|

市場調查報告書

商品編碼

1631606

美國危險區域 LED 照明:市場佔有率分析、行業趨勢和成長預測(2025-2030 年)United States Hazardous Location LED Lightning - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

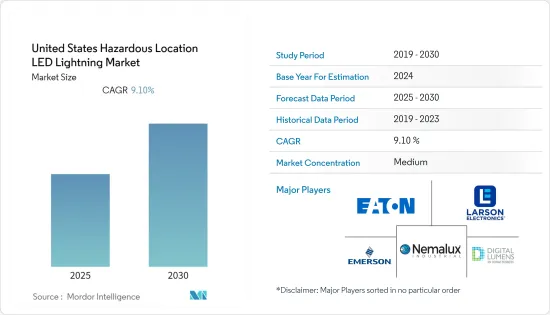

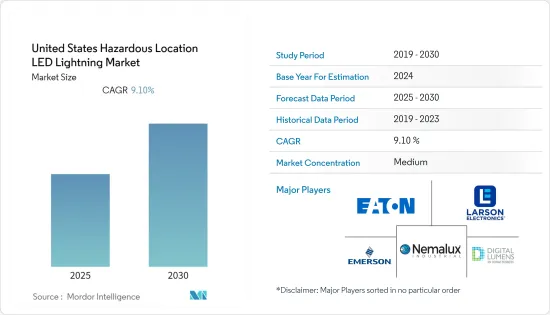

美國危險場所 LED 照明市場預計在預測期內複合年成長率為 9.1%

主要亮點

- 維修LED 技術改造危險場所設施的資本投資可能非常巨大。然而,如果實施得當,改用 LED 可以在節能、減少長期維護和提高設施安全方面提供有吸引力的投資收益(ROI)。

- 製造業占美國能源使用量的近 32%,是美國最大的能源成本降低機會。因此,到 2025 年,LED 照明系統有潛力以經濟高效的方式將能源使用量減少 15% 至 32%。

- 該地區的供應商已確認將參加多項產品推出,以升級危險場所現有的 LED 照明產品。例如,艾默生最近推出了一種針對石油和天然氣行業的陸上鑽機照明解決方案。

- 為了吸引工業客戶,根據環境客製化光輸出已成為製造商的普遍趨勢。因此,可調式 LED 照明解決方案近年來已得到越來越多的採用。在所研究的市場中,合併、收購和聯盟是市場參與者為了產品創新和無機成長而採取的常見趨勢。

- 由於全國範圍內的生產停頓和供應鏈中斷,COVID-19 疫情導致工業生產成長疲軟,主要製造地的輕工業生產下降。根據美國能源局2021 年 7 月發布的報告,許多 LED 製造商表示,由於 COVID-19 大流行後面臨的挑戰,對照明產品的需求減少。

美國危險區域LED照明市場趨勢

對低成本、低能耗 LED 照明解決方案的需求不斷成長

- 近年來,市場正在受到許多因素的研究,例如製造效率的提高、價格的降低、LED 功效的提高以及可以直接替代現有鹵素白熾燈和螢光的合適的LED燈和改裝套件。

- LED 是一種節能照明技術。根據美國能源局,美國住宅LED,尤其是獲得能源之星評級的產品,與白熾燈相比,消費量至少減少 75%,使用壽命延長 25 倍。此外,LED 體積小且定向,因此適合各種住宅應用。這些優勢使室內和住宅應用成為研究市場最大的收益部分。

- 對節能照明系統的需求不斷成長、嚴格的政府法規以及 LED 產品價格的下降是推動美國採用 LED 照明的主要因素。 LED作為一種新的照明光源,正在經歷快速的技術和經濟發展,這使得國家對該行業的投資不斷增加。

- 據美國能源局稱,到 2035 年,預計節能的很大一部分可能來自商業和工業建築以及戶外照明應用中 LED 照明的增加使用。

- 互聯照明智慧功能的整合也已成為市場研究的關鍵促進因素之一,其中 LED 是關鍵組件之一。政府對智慧城市的舉措極大地促進了對智慧照明解決方案的需求的成長。聯網照明系統預計將成為智慧城市基礎設施最重要的組成部分之一。據消費者科技協會稱,到 2020 年,智慧城市的支出將達到 260 億美元。

工業應用顯著成長

- 美國工業部門透過增加對工業級 LED 技術的投資來推動市場成長。工業設施有多處振動劇烈、化學品、碎片和潛在爆炸物的場所。這些因素主要影響安裝在這些位置的燈具的使用壽命和性能。

- 例如,骨材加工和儲存等操作可能會積聚大量灰塵,而其他化學加工操作可能會造成極其惡劣的環境。隨著照明技術的進步,壽命、能源效率、色彩和安全性都在提高。此外,為了確保 LED 燈具在整個生命週期中具有可靠、安全和有效的性能,一些市場相關人員正在為危險重工業應用中的特定應用設計 LED 燈具。

- 工業級 LED 照明解決方案通常具有較高的耐腐蝕性、耐磨性和耐剝落性,即使在高陽光照射下也能長時間保持色彩穩定性。此外,許多傳統的工業照明解決方案,尤其是 HID 系統,不支援先進的感測器或無線控制。此外,由於照明時間長,設施通常被迫長時間打開這些燈。

- 美國主要企業主要積極拓展LED照明市場。我們推出了許多新的工業級產品,並不斷提高 LED 照明的普及度。應用開發方向為智慧照明、光纖通訊等新興領域。

- 此外,長壽命 LED 和新的安裝技術可最大程度地減少頻繁更換燈泡和安定器所需的鷹架和其他固定裝置,從而降低長期維護成本並提高安全性。較低的維護要求可提高安全性並消除高空作業的風險,從而減少發生事故的機會。

美國危險區LED照明產業概況

危險區域 LED 照明市場較為分散。廠商傾向於投資於產品創新,以滿足 LED 照明產業不斷變化的需求。此外,參與者正在採取夥伴關係、合併和收購等策略活動來擴大其影響力。近期市場發展趨勢如下:

2021 年 3 月 - Hubbell Control Solutions 推出 NX Distributed IntelligenceTM 照明控制面板(NXP2 系列)。該面板將連接點集中到機殼中,提供了一個易於安裝的解決方案,最大限度地減少了實施法規照明控制的時間和成本。

2021 年 3 月 - 防爆照明和可攜式配電裝置供應商 WorkSite Lighting 推出了一款適用於危險工業環境的新型 70W LED 防爆燈。 XP 70W LED 燈具有抗振性,可在可攜式應用中實現長壽命,並提供 1 年工業保修,並符合具有防爆標準的 I 類 I 區區域。

2021 年 7 月 - Larson Electronics 是德克薩斯州的公司,在工業照明和設備行業擁有 40 多年的經驗,宣布推出 Class I, Division 2 危險場所 LED 旋轉燈具。這款防爆 LED 照明配備調光控制以及 DALI-PWM 訊號轉換器。該裝置具有使用 Modbus TCP/IP通訊協定的類比輸出模組。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 替代品的威脅

- 競爭公司之間的敵對關係

- 產業價值鏈分析

- 產業政策

第5章技術概況

第6章市場動態

- 市場促進因素

- 促進危險場所工人安全的適當照明的法規

- 對經濟高效且節能的 LED 照明解決方案的需求不斷成長

- 市場挑戰

- 以 LED 照明解決方案取代傳統燈具成本高昂

第7章 市場區隔

- 依設備類型

- 0區

- 20區

- 1區

- 21區

- 2區

- 22區

- 按行業分類

- 石油和天然氣

- 石化

- 產業

- 發電

- 製藥

- 加工

- 其他最終用戶產業

第8章 競爭格局

- 公司簡介

- Nemalux Inc

- Emerson Electric Co.

- ABB Installation Products Inc.

- Digital Lumens Inc.(OSRAM)

- Eaton Corporation

- Larson Electronics

- GE Current

- Hubbell Limited

- Azz Inc.

- Worksite Lighting LLC

第9章投資分析

第10章 市場未來展望

The United States Hazardous Location LED Lightning Market is expected to register a CAGR of 9.1% during the forecast period.

Key Highlights

- The capital investment in retrofitting a hazardous location facility to LED technology can be significant. However, when the change to LED is implemented effectively, it offers a compelling return on investment(ROI) in energy savings, reduced long-term maintenance, and improved facility safety.

- The manufacturing industry accounts for nearly 32% of the energy usage in the United States while representing the most significant energy cost reduction opportunities in the country. Therefore, the LED lighting systems provide a potential chance to cost-effectively eliminate 15% to 32% of the energy usage by 2025.

- The vendors in the region are observed to have increasingly participated in multiple launches to upgrade their existing LED lighting offerings for hazardous locations. For instance, in the recent past, Emerson introduced a solution for the oil and gas industry to illuminate land-based drilling rigs.

- To attract industrial customers, customizing light output by the environment has become a common trend among manufacturers. Hence, tunable LED lighting solutions have been witnessing an improvement in adoption in the past few years. In the market studied, mergers, acquisitions, and collaborations are the prevailing trends adopted among the market players for product innovation and inorganic growth.

- The outbreak of COVID-19 has led to a weakened growth of industrial output and the decline in light-manufacturing production across significant manufacturing hubs, owing to the halting of production and disruption in the supply chain across the country. According to the US Department of Energy's report published in July 2021, many LED manufacturers cited a decreased demand for lighting products due to the challenges faced after the COVID-19 pandemic.

US Hazardous Location LED Lighting Market Trends

Increasing Demand for Low-Cost, Low-Energy LED Lighting Solutions

- The market studied is driven by many factors, such as improved manufacturing efficiency, lower prices, improved LED efficacy in recent years, and suitable LED lamps and retrofit kits, which can directly replace the existing halogen incandescent and fluorescent lamps.

- LED is a highly energy-efficient technology for lighting. According to the US Department of Energy, residential LEDs in the United States, especially ENERGY STAR-rated products, use at least 75% less energy and have a life span that is 25 times longer than incandescent lighting. Also, LEDs are small and directional, suitable for various uses in residential settings. Owing to these benefits, indoor application and residential uses are the largest revenue-generating segments in the studied market.

- The increasing demand for energy-efficient lighting systems, stringent government regulations, and declining prices of LED products are some of the major factors driving the adoption of LED lighting in the United States. LEDs have been undergoing rapid technological and economic development as a new source of lighting, which has been motivating investment in the sector in the country.

- According to the US Department of Energy, most of the projected energy savings in 2035 may be driven by the increased use of LED lighting in commercial and industrial buildings and outdoor lighting applications-applications characterized by high light output and long operating hours.

- The integration of intelligent features for connected lighting has also been emerging as one of the significant drivers in the market studied, as LED is one of the major components. Government initiatives for smart cities have been majorly contributing to the increasing demand for smart lighting solutions. Connected lighting systems are anticipated to emerge as one of the most critical components of the smart city infrastructure. According to the Consumer Technology Association, smart city spending will reach USD 26 billion by 2020.

Industrial Application is Going to Observe a Significant Growth

- The US industrial sector fosters the growth of the market studied, with increasing investments in industry-grade LED technologies. Within an industrial facility, there are multiple locations where high vibration, chemicals, debris, and potential explosives are present. These factors primarily impact the lifetime and performance of light fixtures installed within these locations.

- For example, operations, such as aggregate processing and storage, can have significant dust accumulation, while other chemical processing operations are highly caustic environments. As lighting technologies are evolving, there have been improvements in a lifetime, energy efficiency, color, and safety. Furthermore, to ensure reliable, safe, and effective performance over the LED luminaire's life, several market players are designing LED light fixtures for specific uses in hazardous and heavy industrial applications.

- Industrial-grade LED lighting solutions usually come with high resistance to corrosion, abrasion, and peeling and maintain color stability over time, even in the event of high exposure to sunlight. Moreover, many conventional industrial lighting solutions, especially HID systems, are not compatible with advanced sensors and wireless controls. Moreover, long strike-up times often force facilities to leave these lights on for longer periods.

- Major US lighting companies are primarily engaged in an aggressive expansion of the LED lighting market. They are continuously increasing the penetration rate of LED lighting by launching many new industry-grade products. The application development direction is moving toward smart lighting, light communication, and other emerging fields.

- Furthermore, long-life LEDs and new installation technologies reduce maintenance costs over time and enhance safety by minimizing the need for scaffolding and other apparatus for frequent lamp or ballast changes. The lower maintenance requirement improves safety and lessens accident probability by eliminating the risk of working at heights.

US Hazardous Location LED Lighting Industry Overview

The Hazardous Location LED Lighting market is moderately fragmented. Players tend to invest in innovating their product offerings to cater to the LED Light industry's changing demands. Moreover, players adopt strategic activities like partnerships, mergers, and acquisitions to expand their presence. Some of the recent developments in the market are:

March 2021 - Hubbell Control Solutions has released the NX Distributed IntelligenceTM Lighting Control Panel (NXP2 Series), which centralizes connection points in an enclosure and provides an installer-friendly solution that minimizes time and costs to deploy code-compliant lighting control.

March 2021 - WorkSite Lighting, a provider of explosion-proof lighting and portable power distribution units, has introduced a new 70W LED explosion-proof light for use in hazardous industrial environments. The XP 70W LED light is vibration resistant for extended life in portable applications, comes with a one-year industrial warranty, and is designated for Class I Division I regions with explosion-proof criteria.

July 2021 - Larson Electronics, a Texas-based business with more than 40 years of experience in the industrial lighting and equipment industries, has announced the release of a hazardous site LED pivoting light fixture in Class I, Division 2. This explosion-proof LED light includes a DALI-PWM signal converter as well as dimming controls. This unit features an analog output module that uses Modbus TCP/IP protocol.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porters Five Force Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Industry Policies

5 TECHNOLOGY SNAPSHOT

6 MARKET DYNAMICS

- 6.1 Market Drivers

- 6.1.1 Regulations Promoting Proper Lighting for Worker Safety in Hazardous Locations

- 6.1.2 Rising Demand for Cost-effective and Energy-efficient LED Lighting Solution

- 6.2 Market Challenges

- 6.2.1 High Cost of Replacement of Conventional Lamp to LED Lighting Solutions

7 MARKET SEGMENTATION

- 7.1 By Device Type

- 7.1.1 Zone 0

- 7.1.2 Zone 20

- 7.1.3 Zone 1

- 7.1.4 Zone 21

- 7.1.5 Zone 2

- 7.1.6 Zone 22

- 7.2 By End-User Vertical

- 7.2.1 Oil and Gas

- 7.2.2 Petro Chemical

- 7.2.3 Industrial

- 7.2.4 Power Generation

- 7.2.5 Pharmaceutical

- 7.2.6 Processing

- 7.2.7 Other End-user Industries

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Nemalux Inc

- 8.1.2 Emerson Electric Co.

- 8.1.3 ABB Installation Products Inc.

- 8.1.4 Digital Lumens Inc. (OSRAM)

- 8.1.5 Eaton Corporation

- 8.1.6 Larson Electronics

- 8.1.7 GE Current

- 8.1.8 Hubbell Limited

- 8.1.9 Azz Inc.

- 8.1.10 Worksite Lighting LLC