.

- Energy drinks have become more popular in the United States in recent years. According to Beverage Industry Magazine, in 2017, sales of energy drinks in the United States accounted for USD 11 billion and reached around USD 18.5 billion by 2023. The energy drink market is characterized by intense competition, with brands regularly introducing new flavors, sizes, and packaging options. This continuous innovation stimulates demand for various types of aluminum cans, including specialty designs and larger formats. As a result, can manufacturers benefit from the expanding range of packaging requirements in this dynamic market segment.

- According to Monster Beverage, energy drink sales in the United States reached approximately 1.6 billion units in 2023, up from 1.15 billion units in 2018. The growth in energy drink sales is expected to drive the demand for aluminum cans as a packaging option. Aluminum cans are favored for their lightweight properties, recyclability, and convenience, making them a preferred choice for beverage packaging.

United States Aluminum Beverage Cans Industry Overview

The aluminum beverage cans market in the United States is fragmented due to the presence of a few major market players, such as Ardagh Group, Ball Corporation, and Crown Holdings Inc. Sustainable competitive advantage is expected to be gained through design, technology, and application innovation. The market penetration for aluminum beverage cans has increased over the past decade due to the increasing demand for food and beverages. Furthermore, the market players are adopting competitive strategies such as partnerships, emphasizing R&D and innovative activities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Standards & Regulations on Recycling of Metal Cans

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Demand from the Non-Alcoholic Beverage Sector

- 5.1.2 High Recyclability Rates of Metal Packaging

- 5.2 Market Challenges

- 5.2.1 Growing Demand for Substitutes

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 2-piece

- 6.1.2 3-piece

- 6.2 By Application

- 6.2.1 Carbonated Soft Drinks

- 6.2.2 Beer

- 6.2.3 Water

- 6.2.4 Energy Drinks

- 6.2.5 Other Applications (Wine, Spirits, Flavored, Alcoholic Beverages, Juices, Dairy Based Beverages)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Ball Corporation

- 7.1.2 Ardagh Group

- 7.1.3 Crown Holdings Inc.

- 7.1.4 Silgan Holdings

- 7.1.5 Envases Group

- 7.1.6 CANPACK GROUP

- 7.1.7 Mauser Packaging Solutions (Bway Holding Corporation)

- 7.1.8 Independent Can Company