|

市場調查報告書

商品編碼

1632019

全球二極體:市場佔有率分析、產業趨勢與統計、成長預測(2025-2030)Global Diodes - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

價格

※ 本網頁內容可能與最新版本有所差異。詳細情況請與我們聯繫。

簡介目錄

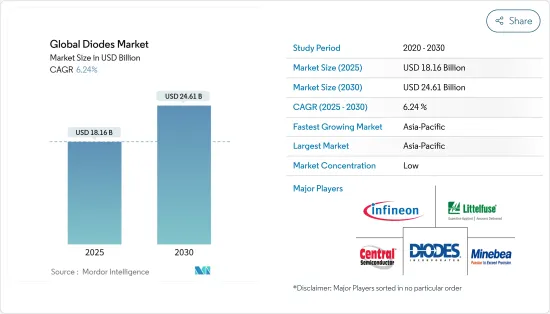

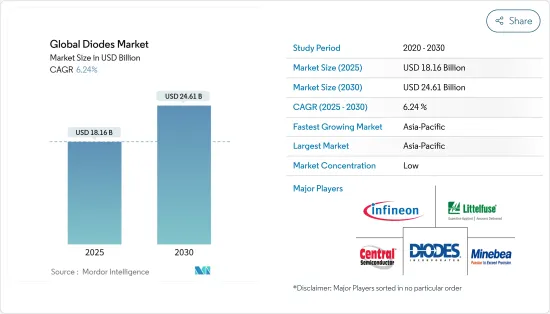

預計2025年全球二極體市場規模將達181.6億美元,2030年將達246.1億美元,預測期內(2025-2030年)複合年成長率為6.24%。

主要亮點

- 在家用電子電器領域,電子產品變得越來越小。最小尺寸、最小功耗和最大功率輸出是所有電子製造商的動力。這增加了對創新和客製化二極體的需求。

- 人們對具有各種功能的智慧型手機的需求不斷成長,例如FM廣播、MP3參與企業、MP4參與企業、可用作手持電視、備忘錄錄音機、相機甚至投影機的行動電話。訊號的增加增加了對訊號路由解決方案的需求。此類解決方案需要更小、更強大的二極體,而行動電話設計人員繼續推動更小的外形規格,同時仍在其設計中提供增強的功能。這些技術需求正在推動二極體市場的成長。

- 電動車需求的成長也推動了二極體市場的成長。電動車製造過程中使用了各種類型的二極體。根據國際能源總署(IEA)的數據,2021年電動車銷量將比2020年成長一倍以上,達到660萬輛。到2021年,電動車將佔全球汽車市場的近9%,是兩年前市場佔有率的三倍多。

- 這些先進的變化要求製造商不斷升級產品設計、功耗、處理能力、使用者介面等,以佔領重要的市場佔有率。為了使產品達到上述規格,每家公司都會花費大量的初始成本。以最低的價格分佈提供更高的功能是該市場的一個挑戰,因為該細分市場的產品在達到規模經濟之前不斷需要升級。

- COVID-19 對二極體市場產生了負面影響,因為它對市場價值鏈中的供應鏈和勞動力產生了重大影響。由於疫情的影響,大多數公司推遲了硬體升級和其他長期遷移計劃。例如,許多國家推遲了5G計劃的推出,商用5G服務的推出也被推遲。 5G 服務的基礎設施需要各種二極體,而延誤也減緩了二極體需求的成長。

二極體市場趨勢

汽車對先進和複雜電子設備的需求不斷成長推動市場成長

- 汽車使用二極體來確保電流僅沿一個方向流動。此關鍵組件可保護您車輛的 LED 頭燈免受電流尖峰的影響。這進一步降低了汽車零件和電氣系統損壞的風險。肖特基二極體可以透過允許從導通狀態到阻斷狀態的快速變化來對汽車應用中的電流進行整流。此外,高溫下的低反向漏電流可減少電路損耗並增強對熱失控的保護。二極體製造公司正在將創新的高性能二極體添加到他們的產品清單中。例如,領先的半導體製造商意法半導體開發了一款用於 DC-DC 轉換器的汽車級肖特基二極體,該二極體符合 AEC-Q101 標準,工作結溫範圍為 -40 度C至 +175 度C

- 高壓碳化矽二極體對於混合動力汽車和電動車電源設計人員提高電氣效率和電池自主性至關重要。此二極體非常適合功率因數校正電路、板載電池充電器和可處理大突波的馬達驅動器。此外,此二極體還開發了具有 2.4V 至 5.5V 寬輸入電壓範圍的同步降壓轉換器,以滿足更合理、更有效率的汽車負載點 (POL) 的要求。這些額定值為 3A 的裝置設計用於汽車遠端資訊處理、ADAS、電力和資訊娛樂系統以及儀表組。

- 二極體將交流電轉換為直流電。二極體存在於汽車的電氣系統中,包括交流發電機。對於汽車充電系統,交流發電機二極體執行三項重要任務:交流電到直流電的轉換、回饋防止以及電池充電的正確極性。電子產品、電池和充電適配器在汽車中越來越常見,積極推動了二極體市場的成長。主要企業正專注於製造先進的碳化矽二極體,以提高電動車電池容量和充電速度。例如,英飛凌科技的第一代碳化矽技術正在幫助電動車製造商客戶將基於 800V 的電動車的電池容量範圍提高 7%。英飛凌承諾透過其下一代 Cool Chic 技術將這項性能提高約 10%。

- 在汽車中,二極體用於連接螺線管。當 B+ 關閉時,線圈的磁場崩壞,包括流經線圈的電流,而電流流經二極體,因為它的流動方向與先前阻擋 B+ 的二極體上的箭頭方向相同。線圈電場中感應出的電流使線圈自行崩壞。 ECM 將受到保護,不會受到損壞,並且不會產生火花。領先的半導體製造商 NXP 開發了 PT2,000 可程式電磁閥控制器,用於汽車 (12V)、卡車和工業 (24V)動力傳動系統。此系統中使用二極體來確保設備的平穩運作和靈活操作。

- 為了避免不必要的尖峰和瞬變,在為車輛的感性負載供電或開關時將電池移除。如果不加以解決,這些瞬變可能會沿著電源線傳播,導致單一電子設備和感測器發生故障,或永久破壞車輛的電氣系統,從而損害其整體可靠性。因此,TVS 二極體變得越來越受歡迎,因為它們可以保護敏感電子設備免受負載突降和其他暫態電壓瞬變引起的瞬變影響。例如,Vishay Intertechnology 提供一系列名為 XClampR(TM) 的 TVS 二極體,可在極低的箝位電壓下工作,並可在高達 175°C 的結溫下保持功能。

亞太地區全球二極體市場將顯著成長

- 由於電子和汽車製造商的廣泛存在以及消費者需求的增加,亞太地區二極體市場正在迅速擴大。

- 由於人們的意識不斷增強,電動車的採用有助於減少排放氣體,減少車輛排放,並緩解有關車輛排放的嚴格政府規則和法規。此外,輕型商用車電動車領域預計將成為亞太地區成長最快的領域。這些車輛的電氣和電子元件中使用了各種二極體。該地區的功率二極體、小訊號二極體和射頻/微波二極體市場預計將呈指數級成長。

- 該地區智慧型手機的普及率和工業流程的數位化也不斷提高。由於二極體是所有電氣產品的重要組件,智慧型手機和電子設備的興起也推動了亞太二極體市場的成長。

- 中國、韓國、印度和新加坡等亞太國家對家用電子電器的需求不斷增加,許多公司正在該地區建立製造設施。豐富的原料供應以及較低的推出和人事費用鼓勵在該地區建立生產基地。

- 需要強大的小型二極體的家用電子電器和智慧穿戴行業在亞太地區成長最快。例如,0402尺寸的蕭特基勢壘二極體比傳統的0603尺寸(0.6mm x 0.3mm)小44%,且佔用的安裝空間減少56%。這些二極體用於智慧穿戴設備,智慧穿戴設備需求的不斷成長預計將推動該地區對這些小型、強大二極體的需求。

二極體產業概況

全球二極體市場高度分散且競爭激烈,世界各地都有大大小小的參與企業。主要企業透過產品創新、夥伴關係、併購和收購來獲得相對於其他公司的競爭優勢。

- 2020年11月,Diodes公司以約4.46億美元現金收購全球電子電源製造商光寶半導體。透過此次收購,該公司擴大了其產品系列。

- 2022 年 5 月,50 多年來光電產業領導者 Power Technology 推出了一款面向OEM應用的新型 532nm高功率雷射二極體模組。該新模組描述了一種更穩定的半導體替代方案,可取代 DPSS 雷射器,功率輸出接近 1W。

- 2022年5月,貝爾曼資本投資組合公司Micros Components, Inc.為國防、太空、航太、醫療和工業應用提供高可靠性微電子產品和服務解決方案,宣布收購全球大型公司Semtech Corporation 。

其他好處

- Excel 格式的市場預測 (ME) 表

- 3 個月分析師支持

目錄

第1章簡介

- 研究成果

- 研究場所

- 調查範圍

第2章調查方法

第3章執行摘要

第4章市場動態

- 市場概況

- 市場促進因素

- 每個領域對先進和複雜電子設備的需求不斷成長

- 分離式電子產品小型化

- 市場限制因素

- 將所需的價格分佈與所有所需的規格相匹配

- 價值鏈/供應鏈分析

- 波特五力分析

- 新進入者的威脅

- 買家/消費者的議價能力

- 供應商的議價能力

- 替代品的威脅

- 競爭公司之間敵對關係的強度

- COVID-19 對市場的影響

第5章市場區隔

- 最終用戶產業

- 通訊

- 消費性電子產品

- 車

- 電腦及電腦周邊設備

- 其他

- 類型

- 齊納二極體

- 肖特基二極體

- 雷射二極體

- 發光二極體

- 小訊號二極體

- 其他

- 地區

- 北美洲

- 歐洲

- 亞太地區

- 拉丁美洲

- 中東/非洲

第6章 競爭狀況

- 公司簡介

- Central Semiconductor Corp.

- Diodes Incorporated

- Hitachi Power Semiconductor Device Ltd

- Infineon Technologies AG

- Littelfuse Inc.

- MACOM

- NXP Semiconductors NV

- ON Semiconductor Corp.

- Renesas Electronics Corp.

- ROHM Co. Ltd

- Semtech Corp.

- Vishay Intertechnology Inc.

- Toshiba Electronic Devices & Storage Corporation

- Mitsubishi Electric Corporation

- Microsemi

- SEMIKRON

- SHINDENGEN ELECTRIC MANUFACTURING CO. LTD

第7章 投資分析

第8章市場的未來

簡介目錄

Product Code: 90879

TThe Global Diodes Market size is estimated at USD 18.16 billion in 2025, and is expected to reach USD 24.61 billion by 2030, at a CAGR of 6.24% during the forecast period (2025-2030).

Key Highlights

- Miniaturization of electronic products is happening across consumer electronics segments. Minimal size with minimum power consumption and maximum power delivery is the motive of all electronic manufacturers. Due to this, the demand for innovative and customized diodes is increasing.

- The increasing demand for smartphones with various functions, such as phones that can be used as an FM radio, MP3 player, MP4 player, handheld TV, memo recorder, camera, or even a projector, is increasing. This increased number of signals has increased the requirement for signal routing solutions. These solutions require diodes with smaller size and higher functionality, enabling mobile phone designers to continue pushing for smaller form factors while still providing enhanced features within their design. This technological need is driving the diodes market to grow.

- Increasing demand for electric vehicles is also boosting the market growth of diodes. Various types of diodes are used in the manufacturing process of EVs. According to the International Energy Agency (IEA), in 2021, electric car sales will more than double compared to 2020 and reach 6.6 million. Electric cars represented nearly 9% of the global car market in 2021, with more than tripling the market share from two years earlier.

- This advanced transformation requires manufacturers to continuously upgrade their products in designing, power consumption, processing power, and user interface to acquire a significant market share. To achieve the above-said specifications in their products, companies bear substantial initial costs. Providing higher functional products with minimum price points is a challenge in this market because before reaching economies of scale, a product in this segment always requires an upgradation.

- COVID 19 has a negative impact on the diodes market as it has heavily impacted the supply chain and workforce of the market value chain. Due to the pandemic, most companies have delayed their hardware upgrades and other long-term migration projects. For instance, the launch of the 5G plan has been delayed across many countries for which the launch of commercial 5G services has been postponed. The infrastructures for 5G services require various diodes, and delays also delay the growth of diodes' requirements.

Diodes Market Trends

Increase In The Need of Advance and Complex Electronic Devices In Automobiles is Driving The Market Growth

- Vehicles utilize diodes because of their application in allowing current flow in only one direction. This critical component protects the vehicle's LED headlamp against current spikes. This further reduces the risk of damage to components and the electrical system of an automobile. Schottky diodes can rectify a current flow in automotive applications by allowing a rapid change from conducting to blocking state. They have a low reverse-leakage current at high temperatures, which reduces circuit losses and increases protection against thermal runaway. The diode manufacturing company is adding innovative high-performance diodes to their product lists. For example, STMicroelectronics, a leading semiconductor manufacturer, has developed an automotive-grade Schottky diode that is AEC-Q101 qualified and intended for a DC-DC converter and can operate at a junction temperature range from- -40 °C to as high as +175 °C.

- High-voltage silicon-carbide diodes are essential for hybrid and electric vehicle power-supply designers to improve electrical efficiency and battery autonomy. This diode is ideal for power factor correction circuits, onboard battery chargers, and motor drives that can handle large surges. Furthermore, these diodes are developing synchronous buck converters with a wide input voltage range of 2.4V to 5.5V to satisfy the requirement for more streamlined and efficient automobile point-of-loads (POLs). These 3A-rated devices are designed for usage in telematics, ADAS, power and infotainment systems, and instrument clusters in automobiles.

- Diodes convert alternating current to direct current electricity. Diodes can be found in an automobile's electrical system, including alternators. For the vehicle charging system, alternator diodes provide three essential tasks: conversion from AC to DC Power, Feedback Preventer, and Proper Polarity for Charging a Battery. Electronic devices, batteries, and charging adaptors are becoming more common in automobiles, positively boosting the diode market growth. Major companies are focusing on manufacturing advanced Sic diodes to increase EVs' battery capacity and charging speed. For example, Infineon Technology's first-generation silicon carbide technology has helped EV manufacturer clients increase the Battery capacity range by 7% for their 800-V-based EV. The company is assuring that its next-generation Cool Sic will raise that to about 10%.

- In automobiles, diodes are used to connect solenoids. When the B+ is turned off, the coil's magnetic field collapses, including the current flow in the coil, and the current passes through the diode as the current is in the same direction as the diode arrow, which was previously blocking the B+. This current flow induced in the coil's electric field allows it to collapse itself. The ECM is protected from damage, and no spark is produced. Being a leading manufacturer of semiconductors company, NXP has developed a Programmable solenoid controller PT2000 which will be used in Automotive (12 V), truck, and industrial (24 V) power trains. In this system, diodes are used for the device's smooth functioning and flexible operation.

- The battery is unplugged during the powering or switching of inductive loads in automobiles to avoid undesirable spikes or transients. These transients would be propagated along the power line if they were not addressed, causing individual electronics and sensors to malfunction or permanently destroying the vehicle's electrical system, compromising overall reliability. As a result, TVS diodes are becoming more popular because they can protect sensitive electronics from transients caused by load dumps and other transient voltage occurrences. For example, Vishay Intertechnology has launched its TVS diodes series named XClampR(TM), which can operate in extremely low clamping voltage and sustain its functioning up to 175 °C junction temperature.

Asia-Pacific to Witness a Significant Growth in the Global Diode Market

- The diodes market in the Asia-Pacific region is expanding rapidly, owing to the extensive presence of electronics and vehicle manufacturing companies and rising consumer spending power.

- Because of rising awareness, the adoption of electric vehicles helps reduce emissions, fleet emissions, and stringent government rules and regulations regarding vehicle emissions. Moreover, the electric light commercial vehicles segment is expected to grow fastest in the APAC region. The electrical and electronic components of these vehicles use a variety of diodes. The market for power, small-signal, and RF and microwave diodes in this region will grow exponentially.

- Smartphone adoption and digitization of industrial processes are also increasing in the region. As the diodes are essential components of all electrical products, thus owing to the rising smartphones and electronics, the diodes market in Asia-Pacific is also witnessing growth.

- The increasing demand for consumer electronics across Asia-Pacific countries such as China, the Republic of Korea, India, and Singapore pushes numerous corporations to create manufacturing facilities in the region. The vast supply of raw materials and inexpensive start-up and labor costs are assisting enterprises in establishing production centers in the region.

- Consumer electronics and the smart wearable industry, which require powerful miniaturized diodes, are growing at the fastest rate in the Asia-Pacific region. For example, the 0402-sized Schottky barrier diodes are 44 percent smaller than the traditional 0603 sizes (0.6mm 0.3mm), with a 56 percent less mounting space. They are used in smart wearables, and the demand for these small, powerful diodes will grow in the region due to the rise in the demand for smart wearables.

Diodes Industry Overview

The Global Diode Market is fragmented and highly competitive, owing to the presence of various small and large players across the globe. The key players are involved in product innovation, partnerships, mergers, and acquisitions, among others, to have a competitive edge over others.

- In November 2020, Diodes Incorporated acquired Lite-on Semiconductor, a global electronic power supply manufacturer with total cash paid of approximately USD 446 million. With this acquisition, the company has widened its product portfolio.

- In May 2022, Power Technology, a leader in the photonics industry for more than 50 years, launched a new high-power laser diode module at 532nm for OEM applications. This new module offers more stable semiconductor alternatives to DPSS lasers at nearly 1W of output power.

- In May 2022, Micross Components, Inc., a provider of high-reliability microelectronic product and service solutions for defense, space, aerospace, medical and industrial applications and a portfolio company of Behrman Capital, announced the acquisition of Semtech Corporation, a leading global supplier of high-performance analog and mixed-signal semiconductors and advanced algorithms.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increase in the Need of Advance and Complex Electronic Devices In Every Sectors

- 4.2.2 Miniaturization of discrete electronic products

- 4.3 Market Restraints

- 4.3.1 Matching required price point of diodes with all desired specification

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Force Analysis

- 4.5.1 Threat of New Entrants

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Bargaining Power of Suppliers

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 COVID-19 Impact on the Market

5 MARKET SEGMENTATION

- 5.1 End-user Industry

- 5.1.1 Communications

- 5.1.2 Consumer Electronics

- 5.1.3 Automotives

- 5.1.4 Computer and Computer Peripherals

- 5.1.5 Others

- 5.2 Type

- 5.2.1 Zener Diodes

- 5.2.2 Schottky Diodes

- 5.2.3 Laser Diodes

- 5.2.4 Light Emitting Diode

- 5.2.5 Small Signal Diode

- 5.2.6 Others

- 5.3 Geography

- 5.3.1 North America

- 5.3.2 Europe

- 5.3.3 Asia-Pacific

- 5.3.4 Latin America

- 5.3.5 Middle-East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Central Semiconductor Corp.

- 6.1.2 Diodes Incorporated

- 6.1.3 Hitachi Power Semiconductor Device Ltd

- 6.1.4 Infineon Technologies AG

- 6.1.5 Littelfuse Inc.

- 6.1.6 MACOM

- 6.1.7 NXP Semiconductors NV

- 6.1.8 ON Semiconductor Corp.

- 6.1.9 Renesas Electronics Corp.

- 6.1.10 ROHM Co. Ltd

- 6.1.11 Semtech Corp.

- 6.1.12 Vishay Intertechnology Inc.

- 6.1.13 Toshiba Electronic Devices & Storage Corporation

- 6.1.14 Mitsubishi Electric Corporation

- 6.1.15 Microsemi

- 6.1.16 SEMIKRON

- 6.1.17 SHINDENGEN ELECTRIC MANUFACTURING CO. LTD

7 Investment Analysis

8 Future of the Market

02-2729-4219

+886-2-2729-4219