|

市場調查報告書

商品編碼

1631612

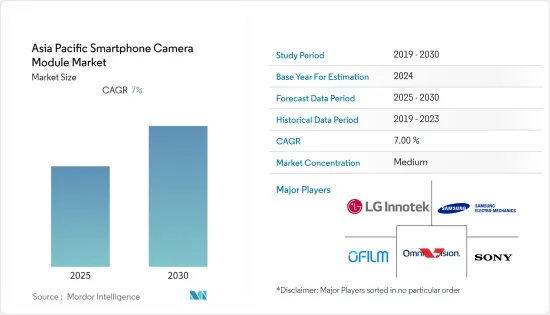

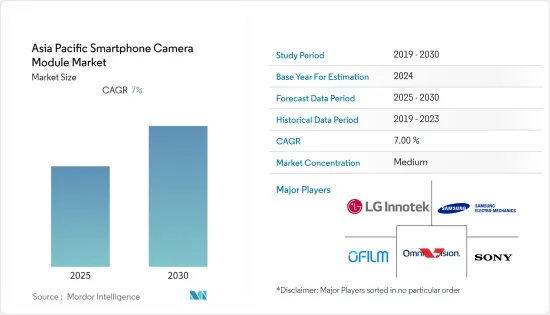

亞太地區智慧型手機相機模組:市場佔有率分析、產業趨勢與成長預測(2025-2030)Asia Pacific Smartphone Camera Module - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

亞太地區智慧型手機相機模組市場預計在預測期內複合年成長率為7%。

主要亮點

- 智慧型手機相機模組顛覆了數位相機 (DSC) 市場。由於相機模組的性能和複雜性顯著提高,輕便型相機的銷量正在下降。雙相機或 3D 感測攝影機是實施現有緊湊型(或 CMOS)相機模組(CCM) 技術的新方法,可透過增加每個系統的攝影機數量來維持成長。

- 推動亞太地區智慧型手機相機模組市場的因素之一是每部智慧型手機相機數量的增加。為了提高智慧型手機的功能和圖像質量,並響應不斷成長的前置相機趨勢,OEM正在從單個後置鏡頭轉向雙鏡頭、三鏡頭和四鏡頭設計,從而採用平均數量的相機模組。智慧型手機的模組正在增加。

- 例如,根據 photonicsViews 的統計,隨著雙前置相機和雙後置相機的推出,到 2022 年,每部智慧型手機的相機數量預計將增加到平均 2.7 個。

- 智慧型手機相機預計即使在室內和夜間也能提供高影像品質、高解析度照片和影片、光學影像防手震、變焦功能、快速自動對焦等。此外,感光元件尺寸是決定傳統相機影像品質的重要因素,對於智慧型手機也是如此。為了應對當前趨勢,智慧型手機公司正在積極致力於開發具有獨特功能的特定影像感測器。

- 由於COVID-19大流行導致消費者支出行為變化,加上智慧型手機市場接近飽和狀態,2020年智慧型手機銷售放緩。

亞太地區智慧型手機相機模組市場趨勢

先進相機技術的引入預計將推動市場發展

- 隨著行動電話的發展,消費者的需求也不斷改變。這帶來了技術進步和研究,包括人工智慧、超快速充電、無邊框顯示器和電動相機的發展。

- 智慧型手機相機的進步並不僅限於相機數量和百萬像素的增加。智慧型手機製造商不斷創新,推出了基於潛望鏡的系統,作為該領域突破性技術的最新例子。這使得智慧型手機相機能夠透過馬達內部光學元件實現先進的 10 倍光學變焦,而不會犧牲影像品質。此類創新可能會成為未來幾年消費者購買決策的差異化因素。例如,2020 年的 Oppo Find X2 Pro、三星 Galaxy S20 Ultra 和 Realme X3 SuperZoom 都具有潛望式變焦功能。在2021年的S21 Ultra中,三星改變了相機的擺放位置,並提高了變焦的質量,擁有潛望式和傳統兩種變焦方式。

- 隨著相機和感測器的發展,將專用影像訊號處理處理器整合到智慧型手機中的需求不斷增加。智慧型手機相機技術正在擴展其在影像品質和便利功能方面的可能性。與流行的觀點相反,專用影像訊號處理器不僅僅用於高速影像處理。提高影像品質、減少雜訊並增強 HDR、自動曝光、自動對焦和自動白平衡等功能。

- 例如,配備 Spectra 580 CV-ISP 的高通全新 Snapdragon 平台具有三重影像訊號處理器(三重 ISP),每秒可處理 2.7 億像素,允許設備同時使用最多三個獨立的相機。該功能提供了令人興奮的可能性,例如三個不同相機之間的無縫變焦、同時拍攝三張影像(每個影像高達 28MP)、多拍攝 HDR 合成以及將前置影片影像疊加到後置影片影像上。高通的三重 ISP 相容設備還可以同時拍攝最多三部 4K HDR 電影。

- 智慧型手機相機的功能正在不斷發展。它首先受到關注是因為越來越多的人用智慧型手機拍照而不是投資專業相機。隨著社群媒體平台和影片內容的激增,下一件大事將是影片功能的發展。

中國佔有很大佔有率

- 蓬勃發展的智慧型手機市場是中國的顯著趨勢之一。需求的成長是多種因素共同作用的結果,包括可支配收入的增加、網路價格的下降以及創新和技術的進步。例如,智慧型手機相機模組中引入了鏡子或棱鏡。這與潛望鏡技術類似,但它不是利用行動電話的厚度和相機凹凸來擴展變焦功能,而是利用行動電話的長度和寬度。

- 例如,華為和OPPO等一些智慧型手機製造商已經在其旗艦機型中採用了該技術。華為的華為Mate XS配備了折疊式變焦模組。

- 2021 年 5 月,中國智慧型手機製造商小米獲得了一款具有螢幕下翻轉相機的智慧型手機的設計專利,該相機既可用作主鏡頭,也可用作自拍相機。這款智慧型手機的相機系統採用翻轉技術,讓相機旋轉180度,並兼具自拍相機和後置相機的功能。然而,該公司在開發旋轉螢幕下相機模組方面正在取得重大進展,世界智慧財產權組織(WIPO)頒發的一項新專利就證明了這一點。

- 2021 年 8 月,中國智慧型手機製造商 Vivo 獲得了世界智慧財產權組織 (WIPO) 的一項創新設計專利,該設計具有可拆卸的螢幕下自拍相機模組。根據 GizmoChina 報導,這家智慧型手機製造商的專利描述了一種可以從行動電話身上拆卸下來的顯示器相機模組。

- 智慧型手機的變焦能力在過去幾年中得到了顯著提高,但仍然落後於傳統相機,儘管現代高階智慧型手機現在標配專用長焦鏡頭。中國相機模組製造商歐菲光展示了一款光學變焦範圍為85-170mm(35mm等效)的智慧型手機鏡頭。原則上,它應該在整個變焦範圍內提供比現有型號更好的影像品質。

亞太智慧型手機相機模組產業概況

亞太智慧型手機相機模組市場是一個競爭激烈的市場,參與者眾多。然而,就市場佔有率而言,主要企業只有少數幾個,包括: LG Innotek、三星集團、舜宇光學科技有限公司、富士康科技集團(夏普)、豪威科技等目前在市場上佔據主導地位。 、產品創新和合作夥伴關係開拓新市場,其中一些最新進展包括:-

- 2021 年 9 月 - Valens Semiconductor 與舜宇光學科技Group Limited合作開發適用於下一代相機模組的 MIPI A-PHY 相容晶片組。用於多Gigabit汽車通訊的 A-PHY 是一種長距離串列器-解串器 (SerDes) 物理層介面。 MIPI 聯盟於 2020 年 9 月宣布將其作為在車輛中整合攝影機、感測器和顯示器的標準,同時也納入了功能安全和保障。 Valens VA7000 晶片組系列(首款符合 A-PHY 標準的晶片組)的工程樣品預計將於 2021 年第四季推出。

- 2021 年 5 月 - 高級數位成像系統開發商 OmniVision Technologies, Inc. 宣布推出 OV60A,這是一款用於行動電話相機的 0.61 微米 (m) 像素高解析度 CMOS 影像感測器。 OV60A 支援長寬比為 3:4 或 16:9 的 1/2.8 英吋光學格式。 OV60A 的4 單元濾色器陣列使用近像素合併,可產生高達15MP 的照片,預覽靈敏度提高4 倍,並可生成原生4K 影片,並具有額外的像素用於電子圖像穩定和1.22 演示性能(EIS)相當於m。

其他好處:

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 新進入者的威脅

- 買方議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間的敵對關係

- 每個最終產品的平均相機數量 - 智慧型手機

- COVID-19 對產業的影響

第5章市場動態

- 市場促進因素

- 多攝影機方法的演進和先進攝影機技術的介紹

- 市場挑戰

- 價格競爭加劇

第6章 市場細分

- 按國家/地區

- 中國

- 印度

- 其他亞太地區

第7章 供應商排名分析

第8章 競爭格局

- 公司簡介

- LG Innotek Co., Ltd.

- Samsung Electro-Mechanics Co., Ltd. and Samsung Group

- Sunny Optical Technology Company Limited

- JiangXi Holitech Technology Co., Ltd

- Q Technology(Group)Company Limited

- O-Film Tech Co. Ltd.

- Foxconn Technology Group(Sharp)

- Luxvisions Innovation Limited

- Sony Corporation

- Largan Precision Co Ltd.

- OmniVision Technologies Inc.

第9章投資分析

第10章市場的未來

The Asia Pacific Smartphone Camera Module Market is expected to register a CAGR of 7% during the forecast period.

Key Highlights

- The smartphone camera modules have disrupted the digital still camera (DSC) market. The performance and complexity of camera modules have increased considerably, which explains the decline in compact camera sales. Dual and 3D sensing cameras are new ways to implement existing compact (or CMOS) camera module (CCM) technology and sustain growth by having more cameras per system.

- One factor driving the Asia-Pacific smartphone camera module market is the growing number of cameras per smartphone (in units). To improve the functionality and quality of images produced by smartphones and rising trends of front cameras, OEMs are shifting from single rear cameras to dual, triple, and quad-camera designs, resulting in increasing adoption of an average number of camera modules per smartphone.

- For instance, according to the statistics by photonicsViews, the introduction of dual-front and back cameras would increase the number of cameras per smartphone that is expected to be 2.7 cameras per phone on average by 2022.

- Smartphone cameras are expected to offer high image quality even in indoor and nighttime, high-resolution photography and video, optical image stabilization, zoom ability, and high-speed autofocus. Moreover, Sensor size is a crucial determinant of image quality in traditional cameras, and the same is true in smartphones. With the current trends, smartphone companies are now aggressively developing specific image sensors with unique features.

- A shift in consumer spending behavior due to the COVID-19 pandemic, coupled with the smartphone market nearing a point of saturation, witnessed the slowdown of smartphone sales in 2020.

APAC Smartphone Camera Module Market Trends

Introduction of Advanced Camera Technologies is Expected to Drive the Market

- Consumer demands have evolved in tandem with the evolution of phones. This has pushed for technological advancement and research, resulting in developments such as artificial intelligence, ultra-fast charging, bezel-less displays, and motorized cameras, etc.

- The progress of the smartphone camera did not stop at increasing the number of cameras or the megapixel count. Smartphone manufacturers continue to innovate, introducing a periscope-based system as the most recent example of breakthrough technology in this field. It enables a smartphone camera to provide a sophisticated 10x optical zoom with motorized internal optics without sacrificing image quality. Innovations like these will be the differentiating element for consumers' purchase considerations in the following years. For instance the Oppo Find X2 Pro in 2020, the Samsung Galaxy S20 Ultra, and the Realme X3 SuperZoom all included periscope zoom. It remains a popular feature, with Samsung rearranging the cameras in the S21 Ultra for 2021 to include two zooms, one periscope and one conventional, in an effort to improve zoom quality.

- Along with advancements in camera sensors, the demand for the integration of a dedicated image signal processor in smartphones is growing. In terms of image quality and helpful functionality, this has opened up a world of possibilities in smartphone camera technology. Dedicated image signal processors aren't simply for high-speed picture processing, contrary to popular opinion. It improves image quality, reduces noise, and enhances features such as HDR, auto exposure, autofocus, and auto white balance, among others.

- For instance, Qualcomm's new Snapdragon platforms with the Spectra 580 CV-ISP feature triple image signal processors (Triple ISP) capable of processing 2.7 gigapixels per second, allowing devices to use up to three separate cameras at the same time. This functionality opens up several intriguing possibilities, including seamless zooming between three different cameras, triple simultaneous image captures (each up to 28MP), multi-capture HDR composites, and even putting front-facing video footage atop rear-facing video footage, to name a few. On Qualcomm's Triple ISP-enabled devices, the customers may even capture up to three 4K HDR films at the same time.

- The function of smartphones cameras is evolving. The initial surge came as more people began to use smartphones to take photos rather than investing in professional cameras. The next boost will be built around developments in video capturing capabilities, given the prevalence of social media platforms and video content.

China to Hold a Major Market Share

- The boom of smartphone market has been one of the notable trends in China. This incraese in demand has been a result of various factors including rising disposable income, cheaper internet, innovations and advancements in technology. For example, the introduction of the mirror or prism in the smartphone camera module, which lies in the centre of the lens to reflect light in a folding zoom camera mechanism. It operates similarly to periscope technology, but instead of using the phone's thickness and camera bump for the increased zoom capability, it allows the camera to leverage the phone's length and width.

- For Instance, several smartphone manufacturers, like Huawei and OPPO, have already used this technology in their flagship models. Huawei's Huawei Mate XS is equipped with a folding zoom module.

- In May 2021, Xiaomi, a Chinese smartphone manufacturer, has patented a smartphone design with an under-screen flip camera that can function as both a primary and a selfie camera. The phone's camera system will feature flip technology, which will allow the camera to spin 180 degrees and act as both a selfie and a rear-facing camera. However, as evidenced by a new patent obtained by the World Intellectual Property Organization, the company is making significant progress in the development of a rotating under-display camera module.

- In August 2021, A Chinese smartphone manufacturer, Vivo has received a patent from the World Intellectual Property Organization (WIPO) for an innovative design that features a smartphone with a removable under-display selfie camera module. The smartphone maker's patent, according to GizmoChina, describes an in-display camera module that can remove from the handset's body.

- Despite dedicated tele lenses being the standard on high-end smartphones these days, smartphone zoom capability has improved substantially in the last couple of years, but it still trails behind traditional cameras. O-Film, a Chinese camera module manufacturer, has demonstrated a smartphone lens with an 85-170mm (35mm equivalent) optical zoom range. In principle, this should deliver better image quality throughout the zoom range than existing models.

APAC Smartphone Camera Module Industry Overview

The Asia-Pacific Smartphone Camera Module Market is a competitive market that consists of significant players. However, in terms of market share, few major players such as LG Innotek Co., Ltd, Samsung Group, Sunny Optical Technology Company Limited, Foxconn Technology Group (Sharp), OmniVision Technologies Inc., etc., currently dominate the market. The mid-size and the smaller companies can increase their market presence by securing new contracts and tapping new markets with the help of technological advancements, product innovations, and partnerships. Some of the latest developments include :-

- September 2021 - Valens Semiconductor and Sunny Optical Technology Group Company Limited have partnered to develop MIPI A-PHY-compliant chipsets for next-generation camera modules. For multi-gigabit vehicle communication, A-PHY is a long-reach serializer-deserializer (SerDes) physical layer interface. The MIPI Alliance launched it in September 2020 as a standard for integrating cameras, sensors, and displays in automobiles while also incorporating functional safety and security. Engineering samples of the Valens VA7000 chipset family, the first A-PHY compliant chipset, will be available in the fourth quarter of 2021.

- May 2021 - The OV60A, a 0.61 micron (m) pixel high-resolution CMOS image sensor for mobile phone cameras, was unveiled by OmniVision Technologies, Inc., a developer of sophisticated digital imaging systems. The OV60A can be used in either a 3:4 or 16:9 aspect ratio 1/2.8 inch optical format. The OV60A's 4-cell color filter array uses near-pixel binning to produce up to 15MP photos with 4X the sensitivity for preview and native 4K video with additional pixels for electronic image stabilization, with 1.22m equivalent performance (EIS).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Average Number of Cameras per End-products-Smartphones

- 4.5 Impact of COVID-19 on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Evolution of Multiple Camera Approaches and Introduction of Advanced Camera Technologies

- 5.2 Market Challenges

- 5.2.1 Increasing Pricing Competition

6 MARKET SEGMENTATION

- 6.1 By Country

- 6.1.1 China

- 6.1.2 India

- 6.1.3 Rest of Asia-Pacific

7 VENDOR RANKING ANALYSIS

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 LG Innotek Co., Ltd.

- 8.1.2 Samsung Electro-Mechanics Co., Ltd. and Samsung Group

- 8.1.3 Sunny Optical Technology Company Limited

- 8.1.4 JiangXi Holitech Technology Co., Ltd

- 8.1.5 Q Technology (Group) Company Limited

- 8.1.6 O-Film Tech Co. Ltd.

- 8.1.7 Foxconn Technology Group (Sharp)

- 8.1.8 Luxvisions Innovation Limited

- 8.1.9 Sony Corporation

- 8.1.10 Largan Precision Co Ltd.

- 8.1.11 OmniVision Technologies Inc.