|

市場調查報告書

商品編碼

1631664

閘流體-市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Thyristor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

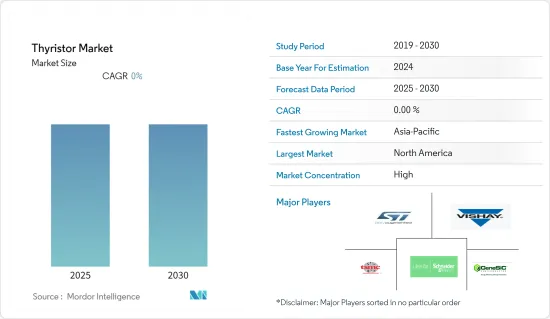

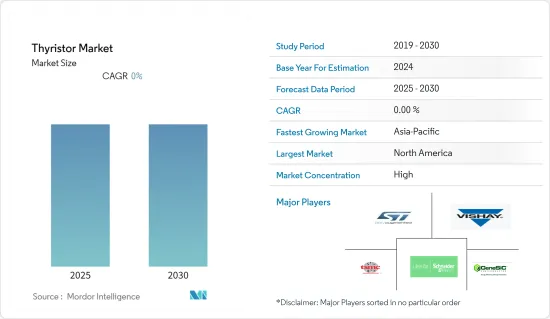

閘流體市場預計在預測期內複合年成長率為 0%

主要亮點

- 由於人口成長,新興經濟體對電力的需求不斷增加。閘流體用於金屬氧化物半導體場場效電晶體(MOSFET) 中,實現低開關損耗和短開關時間,以滿足目前的功率需求。因此,新興經濟體對它的需求很高。

- 此外,在印度,2022年的每月尖峰電力需求預計將達到約1,320億度,比月平均需求高出15%。這與 2021 年和 2019 年類似,當時的月峰值需求分別比月平均需求高出 15% 和 19%。與流行病相關的封鎖抑制了 2020 年的需求,但月度尖峰時段需求比月度平均需求高出 6%。

- 然而,基礎設施部署的高成本阻礙了市場成長。此外,渦輪機和太陽能新興市場的萎縮以及高鐵的發展也為市場帶來了重大挑戰。

- 冠狀病毒大流行(COVID-19)擾亂了全球生產和供應鏈系統,對閘流體市場產生了負面影響。大多數工業管理者和政策規劃者正在尋找適當的策略和措施來重組生產模式並滿足消費者需求。從全球供應鏈來看,原料主要從中國和亞洲新興國家進口。 COVID-19 大流行擾亂了供應商、製造工廠和客戶之間的大多數運輸和分銷聯繫。

閘流體市場趨勢

電力產業對閘流體的需求不斷增加

- 閘流體模組由於統計故障率低,在電力應用中發揮重要作用。閘流體模組主要用於電力行業,將電能從一種形式轉換為另一種形式,並用於各種電氣應用。

- 閘流體模組利用公路式接開關和飽和電抗器的最佳組合,提供高效率且經濟高效的寬範圍電壓調節器。閘流體整流系統透過閘流體門極控制從零電壓到額定電壓的平滑無級控制。

- 閘流體在汽車點火系統中的使用不斷增加也促進了市場的成長。 2021年,全球汽車產業將以兩位數成長。繼2020年下降18%之後,2021年新車銷量將成長15%。商用車銷量繼 2020 年下降 16% 後,2021 年將成長 16%。

- 閘流體在數位電路電源中用作一種“斷路器”或“撬棍”,以防止電源故障損壞下游組件。此外,閘流體模組製造商正在不斷致力於此類組件的開發。

- 由於這些因素,隨著世界各國政府投資的增加,對遠距電力傳輸的閘流體模組的需求正在增加,預計這將在預測期內推動全球閘流體模組市場。此外,技術先進的閘流體模組適用於各種電氣應用。因此,閘流體模組在電力產業的發展備受關注,並有望推動市場成長。

- 此外,閘流體幾十年來一直在電視、電影和劇院中用作照明調光器,取代了自耦變壓器和變阻器等劣質技術。它也被用作攝影中閃光燈(閃光燈)的重要組成部分。

亞太地區是閘流體市場成長最快的地區

- 全球閘流體模組市場分為北美、歐洲、亞太地區、中東和非洲以及拉丁美洲。由於閘流體模組製造商數量眾多,亞太地區是一個快速成長的閘流體市場。此外,許多老字型大小企業都專注於半導體產品的技術進步,預計這將在預測期內進一步推動該地區的閘流體市場成長。

- 由於亞太地區擁有大量閘流體模組製造商,因此預計在整個預測期內將主導全球閘流體模組市場。此外,由於商機不斷擴大,亞太地區許多老字型大小企業都專注於半導體產品的技術進步,預計這將在預測期內推動該地區的閘流體模組市場。

- 新興國家越來越多採用 HDVAC 也推動了閘流體市場的發展。例如,根據《電力線雜誌》報道,印度正在專注於發展直接高壓電流(HVDC)輸電系統。目前,高壓直流輸電線路佔輸電線路總長度的4%。此外,2020年,400kV將成為印度輸電線路的主流電壓類型,佔輸電線路總長度的43%。其次,220kV輸電線路佔42%。

閘流體產業概況

閘流體市場高度分散,主要企業都參與其中。各種參與企業活躍在全球市場上,他們的主要重點是推進和擴展新技術,以滿足對閘流體模組不斷成長的需求。此外,製造商正在夥伴關係開發創新產品。

- 2021 年 5 月,新型 BiPolar 電源模組具有業界標準外殼、最低損耗和最高動作溫度。 60Pak 模組系列提供終極可靠性,是品質的縮影。業界標準外殼,具有最低的損耗和最高的動作溫度。當談到高效驅動工業馬達、平穩控制風扇和泵浦以及為要求苛刻的應用提供動力時,故障是不可能的。這些新產品將日立能源最高品質的產品封裝在標準工業外殼中,以提供頂級性能、卓越的可靠性和更高的過載容限。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究假設和市場定義

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場洞察

- 市場概況

- 產業價值鏈分析

- 產業吸引力-波特五力分析

- 供應商的議價能力

- 消費者議價能力

- 新進入者的威脅

- 競爭公司之間的敵對關係

- 替代品的威脅

- COVID-19 對市場的影響

第5章市場動態

- 市場促進因素

- 在工業、商業和住宅應用中採用馬達

- 人們對電動車和混合動力電動車的興趣日益濃厚

- 市場限制因素

- 基礎設施開發成本高且缺乏技術意識

第6章 市場細分

- 按額定輸出

- 500MW

- 500~1,000MW

- 1,000MW

- 按行業分類

- 消費性電子產品

- 通訊/網路

- 工業的

- 車

- 航太/國防

- 其他

- 按地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第7章 競爭格局

- 公司簡介

- STMicroelectronics

- Vishay Intertechnology

- Schneider Electric

- Central Semiconductor

- GeneSiC Semiconductor

- TSMC

- WeEn Semiconductor

- Diodes Incorporated

- Sensata Technologies

- Shindengen Electric

第8章投資分析

第9章市場的未來

簡介目錄

Product Code: 90870

The Thyristor Market is expected to register a CAGR of 0% during the forecast period.

Key Highlights

- Electricity demand is constantly increasing in developing economies due to the rising population. Thyristors are used for low switching losses and short switching times of metal-oxide-semiconductor field-effect transistor (MOSFET) to meet current electricity demands. Thus, they are highly in demand across developing economies.

- Moreover, In India, the monthly electricity demand in 2022 is expected to peak at around 132 billion kWh, 15% higher than the average monthly demand, similar to 2021 and 2019, when peak monthly demand was 15% and 19% higher, respectively than average monthly demand. Pandemic-related lockdowns dampened demand in 2020, but peak monthly demand was 6% higher than average monthly demand.

- However, the high cost of infrastructure deployment is impeding the market growth. Furthermore, the declining deployment of turbines and PV and the development of high-speed trains pose a significant challenge to the market.

- The coronavirus pandemic has disrupted the global production and supply chain system (COVID-19), negatively impacting the thyristor market. Most industrial managers and policymakers look for appropriate strategies and policies to restructure production patterns and meet consumer demand. Mainly the raw materials are imported from China and other Asian developing countries from the global supply chain standpoint. The COVID-19 pandemic has disrupted most transportation and distribution links between suppliers, manufacturing facilities, and customers.

Thyristor Market Trends

Increasing Demand for Thyristor in Power Industry

- Thyristor modules play a vital role in power applications, owing to their low statistical failure rate. Thyristor modules are primarily used in the power industry to convert electrical energy from one form to another for various electrical applications.

- A thyristor module provides wide-range voltage control efficiently and cost-effectively by utilizing an optimal combination of on-load tap-changers and saturable reactors. Thyristor rectifier systems provide smooth step-less control via thyristor gate control from zero to the rated voltage.

- The growing use of thyristors in automobile ignition systems has also contributed to the market's expansion. In 2021, the global automotive industry will grow by double digits. Following an 18% drop in 2020, new car sales will increase by 15% in 2021. Commercial vehicle sales will rise by 16% in 2021, following a 16% drop in 2020.

- Thyristors are used in power supplies for digital circuits as a kind of "circuit breaker" or "crowbar" to prevent a power supply failure from damaging downstream components. Moreover, manufacturers of thyristor modules are continually engaged in developing such components.

- Due to these factors, demand for thyristor modules for long-distance power transmission is growing, with an increase in investment by various governments across the globe, which is expected to drive the global thyristor module market during the forecast period. Moreover, technologically advanced thyristor modules for various electrical uses. Thus, increasing focus on developing thyristor modules in the power industry is expected to bolster the market's growth.

- Additionally, thyristors have been used as lighting dimmers in television, film, and theatre for decades, replacing inferior technologies such as autotransformers and rheostats. They have also been used in photography as an important component of flashes (strobes).

Asia-Pacific is Fastest Growing Region for the Thyristor Market

- The global thyristor module market has been segmented into North America, Europe, Asia Pacific, Middle East & Africa, and Latin America. Because of the large number of thyristor module manufacturers in Asia-Pacific, it is the fastest-growing market for thyristors. Furthermore, many well-established players are focusing on technological advancements in semiconductor products, which will further boost the growth of the region's thyristors market during the forecast period.

- Asia-Pacific is anticipated to dominate the global thyristor module market throughout the forecast period, as many manufacturers of thyristor modules operate in the region. Additionally, due to the growing opportunity, many well-established players from the Asia Pacific region are focusing on technological advancement in semiconductor products, which is expected to boost the thyristor module market in the region during the forecast period.

- The increasing adoption of HDVAC in developing countries is also boosting the thyristors market. For example, according to Powerline Magazine, India is focusing on direct high-voltage current (HVDC) transmission systems because they allow electricity to be transmitted over long distances with minimal loss. Currently, HVDC transmission lines account for 4% of total transmission line length. Additionally, in 2020, India's predominant voltage type of electricity transmission line is 400 kV, accounting for 43% of the total line length. With 42%, it is followed by 220 kV transmission lines.

Thyristor Industry Overview

The Thyristor Market is highly fragmented owing to the various key players in the market. Various players are operating in the global market and are majorly focusing on the new technological advancements and expansions to meet the increasing demand for thyristor modules. In addition, manufacturers are entering into partnerships for the development of innovative products.

- May 2021, New BiPolar power modules featured industry-standard housings, the lowest losses, and the highest operating temperatures. The 60Pak module family provides the ultimate reliability and is the epitome of quality. It features the lowest losses and highest operating temperatures in industry-standard housing. Failure is not an option, whether efficiently driving industrial motors, smoothly controlling fans and pumps, or supplying power to demanding applications. These new products wrap up Hitachi Energy's best-quality products in standard industrial housing, delivering the highest performance, outstanding reliability, and increased overload capability.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Bargaining Power of Suppliers

- 4.3.2 Bargaining Power of Consumers

- 4.3.3 Threat of New Entrants

- 4.3.4 Intensity of Competitive Rivalry

- 4.3.5 Threat of Substitutes

- 4.4 COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Adoption of electric motors in industrial, commercial, and residential applications

- 5.1.2 Growing inclination toward use of electric and hybrid electric vehicles

- 5.2 Market Restraints

- 5.2.1 High infrastructure development cost and lack of technology awareness

6 MARKET SEGMENTATION

- 6.1 By Power Rating

- 6.1.1 500 MW

- 6.1.2 500 MW-1000 MW

- 6.1.3 1000 MW

- 6.2 By Application Industry

- 6.2.1 Consumer Electronics

- 6.2.2 Telecommunication & Networking

- 6.2.3 Industrial

- 6.2.4 Automotive

- 6.2.5 Aerospace & Defense

- 6.2.6 Others

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 STMicroelectronics

- 7.1.2 Vishay Intertechnology

- 7.1.3 Schneider Electric

- 7.1.4 Central Semiconductor

- 7.1.5 GeneSiC Semiconductor

- 7.1.6 TSMC

- 7.1.7 WeEn Semiconductor

- 7.1.8 Diodes Incorporated

- 7.1.9 Sensata Technologies

- 7.1.10 Shindengen Electric

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219