|

市場調查報告書

商品編碼

1631602

美國智慧鎖:市場佔有率分析、產業趨勢、成長預測(2025-2030)United States Smart Lock - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

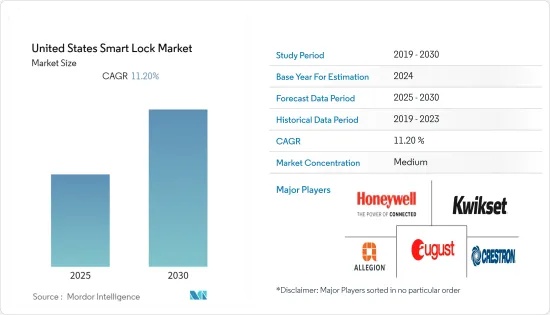

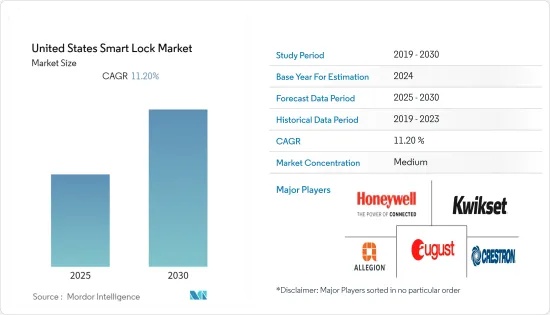

美國智慧鎖市場預計在預測期間內複合年成長率為11.2%

主要亮點

- 在美國,智慧鎖仍然不如其他智慧家庭設備受歡迎。根據消費者科技協會 (CTA) 最近進行的一項調查,大約 69% 的美國家庭(代表 8,300 萬個家庭)擁有至少一台智慧家庭設備。這些統計數據凸顯了市場參與企業透過適當的行銷策略所獲得的商機。

- 美國市場的主要企業向其他地區,特別是歐洲國家的擴張,預計也將成為市場成長的強勁推動力。例如,在CES 2020上,August Inc.和Yale Locks(美國智慧鎖製造商)在其產品系列中增加了新的智慧鎖,並宣佈在歐洲、中東和非洲推出新款耶魯智慧鎖。有擁有者推出名為「Yale Access module」的產品。

- August Co., Ltd.的新產品「Wi-Fi智慧鎖」需要兩因素認證和兩層加密,並且可以透過公司的應用程式和雲端進行遠端系統管理。同樣,濃啤酒的新產品「Linus智慧鎖」配備了「DoorSense」技術,可以監控並通知門的鎖定/解鎖位置。它還支援從智慧型手機解鎖。

- 新產品在市場上的推出會對競爭反應的發生和性質產生重大影響。例如,2020年11月,總部位於加州的全球家居智慧供應商螢石擴大了其創新智慧家庭產品線,將指紋鎖納入其中。新推出的L2級智慧鎖繼承了螢石安全的核心競爭力。此鎖有 4 種開鎖方法,還具有門鈴功能。更重要的是,一系列安全功能(包括自動鎖和防篡改警報)有助於保護您的家免於強行進入。

美國智慧鎖市場趨勢

商業領域預計將大幅成長

- 本研究的目標商業空間包括旅館業、醫院、公司辦公室、學校和租賃空間。在預測期內,這些領域智慧鎖的採用預計將大幅成長。

- 透過遠端存取對各種入口進行安全、輕鬆的管理、追蹤場所安全的能力等因素使得這些空間中智慧鎖的採用率不斷成長,因此各個相關人員正在進行大量投資。

- 根據非營利組織槍支暴力檔案館 (GVA) 的資料,截至 2019年終,美國總合發生了 417 起大規模槍擊事件。根據槍枝暴力檔案館的資料,2020 年有近 2 萬名美國人死於槍枝暴力,這數字超過了至少過去 20 年來的任何一年。諸如此類的統計數據凸顯了位於這些場所(主要是學校和教堂)的組織在公共場所大規模槍擊事件發生率高的時代需要尋求盡可能高的安全等級。

- 此外,隨著智慧型手機普及率的提高,連網型設備的成長也在加速,用戶可以使用各種連網行動應用程式遠端存取和解鎖門鎖。

- 客戶服務和客戶體驗在酒店業中發揮重要作用。飯店管理層保證為顧客提供舒適的住宿體驗。在此過程中,各酒店正計劃在酒店內採用藍牙鎖和Wi-Fi鎖,以取代可透過晶片卡存取的RFID鎖,以提高飯店場所的安全性。

智慧家庭的普及和住宅盜竊的增加推動了住宅市場的成長

- 由於智慧家庭技術和產品的日益普及,美國成為北美地區的重要市場。根據國家家庭安全委員會 (Alarms.org) 的一項調查,超過五分之三的美國人表示,安全是擁有智慧家庭的最大好處。此外,57% 的美國人表示,智慧家庭科技產品平均每天為他們節省 30 分鐘。

- 未來幾年,全國消費者可能會有更多智慧家庭安全選擇,包括來自ADT、博世和霍尼韋爾等領先公司的智慧鎖和安全攝影機。

- 2020年8月,安全與智慧家庭解決方案供應商ADT與Google宣佈建立長期夥伴關係,共同開發下一代智慧家庭安全。此次夥伴關係將 Nest 屢獲殊榮的硬體和服務(由 Google 機器學習 (ML) 技術提供支援)與 ADT 的安裝和專業監控網路相結合,以幫助美國各地的客戶更好地為他們的智慧家庭提供服務。

- 在美國,智慧鎖的採用持續受到越來越多的關注。我們預計美國許多寬頻家庭已經購買了智慧鎖。預計原因是近 35% 的美國寬頻家庭認為智慧鎖價格實惠。一些打算購買智慧鎖的家庭表示,他們將購買獨立設備。然而,我們預期大多數人會購買智慧鎖作為家庭安全或家庭控制系統的一部分。

- 供應商增加的新產品預計將進一步推動市場成長。例如,美國的Kwikset推出了支援Wi-Fi的智慧鎖系列,並推出了最新的Halo Touch Wi-Fi智慧鎖。

- Hugolog 是智慧鎖技術的創新者,也為有興趣將最先進、最安全的入口大門的住宅提供產品。

美國智慧鎖產業概況

競爭公司之間競爭的強度取決於影響市場的各種因素,例如品牌身份驗證、強力的競爭策略和分銷管理。然而,透過整合遠端存取、無線功能、策略夥伴關係關係(附加服務、優勢、產品捆綁、分銷)和更大折扣等增強功能的策略,市場供應商正在顯著差異化他們的產品。品牌 ID 驗證與在該市場具有重大影響力的公司密切相關。強大的品牌是良好業績的代名詞,因此我們預期老字型大小企業將擁有優勢。我們預計競爭公司之間的競爭將繼續,因為它們的市場滲透率和提供先進產品的能力。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 買方議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- 隨著時間的推移,技術趨勢(基於 BLE 和 Wi-Fi 的智慧鎖的說明)和價格趨勢

- 產業相關人員/生態系統分析

- 分銷通路分析(直接與間接)

- COVID-19對智慧鎖市場的影響(由於實施鎖定而導致智慧鎖需求下降|對成長軌跡的近中期影響)

- 市場促進因素

- 智慧家庭的普及和住宅盜竊的增加促進了住宅市場的成長

- 市場問題

- 供應商提供的產品缺乏意識且高成本

- 市場機會

- 政府增加物聯網支出的舉措

第5章市場區隔

- 按最終用戶

- 住宅

- 商業的

- 按類型

- 鎖舌

- 掛鎖

- 其他類型(槓桿手柄、榫眼)

第6章 競爭狀況

- 公司簡介

- Crestron Electronics, Inc.

- Johnson Controls International plc

- August Home Inc.(AssaAbloy)

- Honeywell International Inc.

- Kwikset(Spectrum Brands)

- Master Lock(Fortune Brands Home & Security)

- The Chamberlain Group Inc.

- Allegion plc

- U-tec Group Inc.

第7章 投資分析

第8章市場的未來

The United States Smart Lock Market is expected to register a CAGR of 11.2% during the forecast period.

Key Highlights

- The adoption of smart locks is still not prevalent in the United States in comparison with the adoption of other smart homes devices. According to a recent study conducted by the Consumer Technology Association (CTA), about 69% (translates to 83 million households) of US households now own at least one smart home device. Of which, the adoption of smart speakers in the country is high, with a rate of 28%, whereas the adoption of smart locks is only 10%-statistics such as these highlights the opportunity for market players by following proper marketing strategies.

- The expansion of the key players in the US market to other regions, especially in European nations, is also expected to provide a strong impetus for market growth. For instance, at CES 2020, August Inc. and Yale Locks (smart lock manufacturers based out of United States) announced new smart locks in their product portfolios and the availability of their products for new and existing owners of Yale Smart Lock in the EMEA region under the name 'Yale Access module.'

- The new product 'Wi-Fi Smart Lock' from August Inc. mandates two-factor authentication and two-layer encryption and can be remotely managed through their App and cloud. Similarly, the new Linus Smart Lock from Yale is equipped with DoorSense technology that can monitor the lock/unlock position of the door and notify. It also supports the unlocking of doors via smartphones.

- New product launches in the market could have a significant impact on both the occurrence and nature of competitive reactions. For instance, in November 2020, EZVIZ, a global vendor in home intelligence having headquarters in California, has expanded its innovative smart home product range to include fingerprint locks. The newly launched L2 Smart Lock inherits EZVIZ's core competency in security. The lock features four methods for unlocking a door and serves as a doorbell at the same time. More importantly, it helps protect the household against potential forced entry through a bundle of security features that includes auto-locking and anti-tamper alarms.

US Smart Locks Market Trends

Commercial Segment is Expected to Grow Significantly

- Commercial spaces considered under the scope of the study include the hospitality industry, hospitals, corporate offices, schools, and rental spaces. The adoption of smart locks in these spaces is expected to grow significantly during the forecast period.

- Factors such as secure and easy management of various entry points through remote access and the ability to track the security of the premises have enabled the growth of smart lock adoption in these spaces, thus, propelling various stakeholders to invest significant amounts.

- According to the data from the non-profit Gun Violence Archive (GVA), there were a total of 417 mass shootings in the United States by the end of 2019. In 2020, gun violence killed nearly 20,000 Americans, according to data from the Gun Violence Archive, which is more than any other year in at least two decades. Such statistics highlight the need for organizations in these spaces (mainly schools and churches) to seek the highest security level possible in the age of mass shootings in public places.

- Also, the increasing penetration of smartphones is augmenting the growth of connected devices, which enable users to remotely access their door locks and unlock the doors using various connected mobile apps.

- Customer service and customer experience play a vital role in the hospitality industry. Hotel management is ensuring that customers' stay at their place is pleasant. In the process, various hotels are planning to adopt Bluetooth-enabled or Wi-Fi-enabled locks in place of RFID locks accessible by IC cards for their hotels to improve the security of their premises.

Increasing Smart Home Adoption, Increase of Home break-ins, Thereby Aiding in the Market Growth for Residential Segment

- The United States is the prominent market in the North American region, owing to the growing adoption of smart home technology and products. According to the National Council For Home Safety and Security (Alarms.org) study, more than 3 in five Americans claim security is the top benefit for owning a smart home. Also, 57% of Americans stated that smart home technology products could save them an average of 30 minutes per day.

- In the coming years, smart home security choices for smart locks and security cameras from big names such as ADT, Bosch, and Honeywell would open up for consumers in the country.

- In August 2020, ADT, a security and smart home solution provider, and Google announced they are entering into a long-term partnership to develop the next generation of smart home security offerings. The partnership would combine Nest's award-winning hardware and services powered by Google's machine learning (ML) technology with ADT's installation and professional monitoring network to create a more helpful smart home and integrated experience for customers across the United States.

- Smart locks adoption is continuously witnessing increasing interest in the country. It is expected that many US broadband households are purchasing the smart lock. The reason for the same has been predicted to account for nearly 35% of US broadband households considering smart locks to be affordable. Some households that intend to purchase smart locks stated they would purchase standalone devices. But the majority expected to purchase smart locks as part of home security or home control system.

- New product additions to the portfolio by vendors would further drive the market's growth. For instance, the US-based Kwikset added to its family of Wi-Fi enabled Smart Locks with its latest addition, Halo Touch Wi-Fi Smart lock.

- Also, Hugolog, an innovator in smart lock technology, has product offerings that have homeowners interested in bringing their front door online, safe, and secure, with unprecedented sophistication.

US Smart Locks Industry Overview

The intensity of competitive rivalry depends on various factors affecting the market, such as brand identity, powerful competitive strategy, and distribution control, to name a few. However, by incorporating strategies across enhanced functionality, such as remote access, wireless capabilities, strategic partnerships (added services, benefits, product bundling, and distribution), and deeper discounts, the market vendors have been distinguishing their offerings significantly. The brand identity is strongly associated with the companies that have a major influence in this market. As strong brands are synonymous with good performance, long-standing players are expected to have the upper hand. Owing to their market penetration and the ability to offer advanced products, the competitive rivalry is expected to continue to be high.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Technology Trends (Commentary on BLE and Wi-Fi based Smart Locks) and Price Trends Over the Years

- 4.4 Industry Stakeholder/Ecosystem Analysis

- 4.5 Distribution Channel Analysis (Direct Vs Indirect)

- 4.6 Impact of COVID-19 on the Smart Lock Market (Decrease in Demand for Smart Locks due to Lockdown Implementation | Near and Medium-term Impact on the Growth Trajectory)

- 4.7 Market Drivers

- 4.7.1 Increasing Smart Home Adoption, Increase of Home break-ins, Thereby Aiding in the Market Growth for Residential Segment

- 4.8 Market Challenges

- 4.8.1 Lack of Awareness Combined With High Cost of the Products Offered by the Vendors

- 4.9 Market Opportunities

- 4.9.1 Government InitiativesRegarding Increase in IoT Spending

5 MARKET SEGMENTATION

- 5.1 By End-user

- 5.1.1 Residential

- 5.1.2 Commercial

- 5.2 By Type

- 5.2.1 Deadbolt

- 5.2.2 Padlock

- 5.2.3 Other Types (Lever Handles, Mortise)

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Crestron Electronics, Inc.

- 6.1.2 Johnson Controls International plc

- 6.1.3 August Home Inc. (AssaAbloy)

- 6.1.4 Honeywell International Inc.

- 6.1.5 Kwikset (Spectrum Brands)

- 6.1.6 Master Lock (Fortune Brands Home & Security)

- 6.1.7 The Chamberlain Group Inc.

- 6.1.8 Allegion plc

- 6.1.9 U-tec Group Inc.